Throughout December, the price of Ethereum (ETH) fluctuated within a narrow range around $3,000, suggesting the possibility of an imminent major change. However, on-chain data revealed unusual signals.

What are these signals, and do they have a positive or negative impact on the price of ETH?

Ethereum transaction volume surged in December.

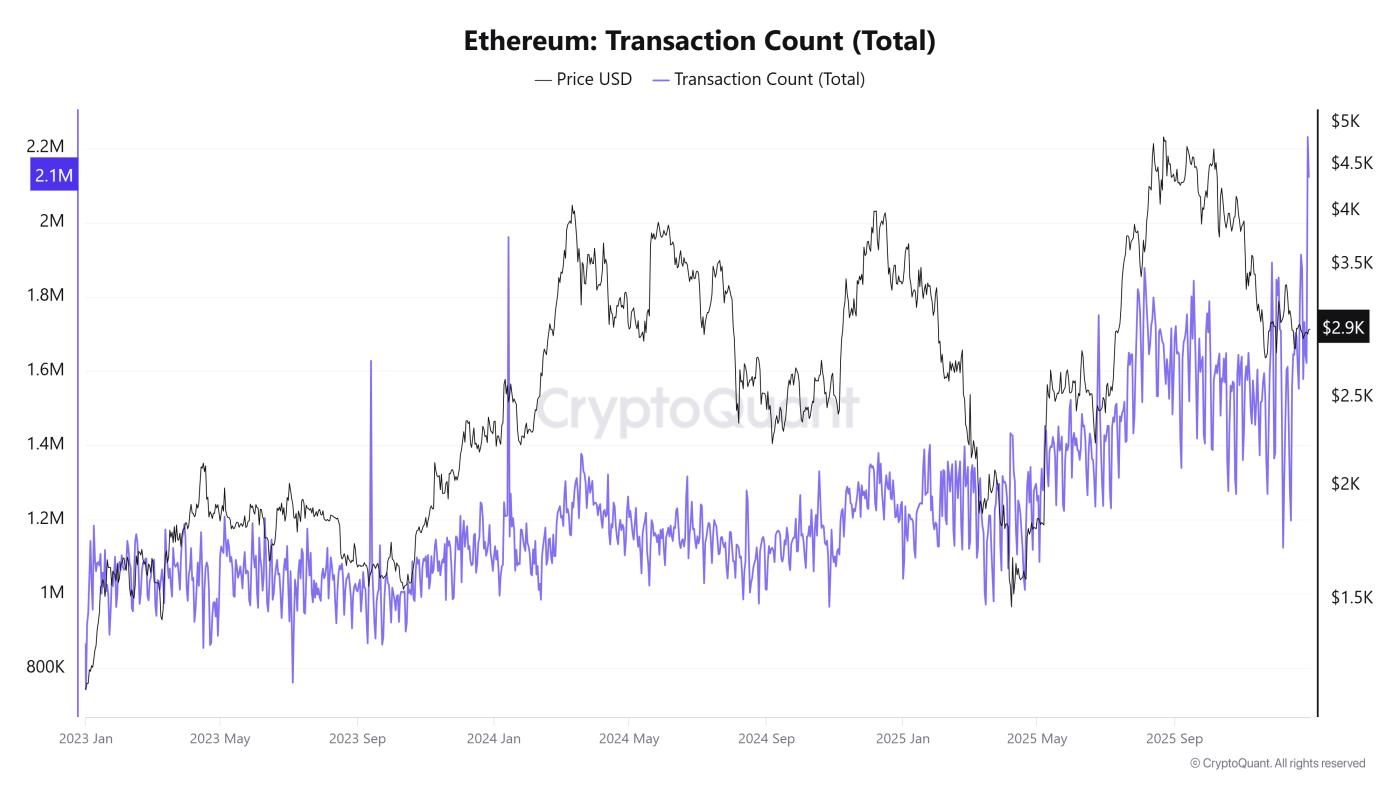

According to data from CryptoQuant, in the last days of December, the number of transactions on the Ethereum network surged dramatically. The number of daily transactions exceeded 2.1 million, the highest figure since 2023.

Data from Etherscan shows this is also a record in the last 10 years.

Number of transactions on Ethereum (Total). Source: CryptoQuant

Number of transactions on Ethereum (Total). Source: CryptoQuantNotably, this surge occurred while the price of ETH had plummeted from over $4,500 to around $2,900. This highlights a significant discrepancy between price movements and network usage activity.

The surge in trading volume could reflect large-scale ETH movement, and also suggest that holder may be preparing for a specific strategy.

“Ethereum just processed 2,230,801 transactions in a single day, the highest in its 10-year history. Transaction fees were under $0.01. Processing times were stable, no congestion, no drama. After years of focusing on expansion, usage is returning to L1. Good performance will bring users back,” commented investor BMNR Bullz.

According to an analysis by an author from CryptoQuant, such spikes are often a sign of panic selling when occurring within a downtrend. However, if supported by positive fundamental factors, this indicates growth potential for ETH.

Even if this signal is neutral, it could still lean more toward a positive direction. Two additional data points support this view.

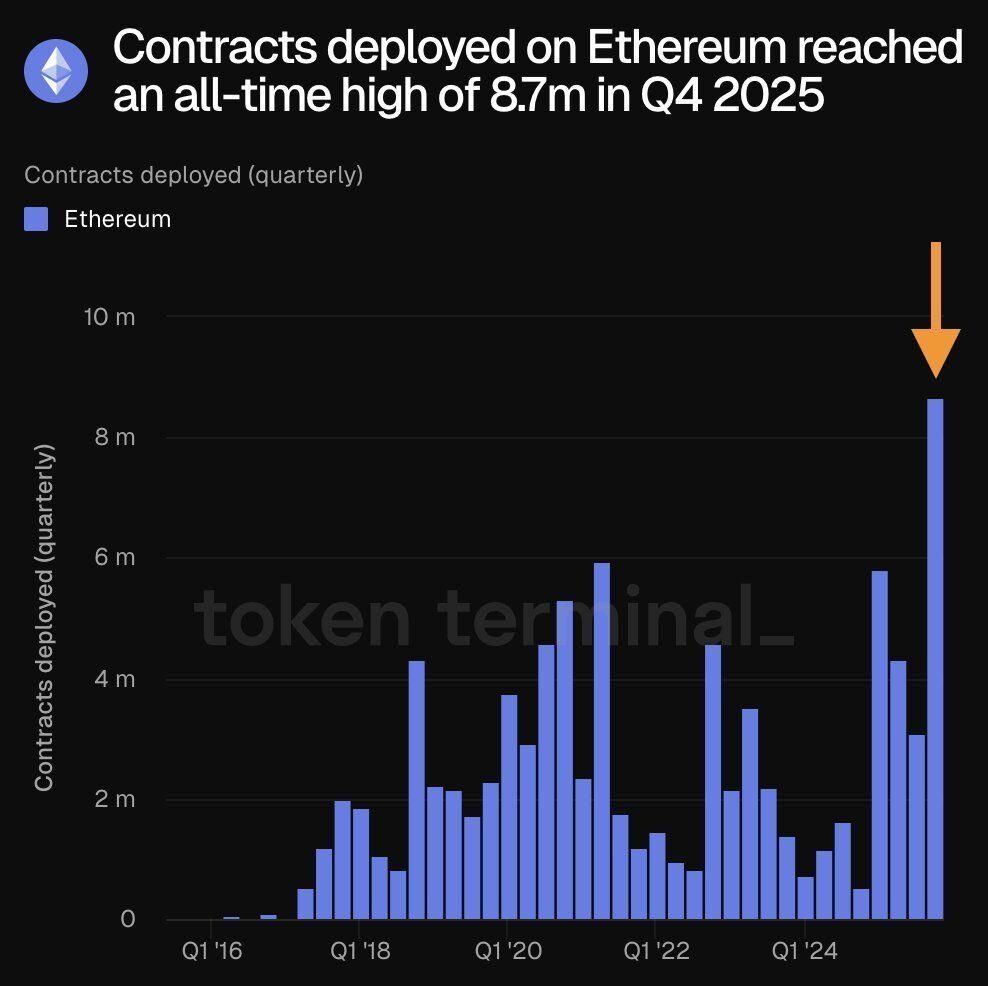

First, the number of smart contracts deployed on Ethereum has reached an all-time high. In Q4 2025, more than 8.7 million new contracts were launched, setting an all-time record.

Number of smart contracts deployed on Ethereum in Q4 2025. Source: Token Terminal

Number of smart contracts deployed on Ethereum in Q4 2025. Source: Token TerminalThis number has surged compared to previous quarters, indicating a rapidly expanding ecosystem. This is also the reason for the increased demand for ETH transfers.

More and more developers are using Ethereum as a payment layer. The main drivers of this growth are the Tokenize of real-world assets (RWA), stablecoin activity , and the development of core infrastructure.

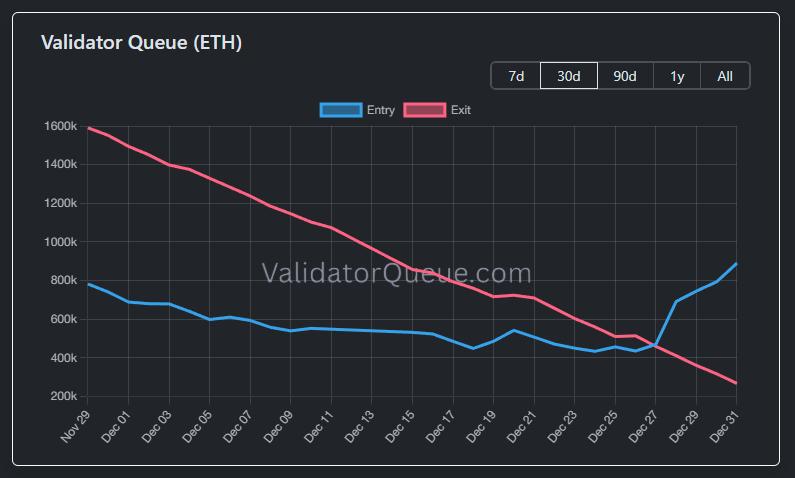

The second factor is the increasing amount of ETH waiting to be Stake . At the end of December, the number of ETH in the validation queue continued to rise, totaling 890,000 ETH awaiting Stake . Bitmine 's ETH Stake activity may be the reason for this sharp increase.

Validation queue ( ETH). Source: Validator Queue

Validation queue ( ETH). Source: Validator QueueThe increase in ETH being Stake also coincided with a period when the network recorded an unusually high volume of transactions. This timing helps explain the aforementioned surge.

Despite many positive signals from on-chain data, the price of ETH remains around $3,000. Recent analysis from BeInCrypto suggests that ETH is forming a bearish pattern and is under strong selling pressure from US investors .