Written by: Gu Yu, ChainCatcher

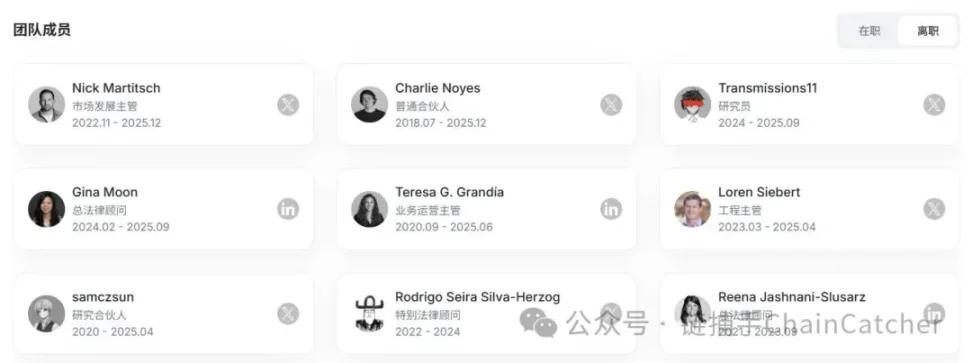

Paradigm has long been a landmark venture capital firm in the crypto industry, representing top-tier investment styles and aesthetics, and its research-driven crypto VCs are highly regarded. However, affected by the industry cycle, Paradigm has not been spared in the current general downturn in the VC world. One manifestation of this is an unprecedented wave of executive departures, with at least seven employees leaving since April of this year, including several partners.

In December, Paradigm's first employee and general partner, Charlie Noyes, and Paradigm's head of market development, Nick Martitsch, announced their departures.

In September, Paradigm's General Counsel Gina Moon and Paradigm researcher Transmissions11 resigned.

In June, Teresa G. Grandía, Paradigm's head of business operations, resigned.

In April, Paradigm's engineering director, Loren Siebert, and research partner, samczsun, resigned one after the other.

Source: RootData

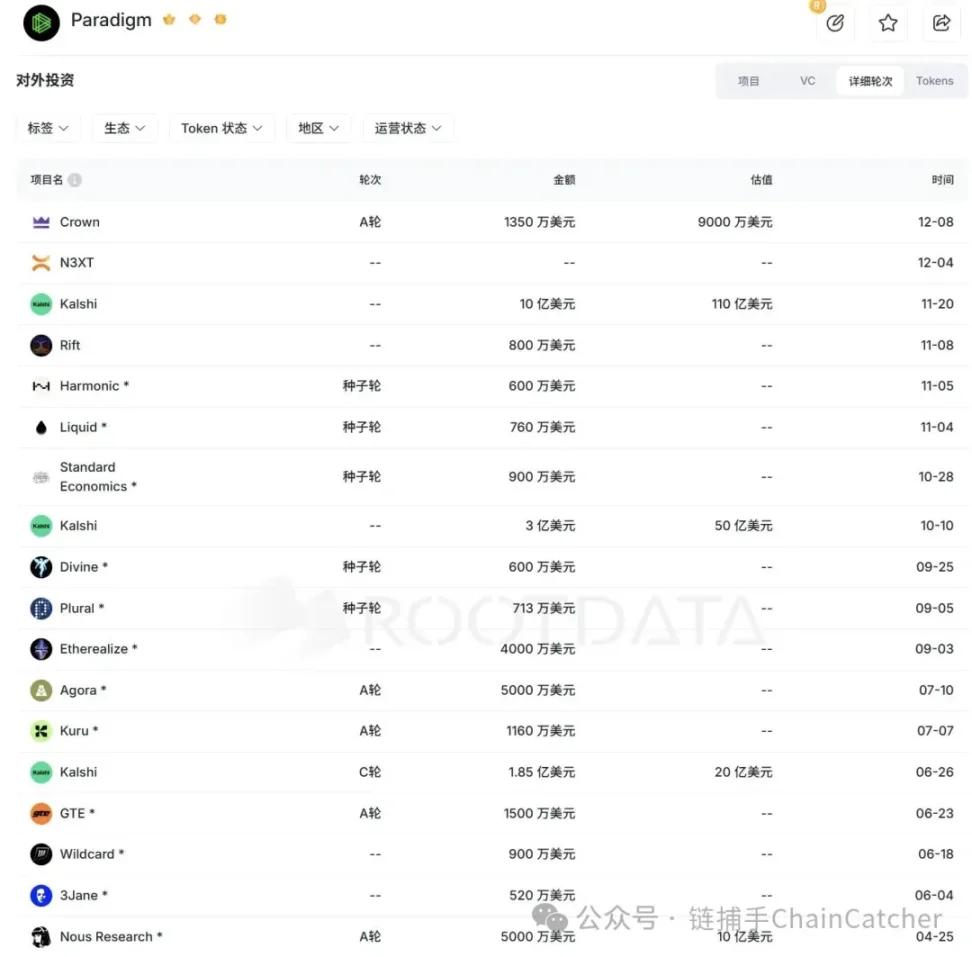

This wave of departures is extremely rare even among top-tier VCs, reflecting that Paradigm has entered a very difficult phase. Looking at its publicly disclosed portfolio and trading frequency, Paradigm has significantly reduced its investment frequency over the past two to three years, lacks a "masterpiece" with industry consensus, and missed many high-return projects. These factors are likely the main sources of Paradigm's predicament.

Repeatedly taking over investments, missing out on star stocks.

Paradigm's golden age was roughly concentrated between 2019 and 2021. During this period, it completed its strategic deployments in key projects such as Uniswap, Optimism, Lido, and Flashbots, thereby establishing a strong brand identity: technological infrastructure, the core Ethereum ecosystem, and long-termism. This also earned Paradigm considerable reputation among crypto entrepreneurs and investors.

These typical investments share several common characteristics: they are not short-term hot topics, but rather underlying protocols or key middleware; the timing of the investments is relatively early, but not extremely early; and they are highly consistent with Paradigm's internal research direction.

It was during this phase that Paradigm developed a clear and repeatedly emphasized investment strategy: research-driven. However, the problem is that this methodology gradually became less adaptable in subsequent cycles to the rapid changes in industry logic, resulting in a significant drop in Paradigm's investment performance and influence.

Starting in 2022, a new generation of high-growth projects began to emerge more frequently in areas such as application layer, financial structure innovation, mechanism design, and product experience, such as prediction markets, revenue structure protocols, and perpetual contract protocols. This round of projects tends to iterate quickly, are more product-oriented, have a higher tolerance for "technical correctness," and are more sensitive to "user growth" and "mechanism efficiency."

In the previous cycle, Paradigm clearly supported and invested in two blockbuster projects, Blur and Friend.tech, becoming one of the main drivers behind their success. However, both projects quickly declined after launching their tokens, with the teams dumping large amounts of tokens and gradually becoming less active, leading the market to question Paradigm's investment acumen and style.

Meanwhile, Paradigm also took over the follow-up financing of many high-valuation projects. Although this strategy made Paradigm very profitable during the bull market, due to the continued slump in the Altcoin market and the problems with the investment targets themselves, almost all of Paradigm's major holdings quickly fell below their cost price after the token was issued, or their development was poor and they sought transformation.

In May 2024, Paradigm led a $150 million Series A funding round for Farcaster at a valuation of $1 billion. Now, Farcaster has announced that it is abandoning the social networking track and turning to the wallet field.

In May 2024, Paradigm led a $70 million funding round for Babylon at a valuation of $800 million. Today, Babylon's token FDV is only $180 million.

In April 2024, Paradigm led a $225 million funding round for Monad at a valuation of $3 billion. Today, Monad's token FDV is only $1.7 billion.

In June 2022, Paradigm participated in Magic Eden's $130 million funding round at a valuation of $1.6 billion. Today, Magic Eden's token FDV is only $200 million.

What's even harder to accept for Paradigm is that it missed out on early-stage investments in numerous high-return projects over the past few years, such as Ethena, Pump.fun, Ondo Finance, and MYX. In the popular derivatives and RWA sectors, Paradigm has not invested in any assets in recent years.

Paradigm invested in the prediction market project Veil as early as January 2019, but the project ceased operation in less than a year.

The prediction market model is not theoretically novel, nor is it technically extremely difficult. Paradigm's failed investment experience meant it didn't participate in Polymarket's first five funding rounds. Perhaps it wasn't until Polymarket announced a $150 million funding round in January of this year, valuing the company at $1.2 billion, that Paradigm realized the value of this sector. It then began to heavily invest in Polymarket's competitor, Kalshi, first leading a $185 million funding round in June at a valuation of approximately $2 billion, and then participating in two more funding rounds within six months, valuing Kalshi at $5 billion and $11 billion respectively. This is also the highest-valued project Paradigm has ever invested in.

This shows that Paradigm is determined not to miss out on the core investment targets in the hottest sectors, and even has a "fomo" mentality.

Hatching Stranded

Deep involvement in project incubation has long been one of Paradigm's signature styles, with Uniswap and Flashbots being representative examples from previous Paradigm cycles.

In a previous article, Paradigm stated that it is a community of developers dedicated to supporting other developers. The most fruitful collaborations often involve deep partnerships with startup teams to jointly solve important business and research challenges.

For VCs, joining a project when it is still in the conceptual stage allows them to better influence product design and strategic direction, thereby unlocking greater value potential and gaining higher bargaining power and returns on investment.

Paradigm, with its numerous successful cases, has continued to explore incubation models in recent years and has launched an institutionalized EIR (Entrepreneurs-in-Residence) model. This model involves both parties working together in an office space, with the VC providing entrepreneurs with substantial support in areas such as strategy, technology, and recruitment. However, recent cases suggest that Paradigm's model has also encountered obstacles.

In December 2023, Paradigm partnered with EIR to develop the on-chain developer platform Shadow and invested $9 million. However, the project has been discontinued this year, and the founding team has instead launched Ventures, an equity derivatives platform for unlisted companies.

Paradigm previously participated in the writing, development, and investment of the white paper for Yield Protocol, a decentralized fixed-rate protocol, which also announced its cessation of operations in October 2023.

Subsequently, Paradigm shifted its focus to the infrastructure sector. In October 2024, the crypto venture capital firm Paradigm announced a $20 million investment in its spin-off company, Ithaca. Ithaca was developing a new Layer 2 blockchain called Odyssey. Paradigm's CTO and General Partner, Georgios Konstantopoulos, became Ithaca's CEO while retaining his position at Paradigm. Paradigm co-founder Matt Huang served as Ithaca's Chairman.

This team structure shows that Ithaca was developed entirely by the Paradigm core team, demonstrating a deeper level of involvement than with previous projects like Uniswap. Choosing the Layer 2 track at this point in time seems like a poor decision. For the following year, Ithaca remained virtually silent in the market.

At the beginning of this year, the crypto industry's focus shifted entirely to stablecoins and payments. Paradigm followed suit, partnering with internet payment giant Stripe to launch Tempo, a Layer 1 high-performance public blockchain for payment scenarios, in August. Paradigm co-founder Matt Huang served as the project's CEO. In October, Tempo acquired Ithaca, with all of Ithaca's members joining Tempo.

At this time, the payment sector already has established players such as Arc, RedotPay, Plasma, Stable, 1Money, and BVNK. Tempo is in a leading position in terms of funding amount and has the resource support of Stripe, giving it a relatively leading position in the fierce competition.

Tempo's payment battle will be a decisive battle for Paradigm to once again prove its product and research capabilities.

Conclusion

Whether Paradigm will find its own rhythm again remains to be seen. But what is certain is that it is now in a position where change is imperative.

Since January of this year, Paradigm's investment frequency has increased significantly, from an average of one investment per month in 2023-2024 to an average of two investments per month, with a noticeable increase in the proportion of early-stage investments. Last June, Paradigm also announced the completion of an $850 million fund, remaining one of the VCs with the largest cash reserves.

Team turnover and investment strategy setbacks are not unique to any one VC firm, but rather an inevitable path that almost all long-term institutions will experience during cross-cycle development. If Paradigm represented the "engineering era" of the crypto industry in the past, then what it faces next may be a more pragmatic and market-driven phase. The success or failure of this adjustment will determine whether it can continue to play the role of a definer rather than a bystander in the next cycle.