Ethereum continues to trade sideways, failing to generate strong upward momentum as market sentiment remains unstable. ETH continues to struggle to establish a clear trend, keeping the price hovering around key technical levels.

With internal signals remaining mixed, Ethereum is currently becoming increasingly dependent on external factors for a significant breakthrough.

Bitmine is more confident than ever in the value of Ethereum.

Bitmine recently announced it has begun Staking Ethereum from its own funds, demonstrating its long-term commitment to the network. Bitmine currently holds 4.11 million ETH, representing nearly 3.41% of the total circulating ETH supply. This move makes Bitmine one of the largest Ethereum holders in the world.

Of these assets, approximately 40,627 ETH, equivalent to $1.2 billion, has been Staking. Bitmine also plans to expand its Staking operations through the MAVAN (Made in America Validator Network), which is expected to launch in early 2026.

“If all of Bitmine’s ETH were Staking by MAVAN and its partners, the fees received from Staking ETH could reach $374 million per year (at a rate of 2.81% CESR), or more than $1 million per day,” quoted Tom Lee from Galaxy Digital, also a private investor.

The actions of Ethereum investors are being taken into consideration.

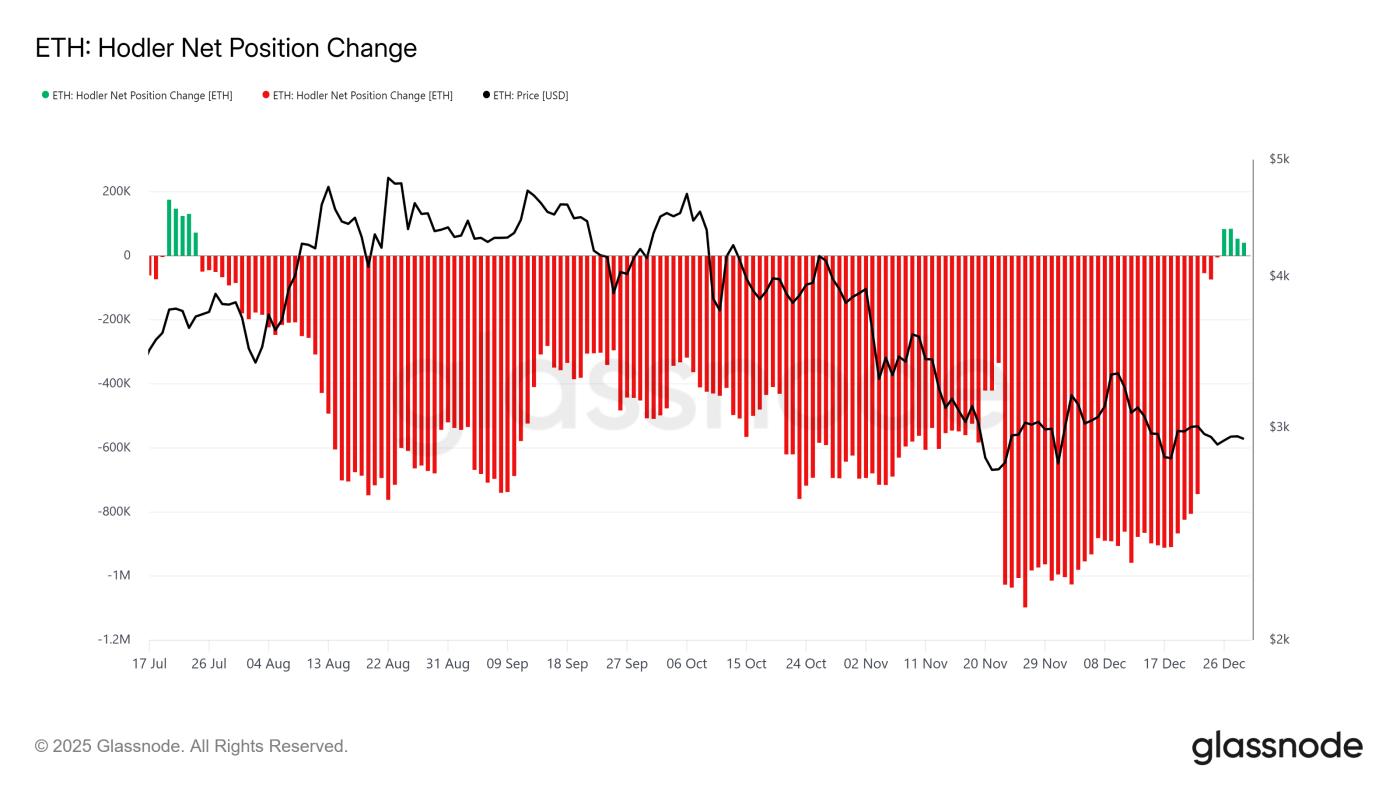

Investor behavior in the Ethereum market is now clearly polarized. Long-term investors – often XEM as the solid foundation of this asset – have returned to accumulating after months of continuous selling and distribution. This shift comes after nearly five months of continuous ETH outflow, impacting the long-term supply.

The return of the "HODL" trend is a positive sign for Ethereum's recovery prospects . Long-term investors often help reduce volatility during periods of market instability. The renewed accumulation activity reflects improved market confidence.

Want more Token analysis like this? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

The position of Ethereum HODLers is changing. Source: Glassnode

The position of Ethereum HODLers is changing. Source: GlassnodeHowever, the activity of whales shows a contradictory signal. In the past 5 days, wallets holding between 100,000 and 1 million ETH have sold approximately 270,000 ETH. At the current price, this is equivalent to $793 million, creating significant supply pressure on the market.

This action suggests that whales are not yet fully reassured by the risk of a short-term price drop. The selling is primarily defensive and does not reflect a completely pessimistic view. However, the reduction in holdings also indicates that confidence in ETH 's ability to recover quickly remains limited.

Ethereum whales hold significant assets. Source: Santiment

Ethereum whales hold significant assets. Source: SantimentETH price is awaiting a clear trend.

Ethereum's current price is at $2,941 within an asymmetrical triangle pattern, indicating market indecision. The price remains constrained by resistance around $3,000 and support at approximately $2,902. The price range is tightening as both buyers and sellers remain cautious, coupled with a gradual decrease in price volatility as the pattern completes.

Investor signals are mixed, leaving ETH 's short-term direction unclear. However, Bitmine's aggressive Staking strategy is creating a positive outlook. If optimistic sentiment persists , ETH could surpass the $3,000 mark and aim for $3,131 by early January 2026. To confirm a breakout, Ethereum needs a clear closing candle above $3,131.

ETH price analysis. Source: TradingView

ETH price analysis. Source: TradingViewIf the market doesn't share Bitmine's positive outlook, ETH is likely to experience a correction. Furthermore, a drop below $2,902 would break the current pattern, potentially sending Ethereum to the $2,796 range. If this happens, ETH could enter a short-term downtrend, impacting hopes for a market recovery.