Author: Jonas , Foresight Research

The next financial super app: a huge opportunity hidden right before our eyes.

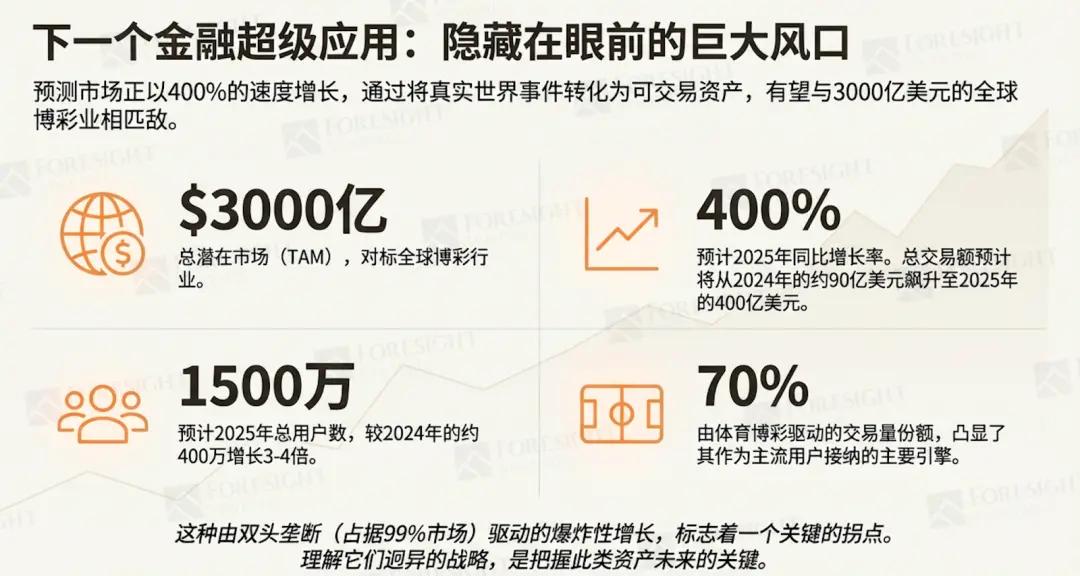

Prediction markets, as a rapidly growing niche sector, have a clear trajectory, aiming to challenge the established global gaming industry. By transforming real-world events into tradable assets, these platforms are unlocking a new form of financial speculation and information aggregation. The momentum of this field is evident in its explosive growth data:

Overall potential market size : This market is comparable to the global gaming industry, which is worth up to $300 billion, indicating that it has huge growth potential.

Projected year-over-year growth rate in 2025 : A staggering 400% growth rate is expected, with total transaction volume projected to surge from approximately $900 million in 2024 to $40 billion in 2025.

Projected total number of users in 2025 : The user base is expected to grow 3-4 times, from approximately 4 million in 2024 to 15 million in 2025.

Key growth engine : Sports betting currently drives 70% of the market’s transaction volume, highlighting its crucial role in attracting mainstream users.

This explosive growth was almost entirely captured by a duopoly: Kalshi and Polymarket, which together hold 99% of the market share. However, their starkly different regulatory, technological, and marketing strategies mark a critical turning point. This article analyzes the competitive landscape defined by these two dominant forces, examining the strategic games reshaping the market and future opportunities.

1. A Clash of Two Platforms: Compliance Giants vs. Crypto Native Visionaries

To understand the landscape of the forecasting market, one must first recognize the fundamental differences between its two leaders, Kalshi and Polymarket. Their opposing philosophies represent not merely operational details, but two distinct visions for the future of this asset class. Kalshi embodies a compliant, top-down model designed for mainstream integration; while Polymarket advocates a permissionless, bottom-up approach rooted in crypto-native principles. This strategic divergence defines the current competitive dynamics and will shape the industry's development.

Core Comparison

Kalshi | Polymarket | |

position | Compliant off-chain exchanges | Crypto-native end-to-end platform |

Regulatory status | Regulated by the CFTC and holding licenses in 50 states. | Having been banned, it seeks to return to the US market through acquisition. |

User access | Strict KYC: Requires social security number, bank account, etc. | No KYC required: Only an encrypted wallet is needed. |

Funding channels | Bank transfer, debit card, USDC, wire transfer | Only supports on-chain USDC deposits on the Polygon blockchain. |

Technical Architecture | It operates off-chain, and data is obtained via API. | It operates across the entire chain, and market and position information is publicly available. |

Main categories | Sports (approximately 90%), especially NFL football | Politics/Entertainment (which accounted for 80% during elections) |

Marketing strategy | B2B2C: Embedded in mainstream apps such as Robinhood | B2C: Relying on crypto-native communities and network effects |

This high-level comparison reveals two fundamentally different business logics. While Polymarket established an early advantage with its crypto-native appeal, a single, pivotal event that followed will soon demonstrate the overwhelming power of the other model, dramatically altering the balance of market power.

2. A Winning Strategy: How a Partnership Can Disrupt the Market

While Polymarket established an early and formidable dominance through the powerful network effects of the crypto ecosystem, its position is not insurmountable. Kalshi, a compliance challenger, executed a strategic partnership demonstrating that a mainstream distribution channel with full compliance support can overwhelm crypto's native moat. This move is not merely a growth strategy, but a disruptive strategic maneuver that validates a completely different business model.

The key to this dramatic shift was Kalshi's integration with retail brokerage giant Robinhood. The partnership began on August 19th by embedding Kalshi's NFL prediction market directly into the Robinhood app. This allowed Kalshi to directly reach Robinhood's massive user base of 27.4 million money accounts, an demographic that overlaps with Kalshi's target audience by 60-70%.

The effects were immediate and far-reaching, triggering a complete reversal of market leadership and validating the effectiveness of Kalshi's compliance and B2B2C strategy.

Market share reversal: Within a few months, Polymarket's dominant market share plummeted from about 95% to 32%, while Kalshi's share soared from just 8% to 66%.

Impact on trading volume: Kalshi's annualized trading volume surged from approximately $300 million to an estimated $40-50 billion, an increase of nearly 200 times.

User impact: Kalshi's daily active users increased 20-fold to 75,000, while Polymarket's daily active users decreased by 50% to 24,000.

This event was more than just growth; it was a strategic brilliance. It demonstrated that in the competition for the US market, accessing mainstream distribution channels through compliant means can be a more powerful weapon than the permissionless network effects of the crypto world. This shift laid the foundation for a deeper analysis of the unique and sustainable business models that each platform is currently pursuing.

3. Analyze the business model and strategy of a duopoly.

Dramatic shifts in market share tell only part of the story. To understand the future of the prediction market, one must look beyond volume charts and dissect the unique, long-term strategic moats and business models each platform is building. Kalshi is waging a regulatory war against the traditional sports betting industry, while Polymarket is executing its transformation from a consumer-facing platform to an institutional-grade data provider.

Kalshi's Moat: A Devastating Blow to Sports Betting

The best way to understand Kalshi's strategy is to view it as a "disruptive attack" on the traditional sports betting industry. It doesn't compete with Polymarket at the crypto-native level, but rather leverages its unique regulatory position to outmaneuver and disrupt traditional giants like DraftKings and FanDuel. This attack is built on two pillars.

Regulatory arbitrage: Nationwide coverage

Traditional sports betting platforms are constrained by fragmented state legal systems, operating legally in only about 30 U.S. states. Kalshi, however, operates under a federal license from the Commodity Futures Trading Commission, making it a federally regulated financial product legal in all 50 states. This advantage opens up vast, untapped markets like California and Texas, effectively circumventing state-level gambling restrictions and creating a nationwide competitive edge.

Better capital efficiency: User value proposition

Kalshi offers a product that is fundamentally more transparent and capital-efficient than its sports betting competitors. Traditional platforms typically charge users a "tax" of up to 25-30% as a fee for early withdrawals. In contrast, Kalshi operates like a financial exchange, offering a superior product with no withdrawal penalties or additional fees. This clear value proposition has attracted sophisticated players and eroded the user base of traditional systems.

Polymarket's Transformation: The Final Battle of B2B Under the Pretense of B2C

As Kalshi conquered the US retail market, Polymarket was strategically shifting from a challenging B2C revenue model to a highly viable B2B data-as-a-service endgame. The clearest signal of this strategic transformation was the $2 billion investment from the Intercontinental Exchange Group (ICE, the parent company of the New York Stock Exchange). This transformed Polymarket's speculative user activity into quantifiable, marketable institutional assets.

This new B2B strategy is built on three core components:

Assets: Real-time on-chain probabilistic data generated by a global user network creates a powerful alternative data source.

Distributor: ICE plans to package this data and position itself as a global distributor for institutional clients.

Institutional Products: This raw data forms the basis for a range of new institutional-grade financial products, including:

A new sentiment indicator: real-time market probability, provided to hedge funds and investment banks to track public sentiment.

Enhanced risk modeling: data used for macroeconomic forecasting and business risk assessment.

New financial derivatives: ICE can issue derivatives based on Polymarket data, creating "event-driven ETFs" that track events such as Federal Reserve interest rate decisions or election results.

Financial vs. Operational Comparison

The divergent strategies of Kalshi and Polymarket are clearly reflected in their financial and operating models. The table below provides a detailed comparison, synthesizing available data to highlight their fundamental differences.

Kalshi | Polymarket | |

Revenue Status | Profitable: Revenue exceeded $200 million in the first half of 2025. | No revenue yet: Established for 5 years and still not charging fees |

Pricing Model | Transaction fees: 0.7-3.5% of the contract amount per transaction (average 0.8%). | Early stage: 2% commission on profits; current order book model: no fees. |

Trading Mechanism | Order Book (CLOB) | Early AMMs have evolved into off-chain order books plus on-chain settlement. |

Liquidity incentives | Larger investment: approximately $35,000 per day (approximately $12.7 million annually). | Continued investment: approximately $5 million annually to maintain core markets. |

Result of the ruling | Centralized human adjudication (CFTC oversight) | Decentralized Oracle (UMA Oracle) |

Ultimately, the contrast is stark: Kalshi, as a traditional, revenue-focused exchange, is executing a proven playbook. In contrast, Polymarket prioritizes network growth and liquidity, funding its operations from its treasury while building its long-term institutional data strategy, rather than pursuing immediate monetization.

4. Three major obstacles on the road to mainstream adoption

Despite their respective successes and clear strategic paths, both Kalshi and Polymarket must overcome three fundamental, industry-specific challenges to evolve prediction markets from niche products into a mature and widely adopted asset class. These obstacles involve market structure, system integrity, and user accessibility.

Liquidity fragmentation

The structure of prediction markets creates serious capital efficiency problems. Each new market—whether it's about election results or football match outcomes—is a separate, isolated pool of liquidity. This disperses capital across thousands of different events, limiting market depth and introducing a persistent "cold start" problem for each new market launch . This inefficiency makes it difficult for platforms to offer a broad range of markets and can deter market makers facing high information asymmetry.

Oracle reliability

Oracles—mechanisms that report the real-world outcomes of events—are the lifeblood of markets. The integrity of the entire system depends on their ability to accurately report results and resist manipulation. Here, the duopoly approach presents a clear trade-off. Kalshi's centralized model is efficient but creates a single point of failure risk, as well as the risk of unfair rulings with limited user recourse. Polymarket's decentralized approach using UMA distributes trust but remains vulnerable to sophisticated economic attacks. Its reliance on UMA for rulings in markets involving hundreds of millions of dollars is already considered a potential systemic risk, and this risk will become more pronounced as the amount involved increases.

User experience (Lessons from Augur)

The failure of early platforms like Augur offers important lessons for the industry. Augur's complex mechanisms, reliance on a native token, and high Ethereum gas fees created insurmountable barriers for mainstream users. For mass adoption, the requirements are clear: the experience must be seamless and approach Web2 applications. This includes simple onboarding processes, easy deposit channels, and intuitive interfaces that abstract away the complexities of Web3—a principle that Kalshi and Polymarket are actively pursuing.

Overcoming these structural challenges is crucial. The platforms that best address these issues will be best positioned to seize strategic opportunities in the future global competitive landscape.

5. Strategic Blueprint: Where are the Real Opportunities?

With the dust settling on the market share reversal, the strategic landscape is becoming clearer. While the two giants, Kalshi and Polymarket, have effectively captured the US market through their respective moats of regulatory and network effects, the battle for the rest of the world has only just begun. The next phase of competition will be determined not only by scale, but also by local knowledge, sophisticated execution, and differentiated strategies.

Ruling on the US market: A closed duopoly

For aspiring entrepreneurs and investors, the conclusion is clear: the window of opportunity to establish a new, U.S.-focused, successful forecasting market is essentially closed. Kalshi's strong regulatory moat, combined with Polymarket's deep, network-effect-driven liquidity, forms an extremely difficult for new entrant to breach. The time and financial costs required to achieve regulatory compliance and overcome cold-start liquidity issues are too high to justify attempting it.

Global Opportunities: Deep Localization is the Path to Victory

While the US market has become increasingly concentrated, Polymarket's key weaknesses on the global stage present clear opportunities for new challengers. Its current strategy is "big and broad," offering a generic market that often lacks focus on sporting events, political events, and cultural moments that resonate within specific regions.

The counter-strategy for new entrants to succeed in non-US markets is "deep localization." This approach focuses not on competing with existing players globally, but on decisively winning in specific, high-potential regions. The blueprint for this strategy is built on three core pillars:

Content localization: A strong focus on creating marketplaces for regional sports leagues, local political events, and culture-related entertainment topics—areas naturally overlooked by global platforms like Polymarket. This creates a higher-quality, more engaging content offering for local users.

Community localization: Build dedicated, local language-based communities and marketing channels. This fosters a sense of belonging and grassroots support, something that centralized, English-dominated platforms struggle to replicate.

Model Differentiation: Empowering local communities and building strong grassroots support by leveraging more decentralized governance models, such as DAOs (Decentralized Autonomous Organizations). This unconventional approach can create a strong competitive advantage over more centralized governance platforms.

The prediction market is at a clear turning point. In the US, the market has been consolidated by two strategically distinct but equally powerful giants—one building a regulated financial exchange, the other an institutional data behemoth. The future of the market is set. However, the global stage remains vast, creating enticing opportunities for agile, localized challengers to build the next wave of successful prediction platforms.

Recommended reading:

The Hidden Concerns Behind Web3's Super Unicorn Phantom

Why isn't Metaplanet, Asia's largest Bitcoin treasury company, buy the dips?