Source: Decrypt

Compiled and edited by: BitpushNews

When law enforcement officers armed with chainsaws stormed BitcoinATMs on the street, and when fraudulent amounts surged by 99% in a year, 2025 became the "year of demolition" for the cryptocurrency ATM industry. This nationwide crackdown on 30,750 machines has exposed the most realistic scars of the crypto world—and the most vulnerable elderly are becoming the biggest victims of this "cash for nightmare" game.

In 2025, Bitcoin and cryptocurrency ATMs will face stricter scrutiny as U.S. authorities and lawmakers try to address the growing number of fraud cases facilitated by these machines.

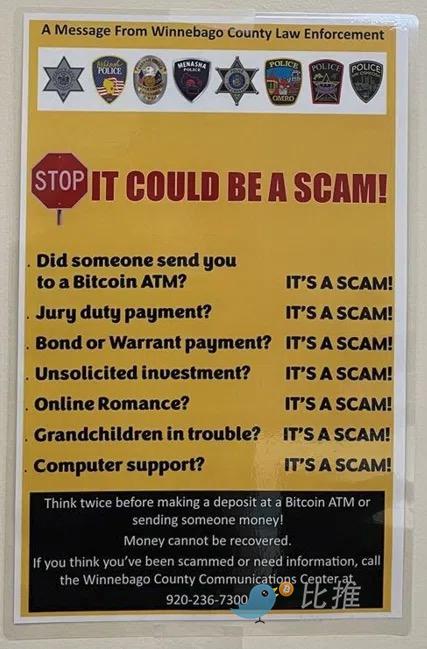

Some law enforcement officials resolved the issue " manually " with chainsaws , while two state attorneys general filed lawsuits against several of the largest companies in the sector. Meanwhile, multiple agencies and other entities issued consumer warnings targeting senior citizens.

Cryptocurrency ATM operators say their machines offer a valuable service, allowing anyone to buy digital assets like Bitcoin with cash. However, critics argue that these companies could have done more to prevent older Americans from losing money to scams—even if it would have been detrimental to their business.

Scam: "Victims are elderly people"

According to an annual report, Americans reported $246 million in losses to the Internet Crime Complaint Center last year due to cryptocurrency ATMs, a 99% increase from the previous year. Approximately 43% of these losses came from Americans aged 60 and older.

The scam is quite straightforward: seniors withdraw cash from their bank accounts, convert it into cryptocurrency using a mobile operator's machine, and then send it to people posing as government, business, or technical support personnel.

However, some versions of the scam are more "creative," including a case in Massachusetts where residents lost money after being asked to pay in cryptocurrency under the pretext of "failure to fulfill jury obligations."

The irreversible nature of cryptocurrency transactions makes it difficult for victims to recover their funds after the scammers disappear, and the user agreement details associated with these machines have become another potential obstacle in court.

For example, in two cases heard this year, the Iowa Supreme Court found that a cryptocurrency ATM operator was entitled to retain cash related to fraud because the company’s terms and services required users to declare that they owned the digital wallets receiving the funds—not third parties.

“Once the transaction is complete, and the user inserts cash and their chosen wallet receives the cryptocurrency deposit, our involvement in the transaction ends,” Chris Ryan, chief legal officer of cryptocurrency ATM operator Bitcoin Depot , told Decrypt in June.

Bitcoin Depot is working with local law enforcement to track down victims' cryptocurrency, but Ryan says authorities are creating more victims by sabotaging the company's equipment, resulting in at least a dozen cases of property damage and cash loss each year.

That same month, police officers in Jasper County, Texas, used a chainsaw to "cut open" a Bitcoin Depot terminal at a rural gas station and retrieved $32,000 in cash. Bitcoin Depot maintains the money belongs to the company, while police believe it is stolen money being returned to victims.

"Common sense guardrails"

In Iowa, Bitcoin Depot and its rival CoinFlip are facing pressure from Iowa Attorney General Breonna Bird. According to a fact sheet, she filed a lawsuit against the two companies in February, accusing them of profiting from scam victims while charging “enormous, hidden transaction fees.”

Criticism of hidden fees was later echoed by Washington, D.C. Attorney General Brian L. Schwarb, who filed a lawsuit in September against cryptocurrency ATM operator Athena Bitcoin. He alleged that, in some cases, residents of the federal district paid undisclosed fees of up to 26%.

Schwalbe's lawsuit accuses Athena of exploiting the elderly and violating consumer protection laws, arguing that the warnings displayed on the company's machines are irrelevant given the circumstances under which most victims come into contact with them.

The lawsuit states: "The elderly victims of the scam, standing in the gas station in a state of panic with unsettlingly large amounts of cash in their pockets, did not understand what it meant to 'generate' a cryptocurrency wallet or have their own 'personal Bitcoin wallet'."

An Athena spokesperson told Decrypt that the company strongly disagrees with the allegations and will defend itself in court. Bitcoin Depot and CoinFlip denied the allegations in the Bird lawsuit, while emphasizing procedures such as identity verification and transaction fee refunds to ABC News.

This year, Senator Dick Durbin (Democrat, Illinois) introduced the Cryptocurrency ATM Fraud Prevention Act. This legislation would impose strict transaction limits on cryptocurrency ATMs and require companies to provide full refunds if victims report losses within a certain period.

Durbin stated that the legislation includes "common sense safety barriers" to protect the elderly, but it has made no progress since it was introduced in the Republican-controlled Senate in February.

State Actions

Despite the lackluster federal efforts to regulate cryptocurrency ATMs this year, more than a dozen states have drafted or passed bills or regulations requiring restrictions on transactions, fraud warnings and refund options, or new licensing requirements, according to data from the American Association of Retirees.

In June, the nonprofit focused on senior citizens in the United States found that 20 states had taken action to address the growing number of scams fueled by cryptocurrency ATMs, noting that it "continues to work with legislators in other states to take similar safeguards to prevent fraud using cryptocurrency self-service terminals."

At the time, city councilors in Spokane, Washington, had just passed a citywide ban on cryptocurrency ATMs, affecting about 50 self-service terminals in the area.

A few months later in August, Illinois became the first Midwestern state to pass a bill aimed at curbing fraud related to cryptocurrency ATMs, requiring ATM operators to register with state regulators, capping transaction fees at 18%, and setting a daily transaction limit of $2,500 for new users.

That same month, the U.S. Treasury Department’s Financial Crimes Enforcement Network issued an urgent warning about cryptocurrency ATMs, stating that “the risk of illicit activity increases if operators fail to maintain appropriate procedures in accordance with the Bank Secrecy Act.”

According to data from Coin ATM Radar, as of mid-November, approximately 30,750 cryptocurrency ATMs had been installed across the United States, representing 78% of all self-service terminals globally. Nevertheless, the total number of machines worldwide has hovered around 40,000 since 2022.

Local governments in the United States have been seeking to restrict cryptocurrency self-service terminals, but some countries have taken comprehensive safeguards. For example, New Zealand announced a nationwide ban on such machines in June as part of efforts to curb criminal financing.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush