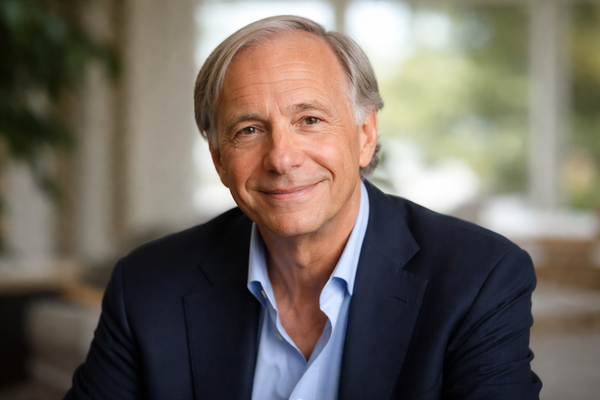

Ray Dalio, a global hedge fund magnate, has once again expressed his negative view on the possibility of central banks holding Bitcoin (BTC). While Bitcoin is gaining attention as a "store of value," he believes there are clear structural limitations to its adoption as a central bank reserve asset.

Dalio recently stated in a podcast that "central banks are unlikely to hold Bitcoin due to several issues." He cited the fact that while Bitcoin is perceived as a form of value, the government could interfere with private transactions by interfering with or monitoring transactions.

The comparison he emphasized was gold. Dalio explained that "gold is the only asset that governments cannot touch or control," and that this is a crucial difference between gold and Bitcoin from a central bank's perspective. His argument is that central banks, charged with monetary policy and financial stability, have no choice but to favor historically proven physical assets over digital assets, which are exposed to technological and policy variables.

This perception also has implications for the debate over Bitcoin's institutional inclusion. While Bitcoin is becoming a mainstream financial asset thanks to the approval of exchange-traded funds (ETFs) and the influx of institutional investors, analysts believe that high hurdles remain for it to reach the level of a central bank reserve asset: controllability and policy consistency.

What's interesting is that Dalio doesn't completely reject Bitcoin. Last November, he revealed that he allocated approximately 1% of his portfolio to Bitcoin. While he acknowledges its value as a diversified investment tool for individual investors and private asset managers, this message seems to convey that different standards apply to the assets of sovereign nations and central banks.

The market sees Dalio's remarks as reaffirming the division of roles between digital assets and gold. While Bitcoin has grown by touting itself as "digital gold," central banks are likely to remain reliant on gold as their primary choice. This statement, independent of Bitcoin's price outlook, is interpreted as a call to rethink the nature and limitations of central bank reserve assets.