Get the best data-driven crypto insights and analysis every week:

Moments of Market Stress: What They Reveal Heading into 2026

By: Tanay Ved

Introduction

2025 marked an inflection point in the adoption and maturation of digital assets, but it also surfaced a series of outliers, stress points, and operational failures that tested the industry in less predictable ways. As we enter the new year, this issue of State of the Network revisits some of these stories, from Solana’s stress test to Bybit’s hack and Paxos’ stablecoin minting error, capturing what they reveal about the industry’s growing resilience, as well as the risks that remain beneath the surface.

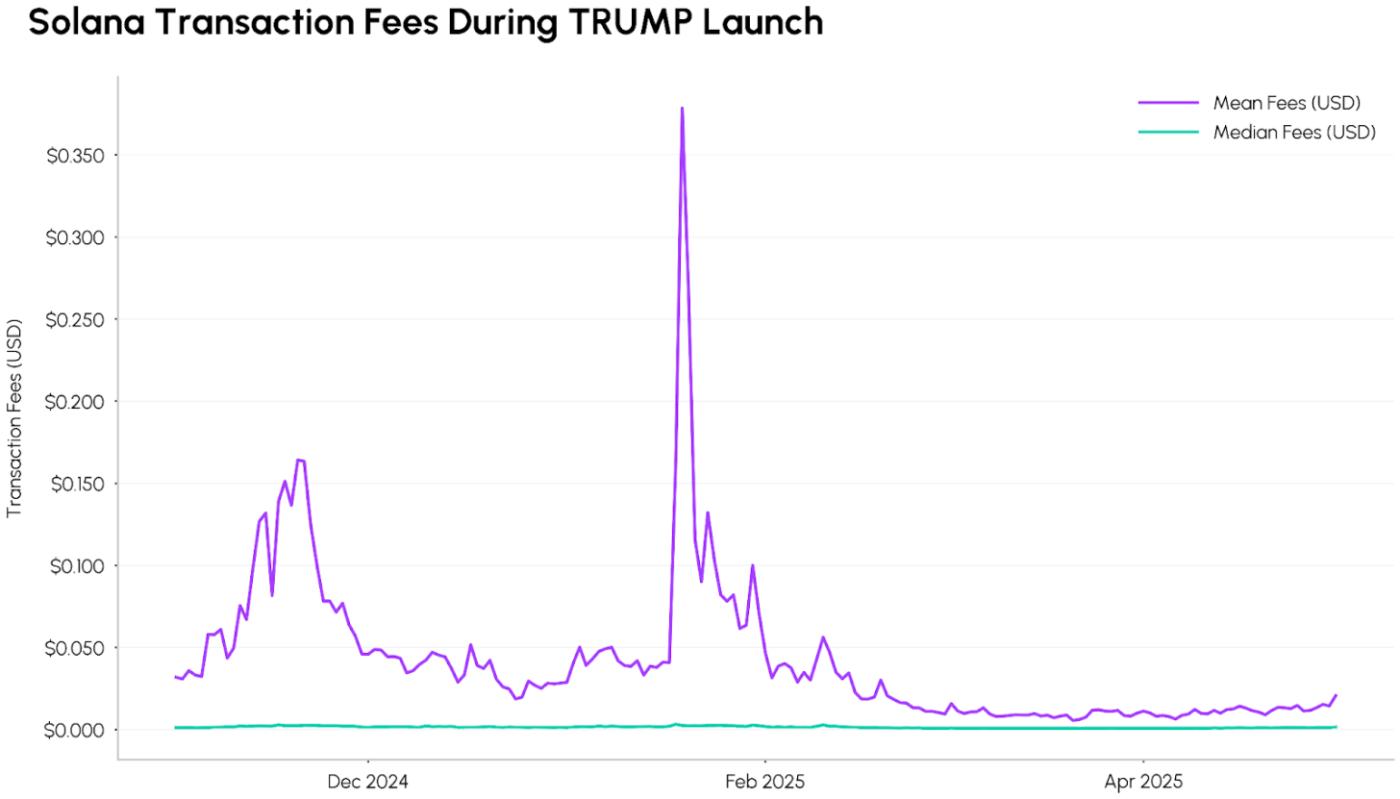

Solana’s TRUMP Stress Test

At the onset of 2025, an unprecedented event gripped crypto markets as the President of the US launched the TRUMP token, a memecoin on the Solana blockchain. The token catapulted to a market cap of roughly $9B within the first few hours of launch, and the speculative frenzy that followed pushed trading activity and onchain transaction volumes to unforeseen levels.

Source: Coin Metrics Network Data Pro

Under this extreme load and influx of liquidity, Solana’s infrastructure held up well, while keeping fees low and relatively predictable for users. While mean transaction fees spiked by 825% to $0.37 in response to network congestion, median fees remained stable at around $0.003. This event proved to be a valuable real world stress test for Solana, highlighting how major blockchains may be faced with sudden spikes in user demand, whether from memecoins or the wave of tokenized assets coming onchain.

Bybit’s Billion Dollar Breach

February brought another stress test, this time for one of the largest crypto exchanges. Bybit was hacked for approximately $1.5B in ETH during a routine transfer from its multi-signature cold wallet to a hot wallet. Attackers exploited the interface layer of its Safe-based setup to trick signers into approving a malicious transfer of roughly 401,000 ETH.

Source: Coin Metrics Network Data Pro

Onchain data showed a sharp decline in Bybit’s ETH balances as funds were quickly moved through attacker-controlled addresses. Despite the scale of the loss, Bybit replenished much of the deficit through external financing, OTC activity, and new deposits, keeping withdrawals open throughout the incident.

Rather than triggering a solvency crisis, the breach functioned as a live stress test of Bybit’s liquidity and risk management, demonstrating that UI integrity, signer workflows, and internal approval processes are now as critical to security as the underlying custody architecture.

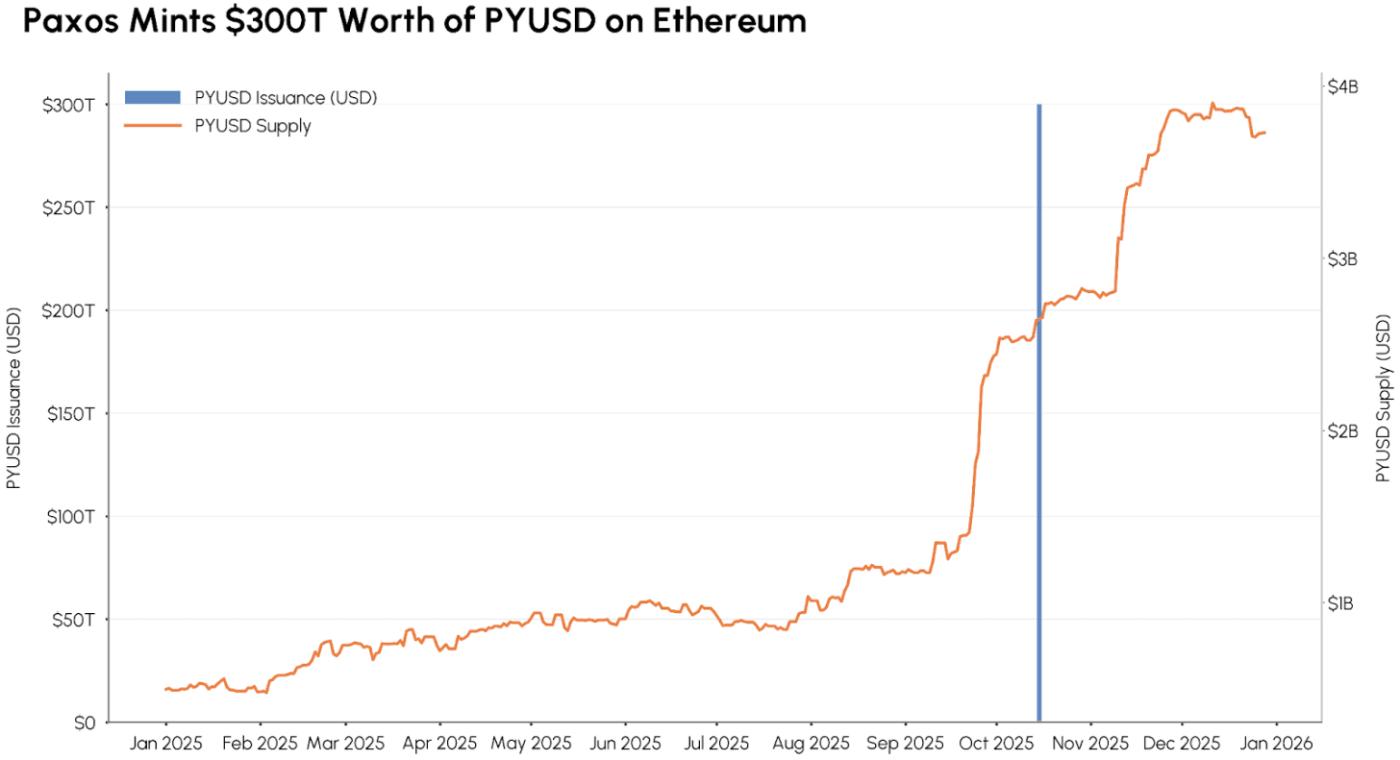

Paxos’ $300T Fat Finger Error

In October, Paxos mistakenly minted $300T worth of PYUSD during an internal transfer, briefly pushing onchain supply beyond the scale of the U.S. dollar money supply and even global GDP. The unbacked tokens existed for approximately 20 minutes before being detected and burned, returning PYUSD supply to roughly $2.6B at the time.

Source: Coin Metrics Network Data Pro

The incident exposed how a centralized minting setup (controlled by a single externally owned account) can produce massive unbacked supply with limited onchain safeguards, and how PYUSD’s peg ultimately depends on Paxos’ reserves and attestations rather than automated smart contract collateral checks. DeFi platforms like Aave responded by freezing PYUSD reserves, while PYUSD briefly lost its dollar peg, underscoring how one operational error at an issuer can ripple into downstream protocols and liquidity venues.

USDe Price Dislocation on Binance

October 10th brought the largest day of crypto liquidations on record, wiping out $19B in leveraged long positions. Freshly imposed tariffs on China set a tsunami of volatility into motion, rippling into digital asset markets as the gears of traditional finance came to a halt outside of business hours.

Among the more notable casualties was Ethena’s synthetic dollar, USDe. Due to its unique backing mechanism, risk profile and usage as collateral across venues, USDe was closely tied to overall leverage conditions that had built up going into the flash crash.

Source: Coin Metrics Market Data Feed

As liquidations spiraled across venues exacerbated by auto-deleveraging (ADL) mechanisms, USDe suffered a localized depeg on Binance, trading at $0.67. This pointed to venue specific positioning and liquidity differences rather than a system-wide failure of Ethena’s design. USDe remained overcollateralized, but the dislocation prompted users to derisk, leading to a meaningful contraction in USDe supply over the following weeks.

The episode surfaced the importance of an aggregated view into secondary market liquidity and the impact that fragmented pricing can have across venues while also exposing some of the vulnerabilities of synthetic stablecoin mechanisms amid 24/7 reflexive markets.

What This Year Revealed

Taken together, these moments show that 2025’s most revealing tests emerged during stress-driven spikes in activity, liquidity dislocations across venues, and operational failures that surfaced directly in the data. They pressured core blockchain infrastructure, trading venues, and stablecoin issuers in real time, and in most cases, the system held: networks continued to process transactions, venues absorbed liquidity shocks, and markets adjusted without cascading failure.

As we move into the new year, these episodes look less like signs of fundamental fragility and more like the kind of pressure that strengthens foundations, hardening infrastructure and risk management and leaving the ecosystem better prepared for the next cycle of growth.

Thank you for reading State of the Network in 2025. We look forward to bringing you more riveting data and actionable insights throughout the next year!

Subscribe and Past Issues

Coin Metrics State of the Network is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.