The year 2025 has marked a significant milestone in financial history, as crypto and digital assets moved beyond being merely speculative tools to become a truly essential part of the global economy.

From Wall Street boardrooms to Washington's policymaking bodies, digital assets have evolved from small-scale experiments into indispensable tools for preserving asset value and fostering innovation.

2025 is a point of no return for crypto—these are the things that have changed forever.

Major financial institutions have invested billions of dollars in Bitcoin, many businesses are building reserves of digital assets to hedge against inflation, meme coins are stirring up the market with a mix of excitement and risk, while crypto-friendly governments have removed many legal barriers with key laws such as the GENIUS Act.

Based on diverse data and perspectives, this article analyzes how these factors have converged to transform the traditional market, attracting billions of dollars in new Capital while also revealing weaknesses as this ecosystem remains in its developmental stage.

As BeInCrypto has noted throughout this year, these shifts demonstrate not just growth, but a genuine power transition within the financial sector.

The institutionalization of Bitcoin

The widespread acceptance of Bitcoin by major institutions by 2025 has become a significant milestone, transforming this cryptocurrency from a highly volatile asset into an integral part of a diversified investment portfolio.

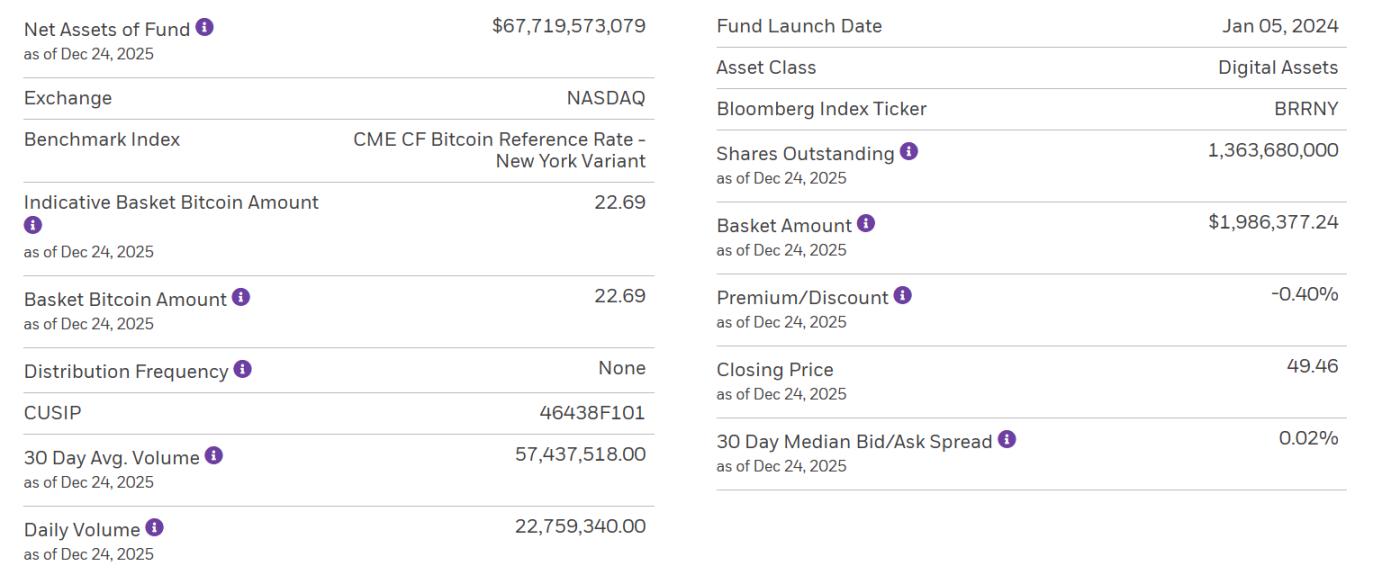

Spot ETFs are growing rapidly, most notably BlackRock's IBIT ETF, which has attracted nearly $68 billion in assets under management (AUM), leading in daily volume and becoming the destination for the largest inflows of funds this year.

Key highlights about the iShares Bitcoin Trust ETF. Source: BlackRock

Key highlights about the iShares Bitcoin Trust ETF. Source: BlackRockThe total value of assets held by Bitcoin investment institutions has surged to $235 billion, a 161% increase compared to 2024. This growth was driven by pension funds managing $12 trillion investing in Bitcoin for the first time.

This AUM value is calculated by multiplying the total amount of Bitcoin held by private companies, public companies, exchanges, custodians, and ETFs by the current Bitcoin price.

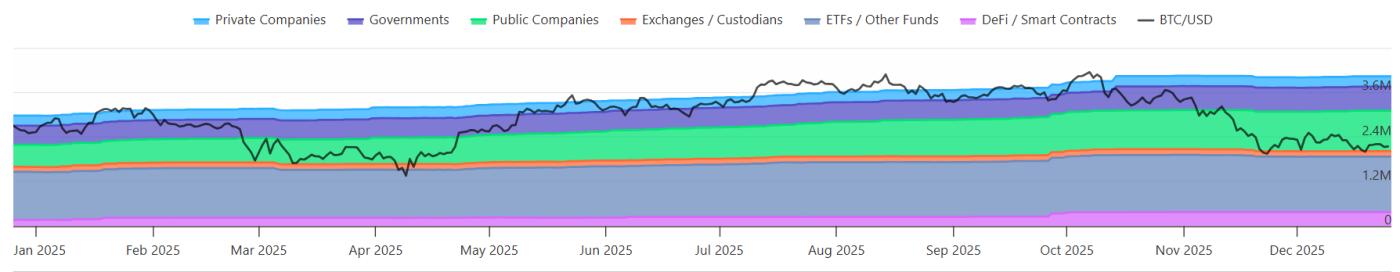

BTC allocation over the years. Source: Bitcoin Treasureries

BTC allocation over the years. Source: Bitcoin TreasureriesAccording to forecasts from Bursera Capital, investment in Bitcoin this year has surpassed $40 billion, exceeding last year's record. This is thanks to fair value accounting regulations, which reduce volatility in financial reporting, allowing businesses to hold BTC without fear of losses due to price changes over time.

Clarity in the legal framework is also Vai , as the US government establishes a strategic Bitcoin reserve fund and eases restrictions on pension funds.

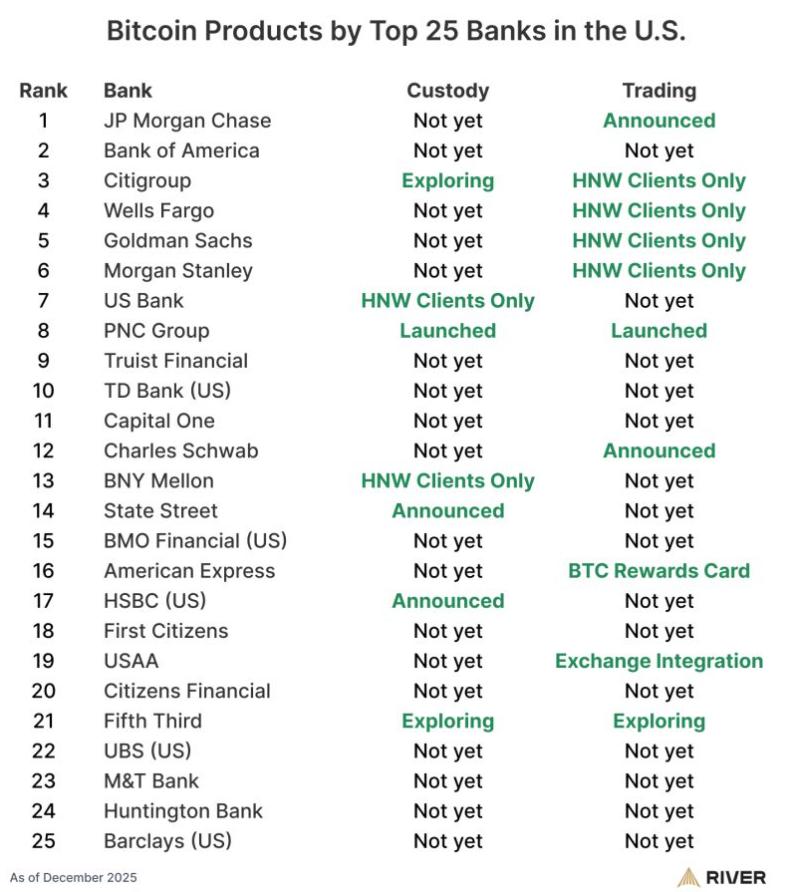

Bitcoin is no longer a small-scale trend.By mid-December, 14 out of the 25 largest US banks had developed Bitcoin-related products, according to financial services firm Bitcoin River. Meanwhile, asset management firms maintained long-term investment positions even as the market declined.

Bitcoin products offered by major US banks. Source: River

Bitcoin products offered by major US banks. Source: RiverAn EY survey conducted earlier this year showed that 86% of institutional investors would increase their crypto holdings. Embrace of DeFi is expected to increase from 24% to 75%, primarily targeting profit generation through lending and the use of Derivative on secure platforms like Fireblocks.

Data on Newhedge shows that Bitcoin's 30-day price volatility has decreased by 70%, from a peak of 3.81% in 2025 to a low of just 1.36% in August 2025. This makes Bitcoin even more stable than some traditional stocks, while its price has risen from around $76,000 to a high of $126,000.

Bitcoin's 30-day volatility index and price fluctuation. Source: Newhedge

Bitcoin's 30-day volatility index and price fluctuation. Source: NewhedgeAnalysts at firms like Standard Chartered predict that pension fund inflows will create significant volatility, with prices potentially rising sharply for every $1 billion poured into ETFs.

According to blockchain analytics firm Arkham, the amount of Bitcoin held by institutions was projected to be below 600,000 BTC at the beginning of 2025. However, this year, interest from institutions has increased significantly. Currently, businesses hold more than 4.7% of the total BTC supply.

In this context, believers like Michael Saylor from MicroStrategy argue that Bitcoin is no longer a marginal asset but has become a genuine financial infrastructure. This view was also emphasized at the Bitcoin 2025 conference, when the BTC ownership of US Vice President JD Vance and Pakistan's national reserves came under scrutiny.

The involvement of large institutions not only helped stabilize the market but also saw Bitcoin as a model reserve asset, completely changing how portfolio strategies are constructed.

Digital Treasury Assets

Digital asset vaults (DATs) began to gain more attention in 2025. Data from CoinGecko shows they have accumulated over $121 billion in assets, including Bitcoin, Ethereum, and Solana, and control a large portion of the supply of these Token : approximately 4% of ETH and 2.5% of SOL.

A major driver of this growth is the adoption of fair value accounting standards, which allow businesses to allocate assets to cryptocurrencies without significantly impacting their financial reporting. Analysts at Bitwise believe this "could dramatically change the market."

MicroStrategy is a prime example of this trend, holding over 671,268 BTC. The total amount of BTC held by businesses increased from 1.68 million to 1.98 million BTC by mid-year.

The amount of BTC held by publicly traded companies. Source: Bitcoin Treasureries

The amount of BTC held by publicly traded companies. Source: Bitcoin TreasureriesData on Rwa.xyz shows that the value of Tokenize vaults has increased by 80% to $8.84 billion, after peaking at $9.3 billion in mid-Q4. These vaults offer higher yields than stablecoins amidst USD interest rates remaining at 3.50%-3.75% , thanks to leveraging blockchain technology for optimal efficiency.

Real assets (RWAs) excluding stablecoins have increased 229% to $19 billion, with Ethereum playing a major Vai with $12.7 billion in holdings.

Stablecoins have reached a market Capital of over $308 billion, according to data from defillama, thriving under the regulatory framework of the GENIUS Act.

Galaxy Research's forecast is quite optimistic, suggesting that decentralized administration bonds (DAOs) could exceed $500 million in 2026, while loans backed by digital assets could reach $90 billion. Inflows into ETFs are predicted to exceed $50 billion, and there is also the possibility of national investment funds actively participating.

Market pressure and capitulationHowever, difficulties also arose when the compression of mNAV forced some DATs to sell assets or close down, due to a sharp 90-95% drop in cash inflows compared to the July peak amidst close scrutiny.

BeInCrypto also analyzed how Miners and companies reacted as demand for Bitcoin decreased . Inflows into DAT bottomed Dip in 2025 at $1.32 billion, while the shift of $25-75 billion towards bonds via stablecoins demonstrates the connection between the debt market and chain technology.

"DAT has the potential to transcend its speculative Vai and become a sustainable economic driver," analyst Ryan Watkins commented on DAT's long-term potential.

This development connects traditional finance and cryptocurrency , but also carries significant risks. Reduced liquidation and weakening confidence have led to sell-offs, putting pressure on companies like MicroStrategy and BitMine to innovate their revenue generation models.

Ultimately, DAT symbolized resilience and aspiration for 2025, contributing to changing the way businesses manage funds for the digital age.

The rise and fall of meme coins

The meme coin of 2025 clearly showed the two sides of the crypto market: a massive surge followed by a "heat death" where volume drops by 70-85% and interest plummets by 90% .

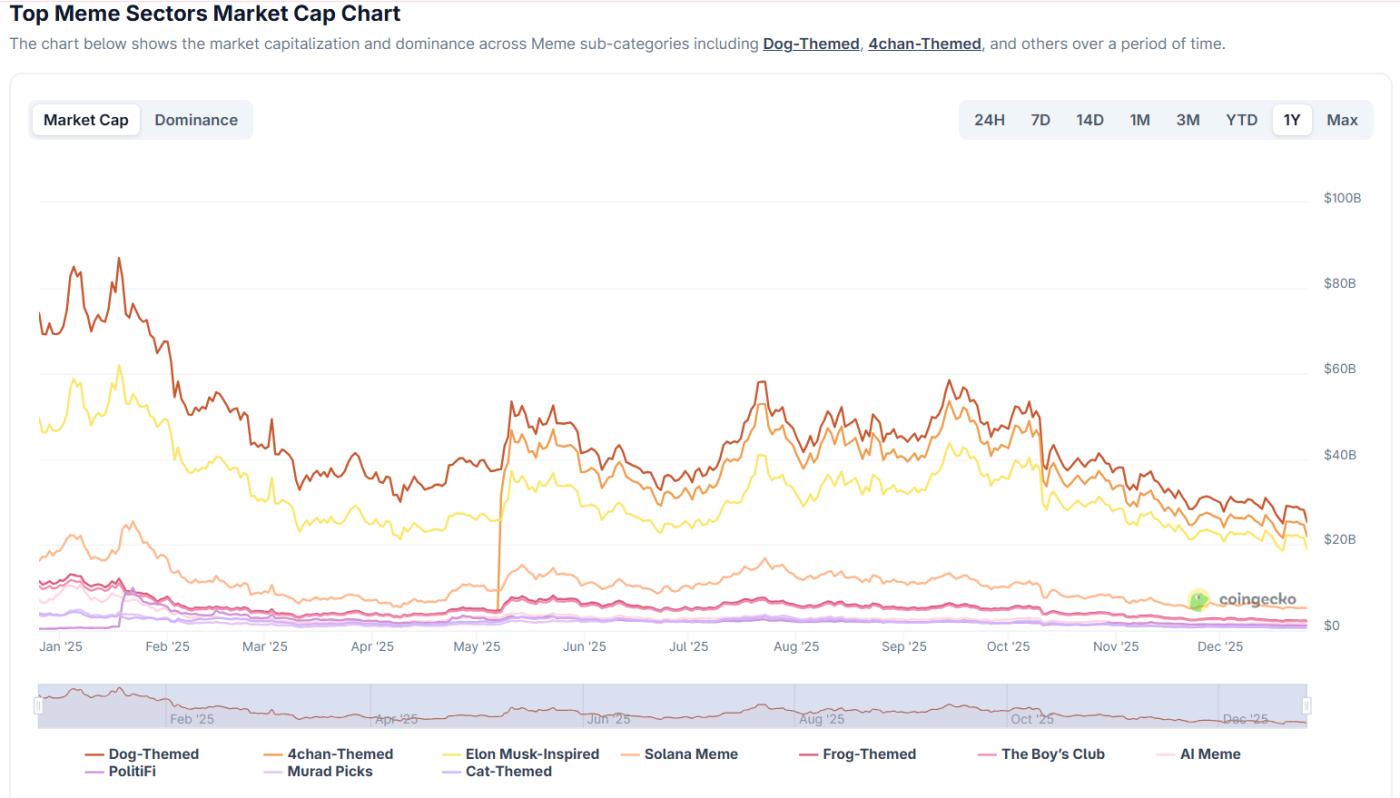

The industry's market Capital briefly surpassed $100 billion at the end of 2024, but then underwent a significant correction. However, by September 2025, the meme coin craze resurfaced at the end of the year, pushing the total market Capital close to $60 billion (accounting for approximately 2% of the entire crypto market).

AI bots and centralized exchanges (CEXs) may have contributed to price manipulation, with AI bots often exploiting thin liquidation and executing arbitrage trades.

OG names like Doge, SHIB, and PEPE still maintain market Capital of billions of dollars, while also developing many new applications as the field matures.

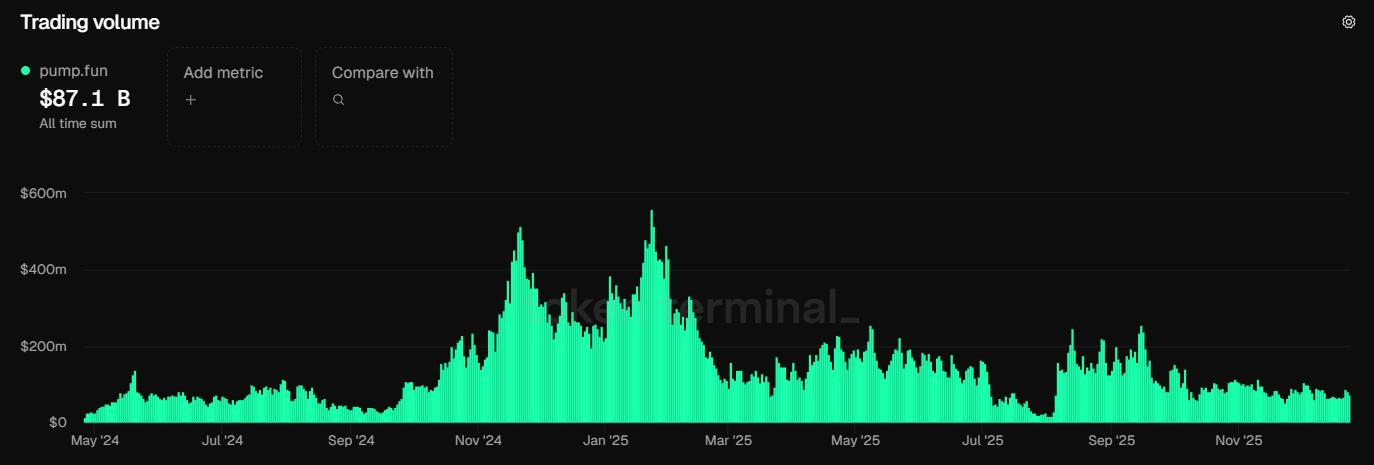

The 90% drop in volume on Pump.fun shows a shift in interest towards altcoins with practical applications, but the community expects the "craze" to return in 2026. Meme coins have captured 25% of investor interest, with their new definition as "emotional betting contracts".

Pump.fun. Source: Token Terminal

Pump.fun. Source: Token TerminalThe CoinGecko dashboard shows signs of a Dip in meme coin market Capital and a shift from hype to Token with practical applications, with nearly 2 million Token disappearing in Q1 alone.

Market performance of meme coins. Source: CoinGecko

Market performance of meme coins. Source: CoinGeckoThis latest meme coin craze is smarter but also carries more risks thanks to AI orchestration, clearly demonstrating the speculative nature of the crypto market.

The president supports crypto and regulations like the GENIUS Act.

Under President Donald Trump, also known as the "Crypto President," 2025 marks a new era of regulatory oversight for the sector. In particular, July 2025 saw the signing of the GENIUS Act .

This new law requires stablecoins to have a 1:1 reserve ratio, undergo regular audits, protect consumers, and not be XEM as securities, with Chia oversight between the OCC and the states.

Before the law was passed, the projected success rate was 68%, and Vice President JD Vance pledged to build a suitable legal framework. While the bill on market structure remained unpassed, leaving exchanges without clear direction, GENIUS was pushing forward the process of Tokenize assets.

Many feared the Trump family's actions would disappoint the community, but the passage of the law shows that America is choosing a rules-first approach. The FDIC has prepared for implementation, allowing banks to custodate digital assets. This has led to a 20-30% increase in the use of USDC and USDT, and the consolidation of issuers.

Globally, this Act has inspired emerging markets, while the EU XEM meme coins as high-risk assets. The FSOC's annual report has put this regulatory framework at the forefront. Investor Paul Barron argues that this move benefits altcoins and stablecoins, bringing the sector closer to the masses.

BeInCrypto has followed the Act's journey, from its passage through the House to the delays at the Treasury Department and loopholes such as Staking profit Chia . The more open regulatory climate – shifting from restrictive to facilitating – has unlocked trillions of dollars worth of potential, making 2025 a landmark year for crypto's maturation.

Looking back, 2025 will not only be the year of the crypto boom but also a turning point that will help digital assets establish their place in the future of the monetary sector.

With large institutions leading the market, treasury funds consolidated, meme coins constantly challenging boundaries and clear regulations, the market has become stronger, more open, and unstoppable.

As we enter 2026, the lessons from this period of change remind us that, in the crypto world, evolution is key to survival.