Over $2.2 billion worth of Bitcoin and Ethereum options contracts will expire today, marking the first major Derivative settlement of 2026.

With both assets trading around key price levels, this event is attracting particular attention from traders, who are awaiting price movements after contract settlements and early signals for the new year.

Over $2.2 billion worth of Bitcoin and Ethereum options contracts were settled in the first major Derivative event of 2026.

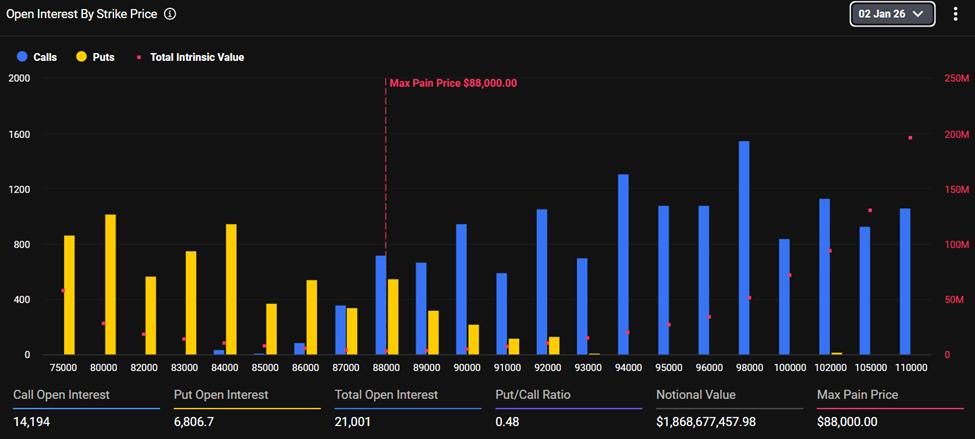

Bitcoin accounts for the majority of the notional value, with approximately $1.87 billion worth of contracts related to BTC. At the time of writing, Bitcoin is trading near $88,972 , slightly above its “max pain” of $88,000.

Open interest data shows 14,194 call contracts compared to 6,806 put contracts, for a total open interest of 21,001 with a put/call ratio of 0.48. This divergence indicates that the market remains bullish, with most traders betting on higher prices rather than hedging against downside risks.

Bitcoin options are about to expire. Source: Deribit

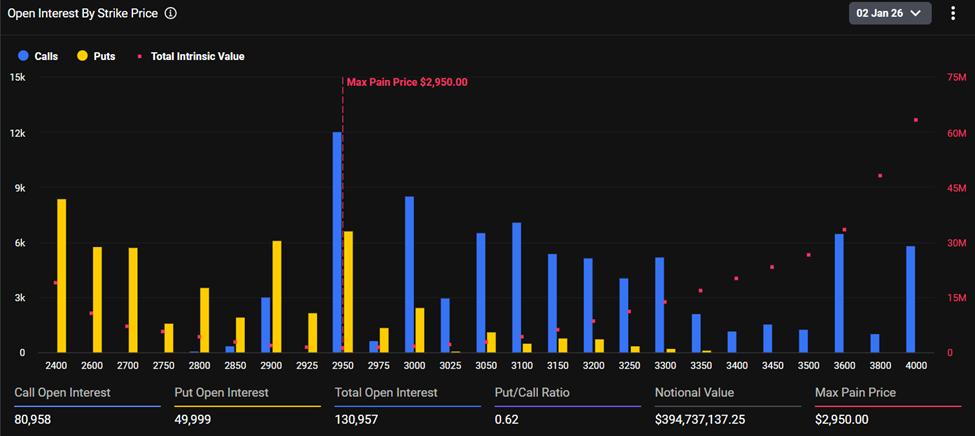

Bitcoin options are about to expire. Source: DeribitEthereum options are worth approximately $395.7 million. ETH is currently trading around $3,023 , slightly above its “max pain” level of $2,950.

Ethereum's total open interest remains high with 80,957 call contracts compared to 49,998 put contracts, bringing the total number of open contracts to 130,955 and the put/call ratio to 0.62.

Ethereum options are about to expire. Source: Deribit

Ethereum options are about to expire. Source: DeribitAlthough the bullish bias in Ethereum isn't as strong as in Bitcoin, the market structure still reflects cautious optimism rather than a defensive stance against downside risks.

Option expiration dates are crucial moments in the Derivative market. When a contract expires, traders must decide whether to exercise their option or cancel the contract, often causing prices to concentrate around the “max pain”—the point at which many contracts will expire unprofitable.

These price levels typically benefit the option seller, who will pay less if the price moves around the "max pain" points.

Why the first major options contract expiration of 2026 could shape market volatility.

This option settlement is all the more significant because it marks the first major Derivative contract expiration of 2026, potentially shaping market sentiment for the next quarter.

History shows that major options events are often the "key" to triggering sharp price movements, especially when spot prices significantly exceed or fall far below the "max pain" zone.

Market position data further reinforces the bullish outlook. Bitcoin Block trades, often associated with institutional investor strategies, show that call contracts account for 36.4% of total volume compared to 24.9% for put contracts.

With Ethereum, Block Trade trade volume is even more skewed, with call contracts accounting for 73.7% of the total volume. This indicates that many investors are betting on long-term strategies rather than short-term speculation.

The optimistic trend isn't limited to contracts expiring near the end of the year. Bitcoin options volume is concentrated on March and June 2026 maturities, while Ethereum is attracting consistent interest across quarterly maturities throughout the year.

These signals suggest that traders are both preparing for short-term volatility and betting on the possibility of broader price increases in the coming months.

However, the concentration of numerous expiring contracts also poses risks. As hedged positions begin to be liquidated, price stability could decrease, especially if spot prices move away from key strike levels.

The current optimistic trend creates a dichotomy: if the price doesn't surge strongly, many call contracts will expire worthless, while if Bitcoin or Ethereum continues to rise, a strong upward wave could occur due to the "gamma" effect.

As traders shift positions and reassess portfolio risk, developments following this expiration could shape the level of volatility for the Bitcoin and Ethereum markets over the weekend.

Whether optimistic sentiment will help prices maintain their upward momentum or will encounter resistance will become clearer once the effects of Derivative are fully resolved.