(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

Conversation overheard between US President Donald Trump video conferencing into the plane flying Venezuelan President Pepe Maduro from Caracas to New York City.

Trump: Pepe Maduro, you are one bad hombre. Your nation’s oil is mine now. USA USA USA!!!

Pepe Maduro: Puta Madre! Eres un gringo loco.

I imagine that a certain cohort of the Venezuelan diaspora is letting it rip right now in the narco-finance capital of the Western Hemisphere … Miami, USA; dancing to bangers like Elvis Crespo’s Suavemente. Like any good armchair macroeconomic punter, I must offer my thoughts on this historic, game-changing, despotic, militaristic … fill in your superlative or pejorative descriptor of America’s abduction/lawful arrest of a sovereign leader. I’m sure countless AI assisted essayists will churn out millions of tokens worth of word salad to frame these events and offer predictions of the future. They will offer moralistic views of the actions, and what other nations should do in response. I shall do none of that. The question is, does the American colonization of Venezuela make Bitcoin/crypto number go up or down?

I’m a ski bum who requires a simple framework with which to understand a chaotic universe. To reiterate, all democratically elected politicians are at all times solely focused on re-election. Glory to God, country, or whatever is second to winning at the ballot box. You can’t affect change if you are not in a seat of power, so on some level this obsession with re-election is rational. There are two elections that concern US President Trump: the November mid-term elections, and the 2028 presidential election.[1] While he himself is not up for re-election in 2026 and cannot run for a third presidential term in 2028, the loyalty and obedience of his phalanx of political supporters depends on their chances of re-election. All the defections from the MAGA tattered tent are because of souring views on future electability should they continue to do what Trump demands. What can Trump do to ensure that the median voter, who hasn’t yet decided whether they are Team Blue Democrats or Team Red Republicans, will show up in November 2026 and 2028 and vote the “right way”?

As of right now, Team Blue would retake the House of Representatives. Trump needs to get his shit together if he wants to be a winner; there is not much time for a policy change-up to cause voters to switch sides.

Above all else, and I will present some statistical evidence and charts to prove my point, the only issue that the median voter cares about is the economy. All that other cultural shit Trump haters and lovers obsess about on social media (the memes are good though) doesn’t hold a candle to whether or not an undecided voter feels rich and poor when they step under the curtain. It is easy to pump the economy, and by that, I mean nominal GDP. That is just a question of how much credit Trump can create. A rise in nominal GDP boosts financial asset prices, and rich folks will dutifully pay their bribes — cough cough, campaign donations to Team Red to giveth thanks. But in America, it’s one human, one vote, and the plebes can easily derail the party if a rise in inflation accompanies a rise in nominal GDP. Trump and US Treasury Secretary Buffalo Bill Bessent said they would run the economy hot, and I believe them, but how will they keep inflation in check? The inflation that torpedoes re-election odds is of the food and energy variety. The key metric for Americans is the price of gasoline, as there is scant usable, affordable public transportation available for most folks. You cannot exist as a proletariat worker in America without a set of wheels, unfortunately. And therefore, Trump and his lieutenants colonized Venezuela for its oil.

When talking about Venezuelan oil, many are quick to point out that the country has the world’s largest proven reserves. But who cares how much oil you have in the ground. The question is, can one extract the oil from the ground profitably? I don’t know the answer to this question, but Trump obviously believes that if he turns on the tap, oil will gush forth from Venezuela into the Gulf of Mexico refineries, and cheap gasoline will placate the plebes by tamping down energy inflation. I can’t opine whether Trump is correct, but the WTI and Brent crude oil markets will be the truth serum. As nominal GDP and dollar credit supply rise, do oil prices rise or fall? Team Blue Democrats will win if GDP and oil prices rise together, and Team Red Republicans will win if GDP rises but oil prices flatline or fall.

The best thing about this framework is that the price of oil will reflect all actions by other oil-producing and military powers (most importantly Saudi Arabia, Russia, and China) in reaction to the US colonization of Venezuela. Another favorable aspect is that markets are reflexive. We know Trump adjusts policy based on the price of stonks, US treasuries, and oil prices. He will continue printing money and colonizing in pursuit of oil so long as stonks continue rising and oil prices stay low. We as investors can react in the same time frame as Trump, which is the best that we can ever hope for. This reduces the need to predict the outcome of a complex geopolitical system. Just read the charts and adjust, degen.

Below are some chart porn and statistics that clearly show why Trump must pump nominal GDP and crush oil prices in order to win elections.

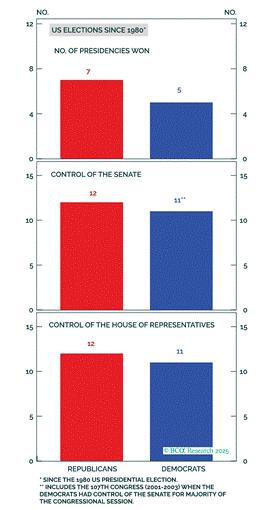

Team Red and Team Blue are evenly matched.

A small percentage of Americans decides which team controls the government.

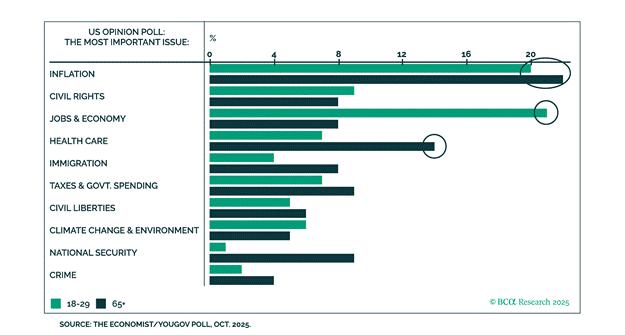

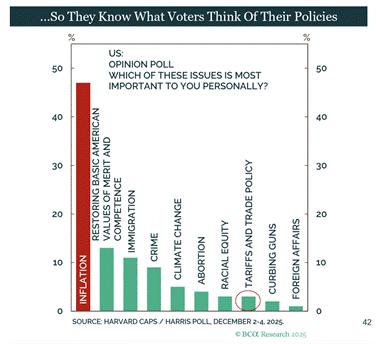

The economy and inflation are the two most important issues for voters. Nothing else matters.

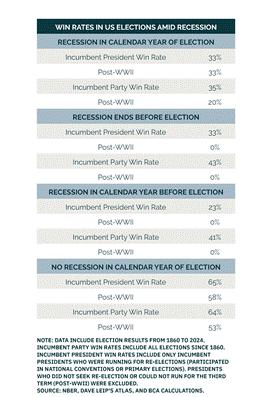

The 10% rule: when the national average price of gasoline rises 10% or more in the three months preceding an election versus the average price in January of the same calendar year, control of one or more branches of government switches teams.[2]

Team Red has the highest chance of winning the 2028 presidential election if there is no recession.

These charts and tables clearly show that Trump must run the economy hot without causing gasoline prices to rise.

We have two scenarios: nominal GDP/credit and oil price up, or GDP/credit up and oil price down. What is Bitcoin’s response?

Bitcoin Mooning

Because of the energy used running computers engaged in proof of work mining, Bitcoin is the purest monetary abstraction there is. Therefore, the price of energy is irrelevant to the price of Bitcoin as all miners will face a parallel shift up or down in the price at the same time. The price of oil only matters regarding its ability to force politicians to stop printing money. If the price of oil rises too quickly and too high because of an expansion of economic activity, which is itself a derivative of energy, a politician must get the price lower somehow (e.g. stealing oil from other nations or slow down credit creation), or face expulsion from office. The 10-year treasury yield and MOVE Index, which measures US bond market volatility, will tell us when the oil price is too high.

Investors face a hard choice: invest in financial or real assets. Investing in financial assets like government bonds makes sense when energy costs are low and stable. But if energy costs are high and volatile, saving in energy commodities is prudent. Therefore, at a certain price of oil, investors will demand a much higher yield on government bonds, most importantly the 10-year US Treasury note. US politicians cannot stop deficit spending because free shit always wins elections. When oil prices rise and 10-year yields reach close to 5% they must alter their behavior. Because of the insane amount of leverage embedded in the filthy fiat financial system as 10-year yields approach 5%, market volatility as measured by the MOVE Index spikes. The entire fiat system is a highly leveraged carry trade, and when volatility rises, investors must sell assets lest they lose their Savile Row tailored shirts. For example, the most recent example of the change-up was last year’s Liberation Day on April 2nd and the subsequent Trump TACO seven days later on April 9th.[3] If you remember, Trump threatened tariffs so high they would have actually reduced the global trade and financial flows imbalances, and as such they would have been very deflationary. The markets tanked, and the MOVE Index spiked to an intraday high of 172. The next day after the spike, Trump TACO’d, “paused” the tariffs, and markets bottomed then recovered violently.

MOVE Index (white) vs. NASDAQ 100 Index (yellow)

There is no point in attempting to use past data to discern what levels of oil prices and 10-year yields cause Trump to rein in the Fed’s money printer. We will know it when we see it, and if oil prices and yields trend sharply higher, then it’s time to become less constructive on risk. The base case is oil prices remain subsided if not outright fall and Trump and Buffalo Bill Bessent print money like it’s 2020. This is because the market will initially believe US control of Venezuelan oil will cause a massive increase in the daily amount of pumped crude oil. Who knows whether the initial bullish crude oil supply predictions will bear fruit as engineers begin the hard work of bringing millions of barrels per day online from Venezuela. But don’t worry about that; just focus on the fact that Trump is going to run the money printer faster than Israeli Prime Minister Benjamin “The Bedouin Butcher” Netanyahu changes the goal posts on why Iran deserves additional military strikes. If none of this logic convinces you it’s time to go long all risky assets because of aggressive money printing emanating from America, please remember that Trump is the most socialist president since FDR.[4] He printed trillions of dollars and, unlike past presidents, handed money directly to everyone in 2020. You best believe he will not lose an election for lack of printing money. Mamdani and Trump are both New Yorkers, don’t cha know. Birds of a feather flock together. Real traders must stop attaching emotions to words like socialism, communism, capitalism, etc. No government practices these “isms” in pure form. Every one bastardized them for their own political uses. Don’t be a schmuck, just BUY!

Taking Trump and his lieutenants at their word, we know credit will expand. The Team Red Republican legislators will deficit spend, Buffalo Bill Bessent’s Treasury Department will issue debt to fund it, and beta cuck towel bitch boy Jerome Powell and his successor’s Fed will print money to buy the bonds. This circle jerk started in earnest in 2008, and as Lyn Alden says, “Nothing stops this train”. As the amount of dollars expands, the price of Bitcoin and certain cryptos will sky rocket.

Bitcoin’s (gold) rise directly results from money printing as evidenced by my USD Liquidity Conditions Index (.USDLIQ U Index on Bloomie).

Trading Tactics

Before I talk about Maelstrom’s positioning, I want to do a quick post mortem on my trading performance last year. My, and by that, I mean I made all trading decisions, liquid directional book was up last year. My goal is to cover my expenses with my trading profits, and I have done so many times over. Although I made money, I pissed away a lot of PNL on a few bad trades. My biggest loss was trading PUMP immediately post the token launch. Also, I need to stay away from memecoins; I only made money trading TRUMP. On the bright side, I made the most money trading HYPE, BTC, PENDLE, and ETHFI. Only 33% of my trades were profitable, but my sizing was on point; the profit from winning trades on average was 8.5x the average loss on a loser. I will improve this year by focusing on what I’m good at, taking large medium-term positions based on a clear macro liquidity thesis that supports a credible shitcoin narrative. When I degen on complete shitters and or memecoins because it is fun, I will reduce the size of my positions. Looking into the future, this year’s dominant narrative will surround privacy. ZEC will become the privacy beta, and we are already long a fuck ton of that at excellent prices obtained in 3Q25. The Maelstrom team’s focus is to find at least one shitcoin that can lead the way and generate outsized returns to our portfolio over the next few years within the privacy meta.

Maelstrom entered 2026 with almost maximum risk. While we will continue to invest spare cash generated from various financing trades into Bitcoin, our dollar stables position is very low. To obtain outperformance versus BTC and ETH, I will sell BTC to fund privacy positions and sell ETH to fund DeFi. In both cases, if I pick well, as fiat credit expands, my selection of shitcoins should outperform. When / if the price of oil rises and causes a slowdown in credit creation, I will hopefully take profit and stack more sats, and buy some mETH.

What a day. I wrote this essay on my day off from backcountry skiing. Now it’s time to hit the gym and lift some heavy weights to ensure when I emerge from hibernation in March, I’m still swoll as fuck.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

[1] All members of the US House of Representatives and some members of the Senate are up for re-election.

[2] The prompt to Gemini AI: looking at election results (house, senate, and presidential) in the US from 1990 to 2024, tell me what the national average price of gasoline was three months preceding any change in control from the incumbent party to the opposition party.

[3] TACO — Trump Always Chickens Out

[4] FDR or Franklin Delano Roosevelt enacted the New Deal, which began the creation of the modern American socialist welfare state in earnest.