MicroStrategy continues to transform the way private Capital and financial markets operate, leveraging Bitcoin to achieve things that traditional funds have tried but largely failed to do over the past decade.

According to Chaitanya Jain, Bitcoin Strategy Director at MicroStrategy, the company has successfully addressed two major, long-standing challenges in the private equity Capital sector.

MicroStrategy transforms Bitcoin into a perpetual source of Capital , surpassing traditional private equity funds.

According to Jain, MicroStrategy (now renamed Strategy) raised Capital directly from small investors and built a long-term, sustainable Capital source.

“For the past 10 years, the private Capital sector has been trying to (i) raise Capital directly from retail investors and (ii) build continuing or perpetual investment funds,” Jain Chia . “Strategy has done both. Capital -term capital through publicly listed securities on the Nasdaq. Digital Equity and Digital Credit backed by $ BTC.”

Instead of the closed-loop model of traditional private equity Capital , MicroStrategy has expanded access to alternative investment products for many people, especially small investors. At the same time, they have created a Capital model that is not dependent on cyclical Capital rounds as before.

At the heart of this approach are two products that Jain calls “Digital Equity” and “Digital Credit.” Both are backed by Bitcoin, elevating this digital asset class to a high-quality collateral option for institutions.

Digital Equity allows investors to leverage MicroStrategy's Capital to invest in Bitcoin with leverage. Meanwhile, Digital Credit provides loans secured by BTC.

Essentially, the company transformed its Bitcoin holdings into a long-term Capital -generating machine , operating much like a private Capital succession fund but in the form of a publicly traded company.

Jain calls 2025 the “Year 0” of Digital Credit, meaning a period focused on building, launching, and expanding BTC based lending products amidst a quiet Bitcoin market.

In 2025, Strategy raised approximately $21 billion through the issuance of common stock, preferred stock (including a $2.5 billion perpetual preferred stock offering, XEM the largest IPO in the US that year by value), and convertible bonds.

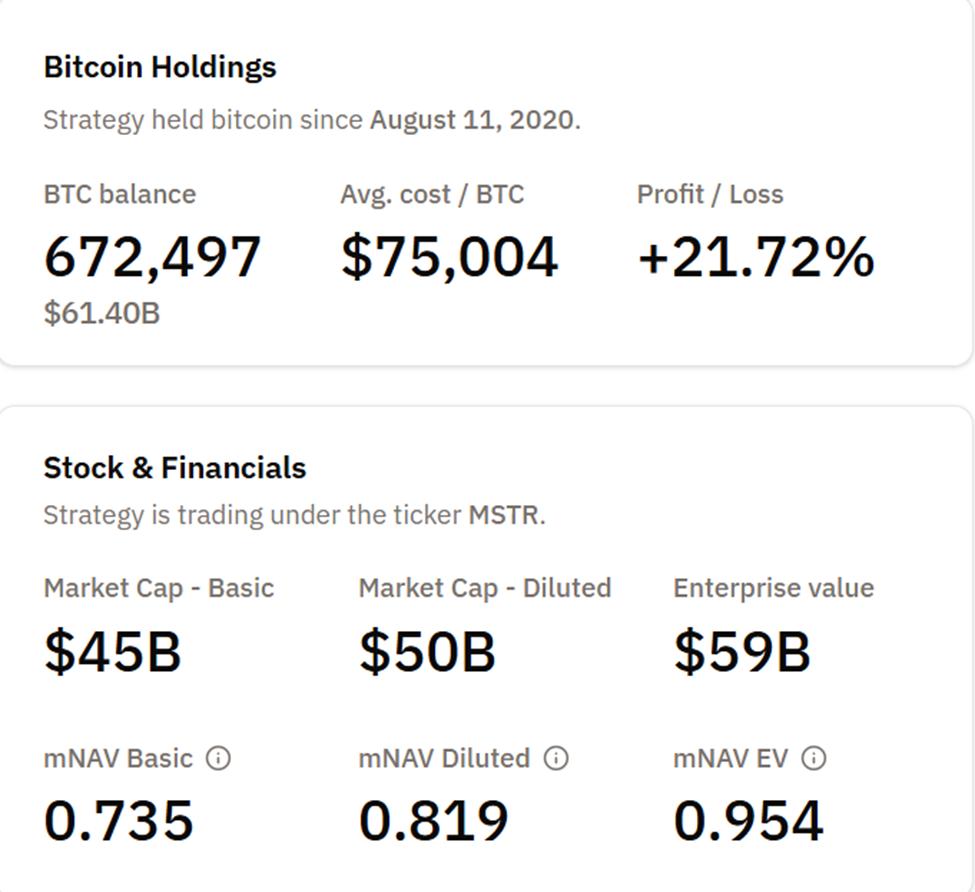

This Capital was used to purchase a large amount of Bitcoin. At the time of writing, Strategy owns 672,497 BTC, purchased at a total value of approximately $50.4 billion ( Medium purchase price of around $75,000/ BTC). The total market value is currently around $61.4 billion ( based on a Bitcoin price of around $91,000 ).

The amount of Bitcoin held by MicroStrategy. Source: Bitcoin Treasureries

The amount of Bitcoin held by MicroStrategy. Source: Bitcoin TreasureriesThe company uses high leverage through the issuance of debt and preferred stock (totaling approximately $15–16 billion from various sources), creating a very large level of exposure to Bitcoin. This is why some analysts believe the company could cause the next “black swan” event in the crypto market in 2026 .

Nevertheless, this model has transformed Strategy from a traditional software company into the world's largest Bitcoin holder, or a leveraged Bitcoin investment fund. The company continuously raises long-term Capital to buy more BTC and provides investors with various ways to participate in the performance of this investment.

According to Jain, 2026 is "Year 1," marking the point at which MicroStrategy transitions from the testing phase to large-scale deployment.

This shift reflects Bitcoin's increasing liquidation , strengthened market infrastructure, and growing investor awareness of crypto-based financial products.

By bridging the gap between retail investor accessibility and sustainable Capital , MicroStrategy is challenging the old rules of private Capital while demonstrating that crypto can absolutely become the foundation for sustainable institutional investment models.

However, even as it enters a new phase, the possibility of being excluded from MSCI remains a major concern for MicroStrategy.