The Fermi Hard Fork is being XEM as a gateway to mass adoption — predictions suggest Binance Coin's price could reverse to an uptrend if the market responds positively.

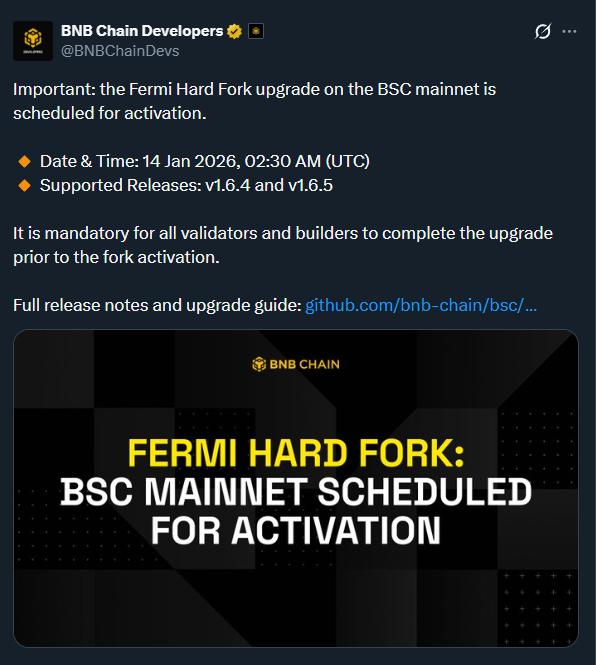

January 14th is XEM as the next major catalyst for BNB, as the launch of the Fermi mainnet Hard Fork could help alleviate the negative BNB price forecasts.

This upgrade is expected to make Binance Smart Chain a more attractive platform for mass Use Case , while also strengthening demand for BNB — the underlying coin for these applications.

Speed is the main highlight.

According to Binance's GitHub documentation, the Fermi upgrade will reduce Block creation time from 750 milliseconds to just 250 milliseconds .

In addition, Fermi introduced a new indexing mechanism , allowing users to selectively access ledger data instead of having to download the entire blockchain history.

These improvements help reduce computational requirements, cut down on storage needs , and support time-sensitive applications that require transaction confirmation in under 1 second.

Thanks to its closer alignment with the efficient centralized infrastructure of traditional finance, Binance has a greater potential to become a bridge between TradFi and DeFi .

This gives Binance Chain a stronger position in the two strongest narratives of the current cycle: institutional participation and real asset Tokenize (RWA) .

Binance Coin Price Prediction: Will the bull run arrive in January?

The market appears ready to enter a trade, as momentum indicators show new ground strength, despite a two-month-long bearish pennant pattern.

The RSI continues to form progressively higher Dip , currently approaching the neutral zone — a signal of a potential trend reversal, which the MACD has already foreshadowed with a golden cross above the signal line.

Although general market sentiment still leans toward a bearish scenario, momentum surrounding the Fermi upgrade could transform the current structure into an upward breakout of the isosceles triangle .

The key breakout level is the strong December resistance zone at $870 . If this zone turns into support, the price could confirm a +20% breakout to $1,050 .

In a more optimistic scenario, if the mainnet launch is not just a "sell-the-news" event, the price of BNB could return to its historical peak , equivalent to a 60% increase to $1,375 .

However, the full impact of the upgrade will likely only be clearly reflected once long-term implementation takes place.

Conversely, the bearish pennant pattern remains valid. If broken below, the long-term support zone of the cycle could come under pressure, with a potential 40% drop to $500 if support fails to hold.

Maxi Doge: A better choice for 2026?

While Fermi may have paved the way for Binance Coin to delve deeper into TradFi, the market narrative may already belong to other systems. Ethereum and Solana are gradually establishing themselves as the "default destination."

In crypto, momentum often follows culture , and culture constantly gravitates back to one icon: Doge .

History shows this pattern quite clearly: Shiba Inu followed Dogecoin in 2021, then FLOKI, Bonk, Dogwifat , and most recently Neiro in 2024. Each Bull run cycle has a "star" with a Doge theme.

As we head into 2026 , speculators are paying increasing attention to Maxi Doge ($MAXI) as the next leading contender.

The attention has been reflected in the numbers: the $MAXI presale has raised nearly $4.35 million , while early participants are receiving Staking yields of up to 71% APY .

For those who missed the previous Doge wave, Maxi Doge could be the next chance to get ahead of a breakout meme coin before it truly takes off.