VanEck argues that Bitcoin is currently underperforming gold and that the Nasdaq in 2025 will provide the foundation for BTC to become one of the highest-performing assets in 2026.

VanEck: Bitcoin could become the fastest-growing asset in 2026.

VanEck: Bitcoin could become the fastest-growing asset in 2026.

Despite Bitcoin continuing to disappoint many investors in 2025, underperforming both gold and the Nasdaq 100 index, VanEck, a giant in the digital asset management industry, argues that the market is underestimating the long-term potential of the world's largest digital asset.

David Schassler, head of multi-asset solutions at VanEck, predicts that despite Bitcoin's underperformance this year compared to gold and the Nasdaq 100, it is poised for a strong rebound as currency devaluation accelerates and liquidity returns. Schassler believes that gold will…

— Wu Blockchain (@WuBlockchain) December 24, 2025

According to David Schassler, Head of Multi-Asset Solutions at VanEck, Bitcoin's current somewhat lackluster performance is actually setting the stage for it to become one of the best-performing assets by 2026.

Bitcoin may lose ground in the short term, but the long-term outlook remains unchanged.

- In his newly released 2026 outlook report, David Schassler points out that Bitcoin's performance is about 50% worse than the Nasdaq 100 year-to-date, and it is also far outpaced by gold in terms of yield.

However, according to VanEck, Bitcoin's underperformance this year does not reflect a weakening of the king coin, but mainly stems from two cyclical factors: declining investor appetite and continued tight global liquidity. Schassler commented:

"Bitcoin is being weighed down by a limited liquidation environment and risk-averse sentiment, but the core investment thesis remains intact."

He emphasized that in the past, Bitcoin has often reacted very strongly whenever liquidation returns to the system.

Notably, David Schassler revealed that VanEck is actively buying Bitcoin at the moment. According to him, the large performance gap between Bitcoin and other risky assets is a sign that the market is mispricing.

- VanEck expects that when central banks are forced to loosen monetary policy again, Bitcoin, with its limited supply, will react much faster and more strongly than traditional assets.

Fiscal inflation and currency devaluation are long-term drivers for Bitcoin and gold.

VanEck's core argument revolves around the concept of "monetary debasement"—the gradual devaluation of fiat currency due to rising public debt and ever-increasing budget spending. According to Schassler, financing future obligations and political ambitions will increasingly depend on printing money, thereby fueling demand for scarce assets.

- In this context, gold and Bitcoin are XEM as two prominent options. Schassler predicts that the price of gold could reach $5,000 per ounce next year, extending the strong upward trend that has already helped the precious metal rise more than 70% this year, currently trading around $4,492 per ounce.

- According to VanEck, Bitcoin is likely to follow the breakout trajectory of gold but with greater volatility, meaning higher potential returns when macroeconomic conditions become favorable.

- Besides crypto and gold, Schassler also points out that a quiet bull market is forming in the natural resources sector. The enormous demand from AI, energy transition, robotics, and re-industrialization is driving a wave of investment in infrastructure and "old assets" such as metals, energy, and raw materials.

According to VanEck, these very assets are laying the foundation for a new economy where high technology and scarce assets coexist. In that picture, Bitcoin Vai as a digital version of gold, serving both as a store of value and as an asset reflecting long-term expectations for the global financial system.

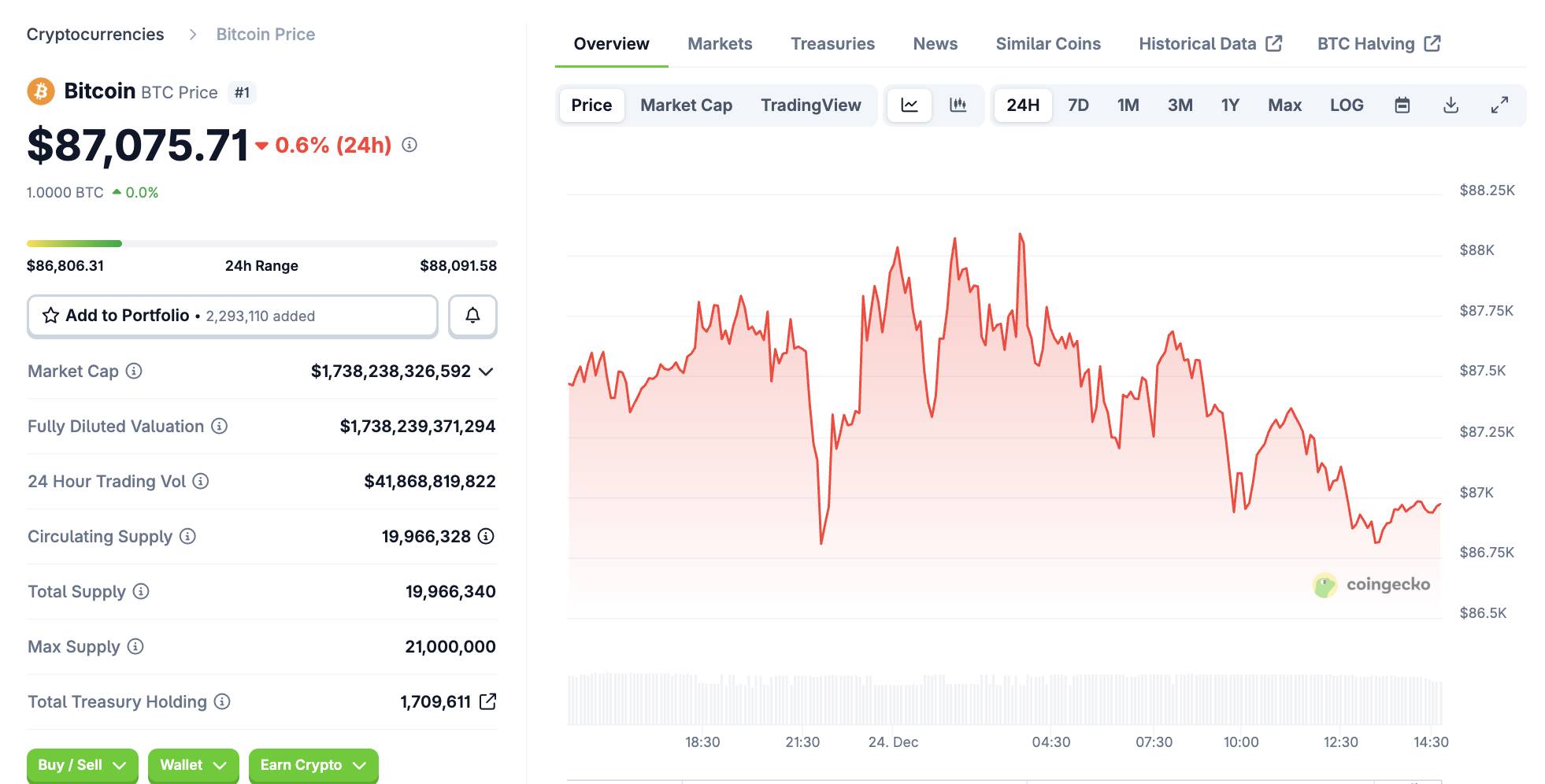

- At the time of writing, the price of BTC is currently fluctuating around $87,075, down slightly by 0.6% in the last 24 hours.

BTC price fluctuations over the past 24 hours, screenshot from CoinGecko at 02:40 PM on December 24, 2025.

BTC price fluctuations over the past 24 hours, screenshot from CoinGecko at 02:40 PM on December 24, 2025.

Coin68 compilation