Jupiter Exchange's $70 million Token buyback campaign in 2025 failed to prevent strong selling pressure on the JUP Token, which is still facing an upcoming unlock of up to $1.2 billion.

The Token 's price has fallen 89% from its peak, highlighting the limitations of traditional buyback strategies in a market with high issuance volumes, continuous unlocking, and intense selling pressure.

Jupiter faces criticism as its $70 million buyback program proves insufficient ahead of its $1.2 billion Token Lockup unlock.

Siong's founder sparked controversy within the community when he proposed temporarily suspending the acquisition of JUP to redirect resources to growth-boosting reward programs.

“We’ve spent over $70 million buying back Token in the last year, but the actual price hasn’t fluctuated much,” he Chia on X. “We could use that $70 million to create a rewards program for both new and existing users. Should we do that?”

This proposal aims to use reward funds to encourage active users and support new ones, shifting the focus from price protection to ecosystem development.

Community response has been somewhat Chia . Some argue that the buyback is ineffective given the immense pressure to unlock JUP, while others worry that halting the buyback could cause further price drops.

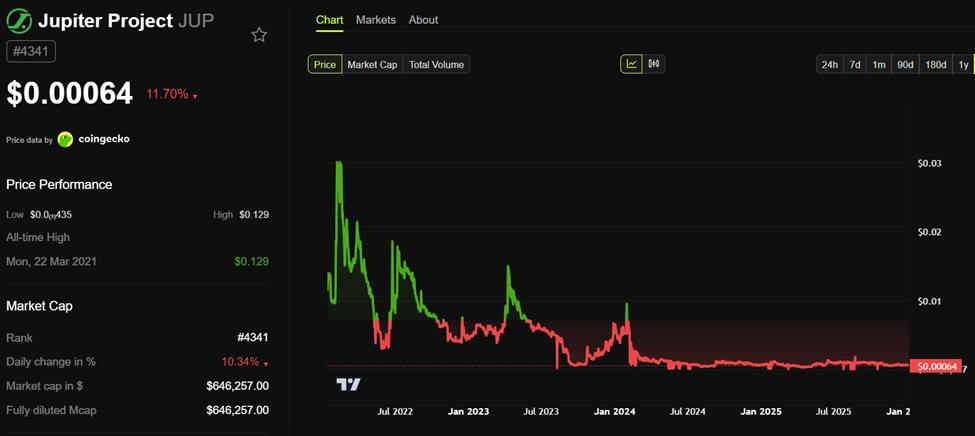

Jupiter (JUP) price movement. Source: BeInCrypto

Jupiter (JUP) price movement. Source: BeInCryptoThe impact of Jupiter's Token buybacks only accounts for about 6% of the total unlocked Token , highlighting the significant challenge. Meanwhile, the monthly unlock schedule of approximately 53 million JUP will continue until June 2026, meaning the circulating supply has increased by about 150% since launch, even with 100 million Token locked for 3 years.

Solana co-founder Anatoly Yakovenko also offered suggestions for Jupiter. He proposed storing profits as assets that can be withdrawn later and using them to pay out a one-year Staking reward to long-term holders.

According to Solana leader, this approach will help to more accurately value Token during unlocks, while also creating sustainable value after each buyback.

"Let users deposit and Stake Token for one year to receive interest on the Token. As the reserve fund grows, those who Stake will receive greater rewards," he Chia .

This model focuses on building long-term Capital rather than concentrating on short-term buybacks, helping to increase the real value and cohesion of the Token over time.

Helium and Jupiter demonstrate the limitations of traditional acquisition programs.

Jupiter DEX isn't the only one debating the Token buyback program. Helium recently paused its HNT buyback program after realizing the market was largely unresponsive. Instead, they chose to invest resources in user growth, such as attracting new subscribers to Helium Mobile and expanding their hotspot network.

Opponents of Token buybacks argue that, given the ecosystem's perspective on Token as utility vouchers rather than stocks, buybacks only create a short-term market effect and fail to address significant structural selling pressure.

The Solana ecosystem is even more complex, as team unlocking, insider prioritization, and continuous Token Issuance constantly dilute acquisition efforts.

Community members pointed out that structural issues, not just the buyback method, are the reason these defenses often fail. Some suggested that more flexible approaches such as Staking based rewards or buybacks based on valuation could be more effective.

Jupiter's challenge remains balancing short-term price support with long-term ecosystem development. While the $70 million buyback isn't enough to stabilize the Token, Yakovenko's suggestions point to a future direction where building sustainable Capital and Staking rewards can help the community align its interests with the Token's solid value.