Ethereum's price has been trading sideways since the end of December 2025, still struggling to establish a clear trend. ETH has repeatedly tested resistance zones but has yet to confirm a new trend.

Despite relatively stable prices, the sentiment of many investor groups has gradually improved. This suggests that the accumulation phase is nearing its end as market confidence begins to recover.

Ethereum investors are excited as 2026 begins.

Ethereum ETFs ended 2025 on a positive note after a volatile December. Spot ETH ETFs recorded total inflows of $67 million, reversing a nearly two-week streak of Capital . This shift suggests institutions have returned to the market after a period of caution due to macroeconomic uncertainty.

The return of Capital suggests that large investors may be preparing for the new year. Despite the cautious sentiment in December, the early 2026 inflows indicate expectations of a price rebound for Ethereum. ETF activity also typically reflects long-term confidence, reinforcing the view that selling pressure is easing among most investors in the market.

Want to stay updated on Token every day? Sign up for editor Harsh Notariya's Daily Crypto newsletter here .

Capital inflow into Ethereum ETFs. Source: SoSoValue

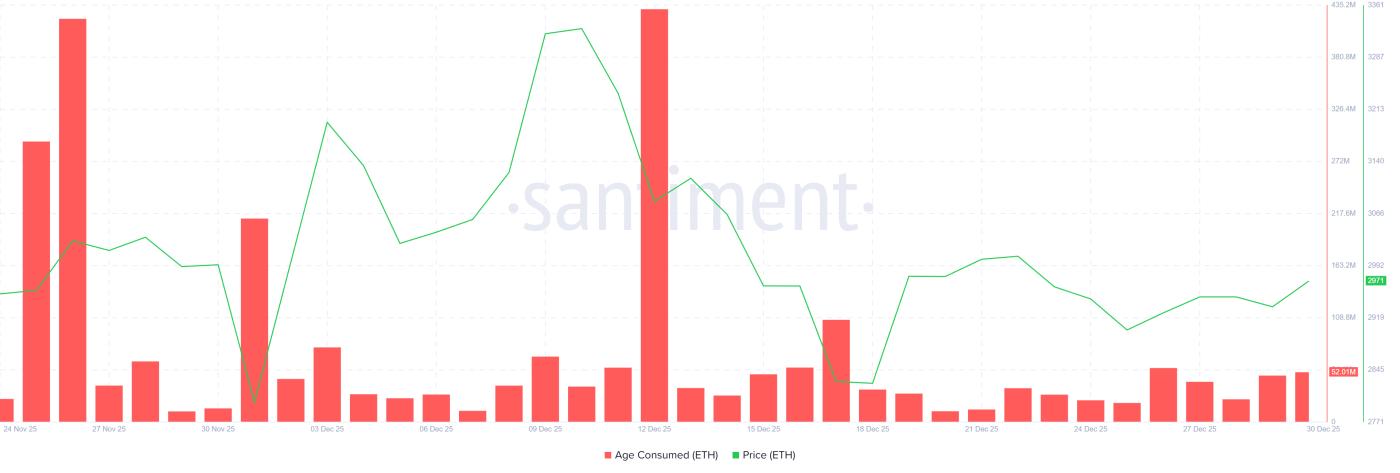

Capital inflow into Ethereum ETFs. Source: SoSoValueon-chain data also supports the rising positive sentiment. The Coin Days Destroyed (CDD) index showed only one notable increase throughout December. Otherwise, the indicator remains fairly stable, suggesting that long-term holders haven't made significant selling moves.

CDD tracks the time a coin is held before a move, often reflecting selling activity from experienced investors. Long-term ETH holders appear reluctant to sell, even though ETH hasn't surpassed $3,000 for over two weeks. This suggests they are confident in higher future prices and reduces short-term supply pressure.

Ethereum HODLer position fluctuations. Source: Glassnode

Ethereum HODLer position fluctuations. Source: GlassnodeETH price continues its tense relationship from 2025 onwards.

At the time of writing, Ethereum is trading around $2,975, just below the $3,000 resistance level. This price level held ETH back for much of ETH 2025. A strong breakout would confirm a return to an uptrend.

Positive holding sentiment could help Ethereum's price break through $3,000 in the first week of 2026. Continued accumulation along with stable ETF Capital will provide further impetus. If the resistance is successfully broken, ETH could target $3,131, coinciding with the old resistance zone which may now become a new support zone.

ETH price analysis. Source: TradingView

ETH price analysis. Source: TradingViewHowever, downside risk remains in an unstable market. If the entire market experiences a sharp correction, the price of ETH could fall to around $2,902. If selling pressure increases, ETH could drop even further to $2,796, at which point the uptrend would be broken and investors would shift to a more defensive stance.