As the narrative-driven gains in the crypto market gradually fade, funds are seeking the next definite outlet. Recently, prediction markets have emerged as a dark horse, not only because of their independent performance amidst market volatility, but also because of the series of high-return "smart money" strategies that have emerged behind them, making them widely regarded as one of the most explosive sectors in 2026.

However, for most onlookers, prediction markets remain a black box wrapped in the cloak of blockchain. Although built on smart contracts, oracles, and stablecoins, their core mechanisms are vastly different from the traditional logic of cryptocurrency trading. Here, we don't look at candlestick charts, only probabilities; we don't tell stories, only facts.

For newcomers, a barrage of questions arises: How exactly does this market operate so efficiently? What are the fundamental differences between it and traditional crypto trading? What hidden arbitrage models do the legendary "smart money" practitioners possess? And, does this seemingly frenzied market truly have the capacity to hold trillions of dollars?

With these questions in mind, PANews conducted a comprehensive survey of the current prediction market. We will peel back the veneer of "gambling," delve into the underlying mechanisms and on-chain data, deconstruct this mathematical war about monetizing knowledge, and reveal the risks and opportunities that may have been overlooked.

The Truth Behind the Data: The Eve of the Prediction Market Boom

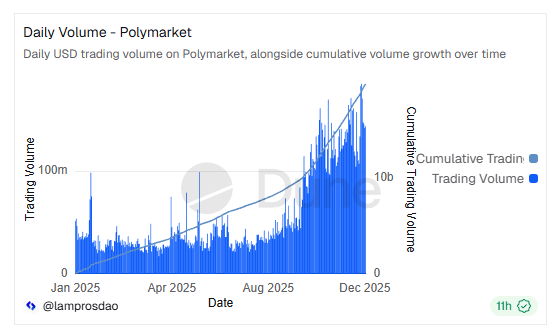

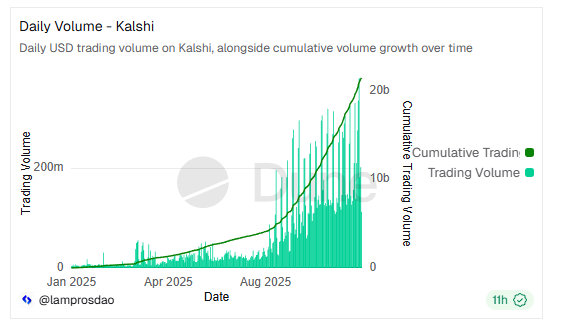

Judging from actual development, prediction markets are indeed one of the few "bull market" sectors in 2025 (similar to stablecoins). Despite the overall slump in the crypto market in recent months, prediction markets, led by Polymarket and Kalshi, are still experiencing rapid and explosive growth.

This trend is clearly visible in trading volume. In September of this year, Polymarket's average daily trading volume remained in the range of $20-30 million, and Kalshi was similar. However, when the entire crypto market began to decline from mid-October, the daily trading volume of these two leading prediction markets began to increase significantly. On October 11, Polymarket's daily trading volume reached $94 million, and Kalshi's exceeded $200 million. The increases were approximately 3 to 7 times respectively, and they remain at high levels and are still surging.

However, in terms of scale, the prediction market is still in its early stages. The combined trading volume of Polymarket and Kalshi is only around $38.5 billion. This total trading volume is less than the daily trading volume of Binance, and a daily trading volume of $200 million would only rank around 50th among all exchanges.

However, with the 2026 FIFA World Cup taking place, the market widely expects the size of the prediction market to further increase. Citizens Financial Group predicts that the total size of the prediction market could reach trillions of dollars by 2030. A report by Eilers & Krejcik (E&K) predicts annual trading volume could reach $1 trillion by the end of this decade (around 2030). Based on this scale, the market still has room for several times more growth, and several reports have also mentioned that the 2026 World Cup will be a catalyst and stress test for this market's growth.

Deconstructing Smart Money: Analysis of Eleven Major Arbitrage Strategies

Against this backdrop, the biggest draw of prediction markets in recent times remains the age-old "wealth stories." After seeing these stories, many people's first thought is to replicate or follow them. However, exploring the core principles, implementation conditions, and underlying risks of these strategies is likely a more reliable approach. PANews has compiled ten of the most discussed and popular prediction market strategies currently on the market.

1. Pure mathematical arbitrage

Logic: Utilizing the mathematical imbalance that Yes + No is less than 1. For example, when an event has a 55% probability of YES on Polymarket and a 40% probability of NO on Kalshi, the total probability is 95%. In this case, placing orders for YES and NO on both sides has a total cost of 0.95, but the final result will always be 1, thus creating a 5% arbitrage opportunity.

Condition: This requires participants to have strong technical skills to quickly identify such arbitrage opportunities, since there is only one person who can take advantage of such opportunities.

Risk: Many platforms use different criteria for judging the same event. Ignoring these criteria can lead to a lose-lose situation. As @linwanwan823 pointed out, during the 2024 US government shutdown, arbitrageurs discovered that Polymarket judged "shutdown occurred" (YES), while Kalshi judged "shutdown did not occur" (NO). This is because Polymarket's settlement standard is "OPM issues a shutdown announcement," while Kalshi requires "the actual shutdown lasted more than 24 hours."

2. Cross-platform/cross-chain hedging arbitrage

Logic: Utilizing price discrepancies for the same event across different platforms (information silos). For example, Polymarket and Kalshi might have different odds for a Trump victory—one might offer 40%, the other 55%. The strategy involves buying into different directions on each platform, ultimately creating a hedging outcome.

Conditions: Similar to the first type, it requires extremely strong technical scanning capabilities for detection.

Risk: We also need to be wary of different platforms' criteria for judging the same event.

3. High-probability "bond" strategy

Logic: Treat high-certainty events as "short-term bonds". When the outcome of an event is already clear (such as on the eve of the Fed's interest rate decision, when market consensus has reached 99%), but the market price remains at 0.95 or 0.96 due to the cost of capital, this is picking up "interest on time".

Condition: Large capital volume, because the low rate of return per transaction requires a larger capital to achieve meaningful profits.

Risk: Black swan events, even if they occur with a small probability, could result in huge losses.

4. Initial liquidity sniping

Logic: Utilize the "central limit order book vacuum period" immediately after a new order book is created. With no sell orders in the new market, the first person to place an order has absolute pricing power. Write a script to monitor on-chain events. At the moment of opening, place a large number of extremely low buy orders at 0.01-0.05. Then, once liquidity returns to normal, sell at 0.5 or even higher prices.

Condition: Due to the large number of competitors, the server needs to be hosted very close to the node to reduce latency.

Risk: Similar to the rush to open the market for MEME, if the speed advantage is lost, one may end up being the one left holding the bag.

5. AI Probability Modeling Trading

Logic: By utilizing large AI models to conduct in-depth market research, conclusions differing from market predictions are discovered. Purchases are then made when arbitrage opportunities exist. For example, if the AI model analysis indicates a 70% probability of Real Madrid winning today, but the market price is only 0.5, then a purchase can be made.

Conditions: Complex data analysis tools and machine learning models, high AI computing power costs.

Risk: You may lose your principal if the AI prediction is wrong or if an unexpected event occurs.

6. AI Information Gap Model

Logic: Leveraging the time difference between machine reading speed and human reading speed, users gain faster access to information than ordinary users, allowing them to buy in before market changes occur.

Conditions: Expensive information sources, which may require paid purchases of institutional-grade APIs and precise AI recognition algorithms.

Risks: Fake news attacks or AI illusions.

7. Related market arbitrage

Logic: Utilizing the lag in the causal chain between events. The price change of the primary event is often instantaneous, but the reaction of secondary, related events is slower. For example: "Trump wins the election" versus "Republicans win the Senate."

Requirements: Must have a deep understanding of the underlying logical connections between political or economic events, and be able to monitor price movements across hundreds of markets.

Risk: Failure to establish a positive correlation between events, such as Messi's absence from the game and the team's loss.

8. Automated market making and market making rewards

Logic: Be the one who "sells shovels." Don't gamble on the market direction; just provide liquidity and earn the bid-ask spread and platform rewards.

Requirements: Professional market-making strategies and substantial capital.

Risks: Transaction fees and black swan events.

9. On-chain copy trading and whale tracking

Logic: Believing that "smart money" possesses insider information. Monitoring high-win-rate addresses, and immediately following the lead of whale when they make large-scale purchases.

Requirements: On-chain analytics tools; data cleaning required to exclude "test orders" or "hedging orders" from whale; rapid response capability.

Risk: Whale' reverse harvesting and hedging intentions

10. Exclusive research-based "information arbitrage"

Logic: Mastering unknown "private information" in the market. For example, during the 2024 US presidential election, French trader Théo discovered the tendencies of "hidden voters" through the "neighbor effect" and then made a large bet against the trend when the odds were down.

Conditions: Exclusive research plan and high cost.

Risk: Incorrect research methods may lead to obtaining incorrect "insider information," resulting in heavy investment in the wrong direction.

11. Manipulating oracles

Logic: Regarding who the referee is. Because prediction markets involve many complex events, their determination cannot be solely based on algorithms. Therefore, an external oracle is needed. Polymarket currently uses UMA's Optimistic Oracle. After each event, a human submits a decision within the UMA protocol. If the voter turnout exceeds 98% within two hours, the result is considered true. Dissenting results require further community surveys and voting.

However, this mechanism clearly has loopholes and room for manipulation. In July 2025, regarding the question of whether Ukrainian President Zelensky would wear a suit before July, although multiple media outlets reported that Zelensky had worn a suit, in the UMA vote, four major holders, using more than 40% of the tokens, ultimately ruled the result "NO," causing users on the opposing investment side to lose approximately $2 million. Furthermore, in events such as whether Ukraine would sign a rare earth mining agreement with the United States and whether the Trump administration would declassify UFO documents in 2025, varying degrees of manipulation were also observed. Many users believe that it is unreliable to have a token like UMA, with a market capitalization of less than $100 million, act as a referee for a market like Polymarket.

Conditions: Large UMA holdings or controversial rulings

Risk: Similar vulnerabilities will be gradually patched after the oracle upgrade. In August 2025, MOOV2 (Managed Optimistic Oracle V2) will be introduced to restrict proposals to a whitelist and reduce spam/malicious proposals.

Generally speaking, these strategies can be categorized into technical players, capital-driven players, and professional players. Regardless of the type, they all rely on a profit model built on a unique, asymmetrical advantage. However, this strategy may only work in the short-term, immature phase of the market (similar to arbitrage strategies in the early days of the crypto market). As secrets are revealed and the market matures, most arbitrage opportunities will become increasingly smaller.

Why prediction markets can be considered a "cure for the information age"

Behind market growth and institutional optimism, what magic does the prediction market possess? The mainstream view in the market is that the prediction market solves a core pain point: in an era of information overload and rampant fake news, the cost of truth is getting higher and higher.

There are likely three main reasons behind this starting point.

1. "Real money" voting is more reliable than research. Traditional market research or expert predictions usually have no real cost in terms of accuracy, and the power to make such predictions is held by certain individuals and institutions with influence. This leads to many predictions lacking credibility. In contrast, the structure of the prediction market is the result of a financial game among multiple investors. It realizes the collective wisdom formed by multiple individual information sources, and the use of money to vote adds weight to the prediction. From this perspective, the prediction market, as a product, solves the societal "problem of truth," which is inherently valuable.

2. The ability to monetize personal expertise or informational advantages. This is well demonstrated by top-ranking smart money addresses in prediction markets. While these addresses employ diverse strategies, their success boils down to their mastery of a particular area of expertise or informational advantage. For example, someone might be highly knowledgeable about a sporting event, giving them a significant advantage in predicting various aspects of that event. Alternatively, some users may use technical means to verify the outcome of an event faster than others, allowing them to profit from arbitrage opportunities in the final stages of the prediction market. This is a significant departure from traditional finance and the crypto market; capital is no longer the biggest advantage (in fact, it's a disadvantage in prediction markets), but rather technology and capability. This has attracted a large number of talented individuals to focus their attention on prediction markets. These benchmark cases then garner even more attention.

3. The simple logic of binary options makes it less accessible than cryptocurrency trading. Essentially, prediction markets are based on binary options; people only bet on "YES" or "NO," making them less demanding. They don't require extensive consideration of price direction, trends, technical indicators, or complex trading systems. Furthermore, the underlying assets are usually simple and easy to understand. The question is: Who will win between these two teams? Not what is the technical principle behind this zero-knowledge proof project? This also means that the user base of prediction markets is likely to be much larger than that of the cryptocurrency market.

Of course, prediction markets also have their drawbacks, such as the short cycles of individual markets, insufficient liquidity in niche markets, risks of insider trading and manipulation, and compliance issues. But the most important reason is that, at the current juncture, prediction markets seem to be filling a dull "narrative vacuum" in the crypto market.

The essence of market prediction is a pricing revolution about the "future." It pieces together fragments of individual cognition through monetary games, creating a jigsaw puzzle that is closest to the truth.

To onlookers, this is a "truth machine" of the information age. To participants, however, it's a silent mathematical war. As 2026 approaches, the picture of this trillion-dollar market is only just beginning to unfold. But no matter how algorithms evolve or strategies iterate, the most fundamental truth of market prediction remains unchanged: there is no free lunch here, only the ultimate reward for monetizing knowledge.