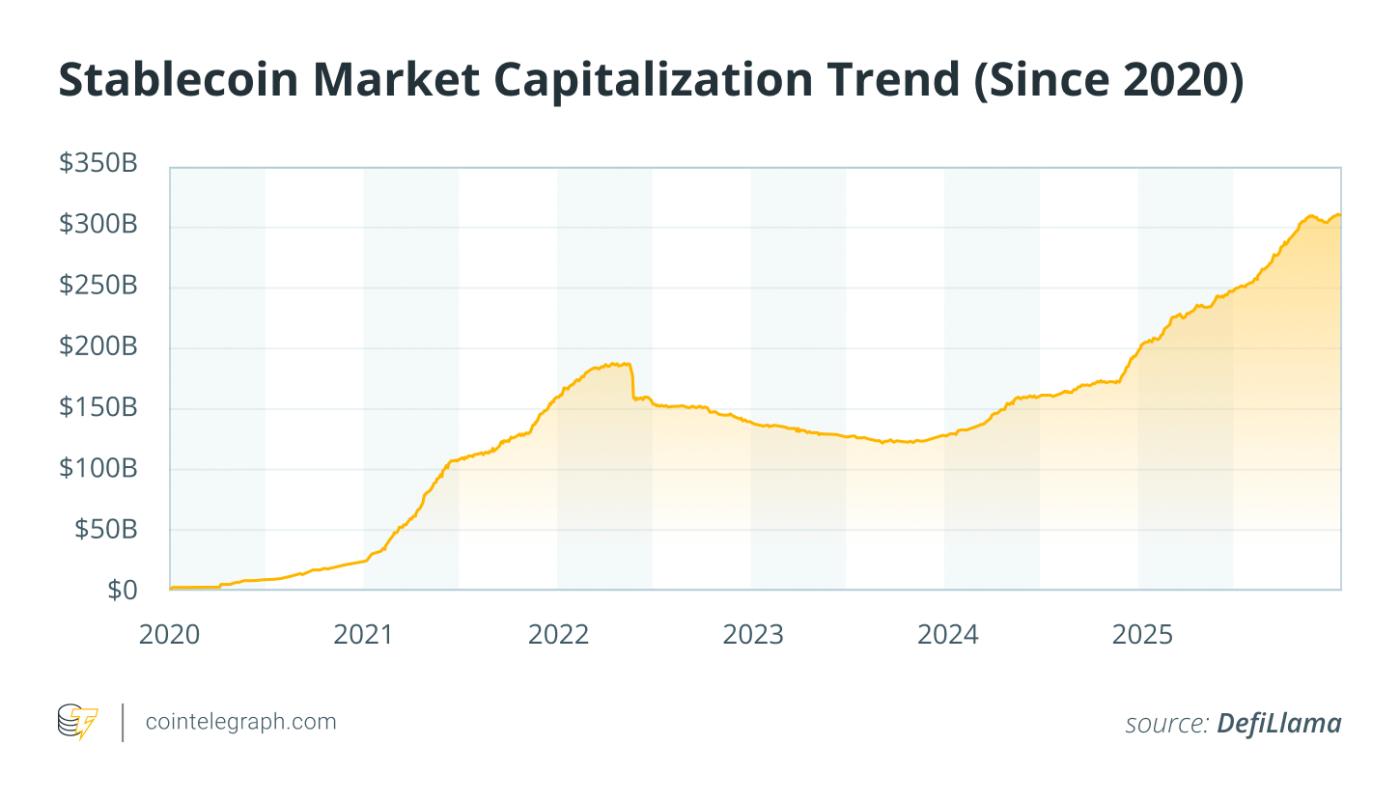

The stablecoin market has grown to $310 billion in a year, reflecting its evolution from a crypto trading tool to a core digital cash layer connecting cross-border payments, institutional funds, and DeFi, accelerating the mainstream adoption of crypto assets.

Article by: Abhinav Tewari

Source: Cointelegraph

Article compiled by: Chang

Stablecoin adoption exhibits "hockey stick-like" growth.

The stablecoin market reached a key milestone on December 12, 2025, with its total market capitalization rising to $310 billion, a growth of approximately 70% in one year. This growth is not yet another indicator of a crypto bubble, but rather reflects a structural shift in how digital assets are used globally.

To understand the importance of the $310 billion stablecoin market, we first need to define what a stablecoin is. Unlike crypto assets such as Bitcoin or Ethereum, whose prices fluctuate due to market sentiment, stablecoins aim for price stability by being pegged to an underlying asset, typically through reserve backing or algorithmic mechanisms. The most common pegged asset is the US dollar, while some stablecoins are pegged to commodities such as the euro or gold.

This relatively simple design solves a core problem in the cryptocurrency space: volatility. When users make a $100 cross-border transfer, they expect to receive $100, not $50 or $150 due to exchange rate or market fluctuations. Stablecoins make this possible by acting as a bridge between traditional finance and the decentralized economy.

Currently, the stablecoin market is dominated by USDT (approximately $172 billion) and USDC (approximately $145 billion), which together account for about 80% of global stablecoin trading activity. This high concentration reflects a key fact: in the actual adoption of crypto assets, network effects and trust are often more important than simple technological novelty.

Stablecoins currently account for about 80% of total trading volume on many mainstream crypto exchage, effectively becoming the "default cash tier" in the digital asset market.

A quietly brewing global payments revolution

Stablecoins' most transformative potential lies in cross-border payments. Traditional international remittances rely on a multi-layered intermediary system, including correspondent banks, clearing houses, and forex brokers, each layer adding to costs and time. A typical international transfer usually takes 3–5 business days, with fees ranging from 2% to 3% of the transaction amount.

In contrast, stablecoin-based transfers can be settled within minutes, at costs as low as a fraction of the transaction amount. Some remittance institutions have stated that switching from traditional payment channels to stablecoin settlements can reduce costs by up to 95%, while settlement times have been shortened from days to minutes.

In high-inflation economies such as Argentina and Venezuela, stablecoins are increasingly being used as a store of value to address the instability of their local currencies. This represents a new form of financial inclusion: even in regions with weak banking infrastructure, individuals can access relatively stable digital assets without relying on traditional bank accounts.

FIS research shows that nearly three-quarters of consumers said they would be willing to try stablecoins if they were offered by their banks; while only 3.6% of respondents said they would be willing to use unregulated service providers.

Institutional demand is a key driver of stablecoin adoption.

Whether it's Stripe's acquisition of the stablecoin platform Bridge, Circle's launch of the Arc Layer-1 blockchain, or Tether-backed Stable's launch of its own Layer-1 protocol, all these indicate that major players are continuously increasing their investment in dedicated stablecoin infrastructure to further improve efficiency.

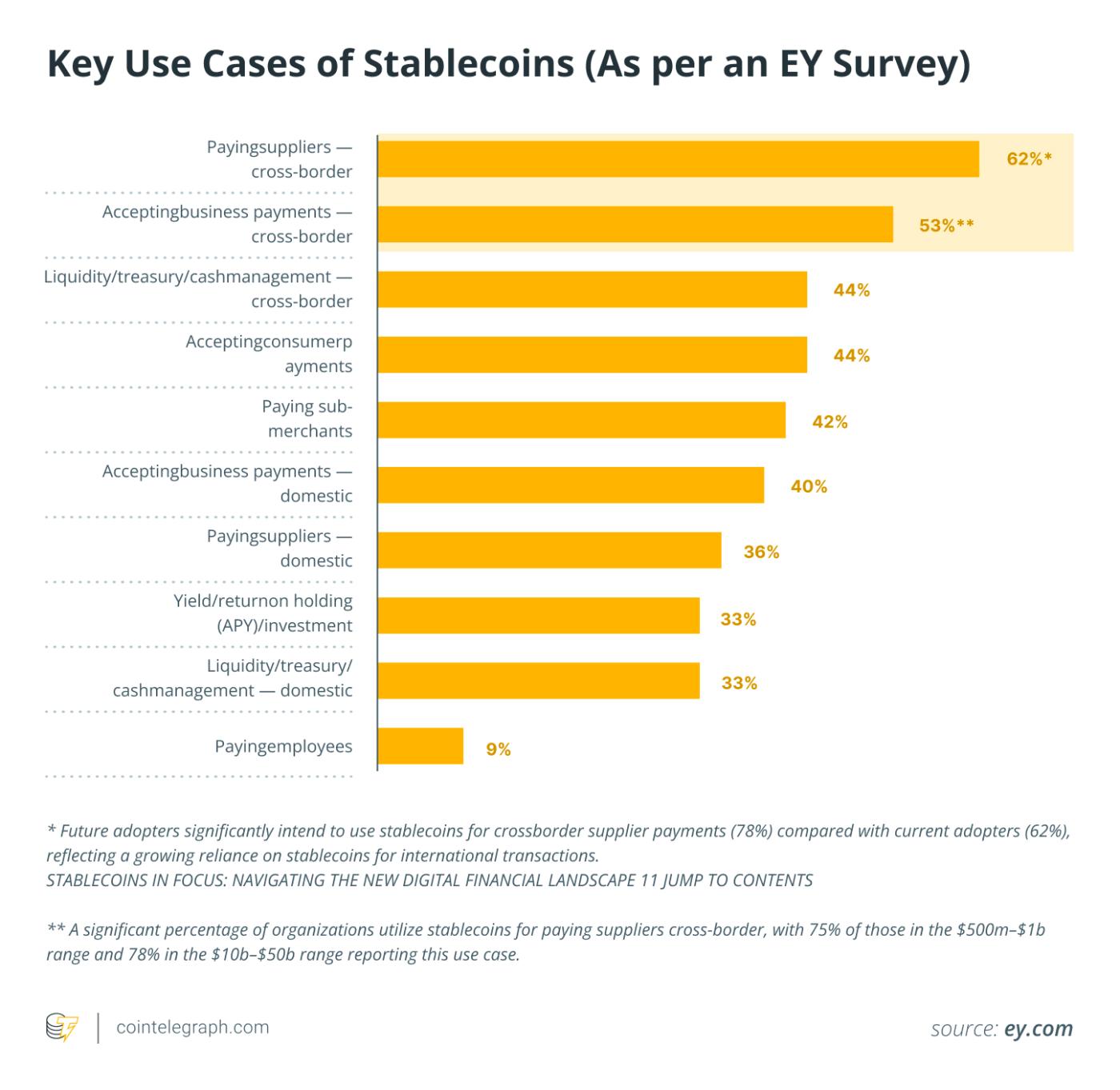

According to Fireblocks' 2025 report, "Stablecoins in Banking," nearly half of the surveyed institutions are already using stablecoins in their actual operations, while another 41% are testing or planning to deploy them. Among institutions already using stablecoins, cross-border transactions are the most common use case. An EY survey shows that 62% of businesses use stablecoins to pay suppliers, and 53% accept stablecoins as a commercial payment method.

The shift at the institutional level from speculative use to operational necessities is reshaping the adoption path of stablecoins. Corporate finance departments are increasingly viewing stablecoins as workflow tools. The flow of funds within the traditional banking system often involves opportunity costs and exchange rate risks, while stablecoins enable near-instantaneous settlement 24/7 and improve fund visibility.

Industry surveys in 2025 show that stablecoins are often the first blockchain products piloted by institutions, even before Bitcoin or Ethereum exposure, because they are closest to existing money and treasury management processes.

Stablecoins have evolved into the foundational layer of DeFi.

Stablecoins occupy a central position in the decentralized finance (DeFi) ecosystem. Mainstream protocols like Aave and Curve build their lending and trading pools around stablecoins because they offer low-volatility, predictable collateral. Developers are also exploring interest-bearing stable assets, such as Ethena's USDe, which aims to enable static currencies to automatically generate yields.

Stablecoin trading volume also confirms its crucial role. In 2025, the on-chain transaction volume of major stablecoins reached trillions of dollars annualized, and at some points, its growth rate, measured by original settlement amount, even surpassed that of traditional bank card networks. Although most users are not directly aware of these underlying mechanisms, the scale of stablecoin settlements has begun to approach that of global payment giants.

In 2025, more than half of the total value locked (TVL) in DeFi was in stablecoins, which have become the primary collateral and unit of account for many on-chain lending protocols and liquidity pools.

The issue of scale: from hundreds of billions to trillions

The $310 billion scale naturally raises a question: if stablecoins are so useful, why haven't they reached the trillion-dollar level yet? The answer lies in the adoption path of financial infrastructure—slow at first, then accelerating rapidly.

Currently, stablecoins are primarily used for transaction infrastructure in the crypto market, as well as for cross-border settlement of remittances and institutional fund flows. To achieve scalable expansion, several infrastructure layers still need to mature, including: compliant deposit and withdrawal channels, merchant tools that make stablecoin payments as simple as swiping a credit card, and user interfaces that shield the complexities of the blockchain.

Multiple industry analyses predict that, assuming broader participation from large financial institutions, the supply of stablecoins could reach $2 trillion by 2028. These predictions are based on the assumption that stablecoins will evolve from transactional instruments into a general-purpose digital cash layer, widely used in e-commerce, corporate payments, and embedded finance.

Under the framework of the Crypto Asset Market Regulation (MiCA) and the GENIUS Stablecoin Act, stablecoins backed by mainstream fiat currencies must be fully backed by high-quality assets and subject to regular audits and information disclosure. Their regulatory structure is very close to that of the traditional financial system.

Robust infrastructure is key to mainstream adoption.

The rapidly growing stablecoin market reveals how technological change truly spreads. Stablecoins may not make headlines like Bitcoin halvings, but they underpin a multitude of real-world crypto use cases.

This asset class achieves a unique balance between price stability, regulatory structure, and technological composability, attracting both prudent institutional participants and experimental DeFi protocols. As regulatory frameworks such as MiCA and the GENIUS Act are gradually implemented, stablecoins are expected to continue to serve as a key link between crypto assets and mainstream finance.

For ordinary users, the most influential crypto innovations may not be a brand new blockchain, but rather the digital dollars that operate more efficiently and gradually replace traditional payment channels.