- The contraction of USDe’s market cap was not the result of a single-day bank run, but rather a prolonged de-scaling process following a systemic market shock.

- As a crypto-native stablecoin that once reached system-level scale, USDe’s size reduction reflects a broader reassessment of risk associated with complex stablecoin structures.

- The event does not invalidate the synthetic stablecoin model itself, but highlights the dual pressures of mechanism resilience and market trust under extreme conditions.

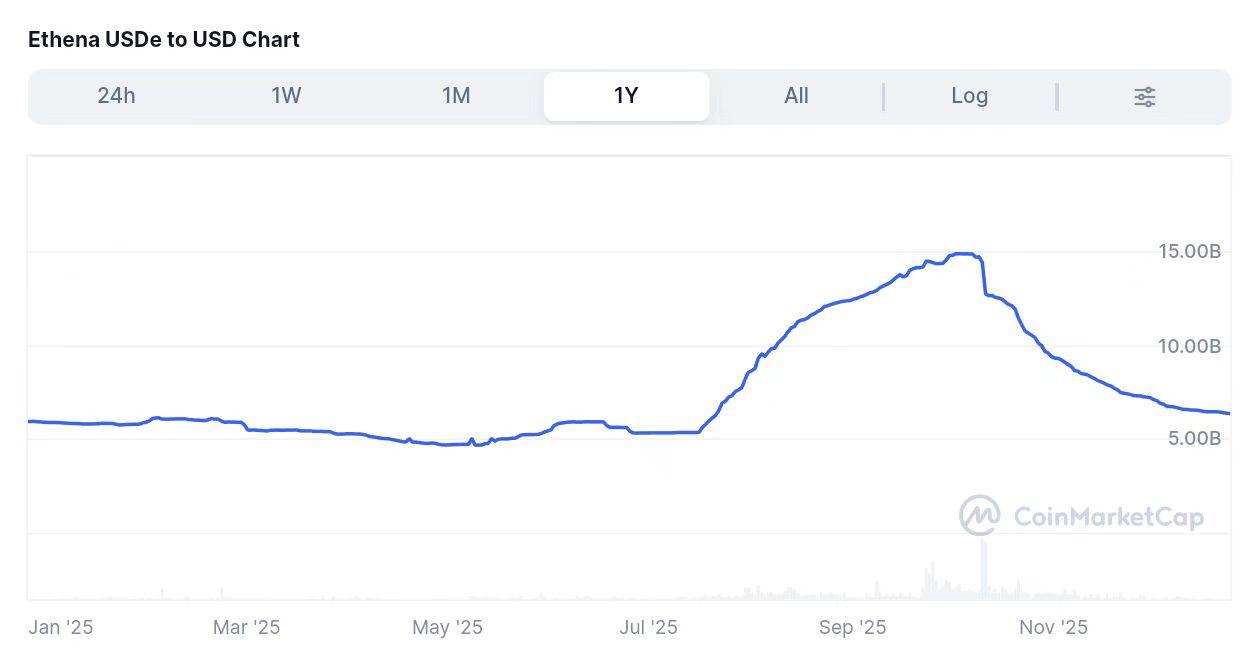

Since the “10/11 market shock,” Ethena’s synthetic stablecoin USDe has seen its market capitalization shrink by nearly half, with net outflows of approximately $8.3 billion. According to CoinMarketCap, USDe’s market cap stood close to $14.7 billion as of October 9, but declined to around $6.4 billion within just over two months.

STRUCTURAL PRESSURE FROM $8.3 BILLION IN NET OUTFLOWS

Once regarded as a “new paradigm” in the stablecoin sector, USDe is now undergoing a pronounced contraction in scale. CoinMarketCap data shows that over roughly two months, USDe’s market capitalization declined from nearly $14.7 billion to approximately $6.4 billion, representing net outflows of about $8.3 billion and an almost 50% reduction in size.

Importantly, this process did not manifest as a sudden cliff-like collapse or persistent de-pegging events. Instead, it unfolded as a relatively smooth but sustained contraction over time. From a capital behavior perspective, this resembles a phased de-risking process: initial redemptions driven by heightened uncertainty, followed by more measured risk adjustments by capital allocators, and eventually stabilizing at a lower equilibrium level. This pattern differs materially from short-lived, sentiment-driven anomalies.

Because USDe once reached system-level scale, its market cap movements carry broader signaling value beyond a single project. As a representative crypto-native stablecoin, changes in its size directly reflect shifting confidence in “non-reserve, synthetic” stablecoin models, which explains why its contraction has drawn sustained market attention.

Figure 1: USDe Historical Market Cap Trend (Q4 2025)

FROM ZERO TO $10+ BILLION: THE STAR GROWTH PHASE

To understand the significance of USDe’s contraction, it is necessary to revisit its expansion phase. Prior to mid-2024, USDe was among the fastest-growing stablecoins in the market, with a growth trajectory that outpaced many established peers. At its peak, USDe’s market cap approached $15 billion, placing it among the top-tier stablecoins alongside USDT, USDC, and DAI. The journey from launch to a $10 billion scale took less than a year—an exceptionally rapid expansion within the stablecoin sector.

This growth was not merely quantitative. It reflected USDe’s successful absorption of large-scale capital and its widespread integration into DeFi protocols and institutional yield strategies. From liquidity pool allocations on major DeFi platforms to low-risk arbitrage strategies employed by quantitative funds, USDe became a core asset. As a result, its scale conferred systemic relevance, making subsequent fluctuations meaningful not only for the project itself but also for stablecoin market structure and DeFi capital allocation logic.

A CRYPTO-NATIVE, BANK-FREE STABLECOIN EXPERIMENT

USDe’s defining characteristic lies in its departure from bank custody and U.S. Treasury-backed reserves. Instead, it maintains its dollar peg through a combination of spot ETH or stETH collateral and short positions in perpetual futures. From the outset, this approach sought to address a long-standing industry question: must stablecoins rely on traditional financial infrastructure?

Within the Web3 narrative, this mechanism carried significant symbolic value. By eliminating dependence on bank accounts and fiat reserves, USDe positioned itself as a fully crypto-native stablecoin, relying entirely on on-chain assets and derivatives markets. Mechanically, spot collateral provides baseline value, while short perpetual positions hedge price volatility, theoretically creating a balanced exposure. This structural differentiation was central to USDe’s rapid rise in visibility and capital inflows during its growth phase.

FROM A SINGLE STABLECOIN TO A DEFI CORE VARIABLE

USDe’s influence extended well beyond the stablecoin layer. Together with its staking derivative sUSDe, it reshaped yield dynamics within the DeFi ecosystem. While traditional stablecoin yields typically ranged between 3% and 5%, USDe-related strategies delivered yields exceeding 10% during peak periods, with leveraged strategies temporarily reaching even higher levels.

Numerous DeFi protocols incorporated USDe as a core asset for liquidity pools, staking mechanisms, and leverage products. This deep integration transformed USDe from a standalone stablecoin into an ecosystem-level variable. Consequently, as USDe supply began to contract, the effects spilled over into associated protocols, contributing to declining yields and liquidity adjustments, further amplifying market focus on its scale reduction.

Figure 2:Ethena Protocol TVL Sharp Decline Chart

A TEST OF TRUST AFTER SYSTEMIC MARKET VOLATILITY

The timing of USDe’s contraction closely aligned with the broader market turbulence around October 11, often referred to as the “10/11 market shock.” During this period, global risk assets experienced heightened volatility, and the crypto market faced sharp drawdowns, with derivatives markets undergoing rapid repricing and shifts in funding conditions.

Under these stressed conditions, USDe experienced brief price deviations on major exchanges. While Ethena Labs attributed these movements to technical and data-related factors and the peg was subsequently restored, the episode intensified market scrutiny regarding USDe’s performance under extreme volatility. It is important to note that such stresses were not unique to USDe; many strategies reliant on hedging and funding rates faced challenges during this period. However, USDe’s system-level scale magnified its visibility.

On-chain and market behavior following the shock suggests a pattern of sustained redemptions rather than a singular run event. A significant portion of net outflows occurred in the weeks following the initial shock, with redemptions largely driven by large holders and institutional addresses. This behavior is consistent with professional risk management practices—reducing exposure to complex structures as volatility rises—rather than retail panic. Over time, this reassessment contributed to USDe’s prolonged de-scaling.

CONCLUSION

From a design perspective, USDe’s mechanism offers efficiency advantages in stable market environments, achieving capital efficiency without reliance on traditional financial infrastructure. However, under high-volatility conditions, its stability depends on the simultaneous functioning of multiple factors, including hedging execution, funding rate dynamics, liquidity depth, and collateral price behavior.

When markets reverse rapidly, rising hedging costs, shifts in funding rates, and liquidity concentration effects can all exert pressure on synthetic stablecoin structures. This does not imply that the mechanism is inherently invalid, but rather that its risk profile differs fundamentally from that of reserve-backed stablecoins. While traditional models concentrate risk in reserve transparency and liquidity, synthetic models face compounded exposure to market microstructure and derivatives dynamics.

Against this backdrop, USDe’s market cap contraction can be viewed as the external manifestation of a broader risk–reward reassessment. As investors recalibrate their tolerance for complexity and volatility, capital has gradually rotated toward more conservative reserve-backed stablecoins. In this sense, the USDe episode serves less as a repudiation of innovation and more as a reminder that stability remains the defining benchmark for stablecoin adoption under stress.

Read More:

Why USDe Survived While LUNA Collapsed

The Technical Ghost Behind USDe’s “Depeg”

〈USDe Market Cap Halved: A Test of Trust and Mechanism for Crypto-Native Stablecoins〉這篇文章最早發佈於《CoinRank》。