Written by: BlockBeats Worker

Do you remember the bull market of 2021?

That year, Bitcoin broke $60,000, Ethereum hit a new all-time high, NFT avatars sold for millions of dollars, and the metaverse concept convinced everyone that we were on the eve of an internet revolution. The cryptocurrency industry experienced an unprecedented funding frenzy. Venture capital firms rushed in, afraid of missing out on the next 100x project. In that era of fervor, it seemed that any project labeled "Web3" could easily raise tens of millions of dollars.

According to Venture Capital analysis, crypto startups raised $25.2 billion that year, a 713% surge from $3.1 billion in 2020. However, four years later, when we look back at the top 400+ highly funded projects, only a very few have survived.

Most of these projects have disappeared. They either announced the cessation of operations, transformed into other projects, were hacked and never recovered, suffered huge negative impacts after FTX's collapse, or became zombie projects.

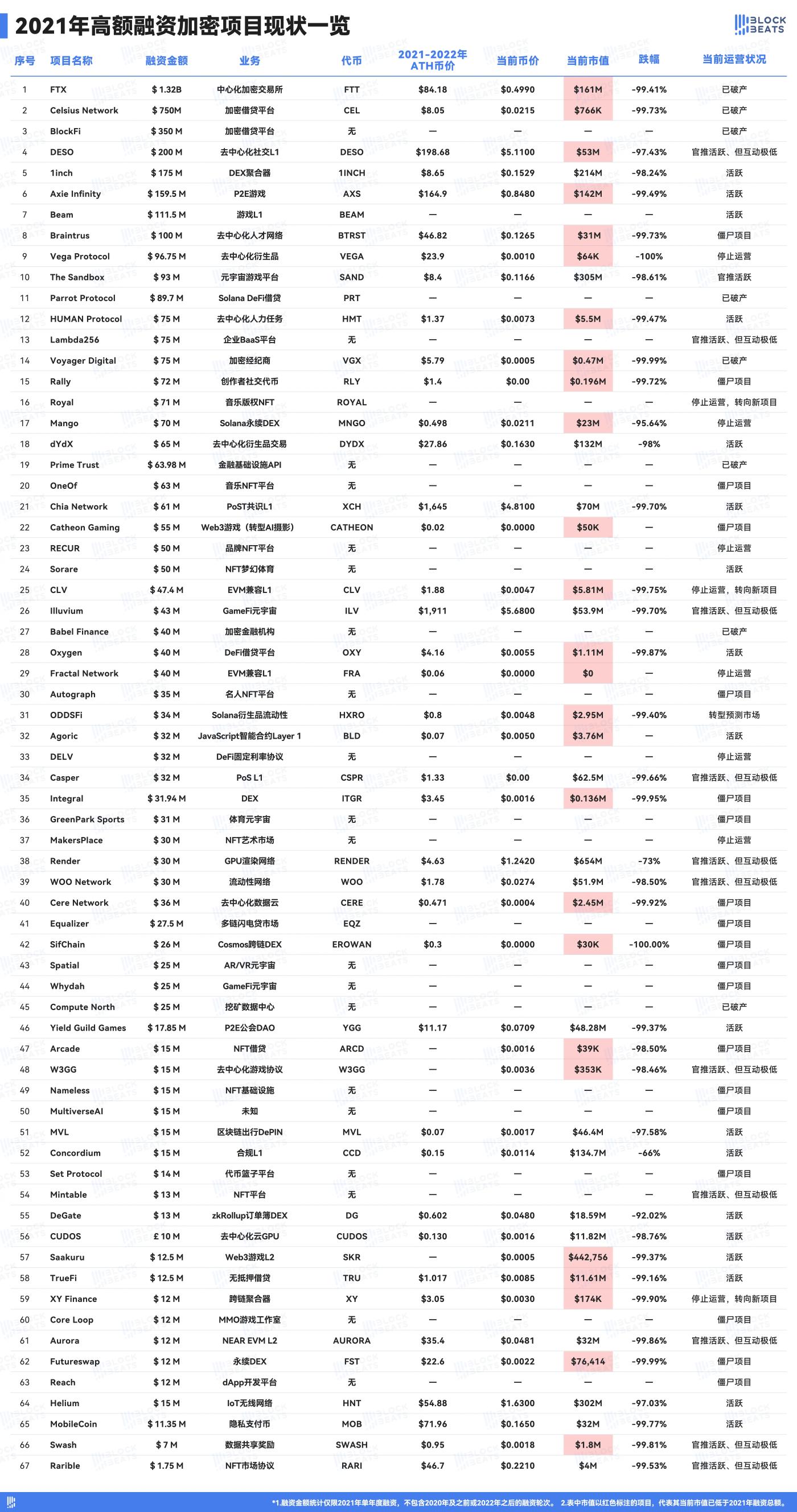

Note: This table includes 67 representative cases from the top 400 projects in terms of funding amount in 2021 that have either gone bankrupt, reached zero, or had low operational activity, with a total funding amount exceeding US$5 billion. Funding amount statistics are limited to funding rounds in 2021 alone and do not include funding rounds in 2020 or earlier, or after 2022. Projects marked with market capitalization in red in the table represent projects whose current market capitalization is lower than their total funding amount in 2021.

The most devastating disaster occurred in the centralized finance platform sector. FTX, which had raised $1.32 billion and was considered Binance's biggest competitor, collapsed in November 2022, with its founder SBF sentenced to 25 years in prison for fraud. Almost simultaneously with FTX, Celsius Network, a crypto lending platform that raised $750 million and promised users an 18% annualized return on deposits, saw its token CEL plummet from $8 to $0.02, a 99.73% loss. BlockFi, Voyager Digital, Babel Finance, and Prime Trust—names that once represented the "formalization" and "institutionalization" of crypto finance, collectively raising over $500 million—fell like dominoes during the 2022 liquidity crisis.

If the collapse of centralized platforms was due to the fraudulent nature of their business models, then the collective demise of NFTs and metaverse projects is more like a nationwide dissipation of illusion.

In 2021, everyone was talking about virtual land, digital art, and play-to-earn games. Axie Infinity raised $159.5 million with its "play-to-earn" concept, and its token AXS once surged to $164.90. In-game pet NFTs were even speculated to be worth hundreds of thousands of dollars each. In developing countries like the Philippines, countless people quit their jobs to "farm" full-time, seeing Axie as an opportunity to change their lives. However, when the game's economic model collapsed, AXS plummeted 99.49% to $0.85. Those players who invested their life savings ultimately discovered that it was nothing more than a Ponzi scheme that required a continuous influx of new players to take over.

The Sandbox, a representative project of the metaverse concept, raised $93 million, and its virtual land NFTs sold out in 2021, pushing the SAND token to $8.40. However, three years later, this so-called metaverse is deserted; occasional events attract few participants, and while the official Twitter account is still being updated, the comment section is practically empty. Ironically, most NFT platforms focused on music and art have become zombie projects.

Projecting the lessons of 2021 onto today reveals some harsh truths: most projects are products of cycles, and no more than 5% truly create lasting value. These 5% are usually only identified at the lowest point of a bear market. The wheels of history keep turning, 2025 is drawing to a close, and a new cycle is about to begin. When the new tide recedes, how many of today's projects will still be swimming in their swim trunks?