South Korea has demonstrated a dominant presence in the global cryptocurrency market. However, the benefits of this enthusiasm are flowing overseas, not domestically. It is estimated that approximately 160 trillion won will have flowed out to overseas exchanges in 2025 alone. We analyze the reasons for this accelerating capital outflow.

Key Takeaways

It is estimated that approximately 160 trillion won will have flowed out to overseas exchanges by 2025, and the resulting fee revenue is also flowing out of the country.

The primary cause of outflows is the asymmetry of investment opportunities. Overseas exchanges are securing early profits through derivatives and pre-market trading.

Simply blocking is not the solution. Funds could be dispersed into regulatory blind spots, like a balloon effect. An approach that allows innovation within manageable boundaries is needed.

1. Korean Cryptocurrency Investors Heading to Binance

South Korea holds a unique position in the global cryptocurrency market. More than 10 million people, or 20% of the total population, are investing in cryptocurrency, a figure comparable to the 14 million domestic stock investors.

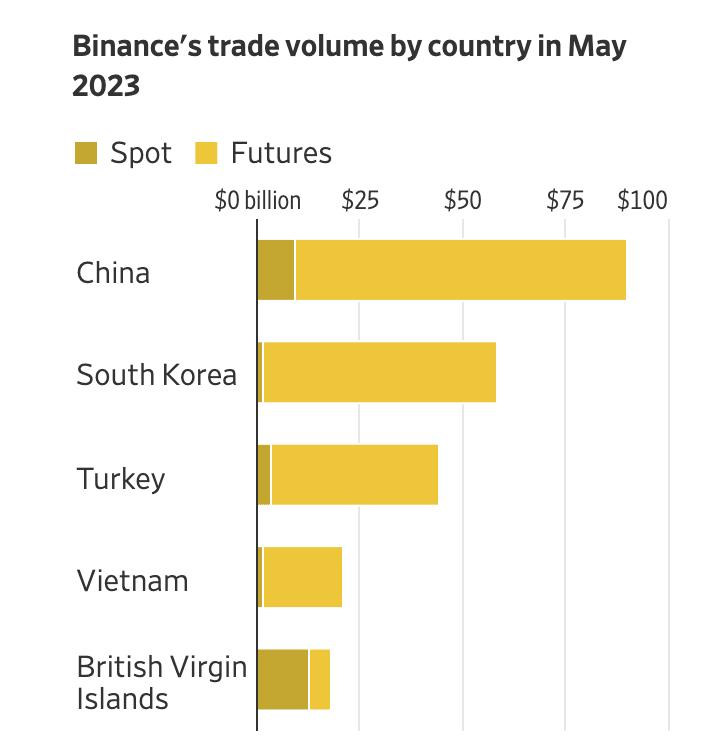

The trading volume is significant, commensurate with the scale of participation. According to Kaiko, a cryptocurrency data analysis firm, KRW-based trading volume rivals, and sometimes even surpasses, the US dollar among global fiat currencies. This is an unusually high figure for a single national currency.

Amid this investment fervor, the domestic exchange industry experienced rapid growth. Upbit and Bithumb achieved trillions of won in revenue, joining the ranks of major corporations. Cryptocurrency has now established itself as a major investment asset, rivaling stocks and real estate.

However, this growth has recently been slowing down. While domestic investors remain active in cryptocurrency trading, the venues are shifting. The proportion of users using foreign exchanges like Binance and Bybit is rapidly increasing, replacing domestic exchanges like Upbit and Bithumb. Simply put, investment demand remains constant, but foreign exchanges are absorbing that demand.

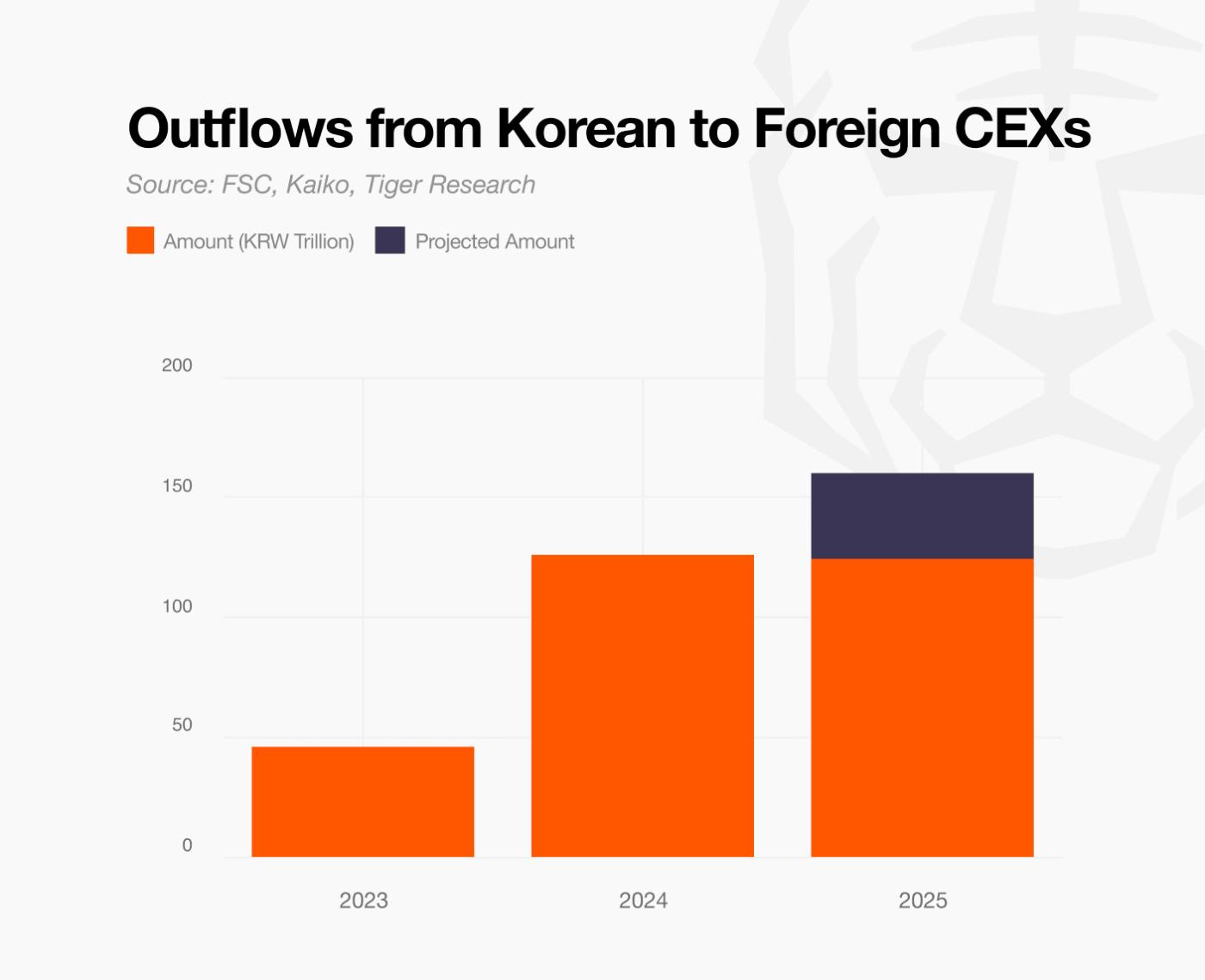

In fact, approximately 124 trillion won flowed out of domestic exchanges to foreign exchanges between January and September 2025. This represents a nearly threefold increase compared to the 2023 outflow. If this trend continues, the outflow in 2025 alone is projected to reach approximately 160 trillion won.

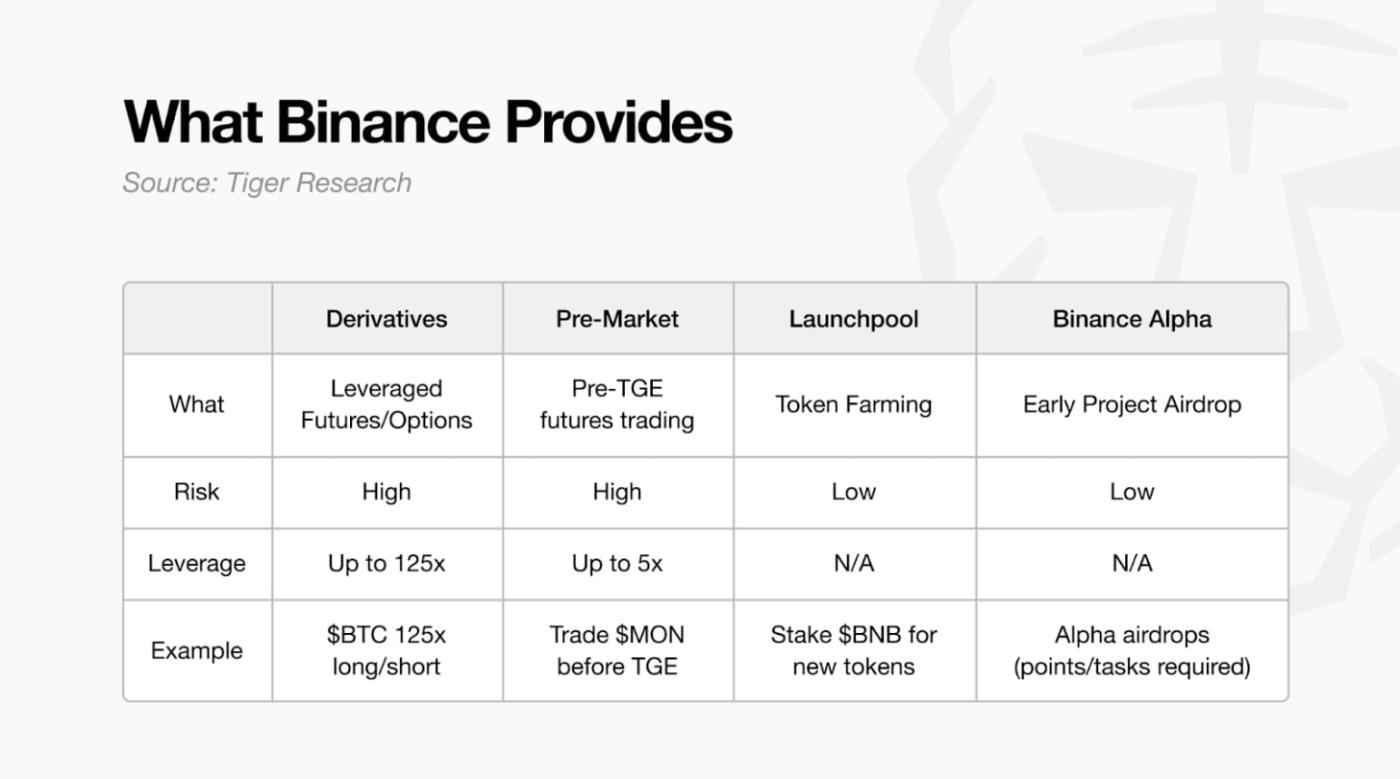

The primary reason domestic investors move their funds to overseas exchanges is the "asymmetry of investment opportunities." Unlike exchanges bound by strict regulations focused on spot trading, overseas exchanges offer a variety of investment options, including leveraged derivatives trading. This means that overseas exchanges offer investment opportunities unavailable to domestic exchanges.

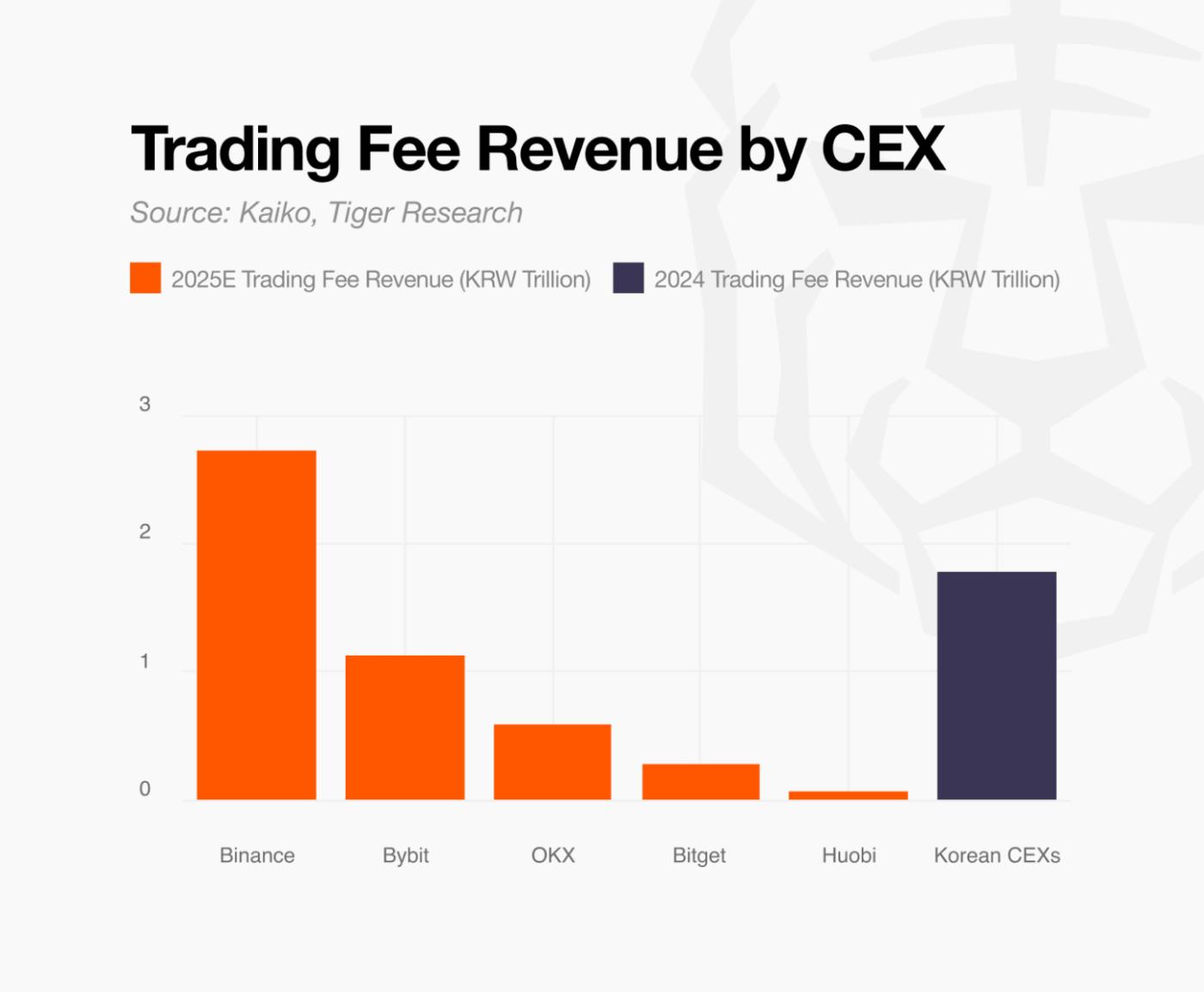

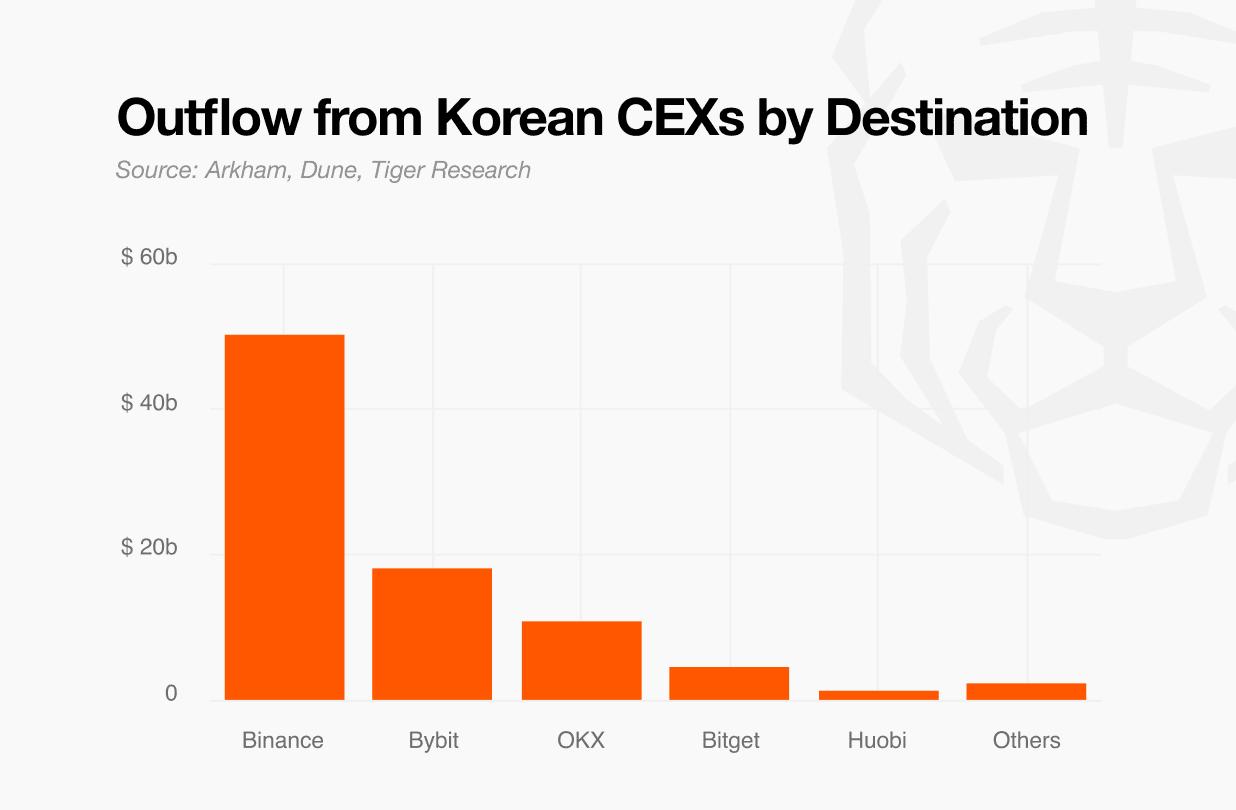

The problem isn't just the money flowing out. When transactions take place overseas, fee revenue also flows overseas. In fact, based on the funds lost this year, an estimate of the fee revenue for each exchange was made: Binance at approximately 2.73 trillion won, Bybit at approximately 1.12 trillion won, OKX at 580 billion won, Bitget at 270 billion won, and Huobi at 70 billion won.

The estimated commission revenue these five overseas exchanges earned from Korean investors amounts to approximately 4.77 trillion won, 2.7 times the combined operating revenue of the top five domestic exchanges (Upbit, Bithumb, Coinone, Korbit, and GOPAX) last year, which was 1.7837 trillion won. This goes beyond a simple capital outflow; the very revenue structure of the domestic cryptocurrency industry is shifting overseas.

While the 160 trillion won outflow is already a significant amount, this trend is expected to accelerate further. This is due to a combination of domestic investor sentiment and overseas exchanges' listing strategies.

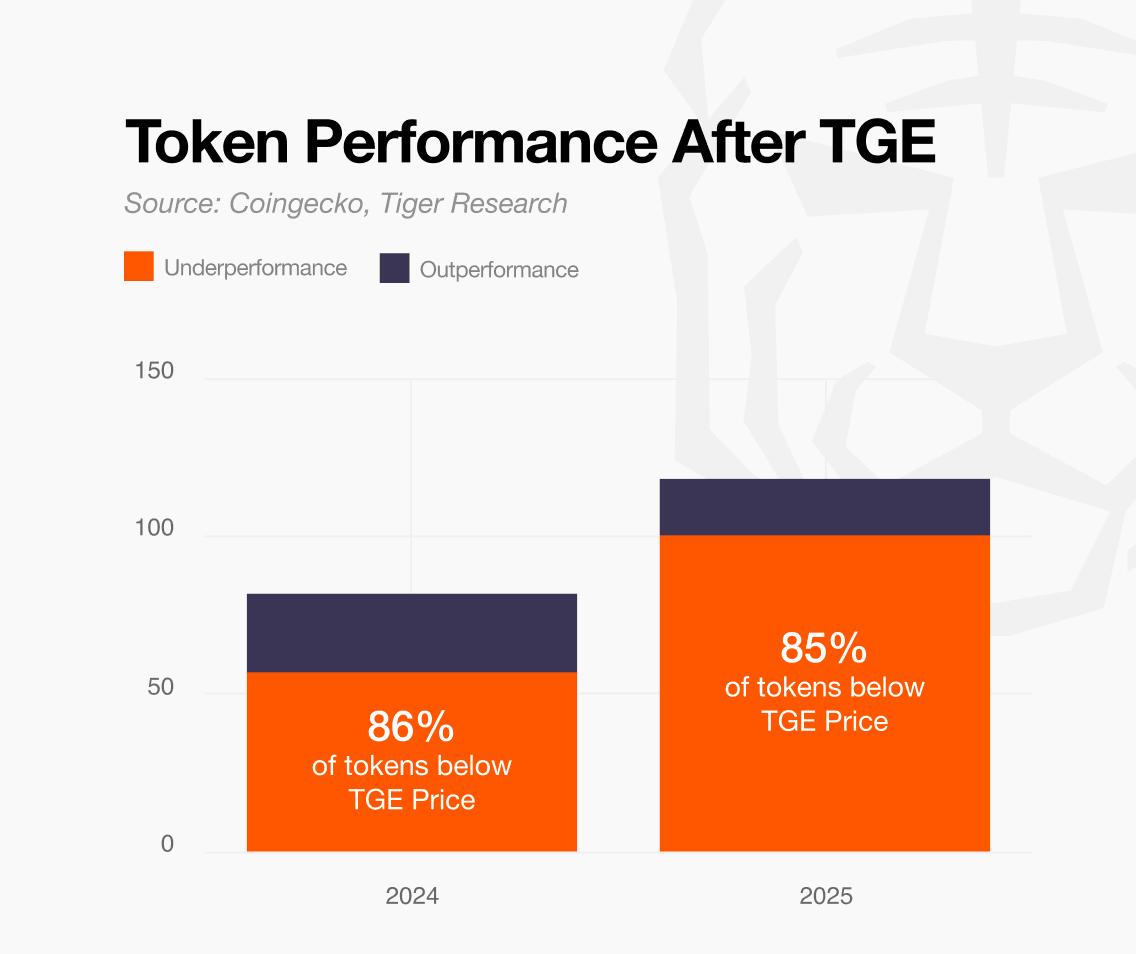

The Korean cryptocurrency market has been driven more by altcoins than by Bitcoin or Ethereum. In fact, altcoins account for 70-80% of trading on domestic exchanges, significantly exceeding the global average of approximately 50%. This is the result of investors' repeated experience in generating short-term profits from assets with small market capitalizations and high volatility.

However, this investment strategy is no longer working. While altcoins used to perform well after TGEs, most projects have recently peaked immediately after the TGE and then declined rapidly. A bigger problem is the timing of listings on domestic exchanges. Because domestic listings often occur after the rally on overseas exchanges has already concluded, domestic investors often enter the market during a price decline. This pattern is recurring, leading to a growing perception that "it's too late to list domestically."

Accordingly, investors are adjusting their strategies. Some are preemptively purchasing tokens listed on overseas exchanges and then profiting from the price difference at the time of listing on domestic exchanges. The longer a domestic listing is delayed, the greater the demand for early positions abroad. Others are trying to offset the decline in altcoin returns with leveraged derivatives. As long as domestic exchanges fail to offer derivatives, this demand will inevitably shift to overseas markets.

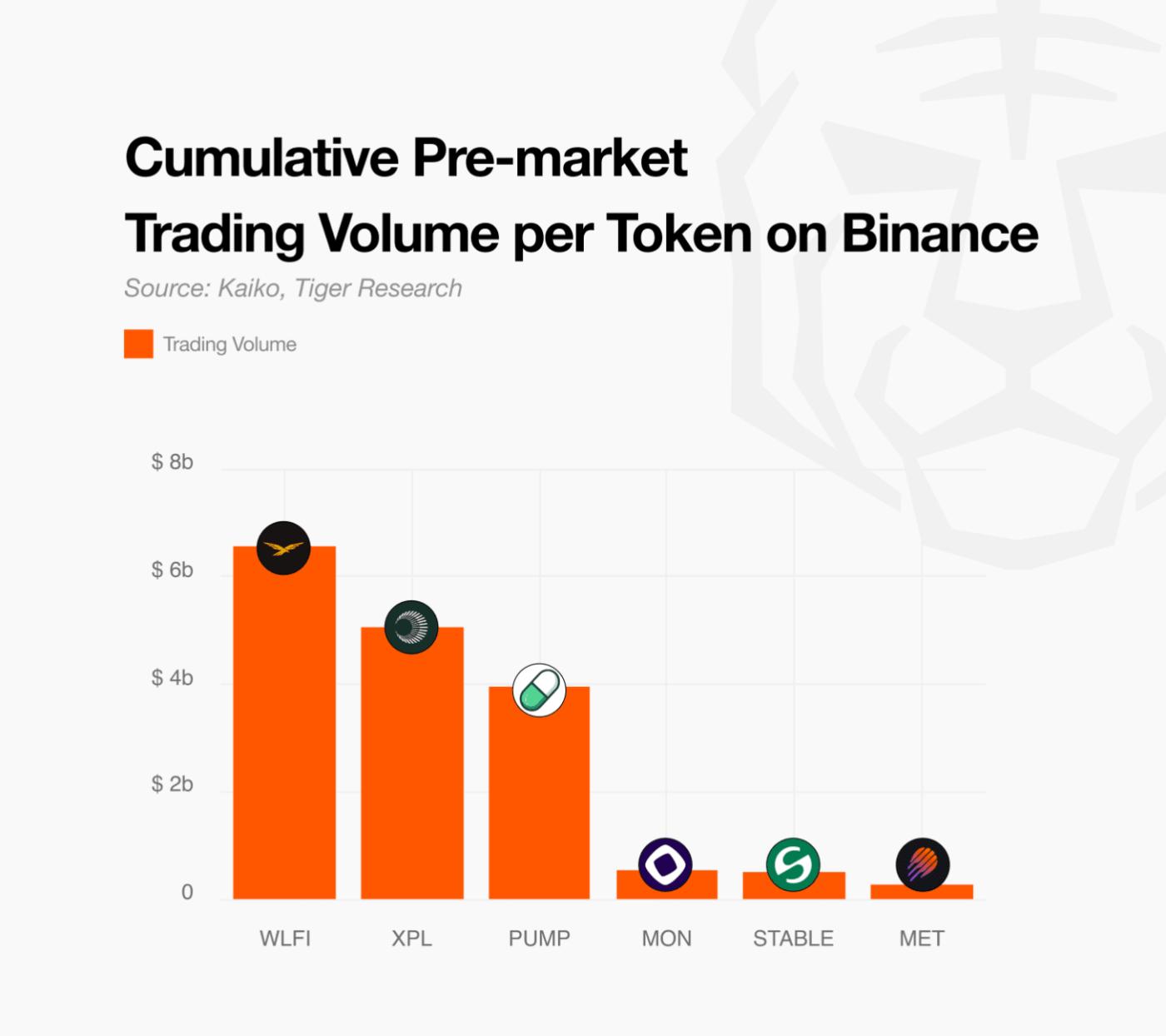

Foreign exchanges are aggressively competing to capture and further capitalize on this demand. The speed of futures listings, in particular, is remarkable. Because futures trading allows for immediate listing of new cryptocurrencies, it eliminates the need to hold physical assets. By 2025, Binance had listed approximately 230 cryptocurrencies, 8.5 times more than spot trading. And it doesn't stop there. Some exchanges, including Binance, operate pre-markets, offering trading even before TGE. This means securing a foothold in the market early, when investor interest is at its peak.

While domestic exchanges undergo the arduous process of spot listing under strict regulations, Binance absorbs initial profits and liquidity through flexible tools like futures and premarkets. The gap is bound to structurally widen. The structural constraints of domestic exchanges, shifting investor strategies, and the preemptive responses of overseas exchanges are intertwined, and the outflow of funds is expected to accelerate further.

Blocking unauthorized overseas exchanges could be considered as an option. However, it's questionable whether this approach can effectively prevent fund outflows. Workarounds exist, and simple blocking is only a temporary measure.

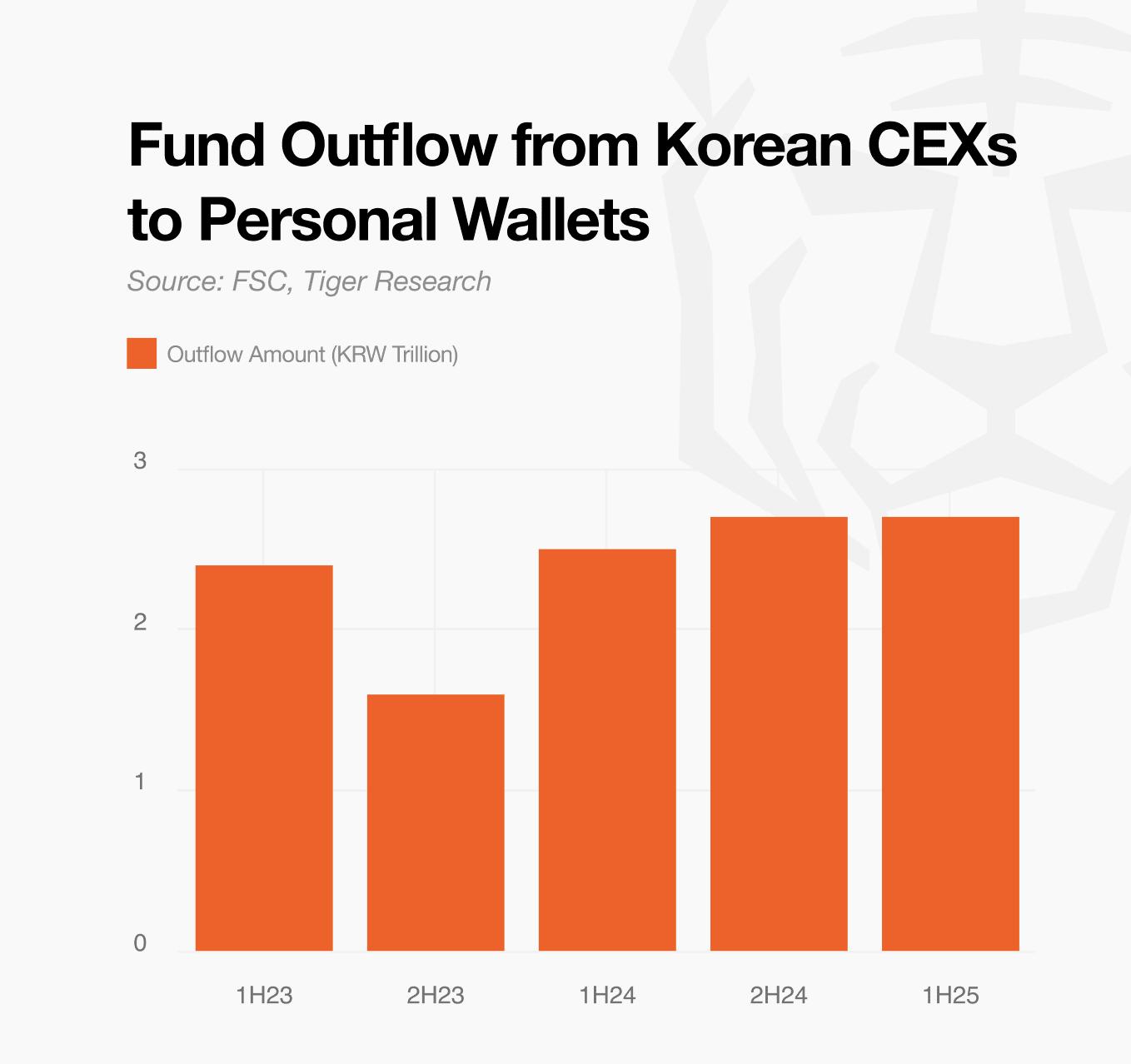

Moreover, as regulations tighten, funds may migrate to decentralized exchanges. In the global market, the share of spot trading on decentralized exchanges is steadily increasing compared to centralized exchanges. The ability for anyone to access without KYC and directly store assets is attracting users. In Korea, approximately 2.7 trillion won flowed out to personal wallets like MetaMask in the first half of 2025 alone. This trend could accelerate as pressure on centralized exchanges continues.

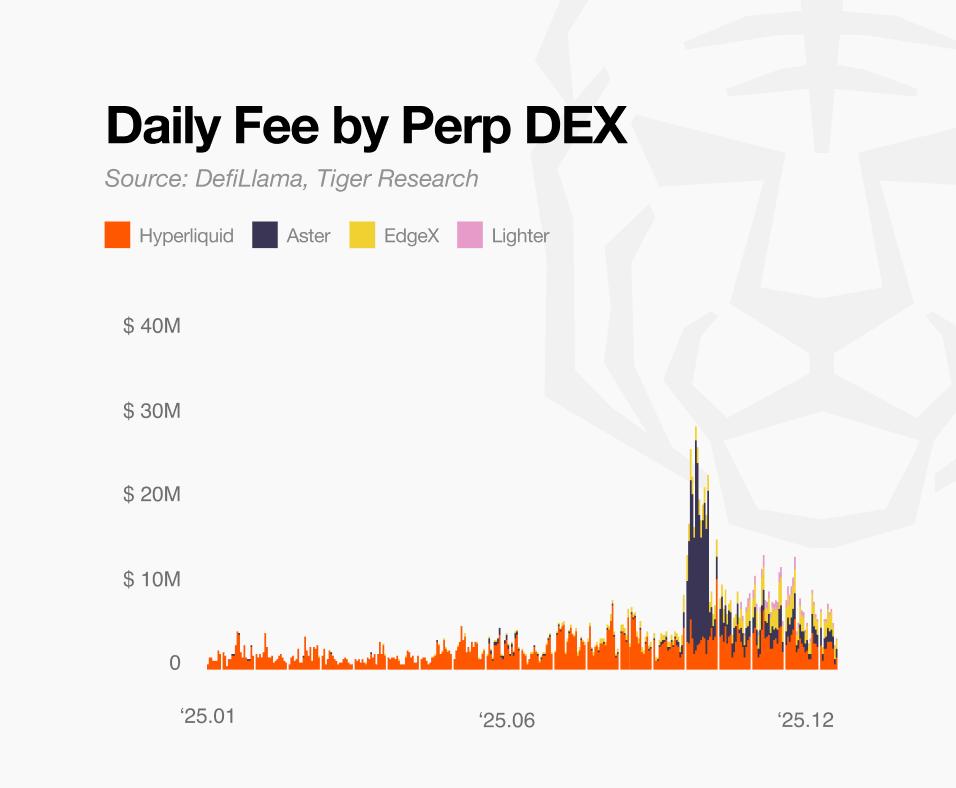

The growth of decentralized exchanges isn't limited to the spot market. Recently, decentralized perpetual futures exchanges (Perp DEXs) have been rapidly growing, achieving record-breaking trading volumes. With the emergence of platforms with competitive execution speeds, user experience, and liquidity, Perp DEXs are increasingly becoming a common choice among domestic investors. Ultimately, even if unlicensed foreign exchanges are blocked, funds are more likely to disperse to decentralized markets, a regulatory blind spot, rather than returning to Korea.

As such, the current situation cannot be resolved simply by strengthening regulations. While regulations are inherently designed to protect investors, excessive application can have the counterproductive effect of shifting funds and transactions beyond scrutiny. At the same time, a stringent regulatory environment restricts product diversification and technological experimentation in the domestic market, hindering the expansion of the industrial ecosystem and the buildup of global competitiveness, despite high transaction volumes and participation.

Therefore, what's needed isn't blocking overseas exchanges or unconditionally strengthening regulations. Rather, it's a flexible regulatory structure that can accommodate innovation within manageable boundaries. Given the trend of major countries integrating cryptocurrencies into institutional finance, a realistic approach that balances investor protection with industry competitiveness is required.

This analysis aims to estimate the annual transaction fees paid by Korean cryptocurrency investors to overseas exchanges. To ensure data objectivity and analytical sophistication, we utilized exchange data from Kaiko and major blockchain analytics platforms such as Arkham Intelligence and Dune.

During the analysis, we estimated the amount of overseas outflows in 2025 at approximately 160 trillion won, based on exchange transaction volume data and the Financial Services Commission's fund outflow statistics. To estimate the amount of fees, we applied a top-down approach based on the share of Korean investors in overseas exchanges, and a bottom-up approach that tracks actual fund flows. The two methods were then cross-validated.

The top-down approach uses the 2023 Wall Street Journal (WSJ) report that "Koreans account for 13% of trading on Binance" as a key benchmark. According to the WSJ report, more than 99% of Korean investors' use of overseas exchanges is focused on futures trading. Since derivatives trading, which is not available domestically, is the primary purpose of using overseas exchanges, this analysis calculated fees solely based on futures trading volume.

[Fee calculation formula] Total fee = Total Binance futures trading volume × Korean user share (%) × Average transaction fee rate × Exchange rate

Meanwhile, considering the accelerated overseas outflow after 2023 (estimated to be approximately 160 trillion won by 2025), the current Korean share is likely to exceed 13%. However, considering the influx of global users and market growth during the same period, the market share scenarios were set as follows.

Assuming Binance's futures trading volume to be $27.5 trillion in 2025, and applying an average commission rate of 0.035% and an exchange rate of 1,420 won, the annual commission paid by Korean investors to Binance is estimated to be approximately 2.05 trillion won under conservative assumptions and approximately 3.417 trillion won under optimistic assumptions.

CASE 2: Funds Flow-Based Estimation (Bottom-up)

The bottom-up approach tracks actual fund flows and reverse-calculates transaction fees. Using on-chain wallet data from domestic exchanges, the scale of assets transferred to overseas exchanges was directly verified, and the amount of fees was calculated based on this data.

This analysis used the previously estimated annual overseas outflow of 160 trillion won as a baseline. Using wallet labeling data to calculate the inflow rate by exchange, we found that approximately 92.3 trillion won, or 57.7% of the total outflow, moved to Binance.

However, commissions cannot be calculated solely based on the principal inflow. This is because actual transaction amounts vary depending on how frequently and how large investors trade with their funds. To estimate this, we applied two variables: turnover rate and futures adjustment factor.

To calculate the velocity, we referenced the Financial Services Commission's "Virtual Asset Business Survey Report for the First Half of 2025." According to the report, domestic investors' total assets under management amount to approximately 98.9 trillion won. Based on this, we analyzed trading volume data from domestic exchanges and found that investors trade approximately twice their monthly assets. This figure translates to approximately 24 times annually. We applied this velocity, assuming that domestic investors' trading tendencies remain similar on overseas exchanges.

Meanwhile, domestic data is based on spot trading without leverage, so it needs to be adjusted to match the Binance environment, which focuses on highly leveraged derivatives. Analysis of Binance data shows that futures trading frequency is approximately 2.3 times higher than spot trading, and the per-transaction volume is approximately 1.5 times higher. This suggests that futures trading volume is approximately 3.52 times higher than spot trading volume.

[Fee calculation formula] Total fee = (Binance inflow principal × annual turnover × futures correction factor) × average fee rate × exchange rate

Applying this approach, the annual fees paid by Korean investors to Binance are estimated at approximately 2.73 trillion won. This falls within the range of top-down estimates (2.05 trillion won to 3.417 trillion won).

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report has been prepared based on reliable sources. However, we make no express or implied warranties as to the accuracy, completeness, or suitability of the information. We are not responsible for any losses resulting from the use of this report or its contents. The conclusions, recommendations, projections, estimates, forecasts, objectives, opinions, and views contained in this report are based on information current at the time of preparation and are subject to change without notice. They may also differ from or be inconsistent with the opinions of other individuals or organizations. This report has been prepared for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.