Over the past year, Dogecoin (DOGE) has matured beyond a simple meme coin and gained recognition as a reserve asset. However, as 2026 begins, several signals suggest that DOGE prices could continue to fall and establish a new low.

What are these signals, and what can investors expect from DOGE in 2026?

Low Demand for DOGE ETFs, With Most Trading Days Showing Zero Net Flows

In the final hours of 2025, DOGE dropped below $0.12. The year ended with a decline of more than 70% from its peak.

Weak buying pressure prevented an immediate rebound. Prices remained below $0.12 on the first trading days of 2026.

Spot Dogecoin ETFs, launched in the United States in late November 2025, are struggling to attract capital.

Total DOGE Spot ETF Net Inflow. Source: SoSoValue

Total DOGE Spot ETF Net Inflow. Source: SoSoValueAccording to SoSoValue data, since trading began on November 24, DOGE ETFs have recorded zero net flows on most days. Total net assets currently stand at only about $5.07 million. This is the lowest level among all US crypto ETFs.

This trend reflects a lack of interest from both institutional and retail investors. The situation contrasts sharply with the stronger performance of XRP and SOL ETFs.

Without fresh ETF inflows, DOGE lacks upward momentum. Prolonged selling pressure continues to weigh on the price. If this situation extends into 2026, DOGE may struggle to recover in the near term.

“Weak ETF demand and declining futures open interest reinforce the ongoing sell-off,” investor Marzell said.

Potential Selling Pressure as DOGE Reserves on Binance Remain High

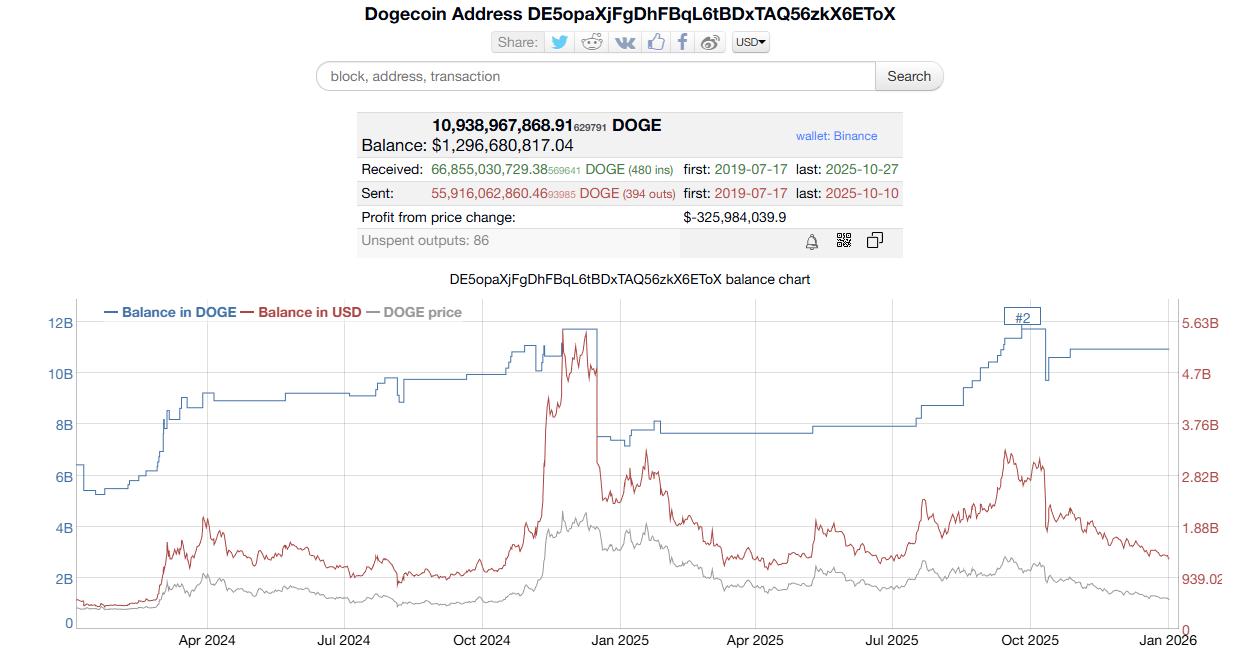

Second, the Dogecoin wallet address of Binance (DE5…ToX), one of the largest holders of DOGE, indicates that balances have risen again in the second half of 2025. This trend suggests potential selling pressure.

DOGE Balance in Binance Wallet Address. Source: Bitinfocharts

DOGE Balance in Binance Wallet Address. Source: BitinfochartsData from Bitinfocharts indicates that DOGE holdings in this wallet rose from 7.9 billion to 10.9 billion during 2025. Historical trends indicate that balances exceeding 11 billion frequently coincide with peaks in DOGE prices.

In a strong market, rising exchange balances can support the redistribution of wealth to new investors. In a low-demand environment, however, high DOGE reserves on exchanges create constant sell-side risk.

Weak Retail Interest While DOGE-Treasury Firms Struggle With Losses

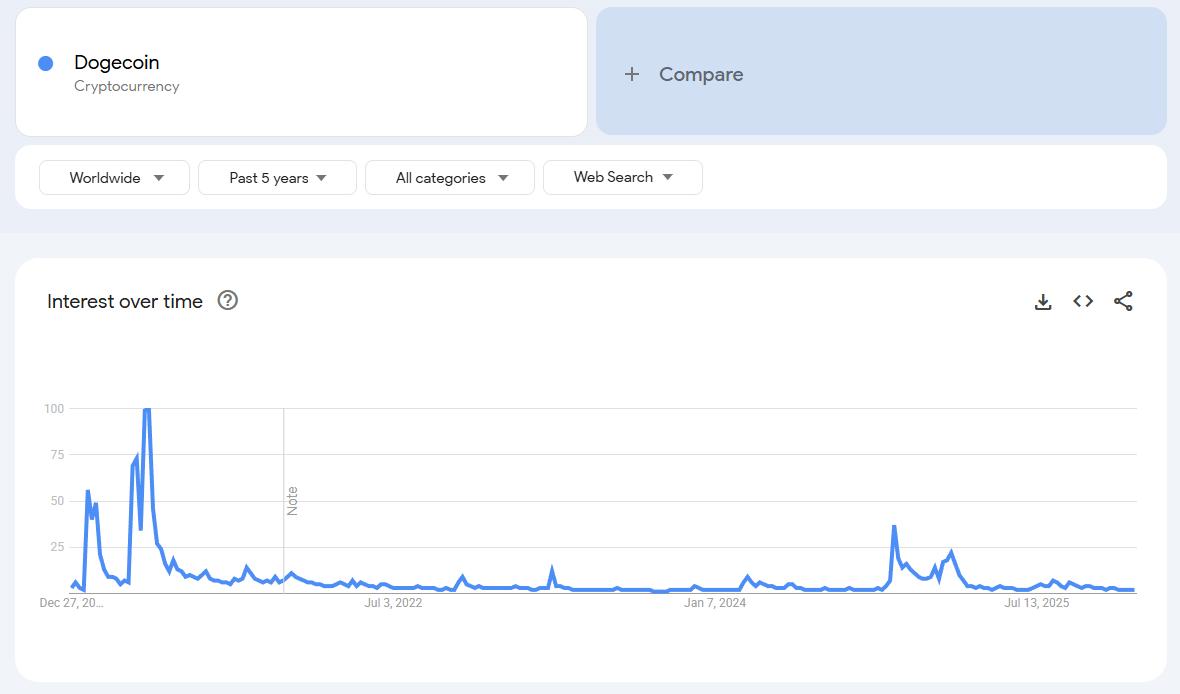

Third, interest in Dogecoin on Google Trends has fallen to its lowest level in five years. This decline mirrors a broader trend across most altcoins.

Dogecoin’s Search Index on Google Trends. Source: Google Trends

Dogecoin’s Search Index on Google Trends. Source: Google TrendsDOGE has traditionally attracted retail investors. Reduced interest means fewer new participants. Liquidity weakens, and prices become more vulnerable to sharp swings.

Some companies, including CleanCore Solutions and BitOrigin, have accumulated DOGE as a reserve asset. Current conditions suggest these positions are under pressure.

BitOrigin purchased DOGE at around $0.22. CleanCore Solutions reported on October 6, 2025, that it held more than 710 million DOGE, with over $20 million in unrealized gains at the time. Since then, DOGE has fallen more than 50% from its October levels. CleanCore Solutions’ stock has dropped 90%, signaling that investors remain unconvinced by the DOGE reserve strategy.

“CleanCore Solutions (ZONE) stock is now down 95% over the past three months. This is a stain on the Dogecoin name,” investor KrissPax said.

Despite these negative signals, a BeInCrypto report notes that long-term holders are showing signs of accumulation. For this group, further price declines appear to represent buying opportunities rather than capitulation.