Over the past year, Dogecoin (Doge) has transformed and is no longer just a meme coin, but is also known as a store of value asset. However, as we enter 2026, there are many signs that the price of Doge may continue to fall and establish a new Dip .

What are the reasons behind these signals, and what can investors expect regarding Doge 's price movements in 2026?

Demand was low for the Doge ETF, with most trading days seeing no net Capital .

In the final hours of 2025, Doge had fallen below $0.12. The year ended with a drop of over 70% from its previous peak.

Weak buying pressure prevented Doge price from recovering immediately. During the first few trading days of 2026, Doge price remained below $0.12.

The Spot Dogecoin ETF, launching in the US at the end of November 2025 , is also struggling to attract investment.

Total inflows into the Doge Spot ETF. Source: SoSoValue

Total inflows into the Doge Spot ETF. Source: SoSoValueAccording to data from SoSoValue, since this ETF began trading on November 24th, the Doge ETF has consistently recorded zero net inflows. Its total net assets currently stand at approximately $5.07 million – the lowest among cryptocurrency ETFs in the US.

This trend reflects a lack of interest from both institutional and retail investors. This is in stark contrast to the better performance of XRP and SOL ETFs.

Without additional inflows from ETFs, Doge will struggle to maintain its upward momentum. The persistent selling pressure continues to weigh on the price. If the situation remains unchanged in 2026, Doge may face difficulties in recovering in the short term.

"Weak demand from ETFs coupled with continuously falling open interest in the Derivative market are the main reasons why selling pressure continues," investor Marzell commented .

Potential selling pressure exists as Doge reserves on Binance remain high.

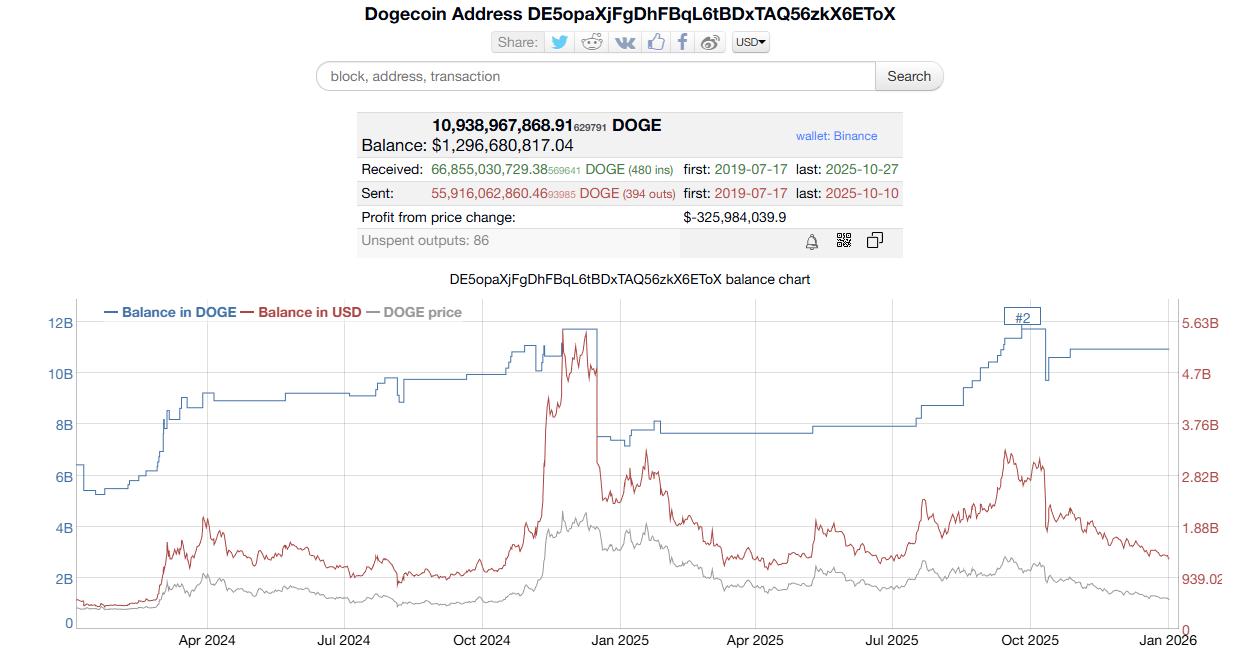

Secondly, Binance's Dogecoin wallet address (DE5…ToX), one of the largest holders of Doge , recorded a rebound in balance in the second half of 2025. This trend suggests the potential for selling pressure.

Doge balance in Binance wallet. Source: Bitinfocharts

Doge balance in Binance wallet. Source: BitinfochartsData from Bitinfocharts shows that the amount of Doge in this wallet increased from 7.9 billion to 10.9 billion in 2025 alone. Previous statistics show that when the balance exceeds 11 billion, it usually coincides with the peak price of Doge.

In a bull market, a large amount of coins on exchanges can help redistribute assets to new investors. However, when demand is weak, large Doge reserves on exchanges can create a risk of persistent selling pressure.

Weak interest from retail investors while the companies holding Doge shares are struggling with losses.

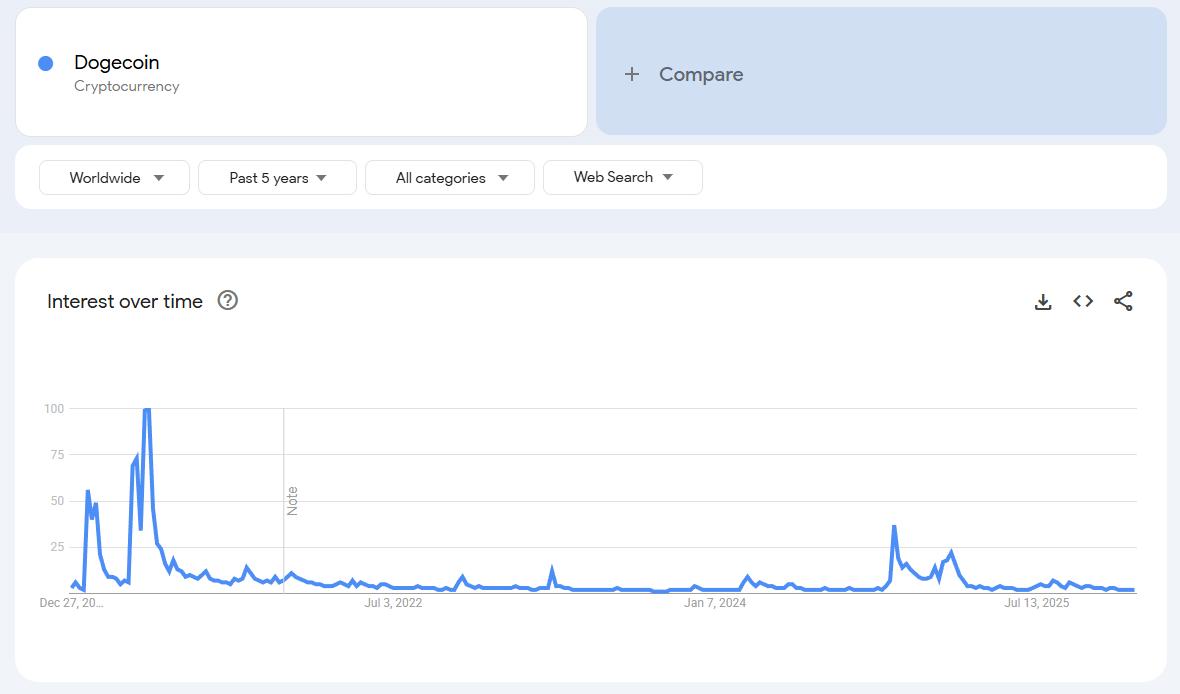

Third, interest in Dogecoin on Google Trends has dropped to its lowest level in the past 5 years. This is also a general downward trend for most other altcoins .

Dogecoin search index on Google Trends. Source: Google Trends

Dogecoin search index on Google Trends. Source: Google TrendsPreviously, Doge often attracted the attention of retail investors. As demand decreased, the number of new participants also declined. This led to a decrease in liquidation and made the price of Doge more volatile.

Some companies , such as CleanCore Solutions and BitOrigin, have accumulated Doge as a reserve asset. However, given current market conditions, these positions are under significant pressure.

BitOrigin purchased Doge at approximately $0.22 . CleanCore Solutions reported on October 6, 2025, that it held over 710 million Doge with unrealized gains exceeding $20 million at the time of writing. Since then, Doge has fallen more than 50% from its October price. CleanCore Solutions' stock has also dropped by as much as 90%, indicating that investors still lack confidence in the Doge holding strategy.

“CleanCore Solutions (ZONE) stock has now dropped 95% in the last three months. This is a real stain on the Dogecoin name,” said investor KrissPax.

Despite these negative signs, according to a BeInCrypto report, long-term investors are still accumulating . For this group, the continued price drop is XEM as a buying opportunity rather than a sell-off.