Original author: Campbell

Original translation: TechFlow TechFlow

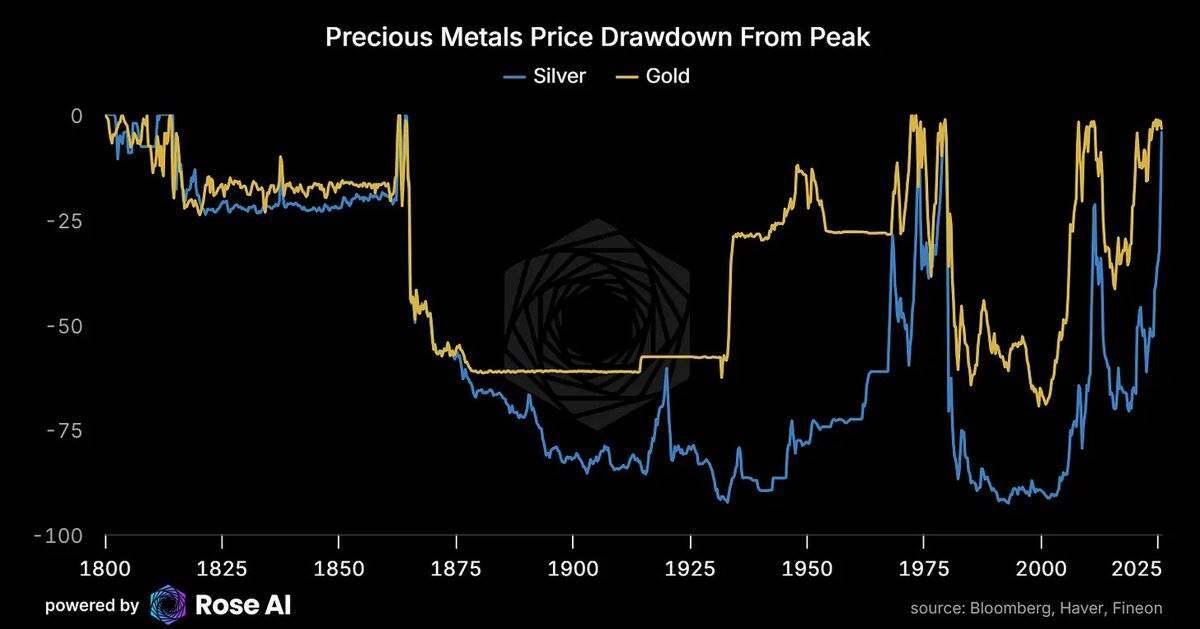

It has been 10 days since our last analysis on silver was published.

The market dynamics of 10 days ago seem to be a quarter of the past. And in this short period, the silver market has experienced a series of significant events:

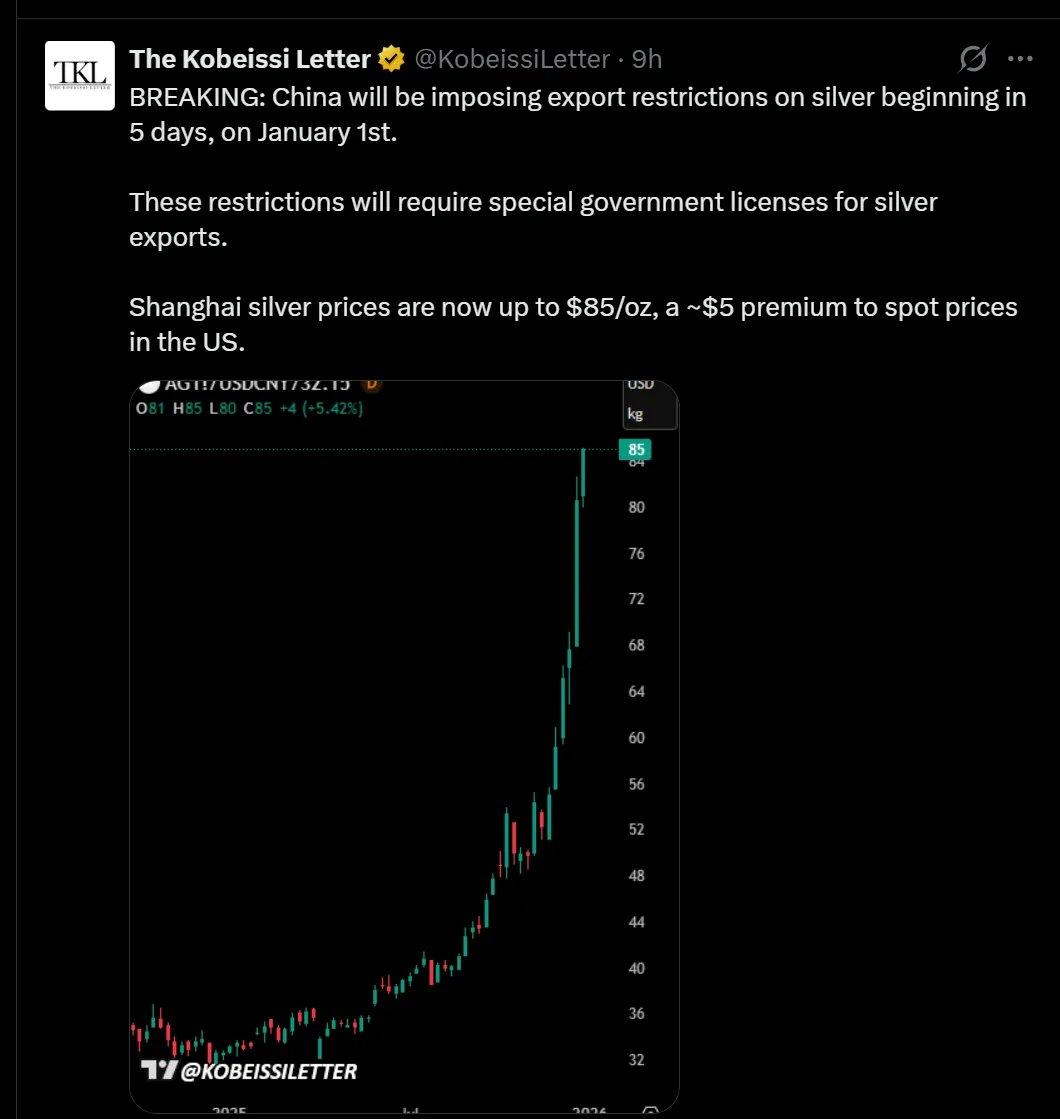

- China has announced that it will implement a licensing system for silver exports starting January 1 next year .

- The price of physical silver in Shanghai surged to $91, while the settlement price on COMEX (New York Mercantile Exchange) was $77.

- The London forward curve remains deeply mired in backwardation, though not as extreme as in October, it is still inverted.

- The CME (Chicago Mercantile Exchange) has raised margin requirements for silver.

- After undergoing a well-deserved digital "detox," I spent the entire afternoon staring at Bloomberg and Rose, trying to figure out whether these changes would affect our market outlook.

Short-term conclusion: Now is not a good time to buy.

I will wait for the upcoming pullback opportunity to continue positioning and remain flexible when operating through options.

This is precisely what trading books won't tell you—when your investment logic works, or even works too well, you need more than just managing your money; you need to manage your emotional resilience. At this point, the mathematical model on paper is no longer just a probability distribution, but has become a call option with "realized gains."

This phase is unsettling because you need to do more homework: re-verify your calculations and evaluate counter-narratives that may be detrimental to you.

This is the current situation.

Bear Market Warning (or: Potentially "Fatal" Risk Factors)

Over the next two weeks, silver bulls will have to contend with some narratives and pressures that could trigger bearish sentiment in the short term.

Don't be surprised by the upcoming "bearish candle"; it's quite possible. The key is whether you'll choose to buy at the low. We've shifted some of our "Delta" (price exposure) to gold, rebalancing our portfolio to approximately 15% gold and 30-40% silver, whereas previously the ratio was closer to 10:1.

In addition, we purchased some upside butterflies and made a significant purchase of dollar call options. The logic behind these actions will become clearer in the future.

In any case, the following are the main factors that may currently bring bearish pressure:

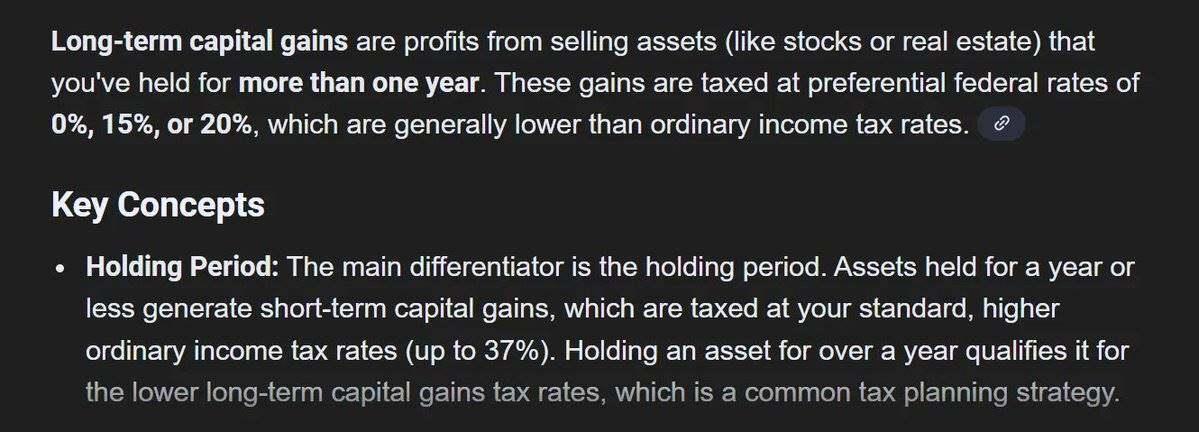

Tax pressure to sell

The trade you're currently holding has already made a considerable profit, perhaps even enough to make your accountant uneasy. Investors who bought silver through long-term call options may be hesitant to sell their positions before December 31st.

This is especially true when these positions are held for less than a year, as this involves not only capital gains tax but may also result in differences in tax treatment between short-term and long-term investments.

This means that there will be bullish pressure at present , but after January 2nd, it will turn into bearish pressure .

US Dollar and Interest Rates

The latest GDP data was strong, which could weaken expectations of easing on the 2-year Treasury yield curve, forcing policymakers to choose between a stronger dollar and higher short-term interest rates . Either way, it's not good news for dollar-denominated precious metals like silver and gold in the short term.

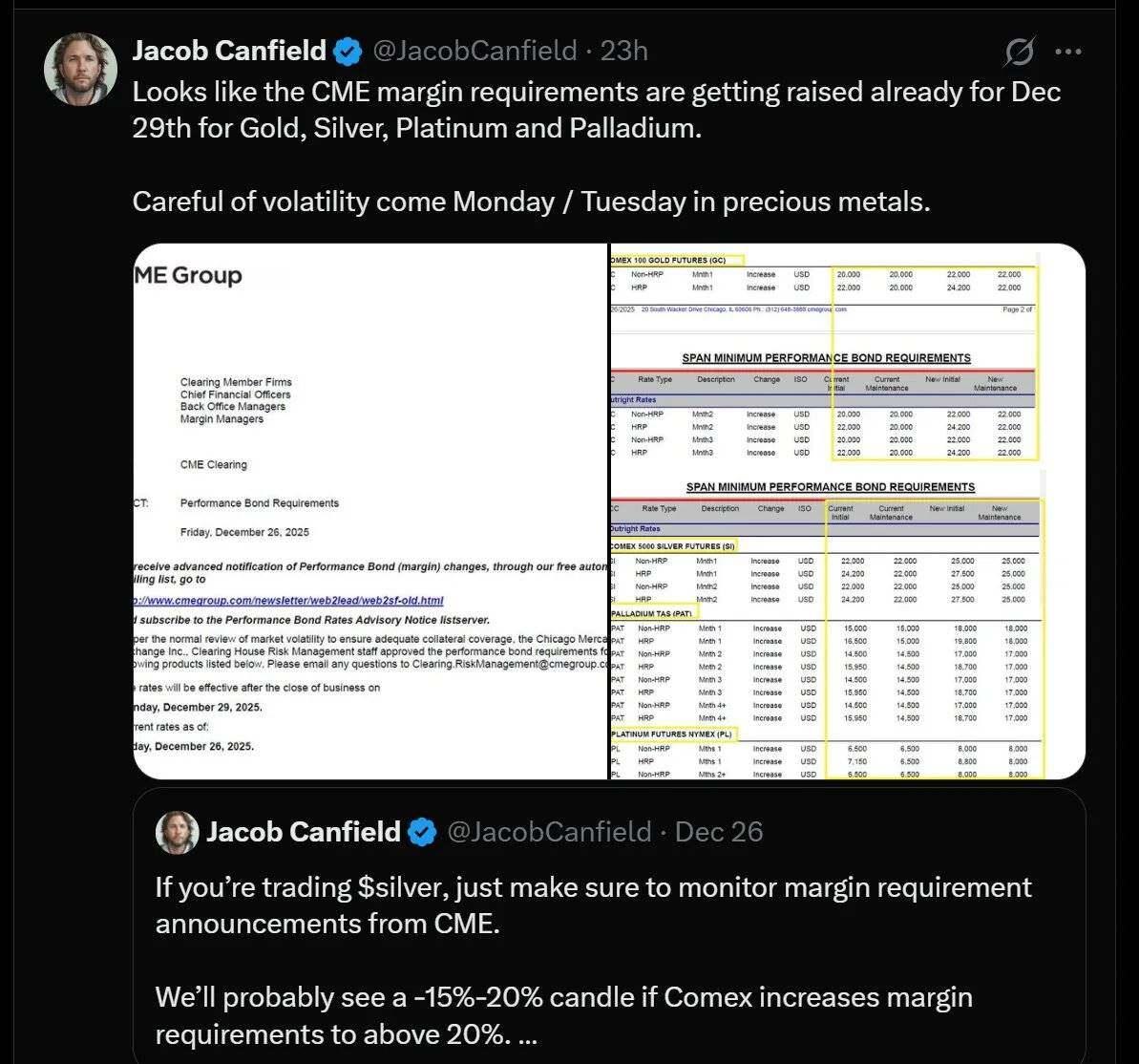

Margin increase

The CME (Chicago Mercantile Exchange) announced that it will raise margin requirements for precious metals starting December 29.

If you use leverage in the futures market, this change could have a significant impact on you. Higher margin requirements = higher capital requirements = forced liquidation for underfunded investors . This is similar to the situation during the 2011 silver market crash, when the CME raised margin requirements five times in eight days, causing leverage to plummet and abruptly ending the silver rally.

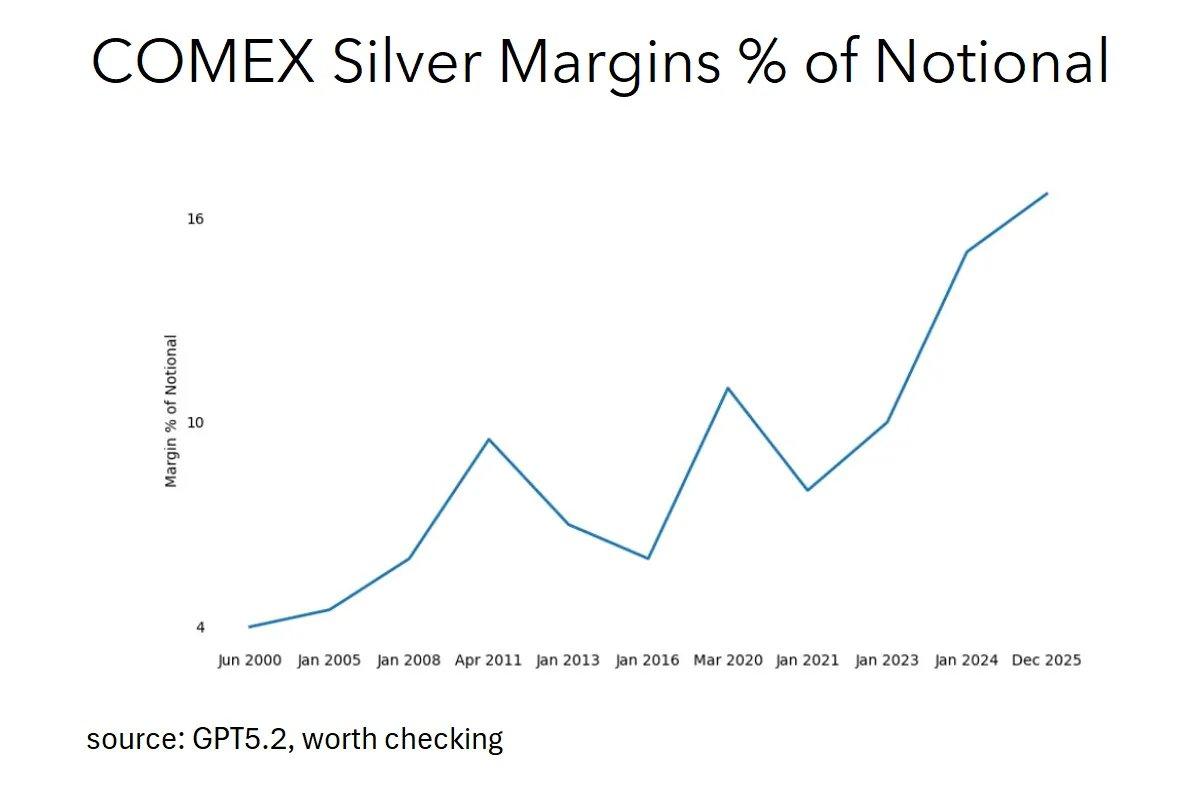

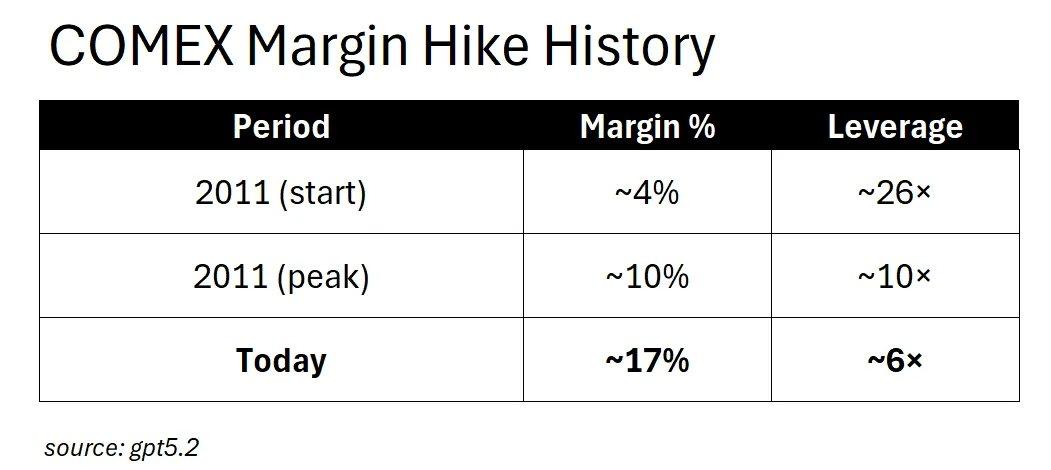

So, is this something to worry about? Actually, the situation isn't that bad. The reason is that silver margin requirements are already far higher than in 2011, so while the recent increase has some impact, the effect is relatively small. Furthermore, most demand in the silver market now comes from physical demand , which is very different from the situation in 2011.

Back in 2011, the minimum margin requirement for silver was only about 4% of its notional value. This meant that a capital investment of just $4 could control $100 worth of silver – equivalent to a leverage of 25 times, which was extremely risky. Subsequently, the CME raised the margin requirement to about 10% within a few weeks, drastically reducing the leverage from 25 times to 10 times. The chain reaction of forced liquidations directly stifled that round of silver price increases.

And what about today? Currently, the margin ratio for silver has reached approximately 17% , equivalent to 6 times leverage, which is even stricter than the margin requirements during the most stringent period in 2011.

The current market environment has entered a "post-squeeze" margin phase, so what impact would further increases in margin requirements have? The answer is: it will no longer trigger panic selling by speculators, because there is little speculative leverage left to clear in the market. Instead, these adjustments will have a greater impact on hedgers, such as producers trying to lock in prices, refiners managing inventory risk, and commercial players who rely on the futures market.

Raising the margin requirement to 20% will not trigger a chain reaction of forced liquidations like in 2011. The real result will be reduced liquidity, widening bid-ask spreads, and commercial players turning to the over-the-counter (OTC) market . The market's operating mechanism has undergone a fundamental transformation.

Therefore, those who warn of margin increases are essentially fighting a "previous war" (if the analysis above is correct). While this argument may help construct a "reverse narrative" in the short term, its practical significance is limited.

The emergence of "overbuying" comments

When the factors mentioned above begin to materialize, you'll hear "charting astrologers" on FinTwit constantly proclaiming "overbought." Technical sell-offs often trigger more technical sell-offs, creating a negative cycle.

But the question is, relative to what is "overbuying"?

The investment logic for silver doesn't lie in technical chart lines or "tea leaf divination." The core driver of silver lies in its supply and demand fundamentals: the clash between the economic benefits of solar panels (inelastic demand, with silver costs accounting for only about 10% of the solar panel price) and the rigidity of silver supply (75% of silver is a byproduct of other metals). These are the real factors driving short-term price fluctuations.

Furthermore, silver just hit a new all-time high. Do you know what else might hit a new all-time high? Those assets that are still rising.

Copper Substitution Theory

This is one of the most common arguments used by opponents: "They would use copper instead of silver."

Okay, there's some truth to that, but let's do the math.

The reality of copper substitution (or rather: four years is a long time)

The bearish arguments for copper substitution do exist, but the problem is that they are very slow .

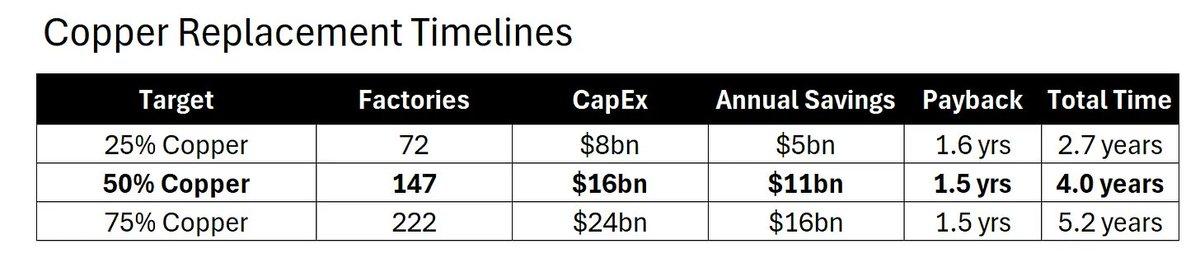

This is actual mathematical calculation, not intuitive speculation:

Time is the key limiting factor

Even with unlimited funds, the conversion is still subject to physical limitations:

- There are approximately 300 factories worldwide that manufacture solar cells;

- It will take 1.5 years to convert each factory to copper plating.

- The maximum parallel conversion capacity is 60 factories per year;

- It will take at least four years to achieve a 50% copper substitution rate.

From the perspective of these return cycles, a 1.5-year transition period is an obvious capital allocation decision. In other words, CFOs should be eager to approve such a transformation plan.

The problem is that even so, it would take at least four years to complete half of the conversion .

Factories need to be rebuilt one by one, engineers need to be retrained, copper plating formulas need to be re-validated, and the supply chain needs to be readjusted. All of this takes time.

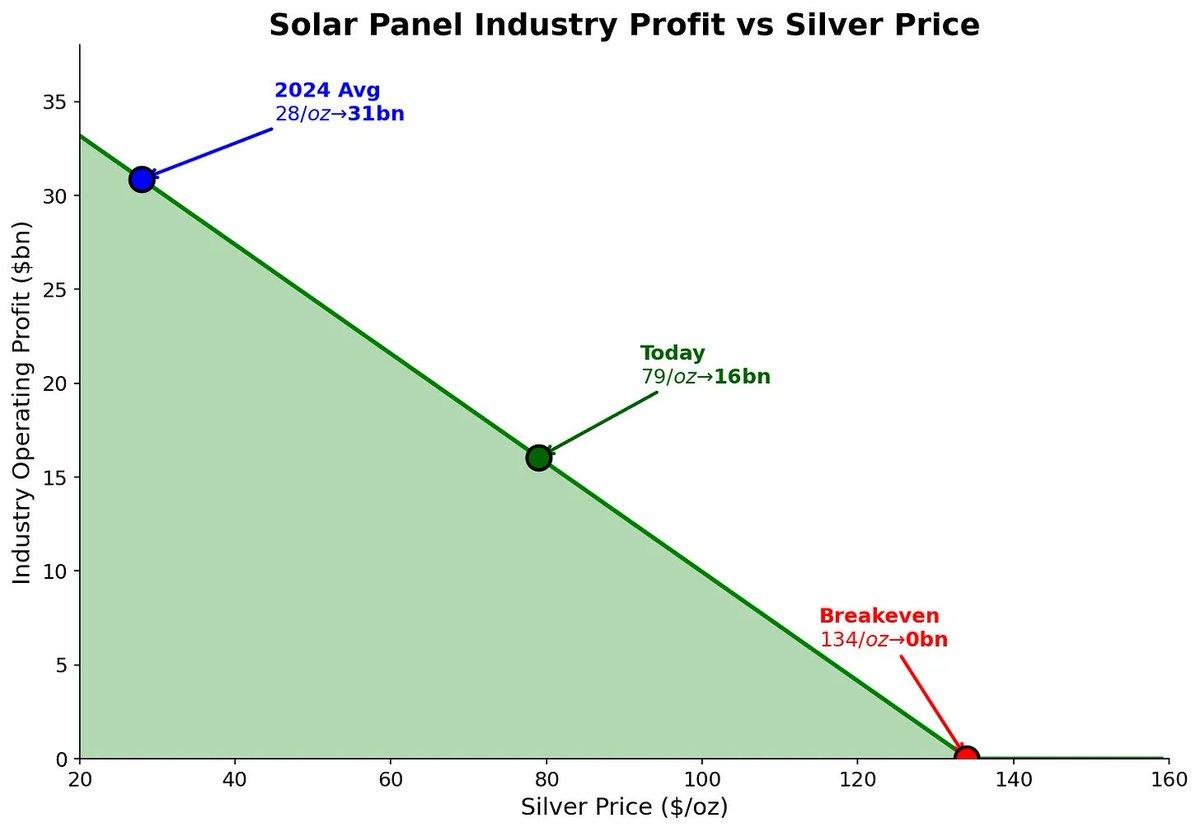

Elasticity calculation of demand

Solar panel manufacturers have essentially absorbed the impact of a threefold increase in silver prices. Let's examine the effect on their profits:

- When the price of silver is $28 per ounce (2024 average price), the entire industry's profits will be $31 billion ;

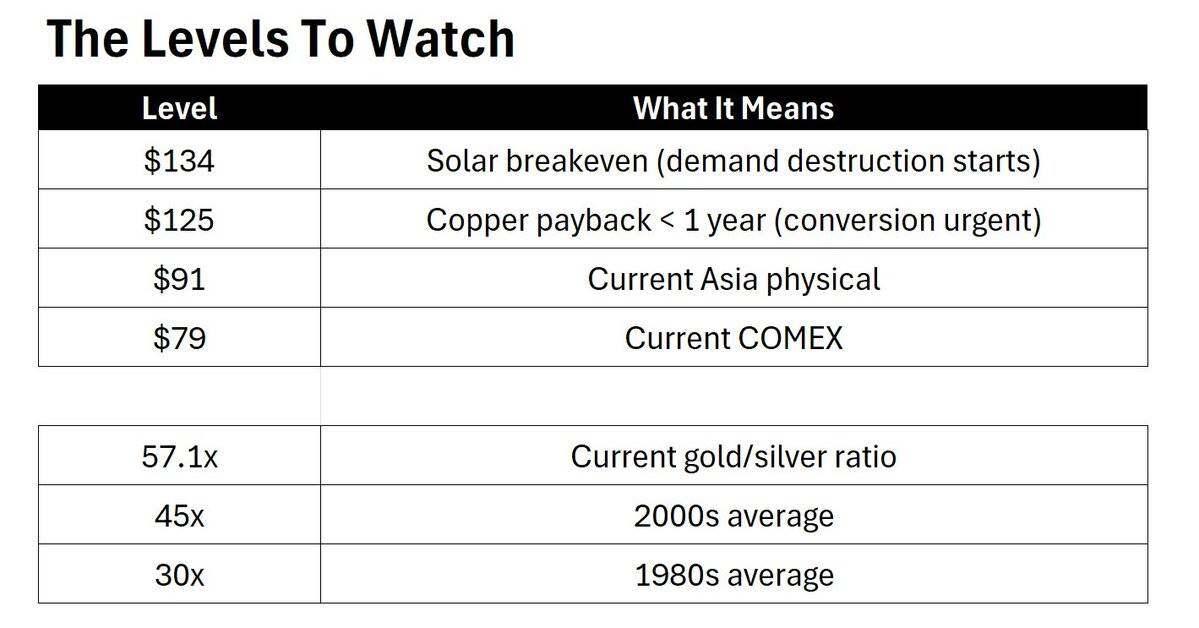

- When silver prices rose to $79 per ounce (current price), industry profits fell to $16 billion . Despite profits being halved, they continued to buy.

Where is the break-even point?

Demand disruption will only begin to manifest when silver prices reach $134 per ounce . This price is 70% higher than the current spot price.

It is important to note that $134/ounce is not a price target, but rather the starting point for demand destruction .

Threshold of urgency

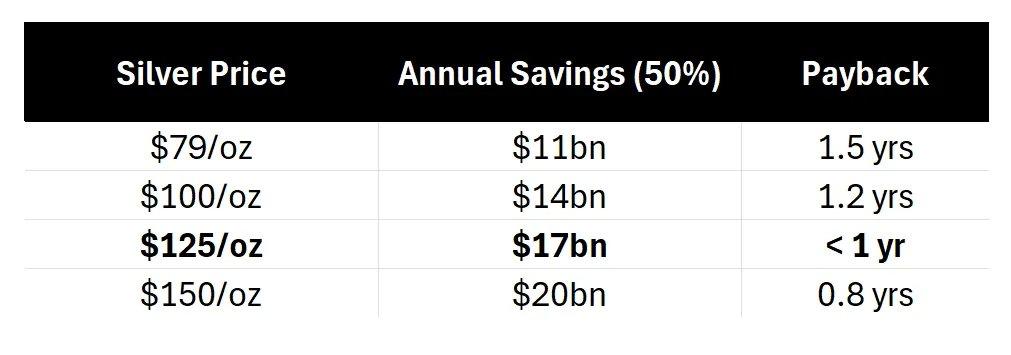

As silver prices continue to rise, the economics of copper as a substitute will indeed become more attractive:

When silver prices reach $125/oz , the payback period for copper substitution will shorten to less than a year , at which point every board meeting will likely revolve around copper substitution. However, even if all companies make their decisions tomorrow, achieving 50% copper substitution will still take four years . Meanwhile, $125/oz will still be 50% higher than current spot prices.

Capital is screaming for action, while physical reality is saying "wait and see."

Strength Paradox

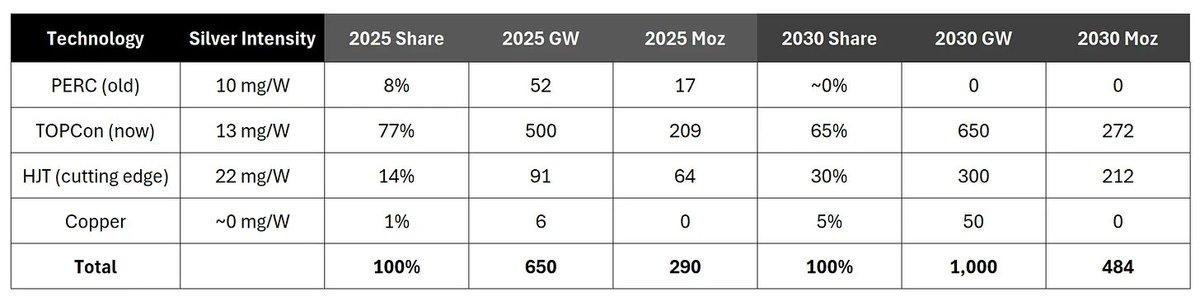

Interestingly, while everyone is talking about "copper replacement," the solar industry is actually shifting towards panel technologies that use more silver :

Weighted average silver usage :

- 2025: Approximately 13.5 mg/W

- 2030: Approximately 15.2 mg/W

The shift from PERC to TOPCon and then to HJT (heterojunction) technology has actually increased the amount of silver used per watt of solar panels, even as copper gradually replaces silver in some aspects. However, it's important to note that while the silver efficiency of each technology improves over time, there are no large-scale copper investment plans, and the industry as a whole is moving towards using more silver per watt , not less.

Short sellers are talking about copper alternatives, but the industry is actually adopting HJT technology.

Conclusions on copper substitution

Time is passing, but it is passing very slowly.

The price of silver is rising faster than the pace of factory upgrades. The four-year window acts as a protective shield for the bullish logic of silver : silver prices need a 70% upside to trigger demand disruption, and even if copper substitution begins today, it will not be able to catch up with the rise in silver in the short term.

Bullish logic for silver (or, in other words: why this market movement may "tear you apart, but be exhilarating")

Okay. The bad situation has been dealt with. Now let's talk about why I'm still bullish.

China is "weaponizing" silver.

Starting January 1 , China will implement a licensing system for silver exports. This is crucial because China is the world's largest net exporter of refined silver, exporting approximately 121 million ounces annually, almost all of which flows into the global market through Hong Kong.

Now, this export flow will require government permission.

A strategic resource game is underway.

The premium for physical silver is astonishingly high.

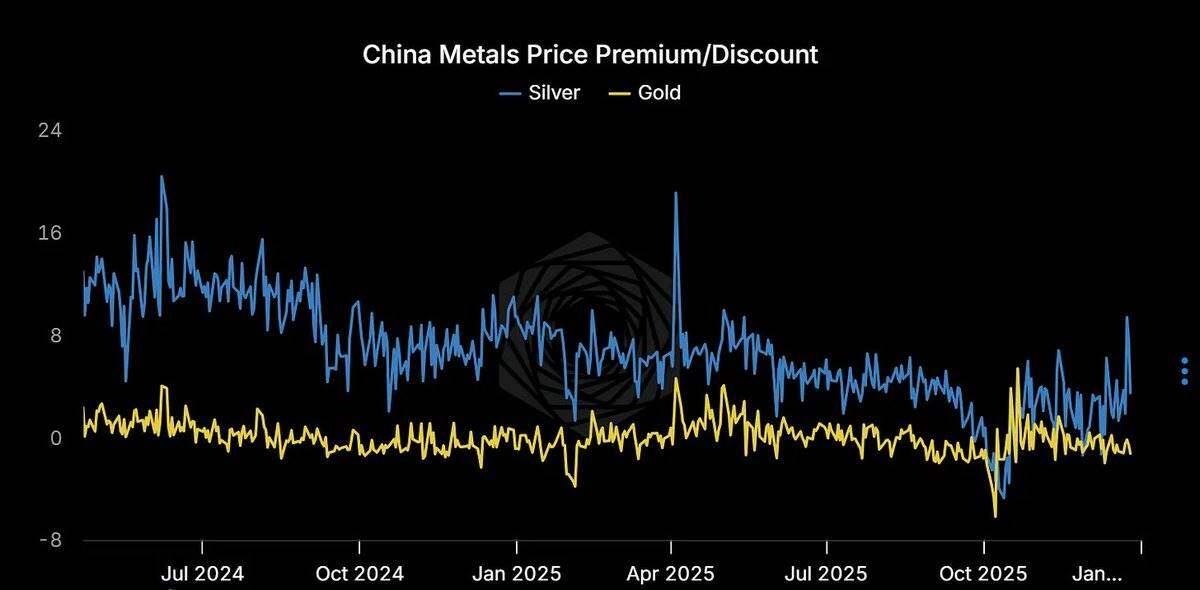

Shanghai: $85/oz; Dubai: $91/oz; COMEX: $77/oz

You live in a world where prices are denominated in dollars, but marginal buyers don't. They pay a premium of $10-$14 and don't care about it at all.

When there is such a large discrepancy between the physical price of silver and its paper price, one of them must be wrong. Historically, however, the error is usually not in the physical market .

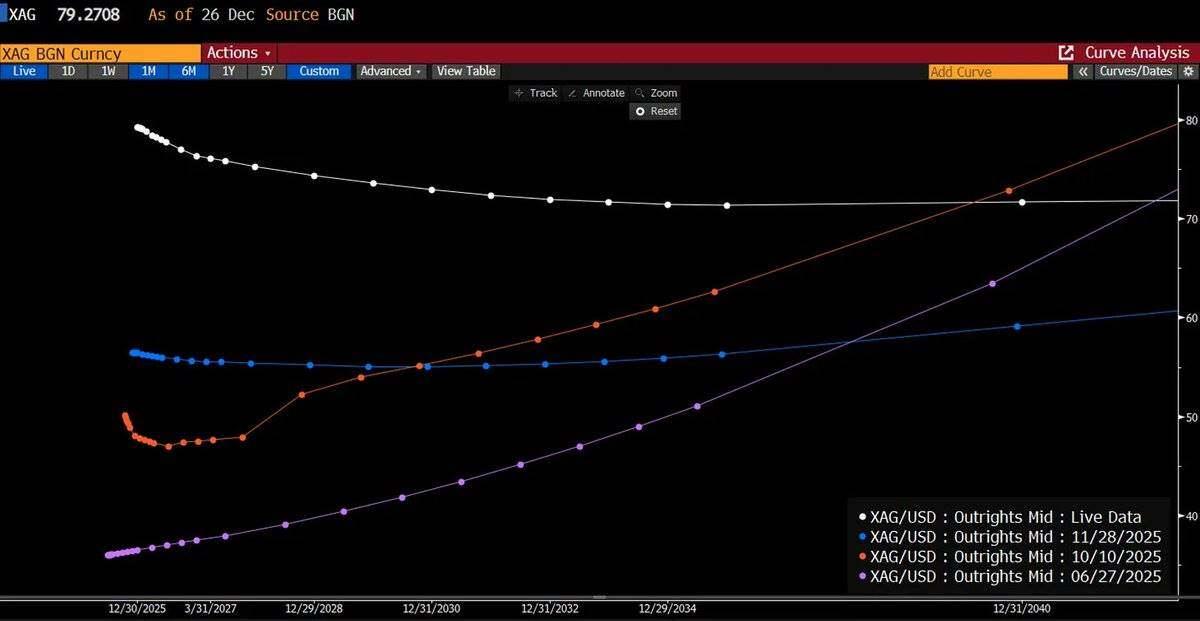

The "Screams" of London Markets

The London over-the-counter (OTC) market is the core of physical silver trading among gold and silver banks, refiners and industrial users, and the market is currently experiencing its most severe backwardation in decades.

What is the spot premium?

Simply put, the market is willing to pay a higher price for physical goods today than for a promised price for future delivery. In other words, the spot price > the forward price . This phenomenon is abnormal and usually indicates significant market pressure.

- One year ago : the spot price was $29, and the price curve gradually rose to $42, which is a normal futures premium (Contango).

- Currently : The spot price is $80, but the price curve has actually dropped to $73, resulting in an inverted price.

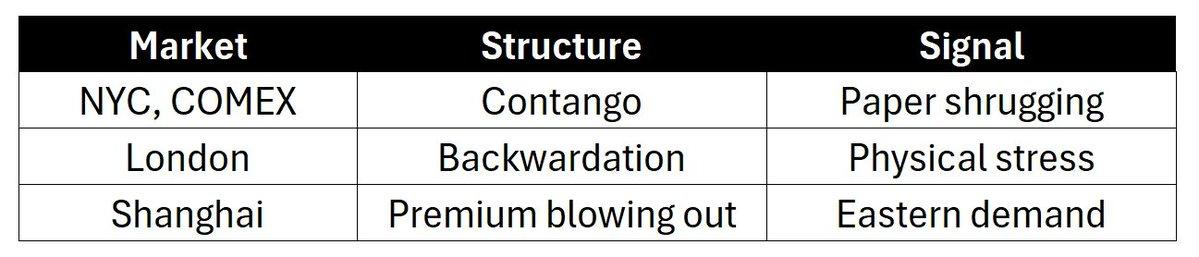

Meanwhile, the COMEX paper market continues to exhibit a sluggish futures premium, pretending everything is normal.

Three markets, three narratives:

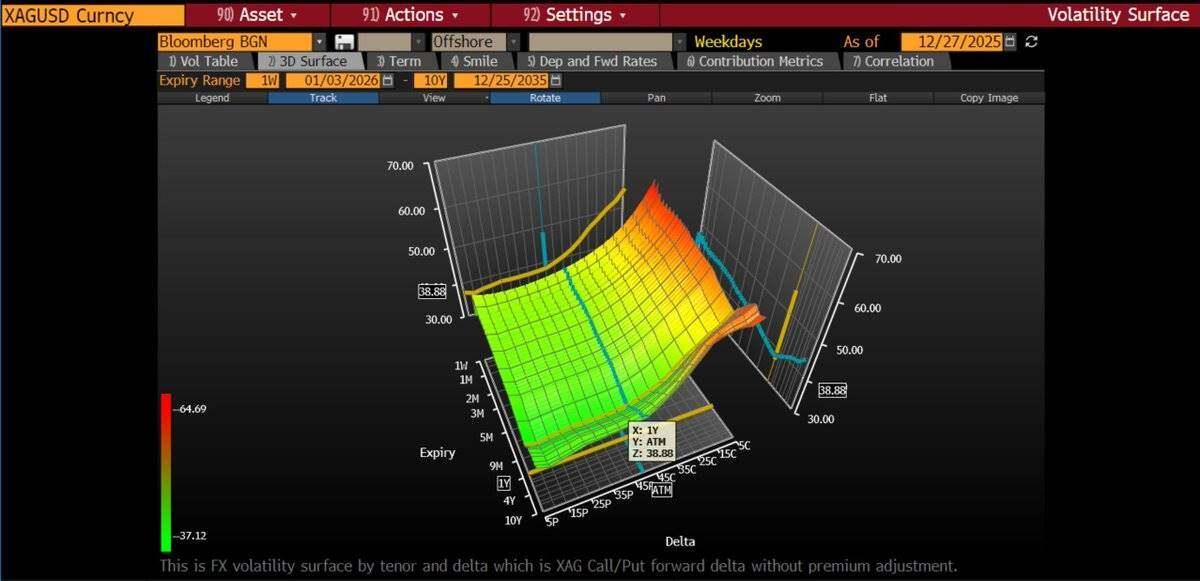

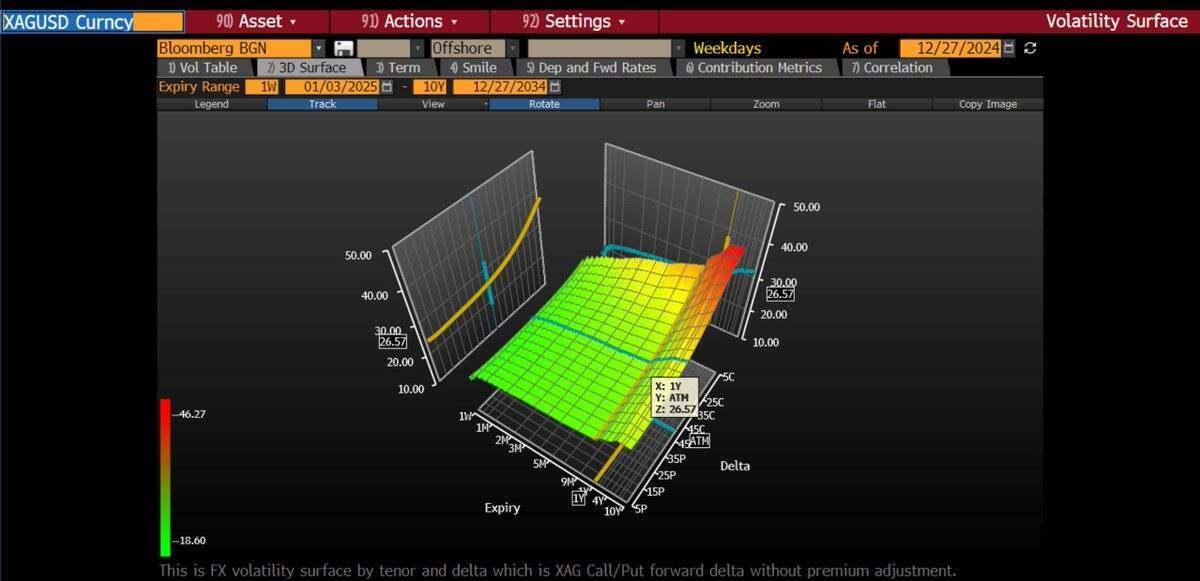

Volatility has been repriced

The implied volatility of at-the-money options rose from 27% to 43% year-over-year. The implied volatility of call options was even steeper— the implied volatility of out-of-the-money (OTM) strike options reached 50-70% . This indicates that the options market is pricing in the tail risk of a significant price increase.

We gradually build our position along the volatility curve by continuously buying call spreads. Specifically, our strategy involves buying the implied volatility of at-the-money options while simultaneously hedging costs by selling call options with higher strike prices. Recently, we've even adopted a strategy of buying 6-month butterfly options .

- Buy one SLV (iShares Silver Trust ETF) call option with a strike price of $70 ;

- Sell two call options with a strike price of $90 ;

- Buy back one more call option with an exercise price of $110 .

This strategy reflects our short-term view that we would like to appropriately reduce our Delta exposure (sensitivity to price changes) in the event of a significant price increase.

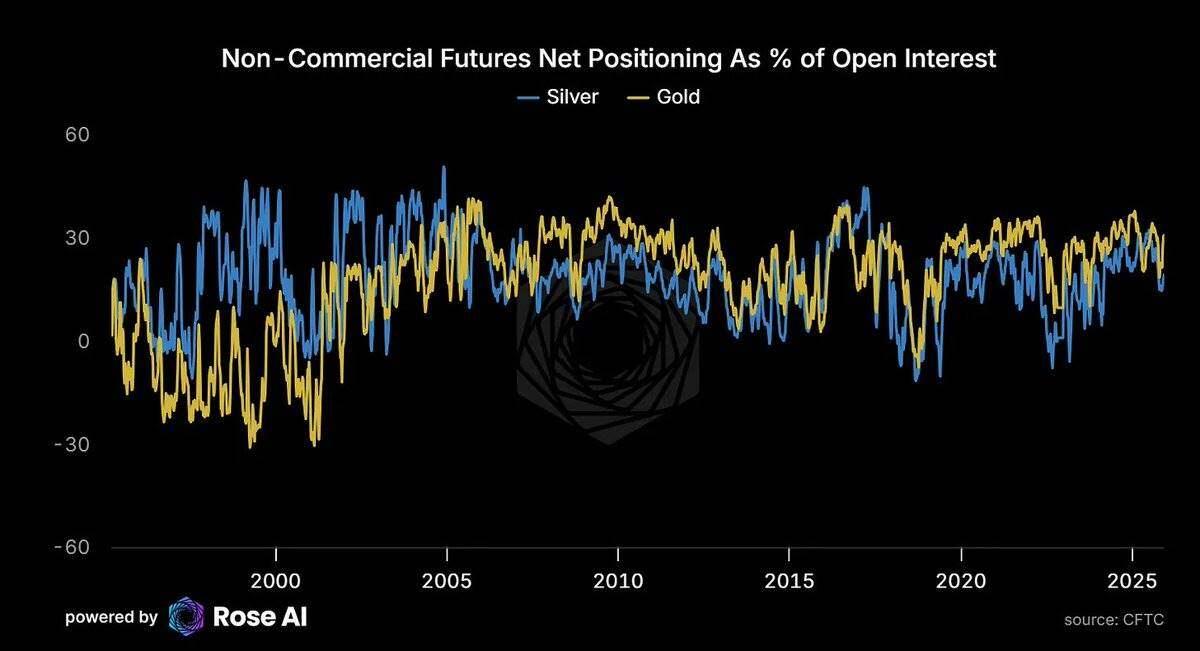

Speculators have not yet crowded in

Currently, speculative net long positions account for 31% of total open interest in the gold market, while this figure is only 19% in the silver market. This suggests that although silver prices have risen, speculative positions have not reached extreme levels and there is still room for further increases .

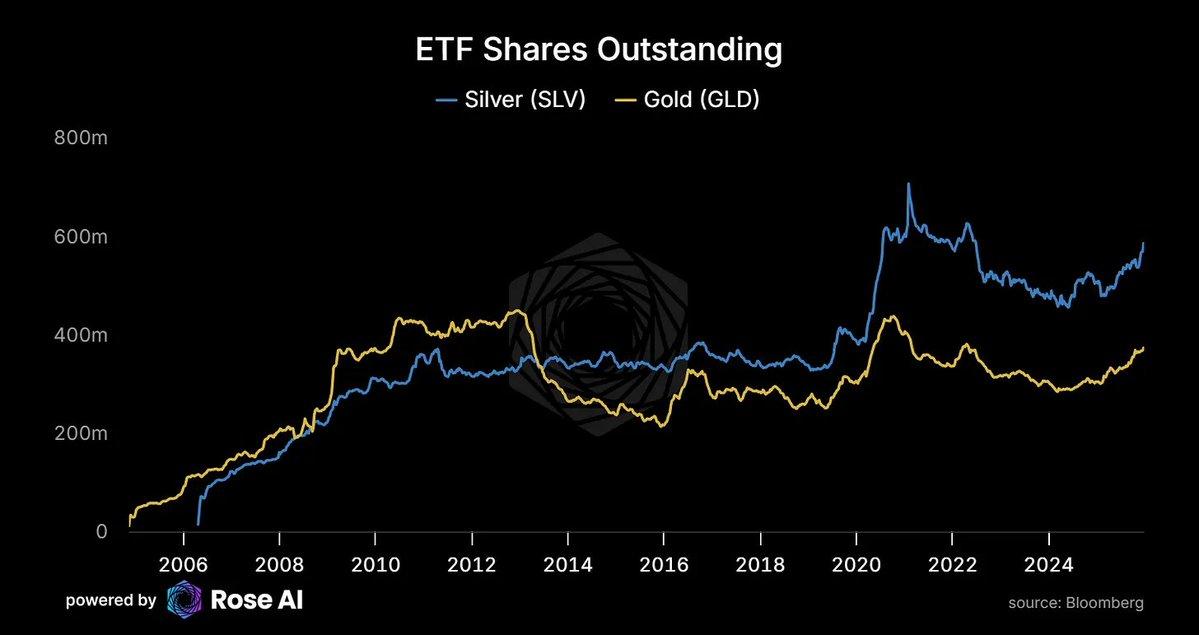

ETF demand is catching up

Investment demand increases as prices rise, which validates our previous prediction that silver will exhibit characteristics similar to Veblen goods, i.e., the higher the price, the greater the demand.

- After years of capital outflows, the number of outstanding shares of the SLV ETF is rising again. As prices rise, demand is also increasing.

- This is not typical commodity market behavior, but rather reflects the growing demand for silver as a monetary asset .

At the same time, the premium for silver in the Chinese market still exists:

- Western ETFs have begun buying silver again;

- The physical demand for silver in the Eastern market has never ceased.

The solar energy industry's "devouring" of silver

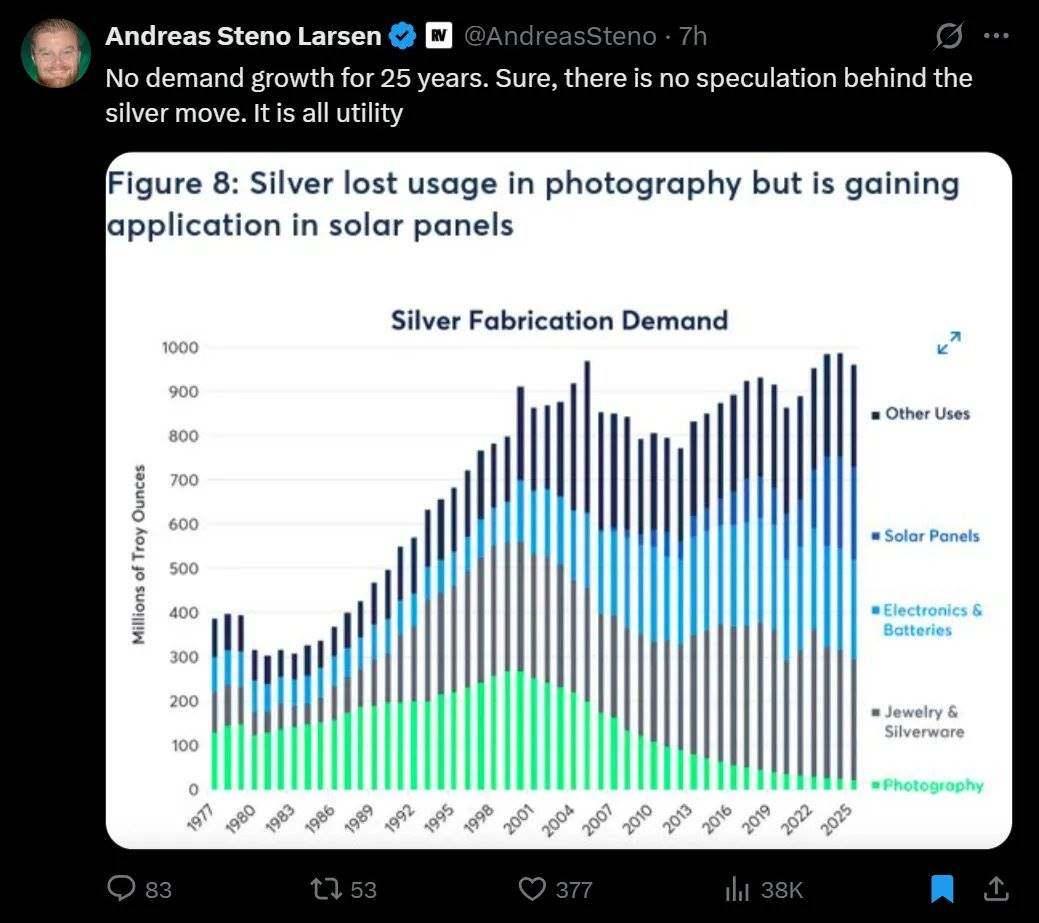

There was no demand growth and no supply growth for 25 years, and then solar energy arrived.

For the past 25 years, demand for silver has barely increased, and supply has not risen significantly. But everything changed with the rise of the solar energy industry. Demand for silver from the photography industry gradually disappeared, and the solar energy industry not only filled that gap but also further fueled an explosive growth in silver demand.

- The current demand for silver in the solar energy industry is 290 million ounces ;

- This figure is projected to exceed 450 million ounces by 2030 .

Artificial Intelligence → Energy → Solar Energy → Silver

The demand chain from artificial intelligence to silver has been formed:

- Sam Altman (CEO of OpenAI) is urgently contacting businesses to secure a power supply.

- To avoid delays caused by connecting to the power grid, data centers have even begun installing aircraft engines as emergency power sources.

- Every query made by artificial intelligence requires electricity, and the marginal contribution of additional electricity supply comes from solar energy;

- And the development of solar energy is inseparable from silver.

This chain is now closed.

Key prices and signals to watch

Risks that need to be paid attention to

- January tax sell-off : Investors may sell at the beginning of the year for tax reasons, causing short-term volatility;

- A stronger dollar could put pressure on silver prices, which are denominated in dollars.

- Margin increase : Although the "killer switch" has been deactivated, we should still be wary of further increases in margin requirements.

Signals to watch

- The widening spot premium and sideways price consolidation indicate that the market is accumulating momentum.

- The easing of spot premiums and the decline in prices indicate that the pressure from external factors is being relieved.

- The persistent premium in the Shanghai market indicates that this is a structural issue, rather than market noise.

Observation framework:

Focus on the curve, not the price.

If pressure persists in the London physical market while the COMEX paper market remains unmoved, arbitrage opportunities will continue to expand until a market "breakdown" occurs.

- Either supply suddenly increases (prices spike to release hoarded silver);

- Either the paper market prices will be forced to readjust to reflect the true situation in the physical market.

Final Summary

In the short term, the bearish logic does exist, and the following factors may impact the market:

- Tax -related sell-offs at the beginning of the year may cause short-term volatility;

- Margin requirement increase : Potential margin adjustments could impact market sentiment;

- A stronger dollar could put pressure on silver prices, which are denominated in dollars.

However, the long-term structural factors supporting silver prices remain strong:

- London spot premiums are at extreme levels not seen in decades;

- The premium in the Asian market is as high as $10-14;

- China will impose silver export restrictions within 5 days;

- Solar energy demand is extremely inelastic to silver prices; even if prices reach $134/ounce, the demand destruction has only just begun.

- It will take at least four years to complete 50% of the copper substitution conversion;

- 72% of the silver supply is a byproduct of other metals, and the demand cannot be met by simply increasing production.

- Speculative positions are not overcrowded, and ETFs are continuing to absorb physical silver.

- Volatility has been repriced, and the market is pricing in the tail risk of a sharp price increase.

This is precisely what makes the market so interesting, and also so terrifying.

Recommendation: Adjust your positions based on the above information and invest rationally. See you next time!