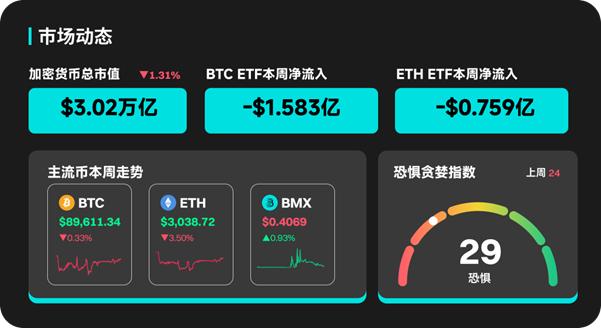

According to BitMart's market report on December 23, the total market capitalization of cryptocurrencies was $3.02 trillion over the past week, a decrease of 1.31% from the previous week.

Article author and source: BitMart

This Week's Crypto Market Updates

The crypto market weakened significantly this week, with Bitcoin falling back after encountering resistance at the key historical level of $94,000 and breaking below the important support level of $86,000, indicating a significant tightening of market liquidity.

On-chain data shows that this round of adjustments was not driven by panic selling from retail investors, but rather by institutional funds, represented by large addresses, continuously mitigating risk and distributing their holdings. Since November, the number of addresses holding large amounts of BTC has decreased at the fastest rate since 2022, while addresses holding small amounts are still experiencing net growth, indicating that retail investors still have the willingness to "buy on dips," but the scale is insufficient to absorb the whale-level selling pressure, resulting in a clear divergence in the capital structure. Ethereum and major Altcoin such as SOL, XRP, and ADA generally fell by 5%–11% this week, underperforming BTC. However, SOL and XRP spot ETFs still maintained net inflows, attracting incremental funds for 11 consecutive trading days, indicating that some funds are positioning themselves for the long-term logic of public chains during price corrections. In contrast, BTC and ETH ETFs have both seen significant net outflows recently. At the same time, the BTC/stablecoin balance ratio on exchanges has tended to stabilize, reflecting a temporary balance between buying and selling forces. From a cross-market perspective, the correlation between crypto assets and traditional markets has decreased in stages, and the rebound in US stocks has had limited impact on the crypto market. As the year draws to a close, the market will focus on the end of the US earnings season and capital expenditure guidance from tech giants. Historical data shows that BTC performs relatively steadily in the week before Christmas, but volatility increases from the holidays to New Year's Day, and then tends to improve as funds are reallocated at the beginning of the new year.

Overall, with institutional risk aversion, tight liquidity, and seasonal disturbances intertwined, the crypto market is expected to remain volatile and weak in the short term, with its trend continuing to be dominated by changes in funding structure and macro risk appetite.

Popular cryptocurrencies this week

Among popular cryptocurrencies, BEAT, NIGHT, CC, SKY, and XMR all performed well, ranking in the top five in terms of percentage increase. BEAT's price rose 61.14% this week. NIGHT's price rose 55.61%. CC's price rose 24.03%. SKY and XMR rose 17.32% and 15.13% respectively this week.

US Market Overview and Hot News

This week, the US market experienced increased volatility due to a confluence of risk factors. Despite the Federal Reserve's third rate cut this year and its dovish signals, expectations of a rate hike by the Bank of Japan and hawkish stances from several other central banks fueled concerns about global liquidity and growth prospects. The release of key US non-farm payroll and CPI data revealed a slowdown in economic momentum. Coupled with the end of the US stock buyback season and the approaching final "quadruple witching day" of the year, the market is about to enter a period of low liquidity, increasing institutional demand for risk aversion and hedging. The AI sector saw increased volatility, with some semiconductor earnings reports providing a temporary rebound, but major indices remained under pressure for the week. The US dollar index strengthened slightly but its upside was limited. Precious metals strengthened significantly due to safe-haven demand, while energy prices were weak. US Treasury yields generally declined, with short-term yields stronger than long-term yields, reflecting lingering concerns about long-term inflation and fiscal policy.

Overall, amid macroeconomic uncertainties and reduced liquidity due to holidays, sentiment in the US stock market is cautious, and short-term trends will continue to be dominated by data, central bank expectations, and institutional behavior.

On December 22, MetaPlanet will hold an extraordinary general meeting to discuss important proposals regarding the future issuance of preferred shares.

On December 23, the U.S. Bureau of Economic Analysis will release the U.S. third-quarter GDP data.

US stock markets will be closed on December 25 due to the Christmas holiday.

On December 26, approximately $23 billion worth of Bitcoin options will expire, potentially exacerbating already high volatility.

Project unlock

MBG By Multibank Group (MBG) will unlock approximately 15.84 million tokens at 8 PM Beijing time on December 22, representing 8.42% of the circulating supply, with a value of approximately $8.1 million.

SOON will unlock approximately 21.88 million tokens at 4:30 PM Beijing time on December 23, representing 5.97% of the circulating supply, with a value of approximately $8 million.

Undeads Games (UDS) will unlock approximately 2.15 million tokens at 8:00 AM Beijing time on December 23, representing 1.46% of the circulating supply, worth approximately $5.2 million.

Humanity (H) will unlock approximately 105 million tokens at 8:00 AM Beijing time on December 25th, representing 4.79% of the circulating supply, worth approximately $14.8 million.

Plasma (XPL) will unlock approximately 88.89 million tokens at 8 PM Beijing time on December 25th, representing 4.5% of the circulating supply, worth approximately $11.7 million.

Risk warning:

Using BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve a significant risk of loss. Past, assumed, or simulated performance is not indicative of future results.

The value of cryptocurrencies may rise or fall, and there may be significant risks involved in buying, selling, holding, or trading cryptocurrencies. You should carefully consider whether trading or holding cryptocurrencies is right for you, based on your individual investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.