The U.S. federal government's interest payments on the national debt have surpassed $1 trillion for the first time in fiscal year 2025. This amount now exceeds defense spending and Medicare spending—a first in U.S. history.

Wall Street analysts and many social media users have mentioned "Weimar" as they warn of the growing risk of a financial crisis. Meanwhile, the US Treasury Department is XEM stablecoins as a strategic tool to absorb the increasing amount of government debt.

The numbers: A crisis is clearly unfolding.

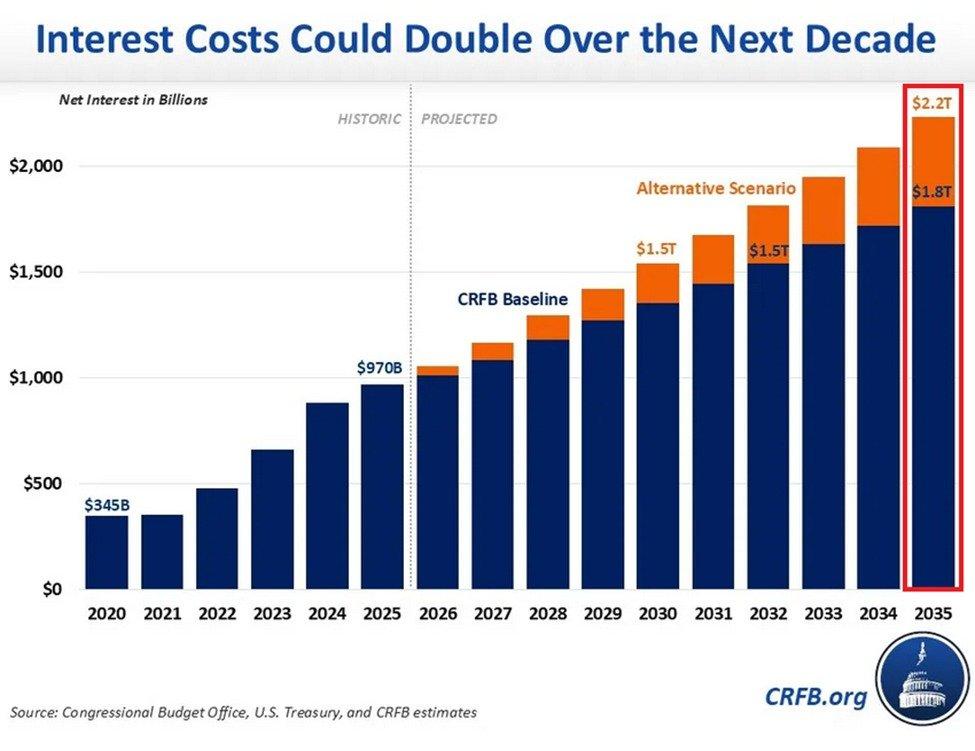

In fiscal year 2020, total net interest expenses were $345 billion. By 2025, this figure will have nearly tripled to $970 billion —about $100 billion more than defense spending. If interest on all public debt is included, this figure will exceed $1 trillion for the first time.

Source: U.S. Congressional Budget Office via KobeissiLetter

Source: U.S. Congressional Budget Office via KobeissiLetterThe U.S. Congressional Budget Office projects that total interest payments over the next 10 years will reach $13.8 trillion—nearly double the total inflation-adjusted payments over the past two decades.

The Federal Budget Committee is responsible for warning that, under an alternative scenario where tariffs are ruled illegal and the provisional provisions of recent laws are permanently maintained, the cost of interest payments could reach $2.2 trillion by 2035—a 127% increase from current levels.

Why is this unprecedented?

The US debt-to-GDP ratio has reached 100%, a level not seen since World War II. It is projected to surpass the historical peak of 106% in 1946 by 2029 and continue to rise to 118% by 2035.

The most worrying aspect is that this crisis will accelerate itself. Currently, the US federal government borrows approximately $2 trillion annually, with about half of that going towards interest payments on existing debt. CRFB analyst Chris Towner warns of the risk of a “debt spiral”: “If lenders are worried we won’t pay enough, interest rates will go up—meaning we’ll have to borrow even more to pay the interest.”

| Historical milestone | Year | Meaning |

|---|---|---|

| Interest rates exceed defense spending. | 2024 | For the first time since World War II |

| Interest rates exceed Medicare rates. | 2024 | Paying interest on loans has become the largest healthcare expense. |

| Debt reached 100% of GDP. | 2025 | For the first time since World War II |

| Debt has exceeded the 1946 peak (106%). | 2029 | Breaking all historical records. |

Market reaction: “Weimar” and “Buy gold”

Social media was abuzz with these predictions. “Without change, this is a dead end,” one commenter wrote. Another simply wrote the word “weimar”—referring to the hyperinflation in Germany during the 1920s. Yet another summarized it with: “The age of debt repayment has begun!”, clearly reflecting the mood that America has entered a new phase.

Most people are calling for safe-haven assets like gold, silver, and real estate. Notably, there's hardly any mention of Bitcoin, suggesting that the traditional mindset about "gold" still prevails in the minds of retail investors.

Impact on the market

In the short term, the massive issuance of US government bonds is draining market liquidation . With risk-free bond yields nearing 5%, both the stock and cryptocurrency markets are facing significant challenges. In the medium term, increasing budgetary pressure could spur tighter regulations and higher taxes on the cryptocurrency sector.

However, in the long term, there's a paradox for crypto investors. As public finances become increasingly unstable, the "digital gold" narrative of Bitcoin becomes even more appealing. The weaker the traditional financial sector becomes, the more attractive assets outside the system become.

Stablecoins: the crisis and the solution.

Washington unexpectedly found an "ally" in the financial crisis. The GENIUS Act, signed into law in July 2025, requires stablecoin issuers to maintain 100% of their reserves in USD or short-term Treasury bonds . This effectively turns stablecoin companies into large-scale buyers of US government bonds.

Treasury Secretary Scott Bessent has declared stablecoins to be “a revolution in digital finance” that will “lead to a surge in demand for U.S. Treasury bonds.”

Standard Chartered estimates that stablecoin issuers will purchase $1.6 trillion worth of U.S. Treasury bonds over four years—enough to absorb all new bond issuances during a second Trump term. This figure is even larger than the amount of U.S. Treasury bonds currently held by China ($784 billion), making stablecoins a potential alternative buyer as foreign central banks reduce their holdings of U.S. bonds.

The era of debt repayment has begun.

The US financial crisis is unexpectedly creating opportunities for cryptocurrencies. While traditional investors flock to gold, stablecoins have quietly become a crucial infrastructure in the US debt market. Washington's acceptance of stablecoin regulation is not just about innovation—it's about survival. The era of interest payments on debt has arrived, and crypto could become an unexpected beneficiary.