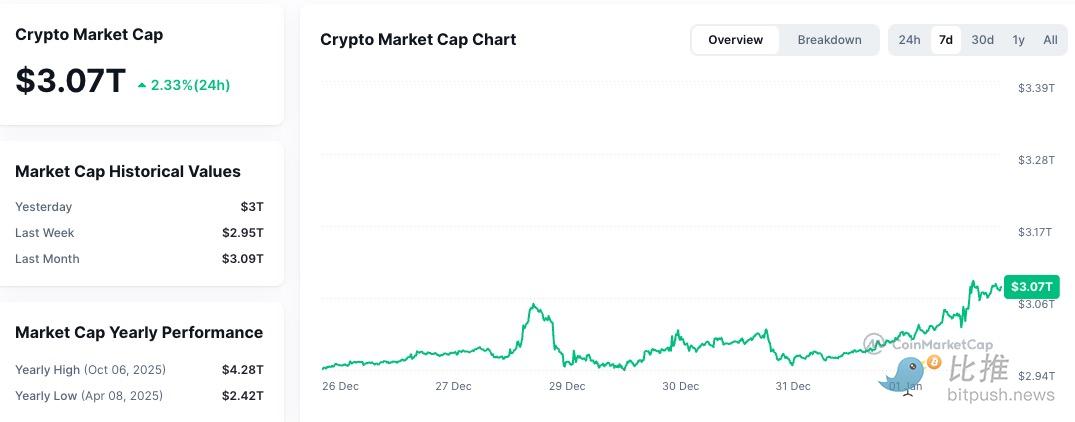

After a near-stagnant two-week holiday period, the crypto market saw a significant rebound on the second trading day of 2026 .

On January 2, Bitcoin rose to over $90,700, a daily increase of about 2%; Ethereum rose by more than 4%, reaching the $3,100 mark.

Meanwhile, the meme coin sector collectively strengthened: PEPE rose by more than 30% at one point during the session, and established meme coins such as DOGE and FLOKI also rebounded, leading to a significant recovery in market risk appetite.

According to CoinMarketCap data, as of that day, the total market capitalization of crypto assets was approximately $3.07 trillion, a 24-hour increase of about 2.33%; total market trading volume rebounded to over $120 billion. Structurally, Bitcoin accounted for approximately 57% of the market capitalization, and Ethereum for approximately 11.9%, with mainstream assets still dominating, but highly volatile sectors have already begun to move.

A typical "risk appetite test"

The surge in MIME coins' price in this round of market activity is not an isolated event, but rather the result of the combined effects of market phase, capital flows, and narrative mechanisms. From a higher perspective, the current crypto market is still in a transitional phase before trend confirmation.

Bitcoin and Ethereum saw a modest rebound, but have yet to break through key structural levels;

The overall trend in Altcoin is towards recovery, with no systemic rotation yet observed.

Trading volume rebounded, but it is still lower than the volume levels seen at the beginning of previous bull markets.

During this phase, funds tend to test risk appetite at a lower cost rather than making long-term bets on "slow-moving" assets.

Meme coin possesses precisely this structural advantage: it is highly elastic, responds quickly, and has low requirements for fundamentals, making it the most sensitive price carrier to changes in risk sentiment.

The role of memes: a risk "thermometer"

In the cryptocurrency market, Meme has long played a role similar to a "high-volatility option":

A unit of capital has a strong ability to influence prices.

The surge was largely driven by sentiment and traffic.

A trend can form without fundamental improvement.

Therefore, when the market shifts from "extreme defense" to "cautious offense", memes often become the first assets to be bought.

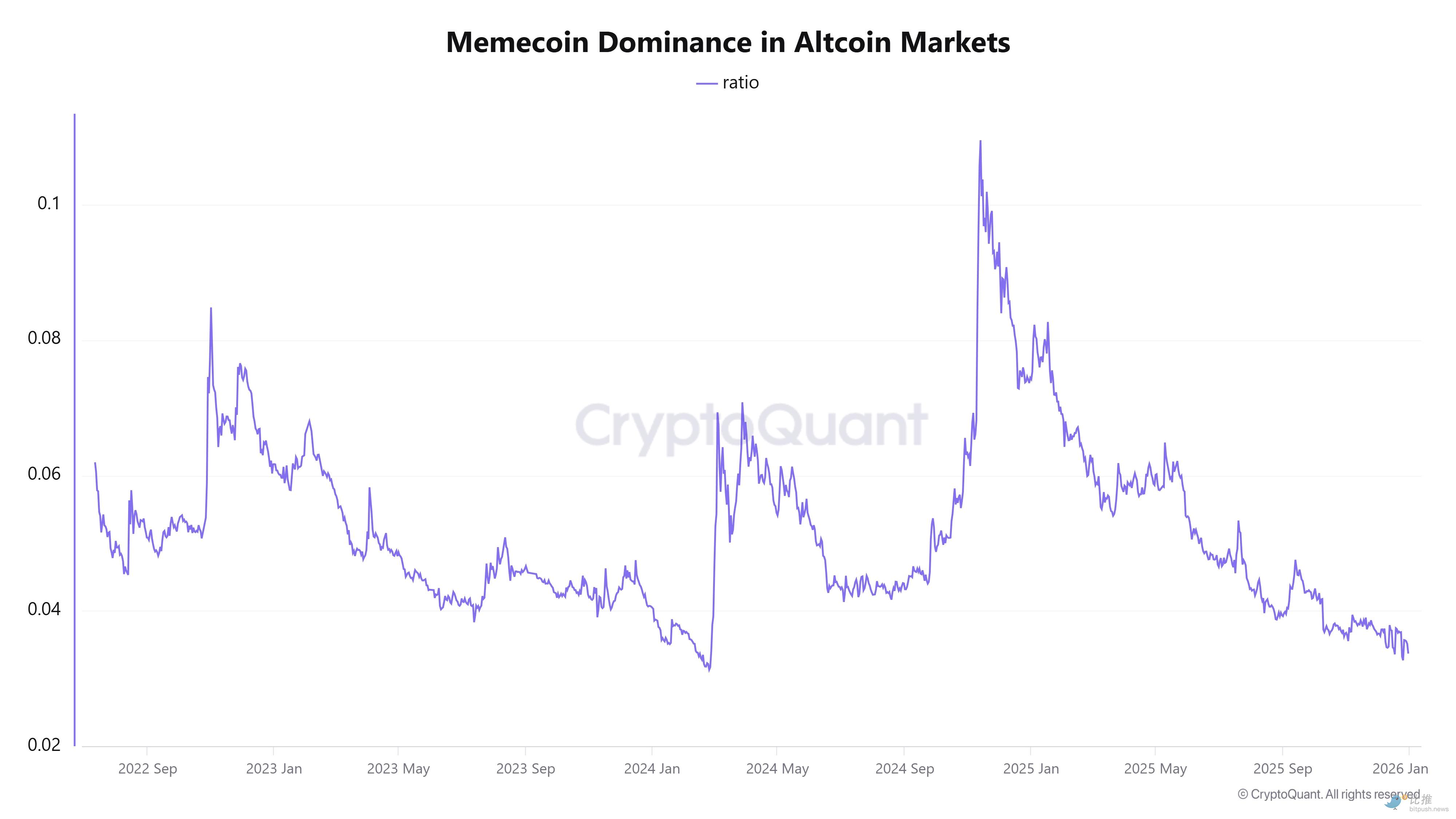

On-chain data also confirms this. According to CryptoQuant's statistics, although meme coins have seen significant gains recently, their market capitalization as a percentage of the overall Altcoin remains at a historically low level, and the structural expansion seen in previous meme seasons has not yet occurred.

The beginning-of-year effect and tax factors amplified short-term buying.

From a timing perspective, this round of price increases occurred on the second trading day of the new tax year in North America, exhibiting a clear seasonal characteristic.

Several market participants pointed out that at the end of 2025, many US investors sold off loss-making assets to offset their tax burden through tax-loss harvesting. Entering 2026, funds that remained bullish quickly replenished their positions, and Meme coin, due to its significant price drop, relatively good liquidity, and high volatility, became a preferred choice.

According to CoinGecko data, PEPE's 24-hour trading volume exceeded $1 billion, showing a clear trend of concentrated buying back.

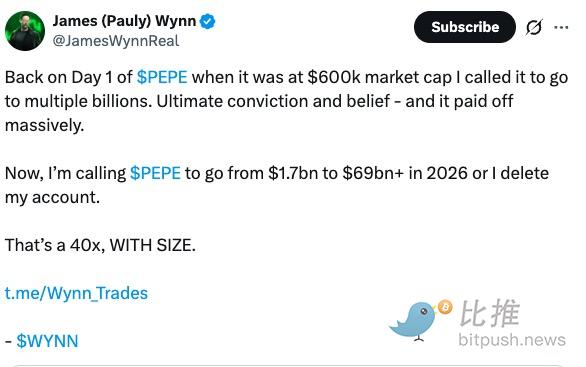

KOL comments accelerate the rise

Unlike other sectors, the pricing mechanism of Meme Coin is highly dependent on the sentiment of KOLs (Key Opinion Leaders).

James Wynn, a well-known trader at Hyperliquid, released his 2026 prediction, stating that PEPE's market capitalization could surge from its current $2 billion to $69 billion, drawing a parallel with SHIB (whose market capitalization jumped from $3.5 billion to $41 billion in the previous cycle). Wynn's "delete my account if I don't meet the target" vow greatly stirred up community sentiment.

Can this trend continue? Analysts say it's a signal, but not the answer.

Despite the impressive performance of Meme Coin, the market remains restrained from a longer-term perspective.

CryptoQuant charts show that Meme's dominance in the Altcoin market remains near its lowest level since 2022, without any upward trend. This suggests that retail speculative activity has not yet systematically returned.

Jake Kennis (Senior Research Analyst at Nansen) points out:

"This round of capital rotation to large-cap meme coins at the beginning of the year is more like a position adjustment after a long period of consolidation. To confirm a trend of upward movement, we need to see structural confirmation over a higher time frame."

Kennis also emphasized that PEPE and DOGE have still retreated by about 80% from their historical highs, and the current rebound is more of a technical correction.

The overall view of institutions leans towards cautious optimism.

Neil Staunton (CEO of Superset) believes there is speculative expectation in the market regarding a potential memecoin ETF in 2026:

“Even just the discussion about ETFs is enough to create a psychological narrative of ‘if it can be packaged by institutions, does that mean it is an investable asset?’”

However, he also pointed out that such expectations have more of an impact on sentiment and valuation anchors than on long-term trends.

Some analysts have cautioned that historically, memes have often been the fastest-rising sector but also the first to experience a correction. If Bitcoin cannot maintain its structural strength, the rise in risk assets could quickly cool down.

Based on a comprehensive analysis of market performance, on-chain data, and analyst opinions, the core signal released by Meme coin's leading price increase in this round is not "the bull market has arrived," but rather:

The market may be emerging from a period of extreme pessimism and beginning to take risks again.

The rebound of meme coins is more like an early test of a return to risk appetite. What truly determines how far the market can go remains Bitcoin's trend performance, continued improvement in liquidity, and broader sector rotation. Until these conditions become clear, meme remains a signal, not an answer.

Author: Seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush