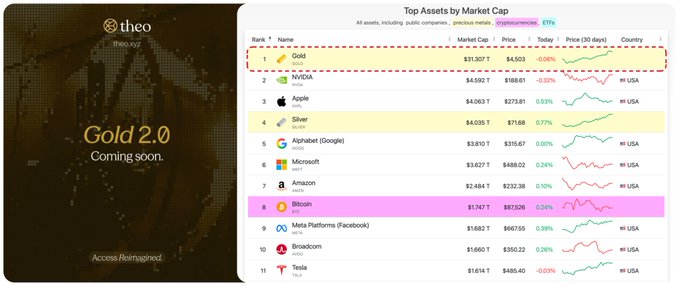

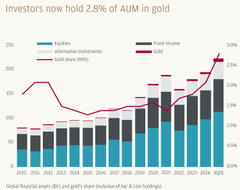

➥ @Theo_Network keeps teasing $thGLD as Gold 2.0 Gold is up 60%+ YTD, printing multiple ATHs above $4,500/oz driven by: - real geopolitical risk, - aggressive central bank accumulation, - sustained ETF inflows, - and the fact that stocks and bonds are no longer diversifying each other like before Gold now makes up ~2.8% of global investor assets (ETFs, futures, bars/coins) Many allocators are now openly talking about 5-15% exposure depending on risk profile This is why I’m paying attention to what @Theo_Network is building Theo already proved they can bridge #RWAs onchain with $thBILL (tokenized T-Bills earning Treasury yield) Now they’re bridging $thGLD as a tokenized gold, low fees, institutional-grade custody & compliance, and DeFi composability Onchain gold that can move, earn, and plug into strategies is a different game TradFi safety + DeFi efficiency is a combo I take seriously here

arijit

@ampingle_

12-24

Gold is finishing the year stronger than ever.

Over the past 5 years, gold’s share of investor portfolios has doubled from ~1.5% of total AUM to nearly 3% today.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share