Author: Lin Wanwan's Cat

On election night in 2024, a French trader made a net profit of $85 million on Polymarket.

This figure surpasses the annual performance of the vast majority of hedge funds.

Polymarket, a decentralized prediction market that has processed over $9 billion in trading volume and brought together 314,000 active traders, is redefining the boundaries of "voting with money."

But first we must be honest: predicting the market is a zero-sum game.

Only 0.51% of Polymarket wallets have achieved profits exceeding $1,000.

So, what exactly did the winner do right?

I wrote a series of strategies some time ago, and recently I also tried to organize and conduct a systematic backtesting analysis of 86 million on-chain transactions.

(Data is based on academic research from the IMDEA Networks Institute, covering a complete on-chain record of over 86 million transactions and 17,218 market conditions from April 1, 2024 to April 1, 2025.)

According to Dune Analytics, Polymarket processed over 95 million transactions in 2025, with a nominal transaction volume exceeding $21.5 billion, but there are instances of double counting.

It analyzes the holding logic and entry/exit timing of top traders.

We have summarized six proven profit-making strategies: from arbitrage based on "neighbor poll" information from French whales to a high-probability bond strategy with an annualized return of 1800%; from capturing cross-platform price differences to a domain-specific approach with a 96% win rate.

Looking back, we can see that the common characteristic of top traders is not "predictive ability."

Instead, there are three things:

Systematically identifying market pricing errors, rigorous to the point of obsession with risk management, and the patience to build an overwhelming information advantage in a single field.

If you've read this far, I bet you'll try it yourself sooner or later in 2026.

Of course, this is not a book that teaches you "how to gamble".

The aim is simply to provide a systematic strategic framework and replicable methodological reference for market participants, especially beginners.

Keywords: prediction market; Polymarket; trading strategy; arbitrage; risk management; blockchain

I will explain it in five parts. If you only want to see the strategy, you can skip to the third part.

I. Research Background

II. Evaluation Dimensions and Standards

III. Six Core Strategies for 2025

IV. Position Management and Strategies

V. Conclusion

I. Research Background

In October 2025, ICE, the parent company of the NYSE, wrote a $2 billion check to Polymarket, valuing the company at $9 billion.

A month later, Polymarket acquired a CFTC-licensed exchange, officially returning to the United States. What was once a "gray area project" driven out by regulators three years prior has now become a sought-after target for traditional finance.

The turning point will be the 2024 election.

While all major polls were saying "too close to predict," Polymarket's odds consistently pointed to Trump. The $3.7 billion bet ultimately predicted the outcome earlier and more accurately than professional polling agencies. The academic community is beginning to re-examine an old question: Does getting people to "put their money on their lips" truly force more honest judgments?

The first thirty years of the internet created three types of infrastructure: search engines tell you "what happened," social media tells you "what others think," and algorithmic recommendations tell you "what you might want to see." But one piece has always been missing: a place that can reliably answer "what will happen next."

Polymarket is filling this gap and becoming the first truly mainstream application in the crypto space, tapping into the essential need for "information pricing".

When the media starts checking odds before writing news, when investors start referring to the market when making decisions, when politicians' teams start monitoring Polymarket instead of polls.

It has evolved from gambling to a "pricing consensus".

A market that makes Wall Street open its doors, regulators give it a pass, and polls blush with shame deserves serious study.

II. Research Methods and Evaluation Criteria

2.1 Data Source

This study uses multiple data sources for cross-validation:

(1) Official ranking data from Polymarket;

(2) Polymarket Analytics third-party analytics platform (updated every 5 minutes);

(3) PolyTrack trader tracking tool;

(4) Dune Analytics on-chain data dashboard;

(5) Chainalysis Blockchain Analysis Report.

The data covers a complete on-chain record of over 86 million transactions and 17,218 market conditions from April 2024 to December 2025.

2.2 Evaluation Dimensions and Weights

The strategy selection process employs a multi-dimensional comprehensive evaluation system, specifically including:

Absolute return capability (weight 30%):

Using cumulative profit and loss (PnL) as the core metric, the total profit generated by the strategy is calculated. Data shows that wallets with a PnL exceeding $1,000 account for only 0.51% of the total, and whale accounts with trading volume exceeding $50,000 account for only 1.74%.

Risk-adjusted return (weighted at 25%):

Calculate metrics such as Return on Investment (ROI) and Sharpe ratio. Excellent traders typically maintain a win rate of 60-70% while controlling the risk exposure of each trade to within 20-40% of total capital.

Strategy replicability (weight 20%):

The evaluation strategy will be assessed for its systematic nature and degree of formalization. Gains that rely purely on insider information or sheer luck will not be considered in the selection process.

Persistence and stability (weight 15%)

Examine the consistency of the strategy's performance across different market cycles, excluding "one-hit wonder" gambling-style returns.

Scalability (weight 10%)

The applicability of the analysis strategy to larger capital scales is considered, taking into account liquidity constraints and market shock costs.

2.3 Exclusion Criteria

The following situations are not included in the selection of the best strategy:

(1) Suspected market manipulation, such as the UMA token governance attack in March 2025, in which a whale holding 5 million UMA tokens (accounting for 25% of the voting rights) manipulated market settlements worth $7 million.

(2) Gambling-style trading with a single position of 40-50% or more;

(3) "Black box" strategies that cannot be verified or replicated;

(4) Insider trading based on non-public information.

III. Review of the Six Core Profit Strategies in 2025

1. Information arbitrage strategy: When a Frenchman knows more about elections than all the polling organizations in the United States

In the early hours of November 5, 2024, while CNN and Fox News hosts were cautiously saying the election was "closely tied,"

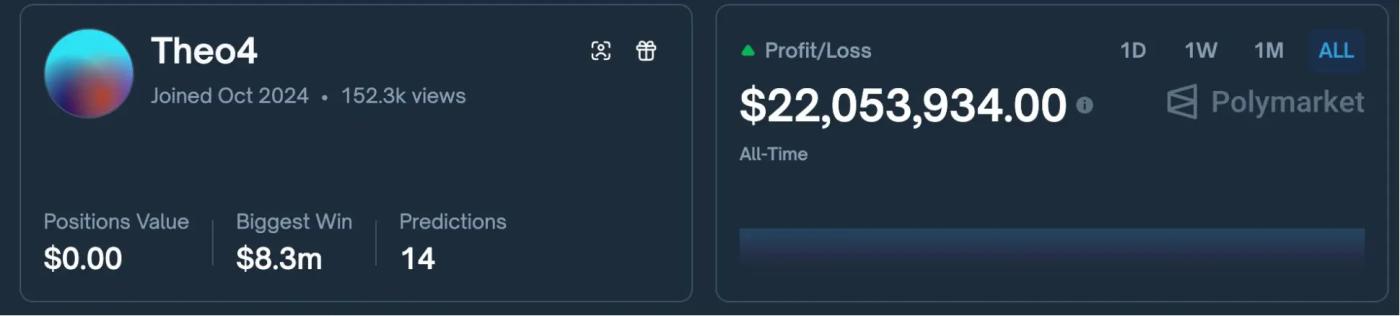

An anonymous account, Fredi9999, has already made a profit of over $50 million on its holdings.

Hours later, Trump declared victory, and the account, along with 10 associated wallets behind it, ultimately reaped $85 million in profits.

The person behind the account is Théo, a French trader who used to work on Wall Street.

When all major polls showed Harris and Trump neck and neck,

He did something that seemed crazy: he sold almost all of his liquid assets, raised $80 million, and bet it all on Trump to win.

Instead of asking voters "Who do you vote for?", Théo commissioned YouGov to conduct a special poll in the three swing states of Pennsylvania, Michigan, and Wisconsin, asking: "Who do you think your neighbor will vote for?"

The logic behind this "neighbor effect" poll is simple: some people are ashamed to admit they support Trump, but they don't mind saying their neighbors do.

The results were "shockingly biased towards Trump." The moment Théo received the data, he went from a 30% position to an all-in position.

This case reveals the essence of information arbitrage: it's not about knowing more than others, but about asking the right questions. Théo spent less than $100,000 on polls and reaped a return of $85 million.

This may be the market research project with the highest return on investment in human history. Currently, his total returns rank first on Polymarket.

Replicability assessment: Information arbitrage has an extremely high barrier to entry, requiring original research methodologies, substantial capital, and the mental fortitude to persist in judgment when "everyone says you're wrong." However, its core idea—finding systematic biases in market pricing—is applicable to any controversial prediction market.

2. Cross-platform arbitrage strategy: The art of "picking up money" between two markets.

If information arbitrage is an "intellectual game," then cross-platform arbitrage is a "manual labor"—tedious, mechanical, but virtually risk-free.

Its principle is easy for even elementary school students to understand: If the same item is sold for 45 yuan in store A and 48 yuan in store B, you can buy one copy from each store to hedge your position and profit from the price difference regardless of the outcome.

From April 2024 to April 2025, academic research recorded a figure: arbitrageurs extracted more than $40 million in "risk-free profits" from Polymarket. The top three wallets alone earned $4.2 million.

A real-world example: On a certain day in 2025, the question "Bitcoin broke through $95,000 in one hour" was priced at $0.45 on Polymarket (YES), while on competitor Kalshi, the same event was priced at $0.48 (NO).

A savvy trader buys both sides simultaneously, with a total cost of $0.93. Regardless of whether Bitcoin rises or falls, he can recoup $1, a risk-free profit of 7.5%, credited to his account within an hour.

However, there is a "fatal detail" here: the two platforms may have different definitions of "the same event".

During the 2024 US government shutdown, a group of arbitrageurs discovered that Polymarket judged "shutdown occurred" (YES), while Kalshi judged "shutdown did not occur" (NO).

Their hedging positions, which they thought were sure to make a profit, resulted in losses on both sides.

Why? Polymarket's settlement standard is "OPM issues a closure notice", while Kalshi requires "actual closure for more than 24 hours".

Arbitrage isn't about making money blindly. Behind every penny of price difference lie the details of settlement rules.

Replicability assessment: This is the least demanding of the six strategies. All you need is accounts on multiple platforms, some initial capital, and the patience to compare price differences. There's even open-source arbitrage bot code on GitHub. However, with the influx of institutional capital, the arbitrage window is narrowing at a visible rate.

3. High-probability bond strategy: Turning "almost certainty" into a business with an annualized return of 1800%.

Most people come to Polymarket for the thrill: betting on underdogs and predicting upsets.

But real "smart money" does the exact opposite: they specifically buy things that are "already set in stone".

Data shows that 90% of large orders exceeding $10,000 on Polymarket occur at prices above $0.95. What are these "whales" doing? They are "bonding," buying into events that are almost certain to happen, like buying bonds.

For example, three days before the Federal Reserve's interest rate meeting in December 2025, the YES contract with a "25 basis point rate cut" was trading at $0.95. The economic data was already out in the open, and the Fed officials' speeches had clearly indicated this; there was no room for surprises. You bought in for $0.95, and after three days, you settled and received $1 back, a 5.2% return, within 72 hours.

5% doesn't sound like much? Let's do the math: If you can find two such opportunities every week, that's 52 weeks x 2 times x 5% = 520% annually. Considering compound interest, the annualized return easily exceeds 1800%. And the risk you take is close to zero.

Some traders have used this strategy to earn over $150,000 a year by making only a few trades per week.

Of course, "almost certain" is not the same as "absolutely certain".

The biggest enemy of bond strategies is the black swan, those unexpected events with a 0.01% probability. A single mistake can wipe out the profits of dozens of successful trades. Therefore, the core competency of top bond players is not finding opportunities, but identifying "pseudo-certainties": those traps that seem certain but actually harbor hidden risks.

Replicability Assessment: This is the most suitable strategy for beginners. It requires no in-depth research, no speed advantage, only patience and discipline. However, its potential for maximum returns is also the lowest. Once your capital reaches a certain size, there simply aren't enough opportunities in the market with a 95%+ success rate to "reap" profits.

4. Liquidity Provision Strategies: Just Earning "Tolls"? It's Not That Simple

Why do casinos always make money? Because they don't gamble with you; they only take a cut.

On Polymarket, there is a group of people who choose to "be a casino" rather than "be a gambler"—they are liquidity providers (LPs).

The LP's job is to simultaneously place buy and sell orders on the order book, profiting from the price difference. For example, if you place a buy order at $0.49 and a sell order at $0.51, you'll earn the $0.02 difference regardless of who trades. You don't care about the outcome; you only care if anyone trades.

Polymarket launches new markets daily. These new markets are characterized by poor liquidity, large spreads, and a high concentration of retail investors. For limited partners (LPs), this is paradise. Data shows that the annualized equivalent return for providing liquidity in these new markets can reach 80%-200%.

A trader named @defiance_cr was interviewed by Polymarket and shared in detail how he built his automated market-making system. At its peak, this system generated $700-800 in profits per day.

He started with $10,000 and initially earned about $200 per day. As the system was optimized and his capital increased, his earnings rose to $700-$800 per day. The key was utilizing Polymarket's liquidity rewards program, which allowed him to earn nearly three times the rewards by placing orders on both sides of the market simultaneously.

His system consists of two core modules: a data acquisition module that pulls historical prices from the Polymarket API, calculates volatility indicators, estimates the expected return on a $100 investment, and then sorts them by risk-adjusted returns; and a trade execution module that automatically places orders based on preset parameters—narrow spreads for markets with high liquidity and wide spreads for markets with high volatility.

However, after the election, Polymarket's liquidity rewards dropped significantly.

LP strategies will remain viable by the end of 2025, but returns will decline and competition will intensify. The setup costs for high-frequency trading are higher than the salaries of ordinary employees. High-end VPS infrastructure needs to be hosted near Polymarket servers. Quantitative algorithms are optimized for rapid execution.

So don't envy those traders who earn $200,000 a month. They do exist. They are in the top 0.5%.

This combination of "market making + prediction" is the standard approach for advanced players.

Replicability assessment: LP strategies require a deep understanding of market microstructure, including order book dynamics, spread management, and inventory risk control. It is not as "mechanical" as arbitrage, nor does it require unique insights like information arbitrage; rather, it lies in between. It requires skill, but skill can be learned.

5. Domain Specialization Strategy: A Market Prediction Version of the 10,000-Hour Rule

An interesting phenomenon exists on the Polymarket rankings: the highest earners are almost all "specialists." They are not generalists who know a little about everything, but rather experts who possess an overwhelming advantage in a narrow field.

Let's look at a few real-world examples:

HyperLiquid0xb, a dominant figure in the sports market, has earned over $1.4 million in total profits, with his largest single gain of $755,000 coming from a baseball game prediction. His familiarity with MLB data rivals that of a professional analyst, allowing him to quickly adjust his judgments mid-game based on pitcher rotations and weather changes.

Mention market maverick Axios maintains a terrifying 96% win rate in markets like "Will Trump use the word 'encryption' in his speeches?" His method is simple but extremely time-consuming: analyze all past public statements by the target person, statistically analyze the frequency and context of specific words, and build a predictive model. While others are still "betting," he is already "calculating."

These cases have one thing in common: expert traders may only participate in 10-30 trades per year, but each trade has a very high degree of confidence and profit potential.

Therefore, specialization is more profitable than breadth.

Of course, I also saw a sports expert named SeriouslySirius who reported a single loss of $440,000 in a major world tournament, followed by significant losses in a series of subsequent tournaments.

If you only have a "slight understanding," you're essentially giving money away to the experts. Of course, even so-called "understanding" is another kind of gamble.

Replicability assessment: This is the strategy that requires the most time investment, but it also has the highest barriers to entry. Once you establish an informational advantage in a certain field, that advantage is very difficult to replicate. It is recommended to choose a field where you already have existing knowledge or that is related to your profession.

6. Speed Trading Strategy: Acting Before the World Reacts

On a Wednesday afternoon in 2024, at 2 p.m., Federal Reserve Chairman Jerome Powell began his speech. Within eight seconds of him saying, "We will adjust policy as appropriate," the contract price for "Fed December rate cut" on Polymarket jumped from $0.65 to $0.78.

What happened in those 8 seconds? A small group of "speed traders" monitored the live stream and preset trigger conditions, placing orders before ordinary people could even "understand" what Powell was saying.

As trader GCR once said, the core of speed trading is "reaction." It utilizes the time window between the generation of information and its digestion by the market, which is usually only a few seconds to a few minutes.

This strategy is particularly effective in "mention markets." For example, if you can find out "whether Biden will mention China in his speech today" 30 seconds earlier than others (by monitoring the White House live stream instead of waiting for news feeds), you can establish a position before the price movement.

Some quantitative trading teams have already industrialized this strategy. According to on-chain data analysis, between 2024 and 2025, top algorithmic traders executed over 10,200 high-speed trades, generating a total profit of $4.2 million. The tools they used included: low-latency API access, real-time news monitoring systems, pre-defined decision-making rule scripts, and funds distributed across multiple platforms.

But speed trading is becoming increasingly difficult. As more institutional capital enters the market, arbitrage opportunities have shrunk from "minutes" to "seconds," making it virtually impossible for ordinary people to participate. This is an arms race, and retail investors have far fewer tools than institutions.

Replicability assessment: Unless you have a technical background and are willing to invest the time to develop a trading system, it is not recommended to attempt this. The alpha of speed trading is rapidly disappearing, leaving less and less room for retail investors. If you insist on participating, it is recommended to start practicing in low-competition niche markets (such as local elections or niche sporting events).

IV. Risk Management and Strategy Portfolio

4.1 Principles of Position Management

Successful traders generally follow these position management principles:

Simultaneously hold 5-12 uncorrelated positions; a mix of short-term (several days) and long-term (several weeks/months) positions;

Reserve 20-40% of funds as a reserve for new opportunities;

The risk exposure of a single transaction should not exceed 5-10% of the total capital.

Excessive diversification (30+ positions) dilutes returns, while excessive concentration (1-2 positions) carries too much risk.

The optimal number of positions is usually between 6 and 10.

4.2 Strategy Combination Recommendations

The following are strategy allocation recommendations based on risk appetite.

- Conservative investors: 70% bond strategy + 20% liquidity provision + 10% copy trading.

- Balanced investor: 40% sector specialization + 30% arbitrage + 20% bonds + 10% event-driven.

- Aggressive investors: 50% information arbitrage + 30% domain expertise + 20% speed trading.

Regardless of the portfolio, you should avoid betting more than 40% of your funds on a single event or a group of highly related events.

V. Conclusion

2025 is a pivotal year for Polymarket as it transitions from fringe experimentation to mainstream finance.

The six profitable strategies reviewed in this article—information arbitrage, cross-platform arbitrage, high-probability bonds, liquidity provision, domain specialization, and speed trading—represent proven sources of alpha in prediction markets.

In 2026, the market is predicted to face more intense competition and higher professional barriers.

Newcomers are advised to focus on: (1) choosing a vertical field where they can build an information advantage and cultivating it deeply; (2) accumulating experience by starting with small-scale bond strategies; (3) using tools such as PolyTrack to track and learn from the patterns of top traders; and (4) keeping a close eye on regulatory changes and platform rule updates.

The essence of prediction markets is a "truth discovery mechanism that uses money to vote".

In this market, the real edge comes not from luck, but from better information, more rigorous analysis, and more rational risk management. May this review provide you with a systematic map of this new world.

References

[1] Chainalysis. "Polymarket Whale Analysis Report." November 2024.

[2] The Free Press. "How a French Whale Made $85 Million off Trump's Win." November 2024.

[3] Polymarket Analytics. "Trader Leaderboard and Performance Metrics." December 2025.

[4] PolyTrack. "Best Polymarket Traders to Follow 2025." November 2025.

[5] Dune Analytics. "Prediction Market Volume and Open Interest Data." September 2025.

[6] Wall Street Journal. "The French Trader Who Bet Big on Trump." November 2024.

[7] Bloomberg. "Trump Whale's Polymarket Haul Boosted to $85 Million." November 2024.

[8] CBS News 60 Minutes. "How a French 'whale' made over $80 million on Polymarket." December 2025.