Political issues are always the most contentious topic in the cryptocurrency industry. Donald Trump is often called "America's first crypto president," while the Biden administration is considered unfriendly to the sector.

However, if we disregard the rhetoric and focus on market data, things are not so simple. The question is not which government speaks better about crypto, but under whose leadership Bitcoin has actually grown better.

Bitcoin's performance: The numbers speak for themselves.

In the 2024 US presidential election, Trump positioned himself as a pro-crypto candidate, pledging to make America the "crypto capital of the world." He promised to halt anti-crypto activities, control the SEC's crackdown, and, in his words :

"End JOE Biden's war on crypto and we will ensure the future of crypto and Bitcoin will be in America."

These statements created optimism in the market and sparked hopes for a sharp price increase. However, towards the end of 2025, the price of Bitcoin dropped by nearly 5%.

Compared to Biden's first year as president, the world's largest cryptocurrency has risen by approximately 65%. Although performance weakened in 2022, the upward momentum returned in subsequent years.

Bitcoin has recovered strongly, increasing by approximately 155% in 2023 and continuing to rise by 120.7% in 2024.

| Year | Bitcoin yield (%) |

| 2021 | 65% |

| 2022 | 64.2% |

| 2023 | 155% |

| 2024 | 120.7% |

| 2025 (As of December 26th) | -5% |

Looking back at Trump's first presidential term, one analyst noted it was "the most significant bull run in crypto history," with the total cryptocurrency market Capital increasing approximately 115 times from the beginning to the end of his term.

“Biden’s term has yielded a 4.5-fold return from start to finish, and even at its worst, it has never fallen below its annual opening level. Trump’s second term is currently below its opening level, but there are still three years ahead,” this anonymous analyst wrote .

Bitcoin under Trump

So what actually happened this year? The drop in Bitcoin's price isn't just reflected in the 2025 return figures.

In January 2025, the trend remained in favor of Bitcoin. Before Trump's inauguration, the price of BTC surpassed $109,000 , setting a new all-time high at that time. From a regulatory standpoint, the SEC also established a task force to create a more transparent legal framework for digital assets.

However, Trump's subsequent moves wiped out these gains. After he announced tariffs on the European Union and expanded tariffs on Liberation Day , the crypto market fell along with stocks.

Notably, when Trump announced a temporary halt to tariffs (except for China), the market rebounded slightly. This shows that the crypto market is highly sensitive to macroeconomic fluctuations, which also increases price volatility.

Simultaneously, Bitcoin adoption continued to rise, driven by state-level Bitcoin reserve initiatives and increasing institutional participation. Bitcoin's price also steadily increased, recording a four-month chain of gains from April to July.

A major trend observed during this period was the rise of digital asset treasuries (DATs) . More and more publicly listed companies chose Bitcoin as a reserve asset, following a model pioneered by Micro (Strategy).

Bitcoin benefits from this trend, as many experts believe the emergence of financial institutions can help reduce price volatility and affirm the asset's maturity within the traditional financial ecosystem.

As market confidence rises, investors are also more willing to take risks and use higher leverage. Meme coin traders using massive leverage are also attracting a lot of attention. On the macroeconomic front, the Fed cut interest rates in September, further boosting growth in risky assets.

Bitcoin continued to set new historical highs in October, reaching $125,761 on October 6th. Many forecasters even anticipate further increases to $185,000, or even $200,000 by the end of the year .

This optimism is supported by several favorable macroeconomic factors and the historical trend of Bitcoin often surging in the final quarter of the year .

BeInCrypto reported on October 11, 2024, that after President Trump announced a 100% tariff on goods from China, the cryptocurrency market plummeted. Over $19 billion in leveraged positions were liquidated, causing significant losses for many traders.

The overall downward trend in the market continued in the following months, and was further exacerbated by the use of leverage.

“It appears to be a structural and mechanical downturn. It started with institutional Capital in mid-to-late October. In the first week of November, cryptocurrency Capital recorded outflows of up to $1.2 billion. The problem here is the excessive leverage used at the same time… This excessive leverage made the market extremely sensitive,” according to The Kobeissi Letter published in November.

According to data from Coinglass, Bitcoin fell 17.67% in November and continued to lose another 1.7% of its value this month. XEM data .

From Bitcoin ETFs to Altcoins: Regulatory Changes and Market Reactions

The Trump and Biden administrations differ on several key issues, including cryptocurrency ETFs. When Biden was president, the SEC was very cautious about the cryptocurrency sector, including crypto ETFs.

However, this view changed when the US Court of Appeals in DC ordered the SEC to XEM Grayscale's GBTC fund conversion into a spot Bitcoin ETF.

Therefore, the SEC approved spot Bitcoin ETFs in January 2024 and then spot Ethereum ETFs in July.

Notably, after Gary Gensler left the SEC, fund management companies quickly filed numerous applications to launch altcoin ETFs. Companies such as Bitwise, 21 Capital, and Canary Capital all accelerated their registrations to launch crypto-based investment products.

In September, the SEC approved a common listing standard for crypto ETFs, eliminating the need for individual token reviews. Following this change, several ETFs related to SOL, HBAR, XRP, LTC, LINK, and Doge appeared on the market.

In November, Canary Capital's XRP ETF achieved a trading Volume of $58.6 million on its launch day, leading in opening day trading volume among more than 900 other ETFs launched in 2025. Bitwise's Solana ETF also recorded an opening day trading volume of $56 million, while other products recorded significantly lower volumes.

From a legal standpoint, ETFs make it easier for investors to access the market and expand opportunities for issuers. However, initial data suggests that the emergence of new crypto ETFs has not yet led to a corresponding increase in total Capital inflow into the market.

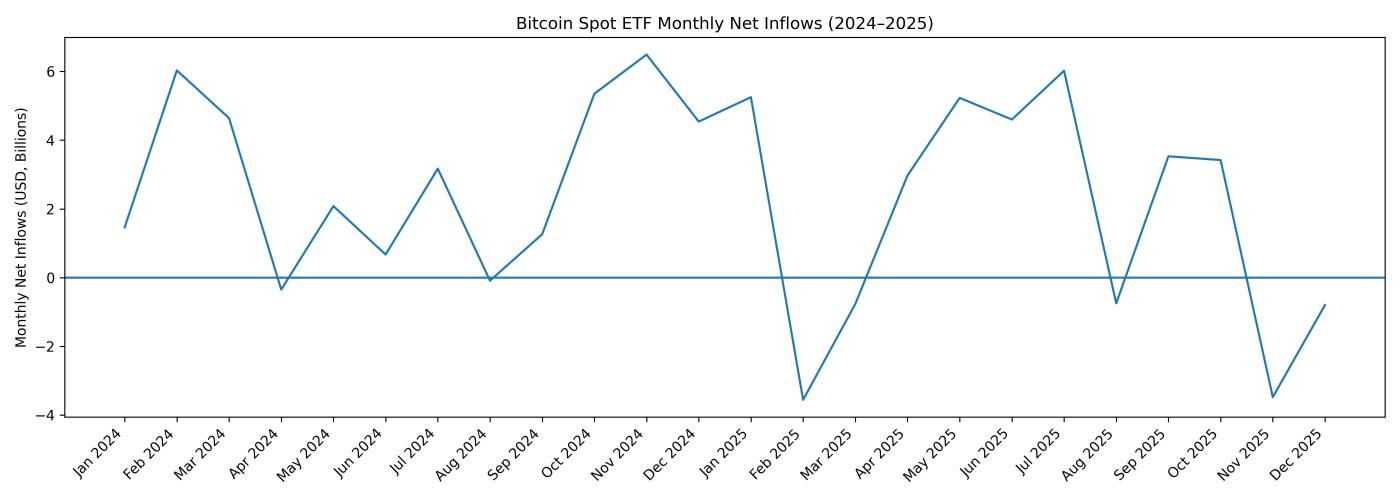

In 2024, spot Bitcoin ETFs attracted approximately $35.2 billion in net Capital . In 2025, this Capital into Bitcoin ETFs is projected to decrease to $22.16 billion, according to data from SoSoValue ( see here) . This suggests that the increase in the number of ETFs primarily disperses funds across products, rather than contributing to the overall expansion of cryptocurrency investment.

Bitcoin ETF cash flow. Source: Data Curated by BeInCrypto

Bitcoin ETF cash flow. Source: Data Curated by BeInCryptoInside the Trump family's crypto empire

Although Donald Trump's influence on the market is very clear, he is also directly involved in the cryptocurrency field. In January, the US president launched a meme coin, and Melania Trump later released a Token with a similar design.

In March, Trump's two sons, Eric Trump and Donald Trump Jr., partnered with Hut 8 to launch American Bitcoin Corp.

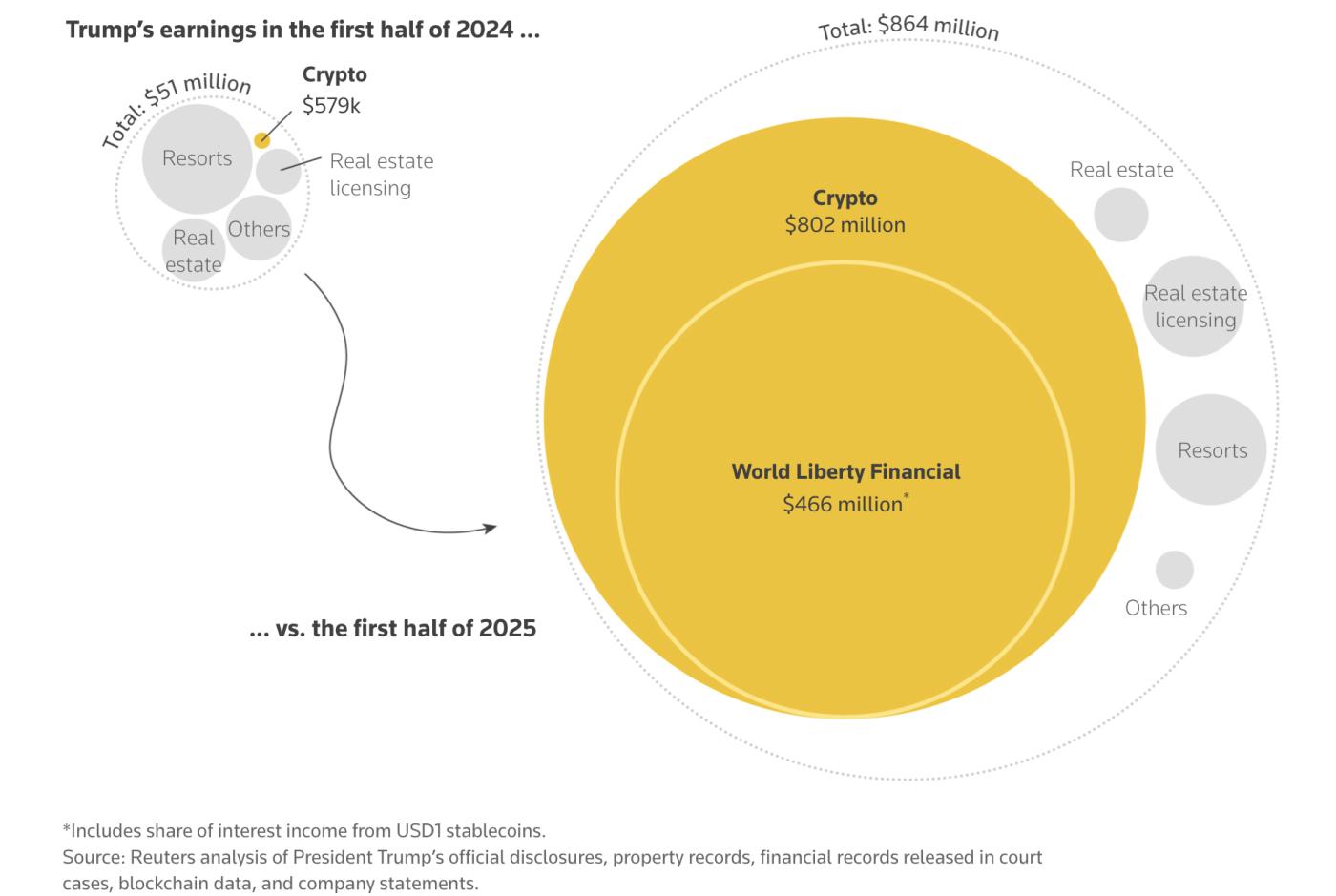

These projects bring in huge sums of money for the US president and his family. According to Reuters analysis, in the first half of 2025 alone, they earned a total of over $800 million from selling crypto-related assets.

The Trump family's cryptocurrency assets. Source: Reuters

The Trump family's cryptocurrency assets. Source: ReutersMany believe these moves have, to some extent, helped legitimize the crypto sector and boost its adoption. However, the involvement of the US President and his family in crypto- Capital projects has raised concerns about transparency, ethics, and the impact on market stability. While meme coins are not new in this field, their association with a sitting US president is unprecedented.

These activities have also drawn strong criticism from regulators and users alike . Meme token related to Trump, such as WLFI and American Bitcoin Corp, have plummeted, resulting in significant losses for supporters .

Conclude

Overall, the data suggests that who has helped the crypto market the most depends on how the word "help" is interpreted. Under Trump, the crypto sector benefited from more liberal regulatory policies, less stringent oversight, and faster approval processes for new investment products.

These changes have helped lower barriers to entry for Token Issuance and expand market access.

However, market developments reflect a different story. Bitcoin's price surged most dramatically during the earlier period, when JOE Biden was president.

In addition, Trump's first year back in office saw significant market volatility.