introduction

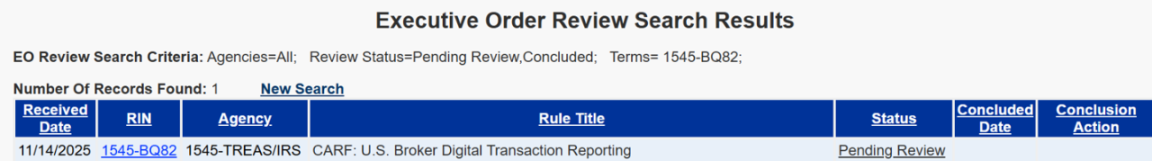

According to the official website of the U.S. government, the Internal Revenue Service (IRS) submitted a proposal to the White House in November suggesting the adoption of an international standard for reporting and taxing digital assets. The White House is currently reviewing the proposal. This proposal, titled "Digital Transaction Reporting by Brokers," was submitted to the White House on November 14th, and its core content is the implementation of the "Crypto-Asset Reporting Framework" (CARF). Once in effect, the IRS will be able to obtain information on U.S. taxpayers' cryptocurrency transactions on overseas exchanges and platforms.

This move is particularly intriguing given the backdrop of the Trump administration's return to the White House. While the market had hoped for a more relaxed regulatory environment under the new administration, fiscal realities and deficit pressures seem to have led the federal government to adopt a more pragmatic and forceful approach to tax enforcement. This proposal is not only a revision of US domestic tax law but also a crucial piece in the global puzzle of cryptocurrency tax regulation.

This article, as part of a CARF series of studies, will begin with this proposal, first briefly reviewing the institutional background and core mechanisms of the CARF framework; then, in conjunction with the existing U.S. tax information reporting and cross-border information exchange system, analyze its institutional connection and potential changes in the digital asset field; finally, from the perspective of different types of market participants, assess the compliance impact and risk exposure that the implementation of CARF may bring, and propose corresponding coping strategies, in order to provide reference and guidance for industry participants and investors.

1. White House reviews new rules targeting global crypto tax revenue.

The core intent of the proposal under review by the White House is to introduce a more cross-border enforceable international information disclosure mechanism based on existing domestic digital asset reporting rules. This would break through geographical boundaries in accessing tax information and push relevant service providers to assume stricter and more comprehensive data reporting obligations. This means that the US regulatory perspective is no longer limited to the data availability of domestic trading platforms, but rather follows the global trend of tax transparency represented by CARF, extending its reach to overseas exchanges and offshore service networks. The goal is to create a closed-loop regulatory system that allows for the identification, tracking, and exchange of encrypted activities conducted overseas by US tax residents.

This proposal is both an institutional response to international collaborative governance and a direct driver of macroeconomic fiscal pressures. On the one hand, with major global economies accelerating the adoption of CARF cross-border reporting standards, the US will face institutional gaps in cross-border information access and law enforcement cooperation if it does not establish a corresponding mechanism. On the other hand, under the Trump administration's economic policies driven by tax cuts and tariffs, federal finances face severe challenges. According to the Congressional Budget Office (CBO), the US deficit could exceed $2 trillion in fiscal year 2025 alone. Without increasing traditional income tax rates, the policy objective of "closing the tax gap" continues to strengthen domestically, with digital assets, especially offshore accounts and cross-platform transactions, considered significant sources of tax evasion and compliance blind spots. As the US Treasury Department has repeatedly pointed out in its Green Paper, "Offshore crypto accounts result in tax losses of tens of billions of dollars annually."

2. CARF Ushers in the Era of Global Crypto Taxation "CRS 2.0"

The Crypto Asset Reporting Framework (CARF) is a global standard for tax transparency regarding crypto assets, developed by the Organisation for Economic Co-operation and Development (OECD). Through uniform due diligence rules and an automatic exchange of tax information mechanism, this framework requires Crypto Asset Service Providers (RCASPs) to report key information such as customer identities, accounts, and transactions to tax authorities, and includes transfers to external wallets in the reporting scope, thus filling gaps in traditional financial regulation regarding the cross-border flow of digital assets.

CARF itself is an international standard developed by the OECD and does not have direct legal force. Its implementation requires national commitments, legislative transformation, and system integration. In other words, the timing of CARF implementation in different countries/regions depends on each country's specific commitments. OECD data shows that as of December 4, 2025, 75 jurisdictions had formally committed to implementing CARF in 2027 or 2028, of which 53 jurisdictions had signed bilateral or multilateral competent authority agreements (CARF MCAAs). This White House review proposal may be the first to systematically outline the US path.

3. The US Crypto Regulatory Framework: Gradually Moving Towards Order and Clarity

While CARF has established a channel for cross-border data exchange at the international level, its effectiveness still depends on whether tax authorities in various countries have sufficient domestic legal authorization and compliance foundation to fully utilize overseas data. For the United States, this means that it must first complete the institutional design of reporting obligations, information scope, and enforcement authority domestically. Looking back at 2021-2025, the United States has shown increasingly orderly and clear characteristics in the governance of crypto assets.

3.1 Phase One: The Foreshadowing of the Infrastructure Bill (2021-2023)

The starting point is often traced back to the 2021 Infrastructure Investment and Jobs Act (IIJA), which reformed tax reporting rules. This act expanded the definition of a "broker" under tax law, including anyone "responsible for regularly providing services involving the transfer of digital assets," thus making DeFi developers tax reporting obligors. However, in the following two years, the Treasury Department, through a series of proposed rulemaking notices, gradually clarified the regulatory boundaries by distinguishing between pure technology providers and customer-facing intermediary services, focusing on factors such as "whether they provide transaction execution/matching/transfer services to clients and whether they can obtain and verify client information."

3.2 Phase Two: Implementation of Form 1099-DA (2024-2025)

Following legislative authorization, the IRS is pushing for Form 1099-DA as the standardized form for reporting digital asset transactions, anchoring its application to transactions occurring after January 1, 2025. This move aims to elevate the reporting process for digital asset transactions to the same standardization level as traditional securities transactions. Specifically, US exchanges (such as Coinbase and Kraken) are now required to generate a 1099-DA form for each user, detailing the cost basis, acquisition date, sale date, and capital gains for each transaction. This measure has also placed significant pressure on the industry to clean up historical data, forcing exchanges to complete large-scale KYC data collection and historical data correction between 2024 and 2025. For accounts unable to provide complete tax information, exchanges have implemented measures such as freezing accounts or imposing mandatory withholding taxes to ensure the robustness of the domestic tax compliance network.

3.3 Phase Three: Global Regulation and Offshore Compliance (2025 to Present)

Since the Foreign Account Tax Compliance Act (FATCA) was passed and implemented in 2010, the United States has been able to obtain information on the overseas financial accounts of U.S. tax residents through the global financial institution reporting system. However, for a considerable period, cryptocurrency trading platforms—especially overseas exchanges and offshore service providers—have not been fully integrated into this cross-border information disclosure network. As domestic digital asset tax reporting systems (represented by rules such as 1099-DA) gradually enter the implementation stage and the compliance channels for the financialization of crypto assets (such as spot ETFs) open up, the structural gaps in the regulatory field increasingly point to the offshore market: if transaction information from overseas platforms cannot be systematically obtained, tax administration will be difficult to form a closed loop, which constitutes the real background for the recent White House review of related proposals.

In 2024, the Treasury Department/IRS finally released and promoted the final rules for digital asset broker information reporting (1099-DA system), laying the foundation for domestic data collection; subsequently, in 2025, relevant departments submitted the proposed rules for connecting with OECD CARF to the White House for review, indicating that the United States began to explore incorporating cross-border information exchange mechanisms into the digital asset tax administration toolbox.

3.4 The Formation of the Regulatory Puzzle: From Strict Enforcement to a Combination of Guidance and Control

It's worth noting that, with the gradual completion of the tax administration system, simply describing it as "tightening tax supervision" is insufficient to summarize the overall landscape of US crypto governance. A more accurate observation is that US regulation is gradually transitioning from a highly fragmented, case-by-case enforcement model to a more comprehensive governance approach. On one hand, it opens institutionalized channels for compliant financialization and institutional participation; on the other hand, it continuously raises the cost of violations and tax base transparency through reporting, enforcement, and information mechanisms. This "combination of guidance and control" structure is key to understanding the divergence in policy signals since 2024.

Following the FTX incident, SEC Chairman Gary Gensler's enforcement-as-regulation strategy reached its peak in 2023, with a series of lawsuits filed against Coinbase, Binance, and others, leaving the industry treading on thin ice.

However, the landscape shifted dramatically in 2024. That year, the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs (January) and spot Ethereum ETFs (May), formally recognizing crypto assets as a "legitimate" asset class and opening the door for compliant entry of traditional capital. Simultaneously, Congress took proactive legislative action, with the Financial Innovation and Technology for the 21st Century (FIT21) passing the House of Representatives with a bipartisan majority (May), attempting for the first time to establish a clear regulatory framework and explicitly define the jurisdiction of the SEC and CFTC. Furthermore, subsequent regulatory interpretations were adjusted in 2025 (SAB 122), which to some extent alleviated the accounting barriers for banks entering crypto custody and other related businesses.

Based on the analysis of the aforementioned policy events, the US regulatory landscape is shifting from a single enforcement model led by the Securities and Exchange Commission (SEC) to a collaborative system comprised of congressional legislation, prudent oversight by the SEC and CFTC, and anti-money laundering and tax compliance responsibilities by the Treasury Department and the Internal Revenue Service (IRS). This shift reflects a more mature and balanced regulatory approach: on the one hand, providing a development channel for compliant assets (such as ETFs), and on the other hand, strengthening control over tax evasion and other illegal activities (such as crypto assets targeted by CARF). The SEC's move towards greater flexibility aims to keep innovative activities within the US, while the IRS's increased oversight ensures that the resulting wealth is included in the US tax base.

4. Industry Impact and Future Outlook: Finding a New Balance in an Era of Transparency

Clearer global regulations and tax compliance are inevitable trends. The United States' continuous strengthening of offshore enforcement will have a profound impact on all participants in the crypto asset industry: the "ostrich mentality" is no longer effective, and a new era of compliance has arrived.

4.1 For virtual currency trading platforms/brokerage service providers

In the US context, the core approach to platform compliance is the domestic "Digital Asset Broker Reporting" system (represented by Form 1099-DA). For platforms serving US clients or having reporting obligations in the US, they need to collect client identification information, aggregate transaction information, and generate reports according to broker reporting rules, while also improving the governance of client tax information (such as TINs) and cost-based data (some elements have transitional arrangements). If the US's alignment with CARF rules continues, platforms with a high proportion of cross-border business will further align their reporting content with cross-border practices, potentially triggering stricter data standardization, reconciliation record keeping, and cross-border reporting capabilities. Overall, this will significantly increase platforms' data governance and compliance investment, but it will also enhance their sustainable operating capabilities in the institutional client, bank partnership, and compliance markets.

4.2 For individual investors

With the implementation of domestic broker reporting, more transaction data will enter the IRS information system through mechanisms such as 1099-DA, reducing the room for individual underreporting. If cross-border information exchange mechanisms are further strengthened in the future (including the CARF connection path), the availability of information on overseas platforms and offshore accounts will increase, raising the pressure to explain historical transactions and funding chains. For investors, the real risk is often not an increase in future tax burden, but rather the potential for back taxes, penalties, and compliance disputes due to insufficient consistency in past year reporting and inadequate cost basis restoration.

4.3 Regarding crypto asset custody institutions

The boundaries of a custodian's obligations depend on whether it provides only simple custody services or also brokerage services such as trade execution, matching, and exchange. If it only provides services such as safekeeping, wallet management, and custody reporting, its compliance pressures are more reflected in client due diligence, asset segregation, security controls, and cooperation requirements with banks. However, if custody and trade execution are deeply integrated, it is more likely to be included in the brokerage reporting and related tax information declaration framework, requiring the establishment of more comprehensive capabilities for collecting client tax information, compiling transaction data, and producing reports. In terms of trends, the evolution of the US system will force custodians to more clearly define their business lines and roles, reducing the gray areas where what is called custody is actually matching.

4.4 For banks and traditional financial intermediaries

While tax reporting obligations primarily fall on brokerage platforms and service providers, banks and traditional financial intermediaries are also being passively drawn into this ecosystem. When providing fiat currency deposits, withdrawals, settlements, custody, or credit services to crypto platforms, banks will pay closer attention to the platform's client due diligence, transaction traceability, tax compliance, and exposure to sanctions/anti-money laundering risks. They may also make auditability, the ability to provide compliant reports, and cooperation with tax/regulatory investigations prerequisites for cooperation. For wealth management, family office, and other businesses, crypto assets will be more systematically incorporated into overall tax compliance and cross-border reporting planning, prompting institutional clients to shift from post-investment remediation to pre-transaction compliance design.

5. Response Strategy: Shifting from Observation to Proactive Compliance

Given that the US is still in the review process for its alignment with the OECD CARF, and the specific scope of application and technical standards are not yet fully clear, a more feasible path for market players is to use the domestic broker reporting system (1099-DA, etc.) as a benchmark, and refer to the common practices of FATCA/CRS and other jurisdictions in promoting CARF, to complete data governance and process transformation in advance, and reserve interfaces for possible cross-border alignment in the future.

Specifically, trading platforms and brokerage service providers should assess as early as possible whether they fall within the scope of brokers/reporting obligations, prioritize aligning with the 1099-DA requirements for customer information collection and transaction data aggregation, supplement key fields such as TIN and tax residency status in the KYC process, establish auditable data traceability and reporting capabilities, and reserve mapping interfaces compatible with international data structures to reduce the transformation costs of subsequent rule implementation.

For individual investors, the key is not the trading platform, but whether the transaction records and cost basis are reproducible, explainable, and consistent with the reported figures. It is recommended to collect cross-platform/cross-chain transaction records as early as possible and retain cost, fee, and consideration vouchers. For investors with overseas trading platforms or offshore accounts, it is advisable to assess the consistency of past years' reports and potential supplementary reporting needs in advance to avoid being reactive once information availability improves.

For custodian institutions and infrastructure service providers, the boundaries of obligations should be defined according to the substance of the business: pure custody should focus on security, isolation, and auditable records; if custody is coupled with brokerage services such as matching/execution/exchange, then the ability to conduct tax due diligence and data reporting for clients should be improved in accordance with platform standards. Even if the detailed rules are not yet finalized, the ability to retain transaction data, reconcile accounts, and generate reports should be prepared for audit.

Conclusion

The White House's assessment of the proposal is far more than an isolated executive order; it represents a re-establishment of national sovereignty over financial boundaries in the digital economy era. For practitioners, this presents both challenges and tremendous opportunities. Traditional tax avoidance strategies will no longer be viable, replaced by sophisticated tax planning and automated compliance reporting. In this new era, transparency and compliance are inevitable. As Benjamin Franklin said, "Nothing in this world is certain except death and taxes." In the world of Web3, this statement perhaps needs an additional footnote: "Even on decentralized blockchains, taxes will ultimately remain a constant presence."