Written by: Golem ( @web3_golem ), Odaily

A short story about the Venezuelan president before his arrest...

On January 1, 2026, Eastern Time, Trump, having weathered a series of troubles including assassination attempts, currency issuance, and tariff trade wars, has relatively successfully completed his first year as president. However, he has no time to celebrate; at this moment, he is plotting a military operation that will shock the world with several key White House figures and military leaders at his Mar-a-Lago resort in Florida.

They finalized the operation details in a secret, heavily guarded room. The atmosphere was tense. Trump, feeling thirsty, pressed the Coke button on the table, wanting an ice-cold Coke. A waiter carrying a Coke weaved through layers of Secret Service agents and delivered the still-bubbling can to Trump. "There can't be any surprises tomorrow regarding Maduro's operation," Trump muttered.

Those who have served political figures for a long time know that it is necessary to "be deaf and mute" at the right time, otherwise it will cause trouble that they cannot afford to offend, but obviously, this "Cola Boy" is planning to take the risk.

That evening, the waiter, nicknamed "Cola Boy," opened Polymarket, the world's largest prediction marketplace, and registered an account. Although he didn't understand the crypto industry, he knew that the platform's results last year had predicted that Trump would become the 47th President of the United States. He then bought "yes" on several related predictions, including "The United States will invade Venezuela before January 31, 2026," with a probability of only 6%. He invested his entire month's salary.

At 10:46 p.m. Eastern Time on January 2, 2026, Trump issued a raid order, and more than 150 warplanes took off from 20 bases and launched a low-altitude raid on the Venezuelan coast.

At 1:01 AM Eastern Time on January 3, U.S. forces breached Venezuela's air defense system. U.S. Delta Force ground forces arrived at Maduro's residence, broke down the steel gate, and after a firefight, the U.S. forces subdued Maduro and his wife before immediately withdrawing. No U.S. personnel were injured. Two hours later, Maduro and his wife were taken to the U.S. warship USS Iwo Jima and subsequently transferred to New York.

The operation to arrest the president of a sovereign nation ended in just 5 hours, with Trump watching the entire U.S. military operation from his Mar-a-Lago resort.

At 4:30 a.m. Eastern Time on January 3, Trump announced on Truth Social that the Venezuelan president and his wife had been arrested and removed from the country.

Meanwhile, multiple predictions on Polymarket, such as "when Maduro will step down" and "when Trump will take war against Venezuela," were quickly settled. The "Cola Boy" had already resigned on January 2nd, having earned his first fortune through these advance bets...

(P.S.: This story is purely fictional. If any director wants to make a movie based on this story, I am willing to provide the script free of charge.)

Insiders learned of the US military operation as early as six days ago.

While the above plot has a strong fast-paced novel feel, like "Rebirth: I Became a Waiter at Mar-a-Lago," it's not entirely untrue. "Cola Boy" is purely fictional, but the capture of Venezuelan President Maduro by the US military is real, and the fact that "insiders" on Polymarket placed bets in advance is also highly likely true.

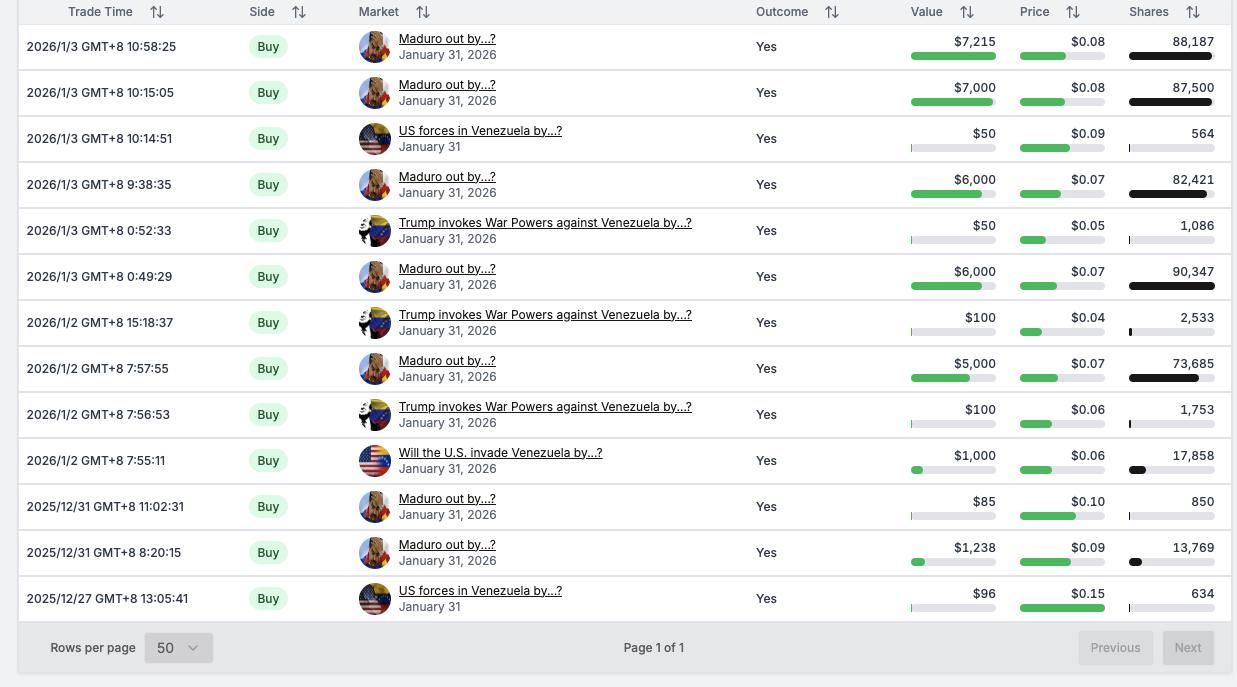

According to Lookonchain's monitoring, before Trump announced the arrest of the Venezuelan president, three insider addresses on Polymarket suddenly placed bets on his downfall, accumulating a profit of $630,400. All of these addresses were created and deposited funds only a few days before the event. Specifically, address 0x31a5 (0x31a5...8eD9) invested $34,000 and profited $409,900; address 0xa72D (0xa72D...eBd4) invested $5,800 and profited $75,000; and address SBet365 invested $25,000 and profited $145,600.

The most significant of these three addresses is 0x31a5 (0x31a5...8eD9). The US military operation to arrest Maduro took place at 1:00 AM Eastern Time on January 3. The media and even other countries first obtained this news at 4:30 AM Eastern Time on January 3, which was when Trump announced the completion of the operation on Truth Social.

However, this insider with the address 0x31a5 (0x31a5...8eD9) first bet that "Maduro will step down before January 31, 2026" at 7:20 PM Eastern Time on December 30, 2025, and even as early as December 27, bet that "the US military will attack Venezuela before January 31, 2026".

0x31a5 (0x31a5...8eD9) is a bet placed before actual US military action.

This means that "insiders" may have known about the US military's operation as early as six days ago and began building positions on Polymarket. Obtaining the operational plans of the US military—considered the world's most powerful armed force—so early is something that probably no hacker or national intelligence agency could accomplish, but Polymarket did.

It didn't employ any eavesdropping methods; it simply opened a fast track to human greed. Undoubtedly, this insider must be close to US political figures or high-ranking military officers, perhaps even holding a high position themselves. It's highly unlikely they were a US soldier involved in the operation, placing orders while fighting? Although they did indeed trade cryptocurrencies. (Related reading: A US Soldier's Investment Chronicle: Missiles and Stock Prices Soaring, Military Bases Become the Craziest Cryptocurrency Trading Zone in the US )

More importantly, the actors involved have virtually no need to worry about their identities being exposed. Polymarket inherently possesses an anonymity advantage in its structure: no KYC required, near-zero account creation cost, ample liquidity, and encrypted settlements to protect privacy. Under such conditions, it is extremely difficult to trace the address and verify the true identity afterward.

Therefore, when the cost of participation is driven to an extremely low level while the potential returns are extremely high, this is no longer a moral issue, but an incentive design issue. Faced with such a mechanism, even politicians who appear respectable and uphold justice will find it difficult to guarantee that they will never cross that line.

Predicting the truth or rejecting inside information?

But let's consider another possibility: what if the Venezuelan government had monitored the unusual buying activity on Polymarket beforehand? Would things have changed? (This isn't difficult, because insider betting is quite obvious. Making large purchases in a low-probability market would almost certainly be detected if someone had been monitoring it beforehand.)

So, perhaps the Venezuelan government would become alert before the US military operation, and as a precaution, Maduro might move to a more difficult-to-breach underground bunker in advance; or he might reorganize the army in advance to prepare for battle (Odaily note: when the operation occurred, half of the Venezuelan army was in a relaxed state due to the Christmas holiday) . In that case, the US military might not suffer zero casualties, but rather a tragic bloodbath. At the very least, Venezuela could seek support from other countries in advance, or publicly declare the possible US military action at the United Nations, thus politically restraining the other side.

Of course, the above assumptions are very crude, and this event may indeed be a coincidence, but it has become a fact that "the probability changes of major political events on Polymarkets always precede the release of mainstream information."

Once this model is repeatedly validated, the price signals used to predict the market will no longer be merely trading results, but will begin to be regarded as a reference indicator by the outside world. Its role may gradually resemble the Pentagon's "pizza index"—an informal yet highly sensitive risk thermometer.

This is certainly something the US authorities do not want to see.

Previously, U.S. Representative Ritchie Torres proposed the "Prediction Markets Public Integrity Act of 2026," which aims to establish restrictive rules against potential "insider trading" in prediction markets. The bill proposes to prohibit elected federal officials, political appointees, and executive branch employees from trading prediction market contracts related to government policy or political outcomes if they have or could reasonably have access to material non-public information during the course of their duties.

Following the revelation of the "insider information" scandal involving Maduro's Polymarket, the bill may receive significant attention from the US government. Kalshi's PR account immediately responded , stating that its platform rules explicitly prohibit any trading based on material non-public information.

Kalshi can make this guarantee because it has adhered to compliance principles since its inception and has extremely high KYC requirements for its platform users. If insider trading is suspected, Kalshi can immediately identify the user and even freeze the user's funds.

Polymarket naturally became a haven for these insiders. In a sense, insider trading and Polymarket complemented each other. Polymarket provided a safe haven for insiders to make money, while insider trading brought Polymarket more trading volume and brand recognition.

Many of Polymarket's breakthroughs stemmed from revealing the truth before traditional media. This wasn't because Polymarket players were exceptionally intelligent, but because a few individuals were manipulating probabilities. Ideally, prediction markets reflect collective wisdom, but in reality, they are merely a playground for insiders.

For most ordinary people, this may not be a bad thing. With the help of prediction markets like Polymarket, people can perceive the direction of certain events earlier, reduce their passive acceptance of breaking news, and are no longer completely controlled by emotional public opinion and lagging media narratives. In the end, this is more like a kind of "decentralization" at the information level.

But for those at the top of the pyramid, the situation is quite the opposite. For a long time, "who knows what, and when" has been an established order . The truth is not hidden, but rather needs to be released at the right time and in the right concentration. Anyone attempting to disrupt this rhythm is seen as challenging the established rules.

Therefore, Polymarket may be about to run into a regulatory hurdle in the US again. In 2024, the FBI raided the New York home of Polymarket's founder, marking the most tense standoff between Polymarket and the US government. Now, Polymarket has returned to the US market and obtained a license from the CFTC, indicating that relations have eased.

However, any leak of information in advance regarding highly classified military or security matters such as the operation to arrest Maduro is unacceptable to the US government. Furthermore, at a crucial stage where prediction markets are attempting to establish compliance and gain regulatory space, such incidents, even if ultimately determined to be coincidences, will be interpreted as potential threats from a regulatory perspective.

The prediction market faces not only compliance and technical issues, but also whether it is inadvertently encroaching on the sensitive boundaries of traditional information security and national governance .

If predictions no longer lead to the truth, what is left of them? This is a question that cannot be avoided in the future.