Foresight News gives you a quick overview of this week's hot topics and recommended content:

01 2025 Foresight News Year-End Series Compilation (Continued)

"The Ups and Downs of the Crypto in 2025: I'm Not a Believer, I'm a Gambler"

"The Crypto Bloodbath List of 2025: The Hundreds of Millions of Dollars in 'Tuition Fees' of 10 Whale"

How to turn $10 into $100 million by 2025?

2025 Airdrop Retrospective: Although We Didn't Make Money, At Least We Were Exhausted.

A Roundup of the Top Ten "Outrageous" Events in the Web3 Industry in 2025

02 Overseas Crypto

The new CFTC chief takes office! Can he shoulder half of the responsibility for US financial regulation?

Exclusive Test | Ctrip Overseas Version Launches Stablecoin Payments, Supporting USDT and USDC

"I bought seafood in Vietnam using USDT: Is Web3 really a mass adoption program?"

03 Project Observation

How is the experience of the fully launched Base App?

Coinbase Acquires Former Polymarket Members, Entering the Deep Waters of Prediction Markets

Polymarket's Coming-of-Age Ceremony: Farewell, Polygon

Hyperliquid personally intervened to reconcile accounts; behind their seemingly perfect public relations lies a calculated attack on competitors.

Ripple chiseled open a crack in the wall, but Swift simply tore down the entire wall.

01 2025 Foresight News Year-End Series Compilation (Continued)

The 2025 crypto market was a year of mixed fortunes and diverse experiences. Foresight News' year-end series continues to be updated. Here you'll find firsthand accounts of the ups and downs of crypto gamblers, heartbreaking recaps of whale' failures, in-depth analyses of wealth-creating opportunities, a true reflection of the airdrop sector, and a review of the industry's most outrageous moments of the year. We invite you to take a comprehensive look at the market, reflecting on the year's gains and losses, and gaining insights into new industry trends! Recommended Articles:

" The Ups and Downs of the Crypto in 2025: I'm Not a Believer, I'm a Gambler "

Leaving aside the exchanges and project teams at the top of the food chain, the winners of this round of the crypto market are nothing more than some professional traders, airdrop hunters, and Bitcoin holders, but more often small retail investors who have lost money in the secondary market.

As yet another wave of trending narratives emerges, some people exit at the peak to enjoy life, flaunting their luxury cars and watches and loudly proclaiming "thank you crypto"; while many others have already fallen behind the pace, remaining stuck in this long season.

Adults often withdraw from the industry silently and without fanfare. But you can still sense the changing seasons of the industry from their many long-dormant social media accounts.

Foresight News interviewed some crypto players to discuss their past and present.

" The Crypto Bloodbath List of 2025: The Hundreds of Millions of Dollars in 'Tuition Fees' of 10 Whale "

The crypto market in 2025 is much like a high-speed express train running at full speed. Looking back from the platform, people can only see the survivors celebrating in the windows, but few notice the passengers who have been thrown off the tracks.

This year, we not only witnessed the madness of gamblers in the futures market, but also the brutal infiltration of the Web3 dark forest theory into the physical world. Stories of sudden wealth are largely similar, but the ways to lose everything are incredibly varied. We reconstructed the financial losses of several typical individuals in 2025—among them billionaires, tech geeks, legendary gamblers, and even ordinary people who simply wanted to save money.

How to turn $10 into $100 million by 2025 ?

From an emotional perspective, 2025 was not a friendly year for retail cryptocurrency investors. So, when reviewing the rotating sectors and popular narratives of the year, we indulged in a fantasy: if I were a "10u War God" with meager start-up capital, and like the protagonist in a movie, I caught every hot trend, could my net worth rival that of Wang Duoyu in "Hello Mr. Billionaire" after a year?

2025 Airdrop Retrospective: Although We Didn't Make Money, At Least We Were Exhausted .

By 2025, airdrops will likely struggle to replicate the high returns expected in the past. While the number of participants continues to increase and task density rises, the returns for most projects will fail to cover the time investment. Constant rule adjustments, higher entry barriers, and increased randomness will make outcomes even more unpredictable.

In practice, many participants were left feeling exhausted, forcing the industry to reassess the functionality of airdrops. As a cold start tool, its effectiveness is being re-examined, and the exchange relationship between users and projects is changing.

This review doesn't aim to recount all events, but rather to analyze the trends themselves. It examines which strategies are fading, which remain viable, which behaviors are no longer yielding returns, and why, starting in 2025, airdrops have been used more to observe project direction rather than simply as rewards for completing tasks.

If you feel that the cost of participation has increased significantly this year, it's not an isolated case, but a reality faced by most participants. Next, we will review some typical projects, some of which are mind-bending, some frustrating, while also revealing the divergent patterns and market preferences of airdrop strategies in 2025.

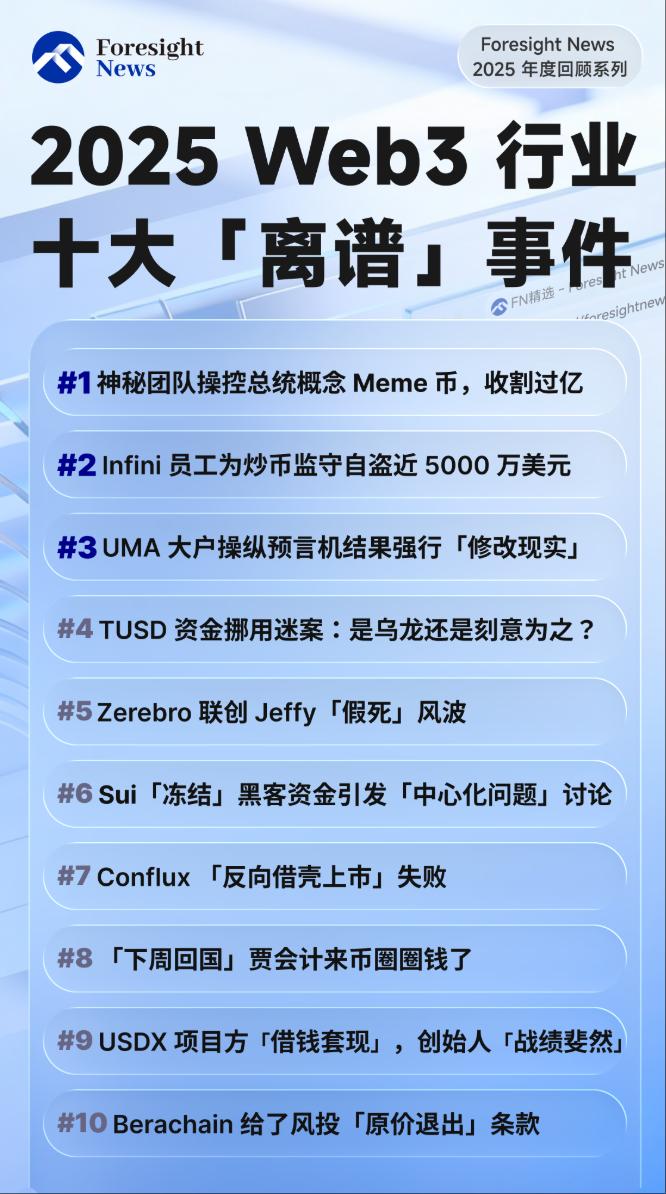

A Roundup of the Top Ten "Outrageous" Events in the Web3 Industry in 2025

Times have changed. Web3 in 2025 is completely different from what it was three years ago. Basic errors like misdirecting to the wrong address or setting incorrect parameters are now rare. Although what happened this year isn't as "funny" as it was back then, it's still just as outrageous. It just goes to show that human nature, the greatest screenwriter, is still putting its power to the test.

02 Overseas Crypto

On December 22, 2025, Michael Selig Sworn officially assumed the position of the 16th Chairman of the U.S. Commodity Futures Trading Commission (CFTC). This new leader, with experience in the SEC's Crypto Task Force and a background in private practice, shoulders the heavy responsibility of balancing financial innovation and regulation, and coordinating the positions of the SEC and the CFTC. His appointment may reshape the regulatory landscape of digital assets in the United States and inject new variables into "Made in America" financial innovation. Recommended Article:

The new CFTC chief takes office! Can he shoulder half of the responsibility for US financial regulation ?

Michael Selig Sworn will serve as the lead legal counsel for the U.S. Securities and Exchange Commission's (SEC) Crypto Assets Task Force starting in March 2025, and will also be a senior advisor to SEC Chairman Paul S. Atkins.

In his inaugural address, Michael Selig Sworn thanked Trump for his nomination and outlined his understanding of the future direction of the CFTC, revealing his emphasis on balancing innovation and regulation.

He pointed out that the CFTC is currently at a critical juncture in its development, with numerous new technologies, products, and platforms emerging, and retail investor participation in the commodities market reaching an all-time high. Selig particularly emphasized the importance of the Digital Asset Market Structure Bill that Congress is about to submit to the President, stating that it will solidify the United States' position as the "crypto capital of the world." He also stated bluntly, "The CFTC will conquer these important areas, ensuring that future innovations are 'Made in America.'"

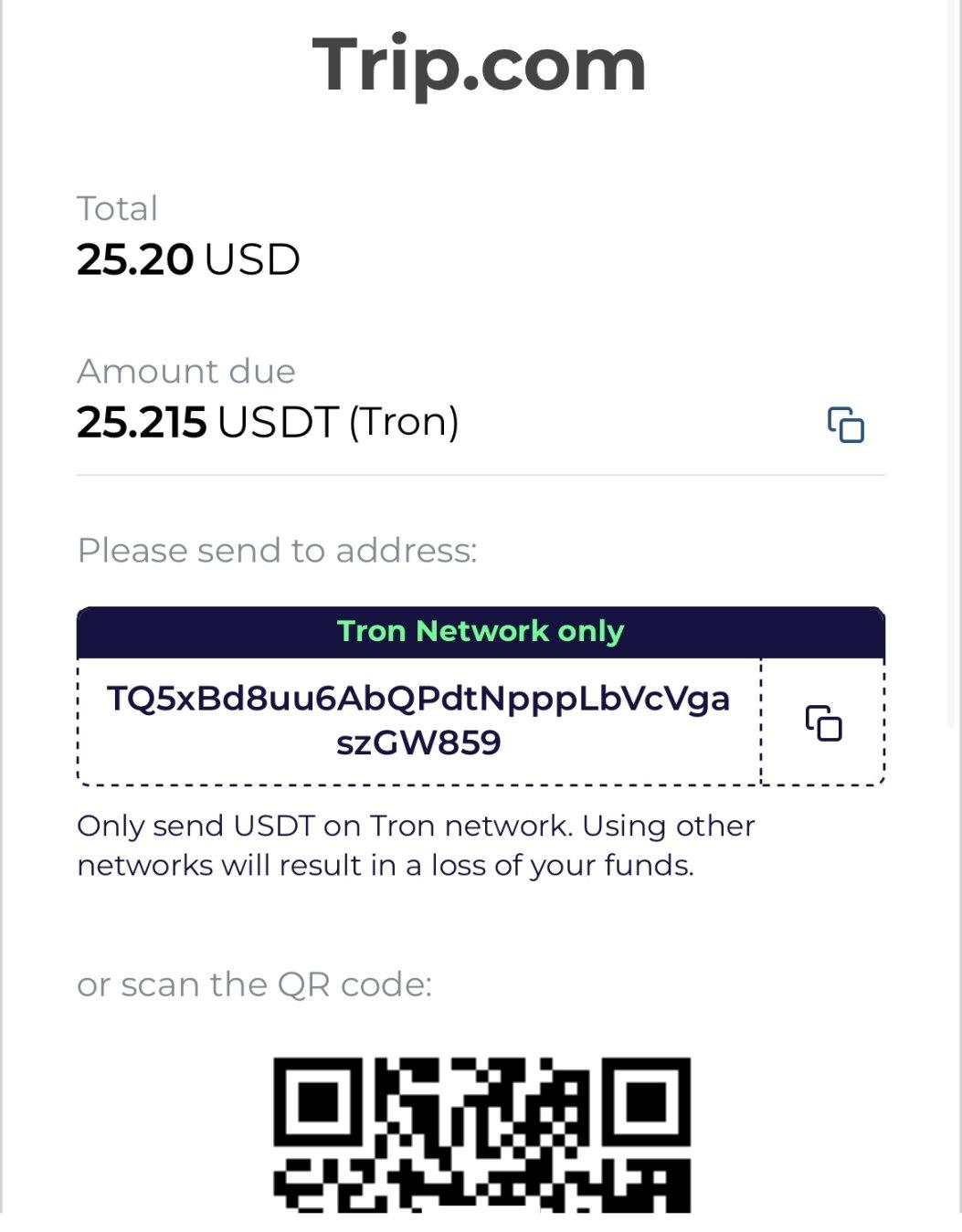

On December 25, 2025, Foresight News testing revealed that Trip.com, the overseas version of Ctrip, launched a stablecoin payment function, supporting USDT, USDC, and multiple public blockchains. Users can save money when booking hotels and flights, and hotel bookings offer strong privacy protection. This move addresses the payment pain point of some global users lacking international credit cards, and is also related to the depreciation of fiat currencies in some regions and increased user privacy demands. Furthermore, the deployment of stablecoins by major players has become a trend. Recommended article:

Exclusive Test | Ctrip Overseas Version Launches Stablecoin Payments, Supporting USDT and USDC

I found that buying airline tickets on Trip.com using USDT saved me approximately 18% compared to buying them on Ctrip. Hotel bookings made with USDT also saved me 2.35%.

In late 2025, the author embarked on a Web3 payment testing journey in Vietnam. From cash discounts at spas to using Bitget Wallet for everyday payments, to encountering payment failures and experiencing polarized public opinion on cryptocurrency, five small incidents outline the current state of Vietnam's crypto ecosystem, revealing both the glimmer of hope for mass adoption and exposing real-world challenges, providing a vivid slice of the story for exploring the implementation of Web3 in Southeast Asia. Recommended Article:

" I bought seafood in Vietnam using USDT: Is Web3 really a mass adoption program? "

A chance discovery has opened a corner of Vietnam's encrypted world.

During a Grab ride, my colleague noticed a hat with the Binance logo casually placed on the young driver's dashboard. Seeing our attention, the driver grinned, expertly pulled out his phone, and showed us the Binance app he was running.

This scene made me realize that cryptocurrency is not just an underground phenomenon in this country; it is permeating the lives of ordinary people in a very vibrant way. Multiple public data show that more than 20 million people in Vietnam have held or used digital assets, and the high proportion of young people in Vietnam (for example, a large proportion of the population is between 10 and 24 years old) has significantly promoted the acceptance of digital assets and the formation of Web3 usage habits.

This permeation manifests in an interesting "north-south difference" geographically.

03 Project Observation

On December 18th, Coinbase's Base App ended its beta testing and was fully launched in over 140 countries and regions worldwide. This Web3 application integrates social, trading, and payment functions, simplifies account creation with Passkeys, and includes a Mini Apps ecosystem and a USDC yield mechanism, attempting to lower the barrier to entry for Web3. However, it faces challenges such as user scale and information flow quality, and whether it can promote the popularization of Web3 remains to be seen. Recommended Article:

How is the experience of the fully launched Base App ?

The full opening of the Base App signifies that the focus of the Base ecosystem has shifted from "building roads and bridges" to "competing for existing users" and "user onboarding".

It integrates wallets, transactions, social features, creator economy, payments, mini-program ecosystem, and revenue into a powerful on-chain traffic portal. For developers, the Mini Apps framework provides a shortcut to directly reach Coinbase's massive user base.

While there is still a long way to go in terms of content governance and user attraction, Base App has undoubtedly provided a clear template: the future of Web3 should not be an isolated wallet, but a warm, interactive, and rewarding on-chain society.

On December 22, 2025, Coinbase announced its acquisition of The Clearing Company, an on-chain prediction market founded by the former Polymarket and Kalshi teams. The transaction is expected to close in January 2026, and the entire team will join Coinbase. Just a week prior, Coinbase partnered with CFTC-regulated platform Kalshi. This acquisition marks a shift from distribution partnerships to deep integration of technical talent, further strengthening its prediction market strategy. This month, Coinbase also expanded its services to include stock trading and AI-powered wealth management, striving to become an "all-in-one exchange." Recommended Article:

Coinbase Acquires Former Polymarket Members, Entering the Deep Waters of Prediction Markets

The acquisition of The Clearing Company is Coinbase's tenth acquisition announced in 2025. Deals completed earlier this year include Roam, Spindl, Iron Fish, Deribit, Opyn Markets, Liquifi, Sensible, Echo, and Vector.fun.

From its distribution partnership with Kalshi to acquiring The Clearing Company's team and technology, Coinbase's path in the prediction market is clear: first, validate demand and product form through partnerships; then, internalize key capabilities through acquisitions; and finally, form a scalable, long-term business line.

Competition in the prediction market is shifting from who launches first to who can operate compliantly and sustainably in the long term. Coinbase's decision to integrate its people and technology into its system is clearly a strategic move to position itself for the next phase of licensing and institutional competition.

Recently, prediction market platform Polymarket officially announced that it will prioritize building its own L2 blockchain, abandoning its long-standing reliance on the Polygon network. This decision stems from the frequent network anomalies of Polygon impacting business operations, and also aims to address trust issues with external oracles and cope with IPO compliance pressures. Simultaneously, the POLY token will be positioned as "operational consumables," marking a new chapter in the platform's development. Recommended Article:

Polymarket 's Coming-of-Age Ceremony: Farewell, Polygon

By building its own L2, Polymarket can escape the predicament of competing for block space with other dApps on Polygon, and can also optimize for the transaction characteristics of prediction markets.

This not only means a more stable network environment, but also that the platform will have more core block ranking power, thereby resolving transaction frictions and recovering the fees that originally flowed to external public chains.

In addition, Polymarket has already set up a dedicated Builder section and Wiki documentation on its website, systematically opening up interfaces and tools to external developers and encouraging third parties to build applications and derivative products based on Polymarket's prediction market capabilities.

Within the framework of general-purpose public blockchains, these applications struggle to form a truly closed-loop ecosystem. However, with the advancement of their own L2 blockchains, these applications, built around prediction, settlement, and information game theory, will be able to migrate entirely to the native network, providing L2 with users, transaction traffic, and real-world use cases.

Recently, the derivatives protocol Hyperliquid was accused in a technical article of having nine major problems, including "insolvency" and a "God mode backdoor," and was labeled as a "centralized exchange disguised as a blockchain." Faced with this crisis of trust, Hyperliquid officially responded with a reconciliation of its accounts, not only clarifying some of the controversies but also using the opportunity to compare itself with competitors and strengthen its own advantages. This public relations storm has also become a key stress test for the transparency of high-performance DeFi. Recommended Article:

Hyperliquid openly categorizes these competitors as relying on a "centralized sequencer." The official statement emphasizes that on these platforms, no one except the sequencer operator can see a complete snapshot of the state (including order book history and position details). In contrast, Hyperliquid attempts to eliminate this "privilege" by having all validators execute the same state machine.

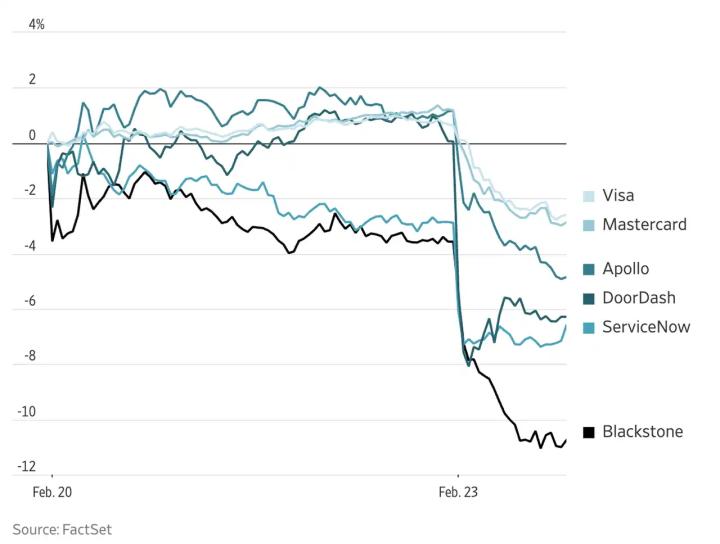

This wave of criticism may stem from Hyperliquid's concerns about its current market share. According to DefiLlama's trading volume data over the past 30 days, the market structure has become a three-way competition:

The global financial landscape will see a crucial turning point in 2025. At the Sibos conference in Frankfurt, Swift announced the construction of a blockchain shared ledger based on the Ethereum Layer 2 network Linea, aiming to establish a foothold in global real-time digital finance. This move contrasts with Ripple, which has been deeply involved in the industry for a decade. The former leverages its existing advantages and technological compliance to restructure its system, while the latter has opened up new avenues with XRP Ledger. Their clash may reshape the future of global value transfer. Recommended Article:

Ripple chiseled open a crack in the wall, but Swift simply tore down the entire wall .

When these tech giants are building their Ethereum ecosystems, they have shown a high degree of consistency in their focus on Layer 2 technologies: Coinbase’s Base Chain is built on the OP Stack, while Robinhood also announced the launch of Robinhood Chain this year, based on Arbitrum technology, to support the tokenization of RWA and 24/7 transactions.

This preference stems from the fact that L2 can leverage Ethereum's security while meeting high-performance requirements through a modular architecture. Swift's choice of Linea over OP or Arbitrum is primarily due to differences in its underlying verification logic.