Written by Eric, Foresight News

Readers who follow cutting-edge technology are likely aware of the progress made in quantum computing this year. This "technological revolution," much touted as such for years, like AI, has finally achieved a breakthrough this year. Simply put, quantum computing has moved from a physics problem to an engineering one, becoming a turning point in the transition from the laboratory to commercialization. This year has also been designated by the United Nations as the International Year of Quantum Science and Technology.

The technological breakthrough is good news, but the bad news is that quantum computing is a matter of life and death for Bitcoin. When computing power reaches a certain threshold, public keys exposed on the network could potentially be used by quantum computing to calculate private keys, which could be devastating for Bitcoin.

If previous discussions about quantum computing were limited to "whether it will affect Bitcoin," this year's discussions have evolved to the question of "what should we do?" The Bitcoin community has always been fiercely debating major issues, from block size increases to the Lightning Network, and then to the Taproot upgrade—each time they seem determined to create a huge uproar, and this time is no exception.

Interestingly, the core of this debate isn't about which solution is better or worse, but rather the conflicting levels of importance placed on it. Given that past debates have all aimed to improve Bitcoin, while this one concerns its very survival, the radicals believe Bitcoin's leaders are too optimistic, and that failing to prioritize it and quickly develop a solution could lead to irreparable losses. The conservatives, on the other hand, feel that the debate is overreacting, arguing that Bitcoin has always found a way forward, and this time will be no exception.

Unlike previous discussions, this time some experts have moved beyond the conflict itself to the level of community culture, and pointed out incisively that the Bitcoin community has become unable to withstand criticism.

Radicals: "The emperor isn't worried, but the eunuchs are."

The representative of the radical faction is Nic Carter, founding partner of Castle Island Ventures. As Fidelity's first crypto asset analyst and the founder of a VC that has invested heavily in Bitcoin ecosystem projects, Nic's words still carry some weight in the Bitcoin ecosystem.

Nic's concern is not that Bitcoin developers cannot provide a solution, but rather, based on past experience, he believes that if no action is taken, Bitcoin may not be able to complete its quantum-resistant upgrade before quantum computing matures.

Nic stated that many quantum computing companies predict that fully functional, scalable quantum computers could be built by the mid-2030s. NIST, the official standards-setting agency of the U.S. government, has recommended to government agencies worldwide that they phase out quantum-vulnerable encryption schemes, such as ECC256, by 2030 and completely cease reliance on them by 2035.

It's important to note that these are just predictions; private companies may not fully disclose their progress and then suddenly announce a major breakthrough, just like with AI. Nic believes that in the face of this unpredictable threat, Bitcoin developers should act immediately.

The uncertainty surrounding the timing of technological breakthroughs is only one reason why Nic feels the urgency. The second reason is that reaching a consensus within the Bitcoin community on quantum-resistant solutions and how to migrate Bitcoin, which is in danger, will be a major problem that will likely require years of discussion.

Nic stated that the SegWit and Taproot upgrades took two and three years respectively from proposal to activation, and the complexity of the "post-quantum" upgrade is obviously much higher. Replacing the encryption technology at the core of the protocol will change almost every aspect of the system, including how users interact with the system. Furthermore, if the upgrade does occur, what will happen to those addresses that have been dormant for years? Will the Bitcoins there be frozen, or will the more than 1.7 million Bitcoins confirmed to be "lost" be left unattended and ultimately given away?

These are all things that you can foresee will take a lot of time, not to mention the need to allow enough time for as many people as possible to know that they need to transfer their Bitcoin to the new address. Nic calculated that it would take about 10 years to complete all of this. If quantum computing really does achieve a breakthrough within 10 years, then the quantum-resistant upgrade for Bitcoin should begin now.

What truly worries Nic isn't the inaction of Bitcoin developers, but rather the morbidly cautious development culture that stems from this apathy. Nic believes that to avoid unpredictable risks to Bitcoin, its upgrade choices are heavily influenced by ideology: minimizing reliance on third-party libraries and limiting functionality, including scripting languages. Since 2017, Bitcoin has only undergone two major upgrades, both accompanied by significant controversy and infighting, precisely illustrating this obsessive reluctance to change Bitcoin.

Conservatives: I know you're in a hurry, but don't rush.

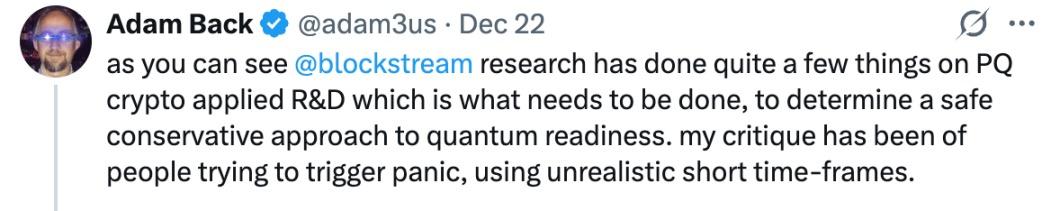

Adam Back, co-founder of Bitcoin development company Blockstream and inventor of the PoW mechanism, seemed unfazed by Nic's criticism. He bluntly stated under Nic's article published on X that Nic was either stupid or malicious: "Either you don't understand the work we do at all, or you are deliberately spreading panic."

Adam stated that Blockstream has been actively involved in PQ (post-quantum) application research, but it's not as simple as writing a BIP and releasing a "PQ signature scheme" and calling it a day. Blockstream focuses on analyzing its applicability and first performs domain-specific optimizations for hash-based schemes. Furthermore, some members of the Blockstream team have contributed to the security proofs of SLH-DSA (Stateless Hash-Based Digital Signature Algorithm, one of the post-quantum cryptography standards released by the National Institute of Standards and Technology in August 2024), so they are fully capable of solving this problem.

Adam stated that what they need to do now is to determine a secure and conservative solution resistant to quantum attacks; hastily choosing a solution that ultimately proves insecure would cause even greater damage. Adam believes that Nic acted this way partly because Bitcoin developers are very low-key and don't share their research on social media, leaving Nic unaware of the latest research progress. Adam also implied that Nic wanted to spread panic.

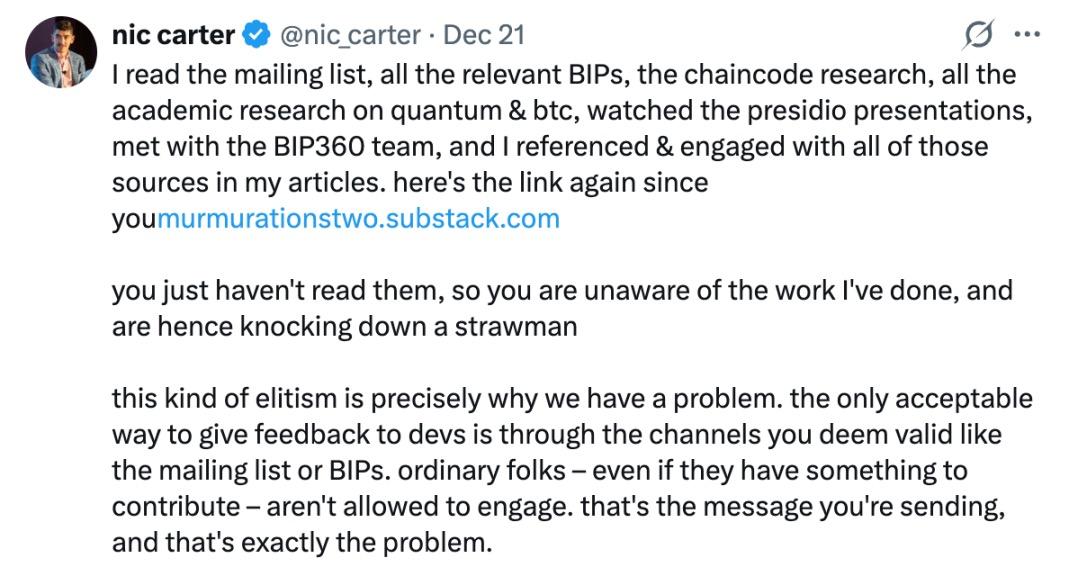

The article Nic published on X was actually a summary of his research report , which was over 20,000 words long. Adam's response, which seemed to be based on not having read the report, directly angered Nic, who responded by denouncing this elitist arrogance and stating clearly: "Read it before you speak."

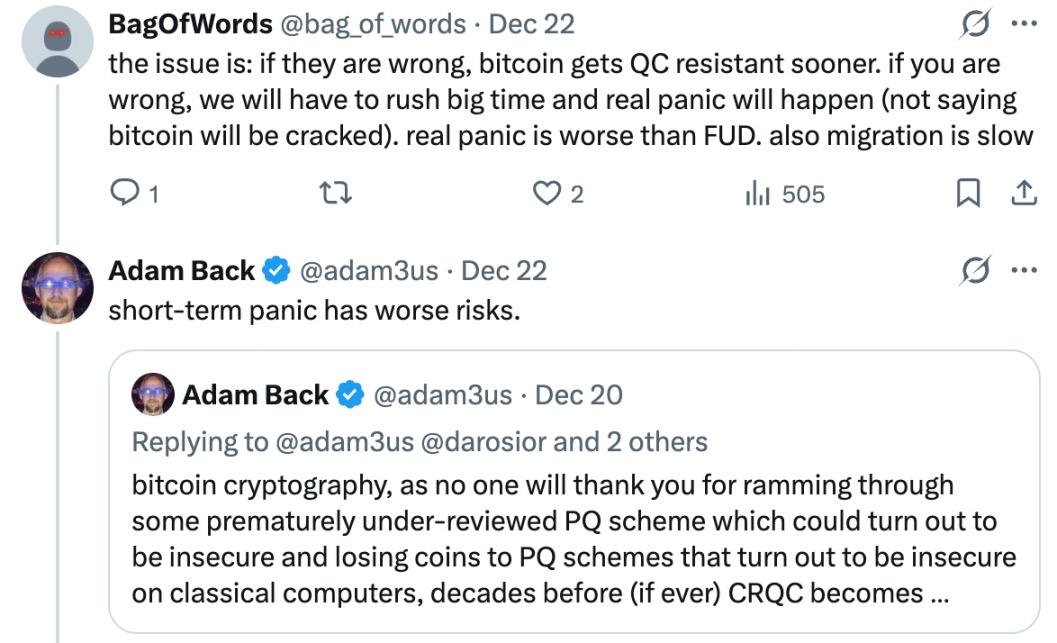

Objectively speaking, Adam's answer seemed somewhat evasive. He didn't directly address whether Bitcoin would be able to solve the problem if quantum computing truly achieves a qualitative breakthrough within 10 years, instead consistently emphasizing that they have made progress and cannot act rashly. A similar view was expressed in the comments section. A user named BagOfWords stated: "The problem is, if they are wrong, Bitcoin will become quantum resistant much faster; but if you are wrong, we will have to act hastily, and real panic will erupt, which is worse than mere panic. Frankly, the migration speed is indeed very slow."

Adam's response was that "short-term panic poses a more serious risk." We're unclear whether this risk refers to price fluctuations or concerns that short-term panic might lead developers to hastily choose a quantum-resistant solution that may not be fully proven effective, but this answer certainly conveys the "arrogance" Nic mentioned.

However, Adam's concerns are not entirely unfounded. While quantum computing has entered the engineering phase, its ultimate development remains unclear. If a quantum-resistant solution is hastily updated now, and ultimately proven ineffective against quantum computing—or, in a sense, "using a sledgehammer to crack a nut"—it will undoubtedly create more problems. We cannot know whether the lack of urgency among Bitcoin developers stems from technological confidence or some other reason, but Nic's "get-rich-quick" attitude clearly resonates more with the public's basic sentiment.

Industry OG: There are indeed problems with the Bitcoin community culture.

The two brothers mentioned above are merely representatives of their respective sides, and the two factions have been arguing about this topic on various platforms for nearly a year. Hasu, an advisor to Flashbots, Lido, and Stakehouse, and a cryptocurrency OG researcher, used the debate between the two sides to pinpoint the root cause of the current problems within the Bitcoin community.

In his article on X, Hasu described the problem as follows: Bitcoin culture has long guaranteed that its core rules will not be easily changed, but this culture has evolved over time into "resistance to change".

Bitcoin faces two long-term risks: a "quantum crisis" and a shift in its economic model towards fee-driven growth as block rewards continue to shrink. Hasu admits he's currently uncertain whether these risks can be adequately addressed. He believes this stems from the cultural shift that has made saying "Bitcoin has problems" or even "Bitcoin can be improved" politically incorrect.

While the reason isn't explicitly stated, I speculate that this culture stems from Bitcoin's long-term exclusion by the mainstream in its early stages. Once it gained acceptance, many long-time Bitcoin supporters, often referred to as "believers," fostered a culture within the community akin to a religious faith. This culture led to the endless mythologizing of Bitcoin, to the point of being intolerant of even a grain of sand, which, to some extent, represents a morbid release after years of suppression.

Hasu went on to explain that an extreme culture makes it easier for gradualists to gain community acceptance and a voice, while relatively radical and bold suggestions or proposals become increasingly rare. Even in discussions of the quantum crisis, many relatively professional people describe it as "alarmist," while very few actually simulate possible consequences and explore solutions. This description aligns very well with Adam's stance.

Hasu's solution to this problem is also very pertinent. He believes that, firstly, the "rigidity" of Bitcoin culture should be a strategy rather than a belief. This strategy can maintain a high degree of neutrality, but it also needs to set up an "emergency plan," that is, when a real threat arises, to what extent criticism and questioning should be allowed without being condemned, and how much power can be mobilized to carry out defense work immediately.

Finally, Hasu stated that pretending tail risks don't exist won't make Bitcoin stronger; it will only weaken its ability to cope with risks when tail risks are no longer just a theoretical concept. What the Bitcoin community should address now is a cultural shift: how to remain cautious while simultaneously being able to adapt to antifragility at any time.