Ethereum once again attempted to reclaim the $3,000 mark after several unsuccessful attempts this month. ETH briefly rose slightly during morning trading, but still faced resistance due to the overall weak market.

Although the upward momentum isn't strong, on-chain data suggests investors may be preparing to support a potential rally.

The number of Ethereum holders continues to grow.

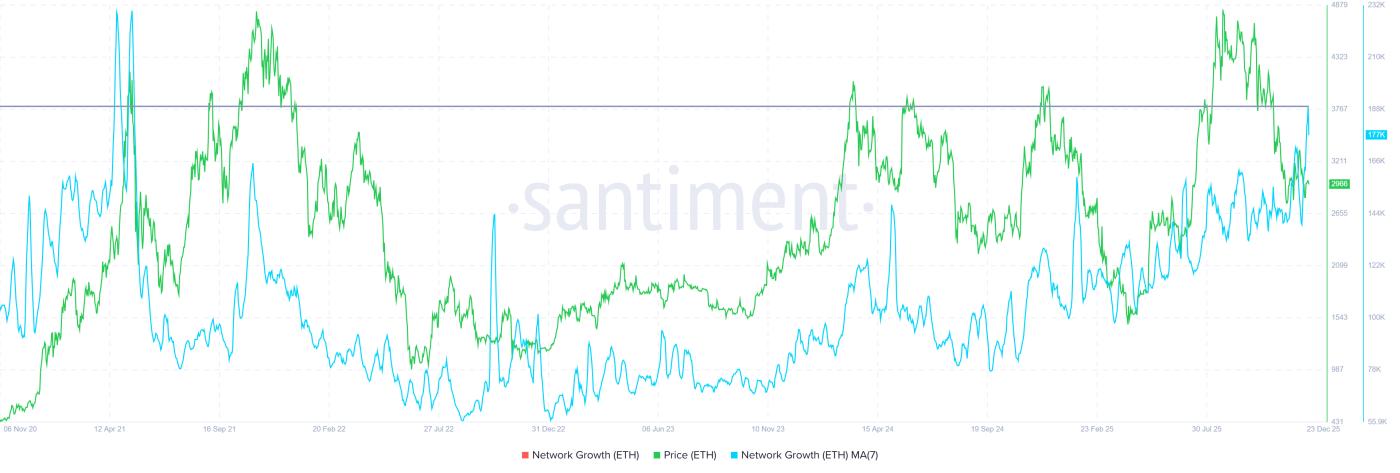

Ethereum's network growth rate has surged to its highest level in 4 years and 7 months. This metric reflects the rate at which new addresses join the network. This increase suggests renewed interest at the current price, even if ETH hasn't yet broken through .

Network growth typically brings in new capital. New participants help increase liquidation and strengthen the demand base. For Ethereum, this is a crucial signal because price recovery requires strong, sustained capital inflows rather than short-term speculative trading. The sharp increase in the number of addresses indicates that investor confidence in the long term remains strong.

Want to follow more Token analysis like this? Sign up for the daily Crypto Newsletter with editor Harsh Notariya here .

Ethereum network growth. Source: Santiment

Ethereum network growth. Source: SantimentBitmine may be supporting the price recovery.

Bitmine is one of the major contributors to this growth. The company quickly accumulated a large amount of Ethereum through its escrow strategy. Currently, Bitmine holds approximately 4.066 million ETH , representing 3.37% of the total supply after only 6 months.

This company has publicly stated its goal of holding 5% of the total ETH, a move that could further reduce the circulating supply and drive the price of ETH higher.

Macroeconomic indicators show a rather polarized picture. The MVRV Longing/ Short Difference remains at a low negative level, indicating that neither long-term investors nor short-term traders have yet made a profit. When investments are not profitable, trading tends to slow down as people hesitate to sell when incurring losses.

The difficulty in achieving profitability may cause online activity to cool down. However, this also reduces selling pressure. If the macroeconomic situation improves, long-term investors will become an important support. Their patience in not panic selling at unfavorable prices will create a stable foundation, helping prices recover when capital flows back in.

Ethereum's current situation reflects this balance. Low returns dampen enthusiasm, but there isn't excessive profit-taking pressure either. If there are additional positive external factors, market sentiment could quickly shift, with strong Capital absorbing supply and pushing the price of ETH higher.

Ethereum's MVRV Longing/ Short spread. Source: Santiment

Ethereum's MVRV Longing/ Short spread. Source: SantimentETH price faces challenges.

At the time of writing, Ethereum is trading around $2,968, just below the $3,000 resistance level. This level has repeatedly hampered ETH 's upward momentum in recent weeks. If it fails to regain this level, ETH will continue to experience significant volatility and is susceptible to short-term corrections.

To return to its December peak of $3,447, ETH needs a recovery of approximately 16%. The first hurdle ahead is the $3,131 region – a crucial resistance level. If the network continues its strong growth and large institutions like Bitmine continue accumulating, there will be enough buying momentum for ETH to break through this level.

ETH price analysis. Source: TradingView

ETH price analysis. Source: TradingViewThe risk of a price drop remains if Ethereum fails to hold the $3,000 level as support. If rejected, the price could fall to the $2,798 region – a level that has been tested previously. Since ETH typically experiences significant volatility in this area, a sharp decline could accelerate before the price stabilizes.