So. First week of the year, and it’s already doing that thing where crypto refuses to give you a clean story. No Santa rally, no cinematic year-end blow-off, but guess what — no collapse into the low $80Ks, either. That’s not a victory parade, of course, but it is a kind of information: sellers had their chance, and the market didn’t just fold.

And when you pull up the daily, the bigger shape is still pretty unforgiving. Since October, it’s been a steady grind lower — lower highs, lower lows, that “every bounce gets measured and sold” vibe. The sort of chart that makes you feel like BTC is walking downhill with its hands in its pockets.

But then you zoom in to last week (29.12–05.01) and it’s much less dramatic. Mostly a range. A lot of back-and-forth. The market basically saying, “I’m tired, give me a minute.” And yet right into the weekend, we got that oddly reassuring little push higher — not huge, not euphoric, but really steady. The kind of move that doesn’t scream “top is in” either. More like: “Okay, maybe we can try again.”

Now the honest question: is that micro rally the first stitch in a bigger repair job — or just another bounce inside the downtrend before gravity reasserts itself?

Honestly, the micro rally doesn’t look chaotic at all. It steps up, holds, steps up again. That’s “buyers willing to defend” behavior. But — and this is the bit people hate — it’s still happening under the shadow of the daily downtrend. So until BTC starts reclaiming and holding the low/mid $90Ks with follow-through, you’re still in “maybe” territory.

The market is basically asking: can we turn $90K from a ceiling and a meme into an actual floor?

Why the market bounced at all

A few things are stacking at the same time — none of them are revolutionary on their own, but together they explain why BTC managed to bounce instead of just rolling over.

First: geopolitics + TradFi reopening = a volatility setup, not a “war hedge” narrative.

The Venezuela headlines matter less for their substance and more for timing. The key story here is that US markets were closed while geopolitical risk escalated, and crypto kept trading. Headlines like “Bitcoin ‘will move’ when TradFi reacts to Venezuela” are basically saying: once equities, rates, oil, and FX reopen, something will gap — and crypto traders want to be positioned before that reaction, not after it.

While everyone is focused on oil:

— The Kobeissi Letter (@KobeissiLetter) January 4, 2026

Venezuela currently holds 161 metric TONS of gold reserves.

161 metric tons is roughly 5.18 million troy ounces, worth ~$22 BILLION at $4,300/oz.

This makes Venezuela the Latin American country with the largest gold holdings.

Every $100 that… pic.twitter.com/pI8DWgt1CB

Bitcoin isn’t suddenly pricing itself as a geopolitical safe haven. But it is a liquid, 24/7 asset that tends to absorb volatility when macro uncertainty spikes. That makes it a natural place for traders to park risk ahead of a potentially messy market open. Even if the move fades later, that positioning alone can support price in the short term.

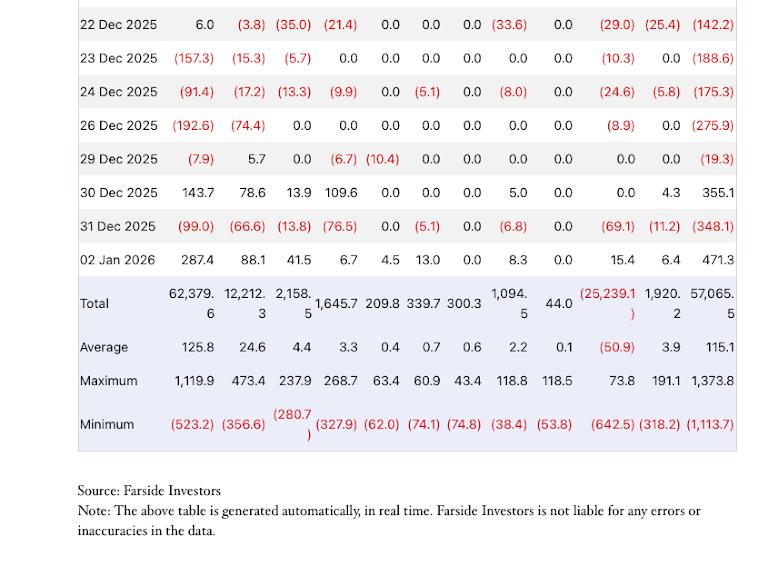

Second: ETF flows stopped screaming “no demand.”

The headline that BTC and ETH ETFs pulled in roughly $646M on the first trading day of 2026 matters because it breaks a pattern. For weeks, the dominant story was outflows, weak participation, and institutions quietly stepping back. That creates a psychological ceiling on rallies: every bounce feels temporary because there’s no marginal buyer behind it.

This inflow doesn’t magically flip the trend. But it does one important thing: it tells the market that some institutional demand is still alive at these levels. When flows go from negative to merely neutral or mildly positive, price action changes character. Instead of every push higher being sold immediately, the market can start consolidating, retesting levels, and actually building structure.

Third: sentiment moved from “fear spiral” to “confused neutrality.”

The Crypto Fear & Greed Index flipping back to neutral for the first time since October isn’t bullish — but it isstabilizing. Extreme fear is when markets overshoot to the downside and rallies get sold aggressively because nobody trusts them. Neutral sentiment is when participants stop panicking and start watching levels again.

That’s important because BTC tends to range, base, and form higher lows after fear burns itself out. Neutral sentiment is basically the market saying: “We don’t know what comes next, so let’s stop forcing trades.” That’s often the emotional backdrop for consolidation phases rather than straight-line drops.

Fourth: whale behavior is mixed — which is exactly what you expect near a potential base.

The whale headlines look contradictory on the surface. You’ve got reports of Bitfinex whales building long exposure for 2026, alongside analysis arguing that whale accumulation is overstated, plus data showing large amounts of crypto moving onto exchanges like Binance without obvious buyers stepping in.

But that contradiction is the signal. It tells you the market is split, not euphoric and not abandoned. Some large players are positioning for upside over months. Others are still cautious, hedging, or preparing liquidity. That’s very different from a blow-off top (everyone bullish) or a capitulation bottom (everyone dumping).

Bitfinex whales $BTC long positions have almost reached a 2-year high.

— BitBull (@AkaBull_) December 29, 2025

Despite people calling for 4-yr cycle repeat, Bitfinex whales think that there's still a big pump left.

What if Bitcoin hits a new ATH in 2026? pic.twitter.com/wshrSKHK04

Markets usually don’t bottom or base when everyone agrees. They do it when participation feels awkward, conviction is uneven, and price just… stops going down easily.

Put together, that’s why this move feels like basing behavior rather than a dead-cat bounce. Not a clean trend reversal yet — but also not the kind of environment where price collapses without a fight.

Where I land for December 2026

Right now, this feels like a market trying to decide whether it’s allowed to be optimistic again — but only in small doses.

If BTC holds $90K and starts printing acceptance above the low $93Ks, the micro rally starts to look like the beginning of actual repair. Not necessarily “new ATH soon,” but at least “the market found its feet.”

If BTC loses $90K cleanly, the whole tone flips back into defensive mode fast, and we’re right back to “okay, so when do we test the high-$80Ks again… and what happens if that doesn’t hold?”

The post Bitcoin’s First Week Of 2026: Repair Attempt Or Another False Start appeared first on Metaverse Post.