Blockchain security company PeckShield has just issued a warning about HNUT, a meme coin on Solana with the theme "Holly The Squirrel," after the Token plummeted 99% in value shortly after its launch.

This is yet another suspected Rug Pull scam to occur within the highly Capital Solana meme coin ecosystem.

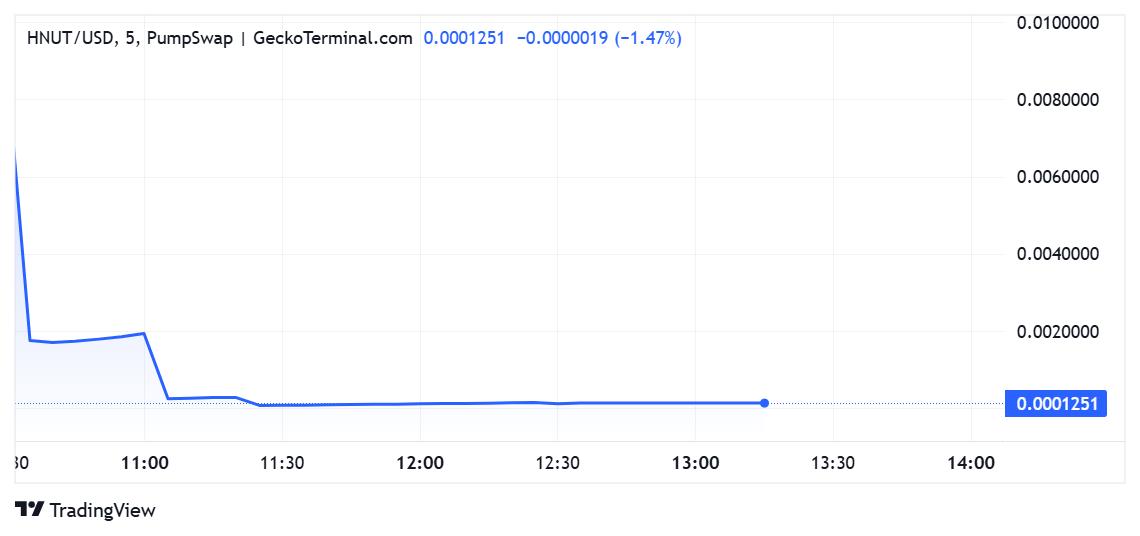

HNUT causes Rug Pull concerns after a 99% drop.

On his Twitter account X, PeckShield stated that HNUT on Solana had plummeted 99%, indicating a complete collapse in the Token price, almost wiping out its entire Capital capitalization.

The price of HNUT has fallen from its peak of nearly $0.007 to almost zero, with liquidation at around $29,000 and a market Capital of less than $1,400.

Price movements of Holly The Squirrel (HNUT). Source: GeckoTerminal

Price movements of Holly The Squirrel (HNUT). Source: GeckoTerminalThis Token was launched on the Pump.fun platform on Solana via this contract address . The Pump.fun project has recently attracted attention for allowing the rapid launch of meme coins but lacking sufficient security measures for small investors, especially towards the end of 2025.

on-chain data analysis of HNUT indicates that a large number of transactions were consolidated immediately after the Token was listed on the exchange.

According to reports, approximately 78% of the initial trading activity was bundle trading . This form of trading typically involves internal supply control, with multiple wallets coordinating to hoard Token, then simultaneously selling Dump , causing a price crash.

Early on-chain warnings reveal the increasing cost of ignoring risk indicators.

According to an on-chain investigator named Specter, the signs of the incident were very clear on the chain, and the structure of the HNUT launch allowed many experienced traders to predict the outcome from the start.

In fact, many warnings had appeared before the HNUT price crash. The Crypto Scam Hunter account had issued a scam alert the day before, pointing out bundle trading behavior and supply concentration as two prominent red flags.

This post also advises traders to stay away from HNUT, citing on-chain transaction logs showing multiple wallets transferring Token simultaneously to a single address, which is XEM as a "stepping stone" before withdrawing liquidation from the project.

Following the price crash, other risks emerged. Many community monitoring channels recorded fake Airdrop scams on X, aiming to exploit the trust of affected investors by pretending to offer "recovery support" tools or fake money-making links. This tactic has become increasingly common after large-scale Rug Pull .

The true extent of losses for traders is difficult to determine based solely on publicly available data. The 99% drop in price so quickly nearly wiped out the assets of late-entering retail investors, while those who entered early may have managed to lock in profits before the price plummeted.

The HNUT incident highlights the inherent risks still present in the Solana meme coin market. Liquidation control, contracts that haven't relinquished their management rights, and LP Token that haven't been burned mean the development team or insiders could easily "exit" the market at any time.

With the meme coin market booming in 2026 , investors need to carefully check factors such as: whether the contract has been abandoned, whether liquidation has been locked, and how it is allocated within the wallet. This is especially important when participating in platforms that launch Token extremely quickly, Capital speed over security.