In an era when BTC remains the sole macro anchor of the crypto market, ETH is more like a financial operating system built upon that anchor.

Introduction: When ETH starts to underperform, where exactly is the problem?

Over the past year, ETH has underperformed BTC, which has become an undeniable fact.

Whether it's price performance, market sentiment, or narrative strength, BTC is constantly being reinforced as the "sole mainstay asset":

ETFs, institutional allocation, macro hedging, dollar hedging... every narrative is converging on BTC.

In contrast, ETH's situation appears somewhat awkward.

It remains the most important underlying network for DeFi, stablecoins, RWA, and on-chain finance, yet it continues to lag behind in asset performance.

This raises a question that has been repeatedly discussed but has never been seriously addressed:

Is ETH underperforming BTC because it is being marginalized, or because the market is pricing it in the wrong way?

In its latest 100,000-word annual report, Messari's answer is neither sentimental nor aligned with any particular line of thought.

What they care about more is: where the funds actually land and what the institutions actually put on the blockchain.

From this perspective, the "problems" of ETH may not be what most people imagine.

This article will not discuss beliefs, nor will it compare TPS, Gas, or technological approaches. We will only do one thing:

Let's break down why ETH is underperforming BTC based on Messari's data.

Chapter 1: ETH underperforming BTC is not unusual.

If we only look at the price performance in 2024–2025, many people will intuitively conclude that ETH is underperforming BTC:

Is there something wrong with ETH?

However, from a historical and structural perspective, ETH's underperformance compared to BTC is not an "abnormal phenomenon".

BTC is an asset with a highly singular narrative.

Its pricing logic is clear, consensus is concentrated, and there are very few variables.

When the market enters a phase of macroeconomic uncertainty, regulatory shifts, and institutional reassessment of risky assets, BTC often takes the lead in capturing the premium.

ETH is the complete opposite.

ETH simultaneously plays three roles:

- Decentralized settlement layer

- DeFi and Stablecoin Infrastructure

- A "production network" with technological upgrade paths and execution risks.

This means that the price of ETH does not only reflect "macro consensus," but is also forced to absorb multiple variables such as technological pace, ecosystem changes, and value capture structure.

Messari clearly stated in its report:

The problem with ETH is not that "demand has disappeared," but that "the pricing logic has become more complex."

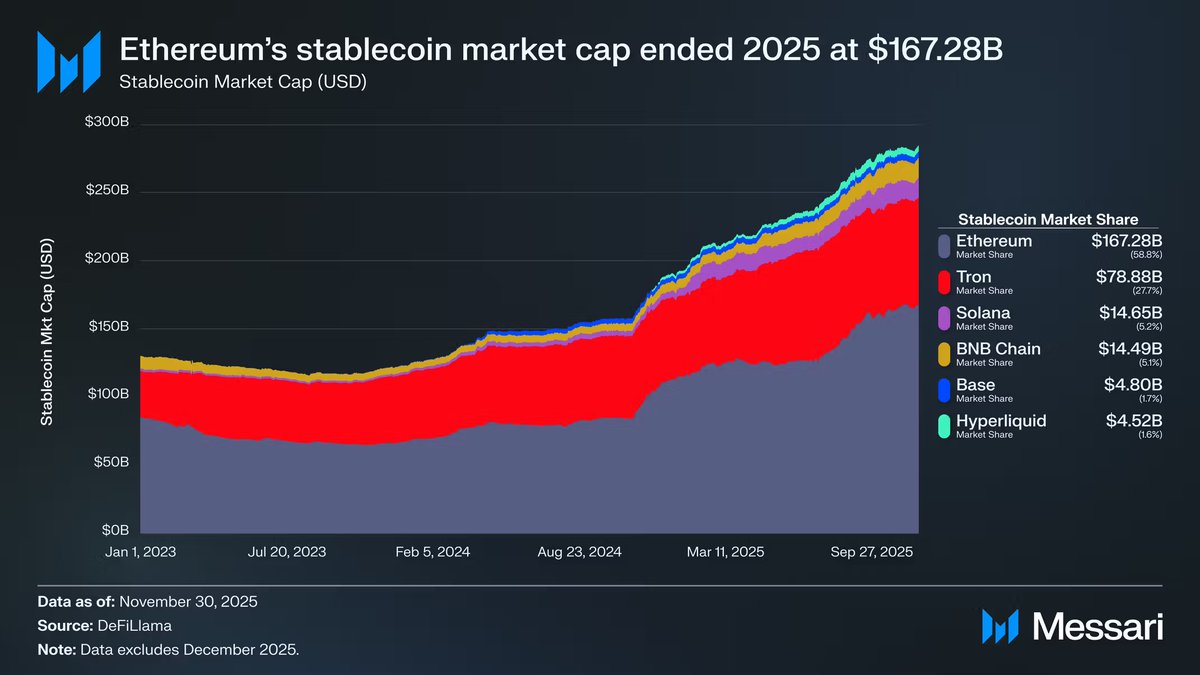

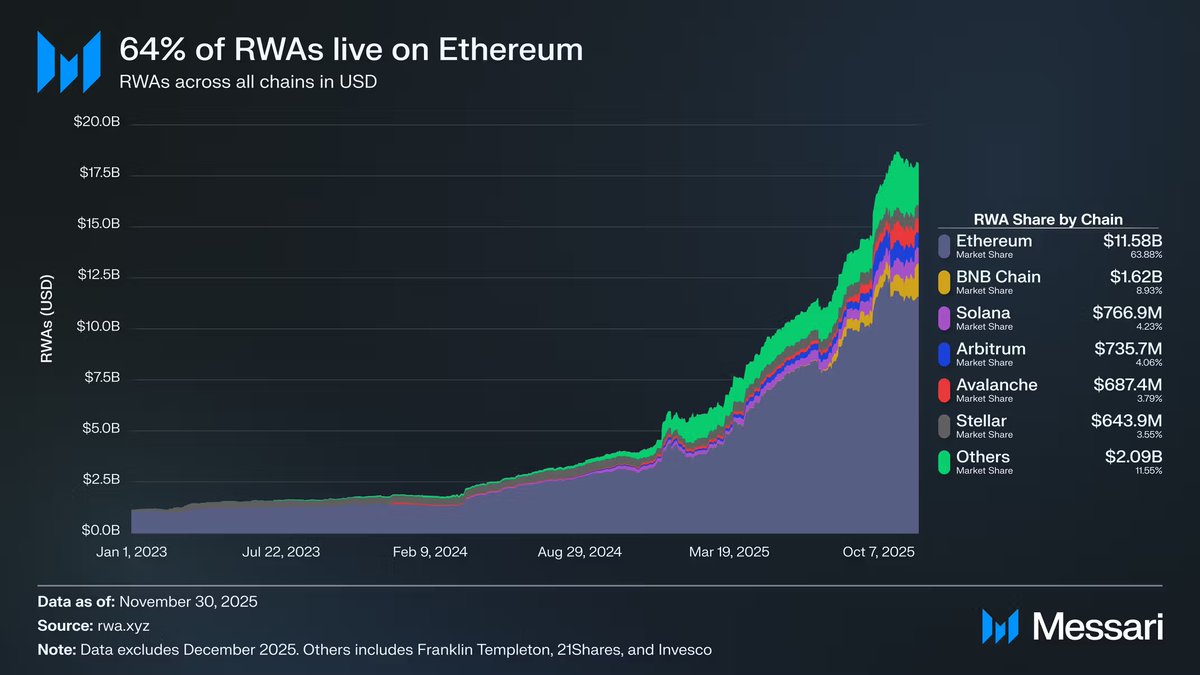

In 2025, ETH will still maintain an absolute dominant position in key metrics such as on-chain activity, stablecoin settlement, and RWA capacity.

However, this growth will not be immediately translated into asset premiums, unlike BTC ETFs or macro narratives.

In other words, ETH underperforming BTC does not mean that the market has rejected Ethereum.

More likely, it means that the market is currently unsure how to price it.

What we should really be wary of is not the act of "losing out" itself.

Rather, the question is: when ETH is used extensively, will this usage continue to contribute to the ETH asset?

This is the issue that Messari is truly concerned about.

Chapter 2: Usage is Growing, But Value Isn't Keeping Up? ETH's Value Capture Dilemma

What truly made the market start to doubt ETH was not its price underperforming BTC.

But an even more glaring fact is that while Ethereum is being used extensively, ETH itself is not benefiting in tandem.

Messari provided a set of key data in its report:

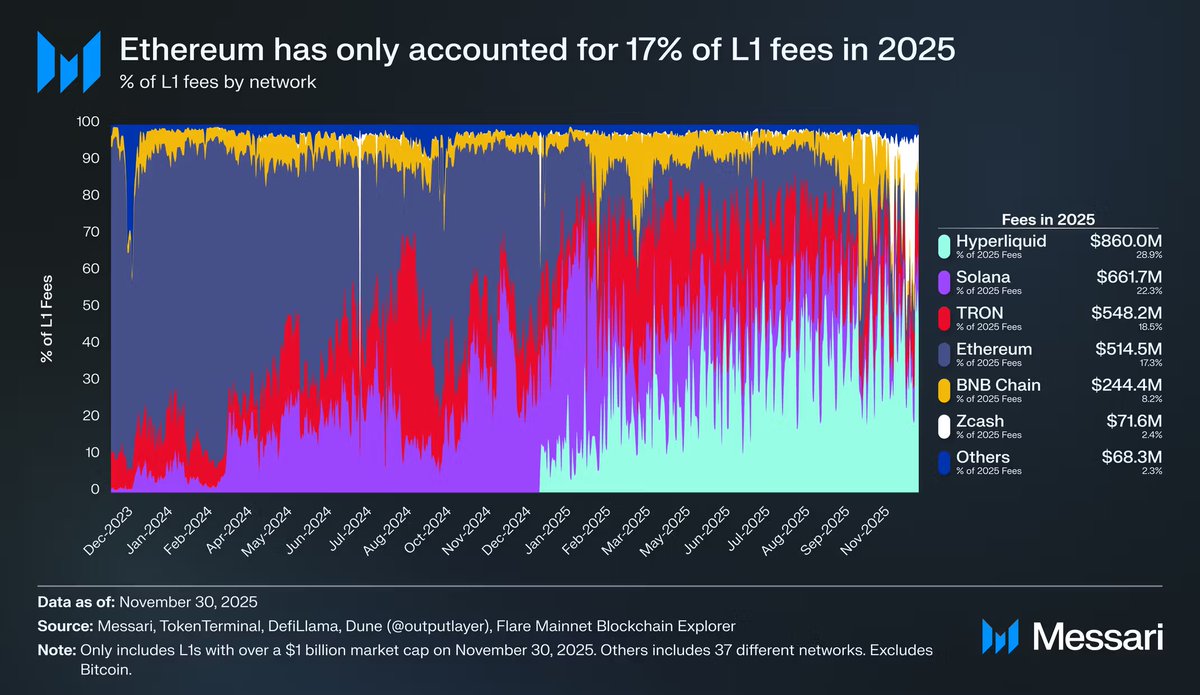

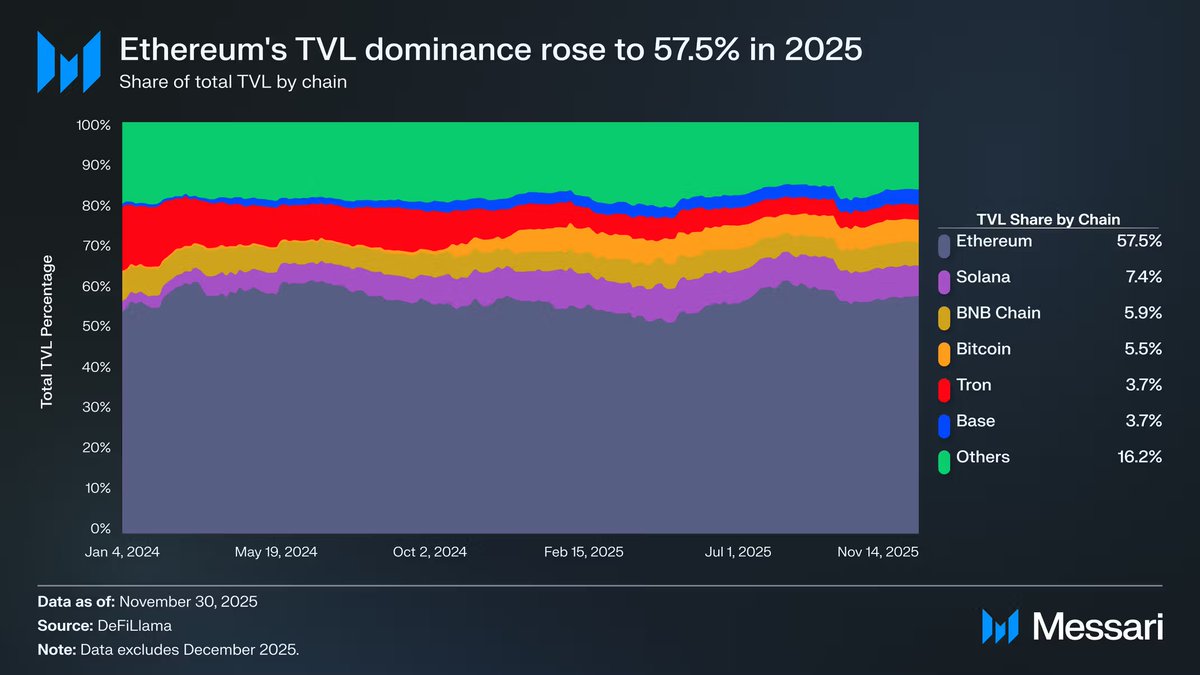

With the rise of competitive L1, Ethereum's share of L1 transaction fees has continued to decline.

- Solana regained its position as a high-performance execution layer in 2024.

- Hyperliquid rapidly scaled up its offerings in 2025 through on-chain derivatives.

- Both factors have squeezed Ethereum's share in the dimension of "direct realization of economic activities".

By 2025, Ethereum's L1 transaction fees had fallen to approximately 17% of total transaction volume.

Its ranking has dropped to fourth place in L1.

Just a year ago, it firmly held the number one position.

Transaction fees are not the only indicator of a network's value, but they are an extremely honest signal:

Where transaction fees are collected, that's where real trading activities and risk preferences are reflected.

This is where the core contradictions of ETH begin to emerge.

Ethereum hasn't lost users. On the contrary, its position in areas like stablecoins, RWA, and institutional settlements has become more solidified. The problem is that these activities are increasingly occurring at the L2 or application layer, rather than being directly reflected in L1 fee revenue.

In other words, Ethereum is becoming increasingly important as a system, but ETH as an asset is increasingly resembling a "diluted stake".

This is not a technological failure, but an inevitable result of the architectural choices made.

While the Rollup scaling approach has successfully reduced transaction costs and increased throughput, it has also objectively weakened ETH's ability to directly capture use value.

When used in a manner "outsourced" to L2, ETH's revenue comes more from abstract security premiums and monetary expectations than from cash flow.

This is why the market hesitated when pricing ETH:

Is it an asset that compoundes with usage, or is it a neutral settlement layer that is increasingly resembling "public infrastructure"?

This problem has been further amplified as competition among multiple blockchains intensifies.

Chapter 3: Multichains are not the threat; the real pressure comes from "execution layer replacement".

If we only look at the narrative aspect, ETH seems to have more and more competitors.

Solana, various high-performance L1 blockchains, application chains, and even dedicated transaction chains have taken turns appearing on the scene.

It's easy to conclude that ETH is being marginalized in the "multi-chain world".

But Messari's assessment was more sober and also more brutal.

Multi-chain technology itself is not a threat to ETH.

The real pressure comes from the continuous replacement of the execution layer, while the value of the settlement layer is difficult to be directly priced by the market.

Using Solana as an example:

- Solana regained dominance in high-frequency trading and retail activity in 2024–2025.

- It is significantly ahead in spot trading volume, on-chain activity, and low latency experience.

However, this growth is more reflected in "trading experience" and "traffic density" than in stablecoin clearing, RWA custody, or institutional-grade settlement.

Messari repeatedly emphasized one fact in the report:

When institutions actually put their money on the blockchain, they still prefer Ethereum.

Stablecoin issuance, tokenized treasury bonds, on-chain fund shares, and compliant custody pathways—these most "boring" but crucial financial infrastructure elements remain highly concentrated in the Ethereum ecosystem.

This also explains a seemingly contradictory phenomenon: while ETH's asset performance is under pressure, Ethereum has further consolidated its leading advantage in the dimension of "blockchains that institutions are willing to use".

The problem is that the market doesn't automatically give you a premium just because "you are important".

When the revenue of the execution layer is taken by other chains, and the value of the settlement layer is more reflected in "security" and "compliance credibility", the pricing logic of ETH inevitably becomes abstract.

in other words:

ETH is not facing being "replaced," but rather being forced to assume a role more like public infrastructure.

However, the higher the utilization rate of infrastructure, the harder it is to tell a story about asset premium.

This is precisely where the fundamental differences between ETH and BTC begin to diverge completely.

Chapter 4: ETH Still Cannot Remain Inseparable from BTC's "Macro Anchor"

If the first three chapters answered one question—has ETH been marginalized?

This chapter will then confront an even crueler, more realistic judgment:

Even if ETH is not replaced, it will still be deeply dependent on BTC in terms of asset pricing.

In his report, Messari repeatedly emphasized a fact that many people have overlooked:

The market is not pricing "blockchain networks," but rather pricing things that can be abstracted into macro-level assets.

In this respect, the divergence between BTC and ETH is extremely clear.

The BTC narrative has been completely simplified into three things:

- Macro hedge assets

- Digital Gold

- "Monetary assets" that can be accepted by institutions, ETFs, and national balance sheets.

The narrative surrounding ETH is far more complex.

It serves as both a settlement layer and a technology platform, carrying out financial activities while continuously undergoing upgrades and structural adjustments.

This makes it difficult for ETH to be directly included in a "macro asset basket" like BTC.

This difference is particularly evident in ETF fund flows.

When the ETH spot ETF was first launched in early 2024, the market once believed that institutions had almost no interest in ETH.

In the first six months, ETH ETF inflows were significantly weaker than BTC, reinforcing the narrative that "BTC is the only institutional asset".

But Messari points out that this conclusion itself is misleading.

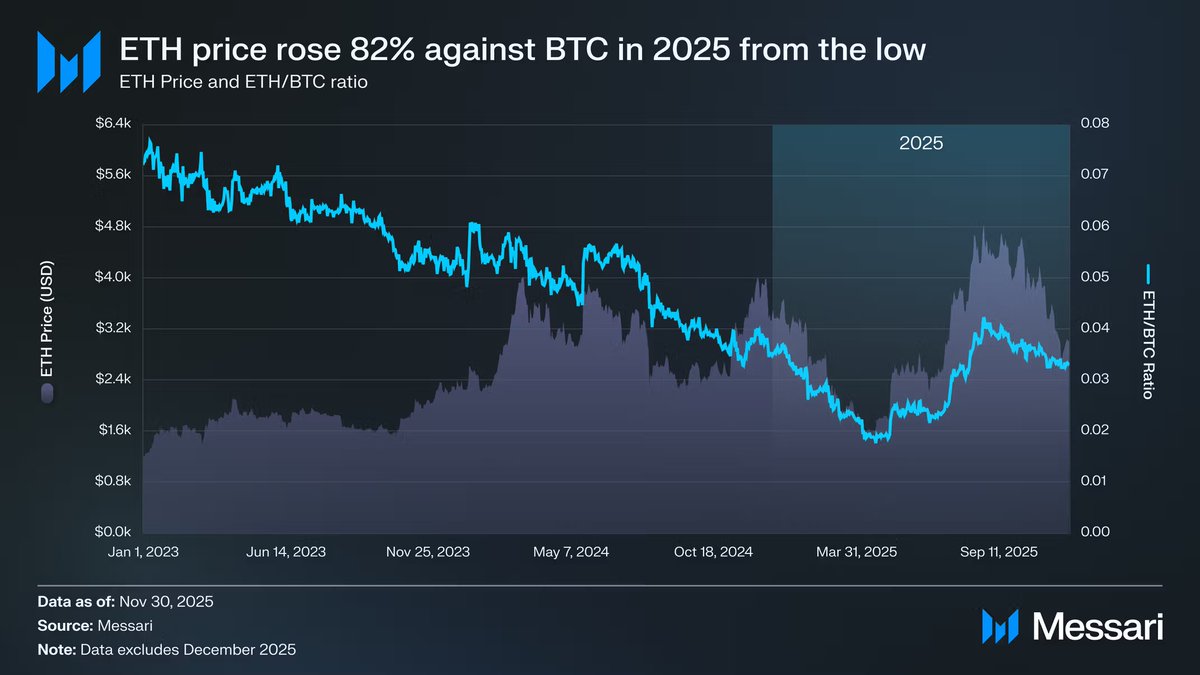

As the price of ETH and the ETH/BTC ratio rebounded in tandem in mid-2025, money flow behavior began to change.

- ETH/BTC rebounded from a low of 0.017 to 0.042, a gain of over 100%.

- The price of ETH in USD rose by nearly 200% during the same period.

- Inflows into the ETH ETF have begun to accelerate significantly.

At certain times, the inflow of new ETH ETFs even exceeded that of BTC.

This illustrates one thing:

Institutions are not unwilling to buy ETH, but are waiting for "narrative certainty".

Even so, Messari still offered a sobering conclusion:

The ETH currency premium remains a "secondary derivative" of the BTC currency consensus.

In other words, the market's willingness to embrace ETH again at a certain stage is not because ETH has become an independent macro asset, but because the macro narrative of BTC still holds true and spills over into the risk curve.

As long as BTC remains the pricing anchor for the entire crypto market, the strength or weakness of ETH will inevitably be measured in BTC's shadow.

This doesn't mean ETH has no room for growth. On the contrary, assuming the BTC trend holds true, ETH often exhibits greater resilience and stronger beta.

But this also means:

ETH's asset narrative has not yet completed its "de-BTCification".

Until ETH can demonstrate lower correlation with BTC, more stable sources of independent demand, and a clearer value capture path over a longer period,

It will still be regarded by the market as:

A second-layer belief asset built on top of BTC.

Chapter 5: Is ETH Threatened? The Real Issue Is Never Winning or Losing.

At this point in the discussion, we can actually answer a question that has been repeatedly raised:

Will ETH be "replaced" by other blockchains?

Messari's answer is very clear:

Won't.

At least for the foreseeable future, Ethereum will remain the default platform for on-chain finance, stablecoins, RWA, and institutional settlement.

It's not the fastest chain, but it was the first chain to be allowed to hold real funds.

What's truly worrying isn't whether "ETH will lose to Solana, Hyperliquid, or the next new blockchain."

But there is another, more uncomfortable problem:

As an asset, can ETH continue to benefit from Ethereum's success?

This is a structural problem, not a technical one.

Ethereum is becoming more and more like a "public financial infrastructure":

- Usage is increasing

- The importance of the system is increasing

- Institutional dependence is deepening

However, at the same time, ETH's value capture is increasingly dependent on:

- Currency premium

- Safety premium

- Macro risk appetite spillover

Rather than direct cash flow or expense growth.

This is why ETH's asset performance is increasingly resembling that of a "high-beta BTC derivative asset" rather than a network equity with an independent pricing system.

In a multi-chain world, the execution layer can compete and traffic can be diverted, but the settlement layer will not migrate frequently.

Ethereum is precisely in this most stable position, but also the least likely to be rewarded by market sentiment.

Therefore, ETH underperforming BTC does not mean failure.

It's more like a result of role division:

- BTC serves as a macro narrative, a currency consensus, and an asset anchor.

- ETH is responsible for settlement, financial infrastructure, and system security.

The problem is that the market is more willing to pay a premium for the former, while remaining restrained towards the latter.

Messari's conclusion is not radical, but honest enough:

ETH's monetary story has been fixed, but it's not over yet. It can surge when BTC's trend is established, but it has yet to prove that it can be priced independently of BTC.

This is not a denial of ETH, but rather a phase of positioning.

In an era when BTC remains the sole macro anchor of the crypto market,

ETH is more like a financial operating system built on this anchor.

It is important and irreplaceable, but it is not yet the "asset that has been priced in first".

At least not yet.