Elon Musk's ambition to amass a trillion-dollar fortune is no longer just a pipe dream.

At the beginning of the year, his net worth was $421 billion. By October, he became the first person in history to surpass $500 billion. Then, SpaceX, the rocket manufacturer, launched a share sale program valuing the company at approximately $800 billion, making Musk the first person in history to reach a net worth of $600 billion. Following this, a Delaware court ruled that Musk could retain his previously voided Tesla stock option awards, making him the first person in the world to surpass $700 billion in net worth last Friday. As the year draws to a close, as of December 22, Musk's net worth had reached a staggering $754 billion.

Elon Musk is arguably the biggest winner this year, with his net worth increasing by over $333 billion throughout the year, equivalent to an increase of $935 million per day. This growth rate not only ranks first among the world's billionaires but also surpasses the net worth of any other billionaire. Currently, the world's second richest person is Google co-founder Riley Page, with a net worth of $255 billion.

However, Musk is not the only billionaire whose wealth has increased significantly over the past year. Throughout the year, the combined net worth of more than 3,100 billionaires worldwide increased by $3.6 trillion from the beginning of the year, reaching a total of $18.7 trillion.

Most global stock markets performed well in 2025, boosting the wealth of the super-rich. The S&P 500 returned 17% for the year, while major stock indices in Germany, Japan, and Canada performed even better, with gains of 22%, 26%, and 30% respectively. Of course, some of the richest individuals fared even better: the ten biggest winners, already incredibly wealthy, saw their net worth increase by over $729 billion in the past year.

Of the top ten wealthiest individuals, six are American, accounting for over 85% of the total wealth increase. This data clearly shows that a new wave of wealth creation is highly concentrated in this country, led by a billionaire president and whose cabinet members are all extremely wealthy. With surging investment in artificial intelligence and the US striving to gain a leading position in the AI race, the top five wealthiest individuals this year are all giants in the American technology sector.

Here are the ten billionaires whose wealth will increase the most in 2025.

(Data as of December 22, 2025.)

1. Elon Musk

(Elon Musk)

Net worth: US$754.4 billion

Wealth growth in 2025: $333.2 billion

Industry: Technology

Nationality: United States

In early December, SpaceX, Musk's company, nearly doubled in value to $800 billion. An investor told Forbes that the company plans to launch its initial public offering (IPO) in 2026, with a potential valuation of $1.5 trillion, which would make Musk the world's first trillionaire. In November, Tesla shareholders approved a compensation plan that would award Musk $1 trillion in stock awards (before taxes and related costs) if preset performance targets are met. Tesla's stock price has risen 22% over the past year. Furthermore, Musk's xAI Holdings (formed by the merger of AI startup xAI and social media platform X) is in talks for a new round of financing, with a potential valuation of $230 billion, nearly double its valuation in March of this year. Therefore, 2026 seems poised to be an even brighter year for the world's richest man than 2025.

2. Riley Page

(Larry Page)

Net worth: $254.7 billion

Wealth growth in 2025: $98.7 billion

Industry: Technology

Nationality: United States

Last month, Google's quarterly revenue surpassed $100 billion for the first time. Simultaneously, the company launched its latest AI model, Gemini 3, whose performance surpasses similar products from competitors like OpenAI, further solidifying Google's leading position in the field of artificial intelligence. Notably, the model's training process did not use NVIDIA's graphics processing unit (GPU) chips. In early December, US Defense Secretary Pete Hegseth announced that the Department of Defense was using Gemini 3 to develop an internal AI platform for the military. Page and Brin co-founded Google in 1998. Although they stepped down from day-to-day management positions in 2019, they retained board seats and, as controlling shareholders, together hold over 6% of the tech giant's shares. Google's stock price is projected to rise 61% by 2025, making Page and Brin the biggest beneficiaries.

3. Sergei Brin

(Sergey Brin)

Net worth: US$235.1 billion

Wealth growth in 2025: $86.1 billion

Industry: Technology

Nationality: United States

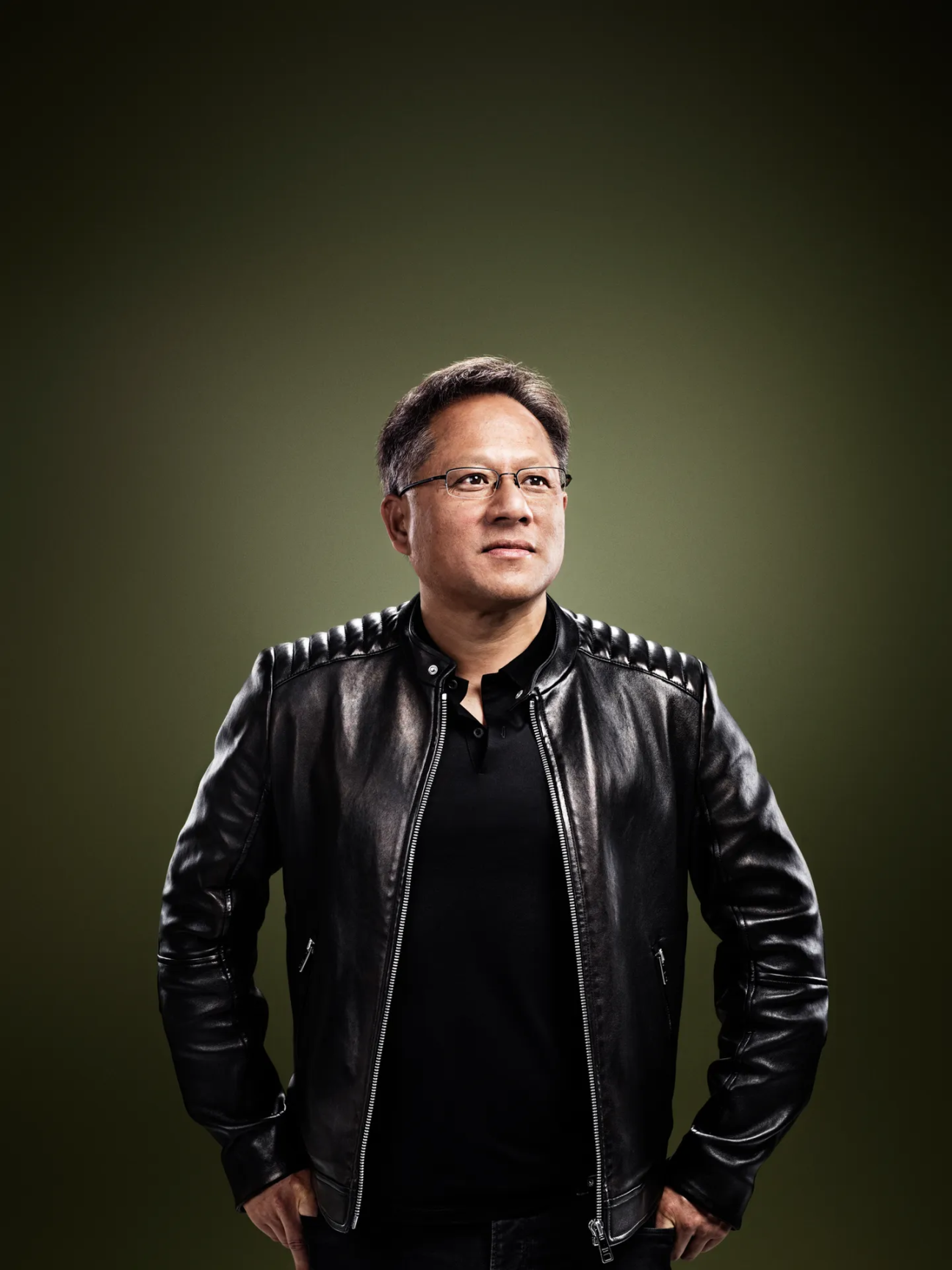

4. Huang Renxun

(Jensen Huang)

Net worth: US$159.5 billion

Wealth growth in 2025: $42.3 billion

Industry: Technology

Nationality: United States

In 1993, Jensen Huang co-founded NVIDIA, and he still serves as the company's CEO and President. Driven by the explosive growth in demand for artificial intelligence chips, the graphics chip manufacturer became the first publicly traded company in history to surpass a market capitalization of $5 trillion in October of this year. Although the company's stock price subsequently corrected by 11%, it is still up 37% from the beginning of the year. Huang holds approximately 3% of the company's shares, and his net worth has increased by nearly $36 billion due to the stock price increase. He has also tattooed the NVIDIA logo on his deltoid muscle.

5. Riley Allison

(Larry Ellison)

Net worth: US$250.3 billion

Wealth growth in 2025: $40.6 billion

Industry: Technology

Nationality: United States

On September 10th, fueled by the artificial intelligence boom, Oracle's stock price surged 36% in a single day, increasing co-founder and CTO Riley Ellison's net worth by nearly $100 billion, setting a record for the largest single-day wealth increase in history. Although the company's stock price subsequently fell by 40%, and Ellison's net worth also decreased slightly, his gains this year are still substantial. Furthermore, he acquired partial control of the short-video social media platform TikTok, and this summer also facilitated an $8 billion deal—the merger of his son David's Skydance Media with entertainment giant Paramount.

Undoubtedly, the deal was made possible partly by the long-standing close relationship between Allison and Trump. At a rally in July, Trump commented on Allison: "I think he'll run CBS very well. This acquisition is a great deal. He's a great guy." However, due to reports on CBS's "60 Minutes," Trump has recently begun criticizing Allison and his son again.

6. Amancio Ortega

(Amancio Ortega)

Net worth: US$145.2 billion

Wealth growth in 2025: $28.7 billion

Industry: Fashion and Retail

Nationality: Spanish

Despite a general reduction in global consumer spending on clothing, Inditex, the retail giant founded by Ortega (which owns the affordable fashion brand Zara), has bucked the trend with increased sales. The company's net profit for the first three quarters of 2025 reached a record high of $5.4 billion, a 3.9% year-on-year increase, driven by a strong Spanish economy and the company's expansion and renovation plans in the United States. This plan involves 30 stores, including a new 33,000-square-foot Zara flagship store on the Las Vegas Strip and a 26,300-square-foot store in Los Angeles. Ortega owns approximately 60% of the company and received over $3 billion in pre-tax dividends this year, which he has invested in real estate markets in Europe and the United States.

7. Gehrman Larria Mota Velasco and his family

(Germán Larrea Mota Velasco & family)

Net worth: US$51.4 billion

Wealth growth in 2025: $25.6 billion

Industry: Metals and Mining

Nationality: Mexican

Driven by strong demand, supply shortages, and tariff concerns, copper prices have continued to rise this year, greatly benefiting Larria, who heads Grupo México, Mexico's largest copper mining company. The company's diversification strategy has also yielded significant results, with its share price rising nearly 100% this year. Thanks to increased production and sales of products such as molybdenum (a metal used to strengthen steel and accelerate oil refining), zinc, and silver, the company's net profit in the third quarter increased by 50% year-on-year.

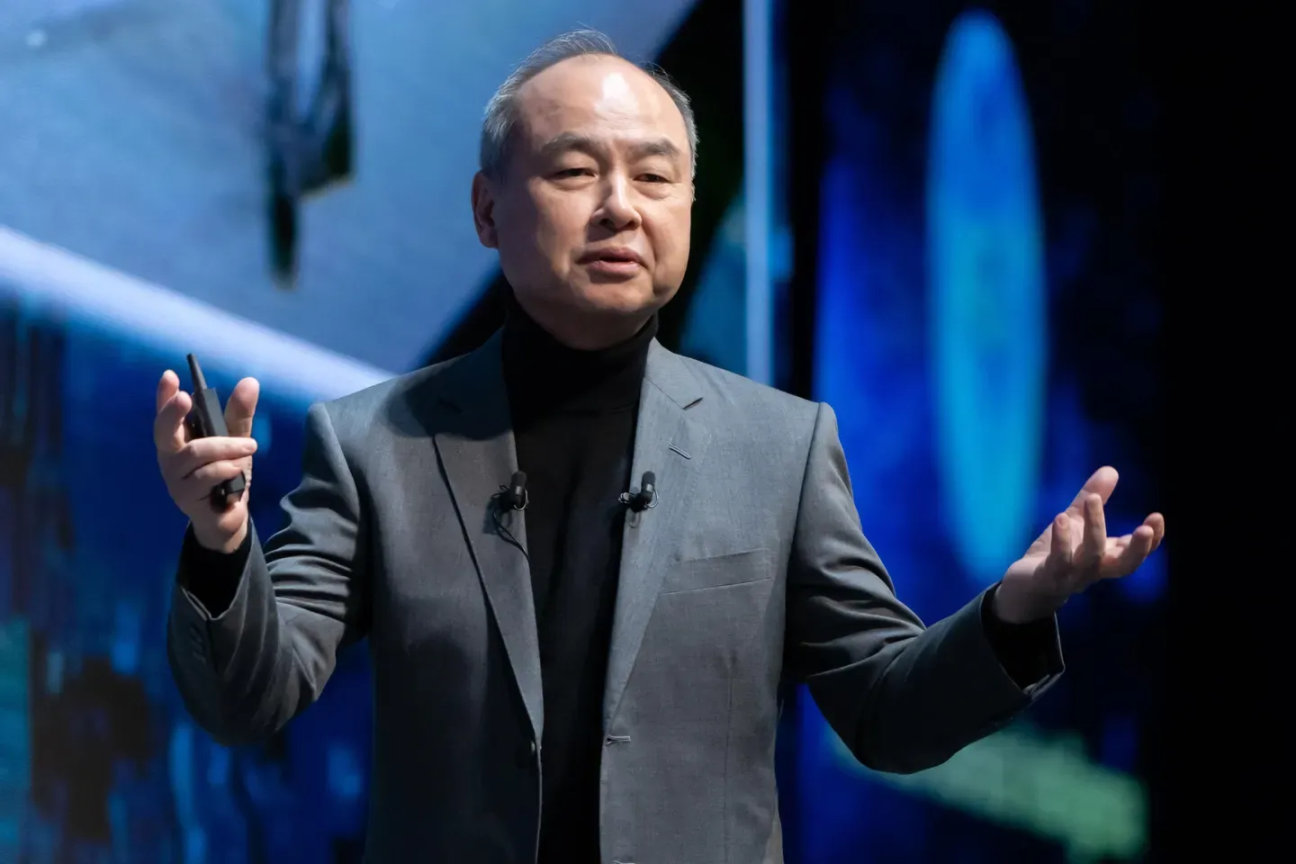

8. Masayoshi Son

(Masayoshi Son)

Net worth: US$56.1 billion

Wealth growth in 2025: $25.4 billion

Industry: Finance and Investment

Nationality: Japanese

SoftBank's founder, Masayoshi Son, has seen his net worth surge this year. The conglomerate has significantly increased its investment in artificial intelligence infrastructure, including the $6.5 billion acquisition of U.S. chip design firm Ampere Computing Holdings in November. Son stated that this acquisition is crucial for driving innovation in artificial intelligence computing technology. To fund its ambitious plans, SoftBank sold $5.8 billion worth of NVIDIA stock, raising funds to advance large-scale projects such as the $500 billion "Stargate" project—aimed at building data centers in the United States, with other stakeholders including OpenAI and Oracle.

9. (in parallel) Mark Zuckerberg

(Mark Zuckerberg)

Net worth: US$226.8 billion

Wealth growth in 2025: $24.3 billion

Industry: Technology

Nationality: United States

Facebook's parent company, Meta, has delivered solid results this year. The company continues to increase its investment in artificial intelligence, with revenue reaching $141 billion in the first nine months of 2025, a 21% year-on-year increase. In 2004, 19-year-old Mark Zuckerberg, then a student at Harvard University, founded Facebook. Today, he holds approximately 13% of the company's shares and remains CEO. Year-to-date, the company's stock price has risen 13%.

9. (in parallel) Carlos Slim Helú

(Carlos Slim Helú)

Net worth: US$101.6 billion

Wealth growth in 2025: $24.3 billion

Industry: Telecommunications

Nationality: Mexican

As Mexico's richest man, Carlos Slim Helú and his family control América Móvil, the largest mobile telecommunications operator in Latin America. This year, the group added over 3 million mobile subscribers, and its total revenue for the first nine months increased by 10.5% year-on-year. Slim's conglomerate, Grupo Carso, is involved in construction, energy, and retail. This year, it has made several moves in the energy sector, such as a $2 billion cooperation agreement with Pemex, planning to develop up to 32 oil and gas wells. Despite the global market turmoil caused by the Trump administration's tariffs, many Mexican goods have enjoyed tariff exemptions, and the Mexican peso has appreciated by nearly 15% against the US dollar this year.