Uniswap 's long-awaited toll switch is now officially live. However, it doesn't offer immediate clarity on how UNI can create long-term value.

Initial on-chain data sparked heated debate about whether the market was jumping to conclusions or discovering fundamental limitations in Uniswap's burn mechanism.

Has Uniswap 's fee switch failed, or is the market misunderstanding it?

Initial estimates from on-chain analysts suggest that Uniswap 's new protocol fee revenue will only reach approximately $30,000 per day in physical assets. This figure is significantly lower than the incentives proposed in recent governance plans .

These initial results have raised many questions about whether the issuance of UNI Token can exceed the number of Token burned from protocol fees, at least in the short term.

"Based on current data, the amount of UNI incentivized tokens is expected to exceed the amount of Token burned from the fee switch," one user wrote , adding that this data prompts reflection on how the outcome might have been different if the fee switch had been turned on earlier.

This warning comes after a detailed analysis by on-chain researchers, which initially estimated that daily protocol revenue on Ethereum alone could be around $95,000 if all goes well.

However, after analyzing each pool individually, this estimate was repeatedly lowered. Analysts discovered that many pools generating high fees were actually liquidation, newly launched, whitelisted, or had a rug risk. This meant that actual revenue was unlikely to be withdrawn.

After eliminating questionable revenue sources, the analyst concluded that only about $30,000 per day could truly be Uniswap guaranteed asset. Even with an optimistic annual calculation, this would only amount to approximately $22 million in protocol revenue, even under conditions of high volume on weekdays and an additional Layer-2 extension.

Meanwhile, UNI proposed incentive amounted to $125 million, making the ratio between fees collected and UNI issued extremely unfavorable.

“Initial data suggests this fee switch is not enough to offset the proposed incentives,” commented Memelord, arguing that asset diversification, liquidation limitations, and arbitrage risks could lead to value losses in the early stages of operation.

“Too hasty and misleading”: Hayden Adams refutes criticism of early fee transition.

The above conclusion was strongly countered by Uniswap and its founder, Hayden Adams. He argued that the analysis was “wrong, hasty, and misleading,” and stressed that the critics were basing their judgment on incomplete data, as the rollout was only just beginning.

"Currently, only a small portion of the fee structure has been activated," he Chia , explaining that many parameters could still be adjusted through future governance proposals.

Adams also dismissed claims of an initial UNI burn , noting that the protocol's Token jar mechanism was not yet effectively arbitrageable.

Fees are still being collected from thousands of different Token , while Token burning occurs in small batches, so initial burn data is insufficient to reflect long-term realities.

"The first burn doesn't tell you anything about future stability," he said.

Overall, Adams also rejected comparing the development budget proposed by UNIfication with traditional liquidation exploitation incentives.

Uniswap leaders stated that the protocol is inherently not heavily reliant on liquidation subsidies. The development budget is used to expand the ecosystem long-term, not to compensate LPs with fees they "cede."

"If the labs and development budget disappear, the amount of UNI burned through fees will continue as it is now," he added.

Many community members also agree with this view, showing that the current sentiment is a complete contrast to the market's optimism just a few weeks ago.

In November 2023, Uniswap 's UNIFiction proposal – which introduced protocol fees, burned 100 million UNI Token , and merged operations between Labs and Foundation – helped UNI surge to its highest level in two months .

At the time, many analysts, such as CryptoQuant CEO Ki Young Ju, predicted that if high volume were maintained, the amount of UNI Token burned annually could reach $500 million.

However, currently, the gap between these optimistic expectations and the initial on-chain reality is significant. Whether the toll switch will become a sustainable UNI burning driver or simply an overestimation of expectations will depend on how quickly Uniswap scales its deployment, adjusts its parameters, and transforms its current small-scale operations into a stable protocol revenue stream over time.

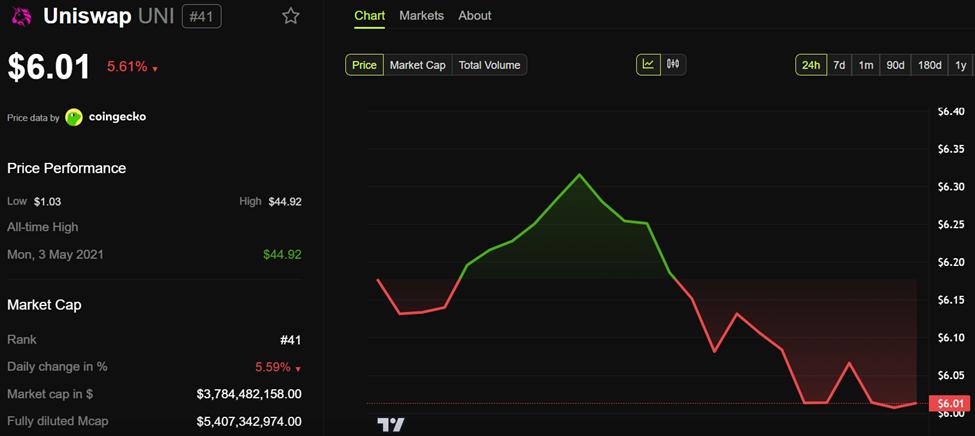

Uniswap (UNI) price movement. Source: BeInCrypto

Uniswap (UNI) price movement. Source: BeInCryptoUNI is the main Token of the Uniswap ecosystem. At the time of writing, UNI is trading at $6.01, down nearly 6% in the last 24 hours.