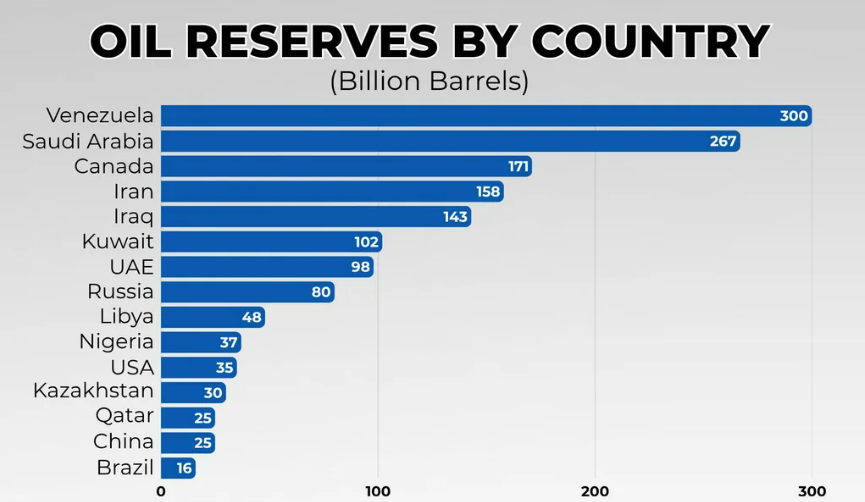

The news that woke South Korea from its slumber on the first Sunday morning of 2026 was nothing short of shocking. It was the news that US special forces had captured Venezuelan President Nicolás Maduro and deported him to the mainland. It would be a mistake to view this as a simple drama of good triumphing over evil, capturing a "drug lord dictator." At its core, this was a "geopolitical event": the United States had seized the world's largest single energy vault: 300.3 billion barrels of Venezuelan crude oil.

This is a truly chilling calculation. Eighteen percent of the world's crude oil reserves fell under American control overnight. At current oil prices ($57 per barrel), this represents a staggering $17.3 trillion in underground assets, or approximately 240 trillion won in Korean currency. This is larger than the combined GDP of all countries excluding the US and China, and four times the size of Japan's economy. The US has now established an unassailable "energy fortress"—Energy Fortress America—beyond mere hegemony.

The End of the Petrodollar, the Beginning of the AI Empire

We must face this situation with a cool head. This is not a repeat of the 20th-century oil wars. What the United States is aiming for may be the permanent establishment of "AI (artificial intelligence) hegemony."

Silicon Valley's biggest concern right now is the power shortage. Running AI data centers requires massive amounts of electricity, and energy supply has been holding back technological advancement. However, the United States has solved this bottleneck by turning on the Western Hemisphere's largest oil tap. The era of the "petrodollar," which depended on the Middle East, is over. The ruthless "techno-dollar" era, combining US military might, Venezuelan crude oil, and American AI technology, has begun.

◇ Fear of 'physical force' and Bitcoin

So, will Bitcoin, a digital asset, lose its footing in the face of this massive "physical storm"? The market is moving in the opposite direction.

Bitcoin, which had fluctuated to $89,300 immediately after Maduro's arrest, has now recovered to the $90,000 level. This is because, paradoxically, capitalists around the world have come to realize the need for "decentralization" after witnessing the US kidnapping another country's president and effectively nationalizing that country's resources.

Consider this: if you offend the United States, the president can be arrested, and the nation's energy can be seized. All assets with "physical substance" are powerless against the might of a powerful nation. But Bitcoin's private keys cannot be stolen, not even by the US special forces, Delta Force. As the US controls Venezuela's oil to strengthen the power of the "dollar," Bitcoin serves as the only shelter, using mathematics and code to protect "personal wealth."

◇ The Upcoming '72 Hours of Fate'

The global crude oil futures market opens tomorrow (Monday) at 8:00 AM Korean time (6:00 PM Sunday, US time). This is the first moment when prices will reflect the reality that the United States now controls 18% of the world's oil. Oil prices will fluctuate, but the real game lies beyond that.

In January 2026, the Empire completed its "Energy Fortress." As the order of overwhelming power is reorganized, capital, yearning for freedom outside its control, will flock to Bitcoin, the "digital ark."

In a time of geopolitical crisis, where are your assets? In a US-controlled bank account, or on an untouchable blockchain? The Venezuelan crisis has raised this weighty question, and we have only 72 hours left to answer it.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.