Tensions between the US and Venezuela haven't caused crypto prices to fall; in fact, they've surged. Why?

The US's direct military intervention in Venezuela and the news of President Nicolás Maduro's arrest on January 3, 2026, occurred in a geopolitical context Capital highly sensitive. As is often the case, such events typically trigger a defensive response in financial markets: risky assets are sold off, and money flows towards gold, cash, and other safe-haven assets.

However, the actual developments in the crypto market went in the opposite direction. After a brief correction immediately following the news, Bitcoin quickly stabilized and recovered. By January 5, 2026, Bitcoin had surpassed the $92,000 mark, significantly higher than the price immediately after the bad news, resulting in an increase of approximately $200 billion in the total crypto market Capital in just a few days.

This reaction suggests the market doesn't view the US-Venezuela tensions as a systemic shock. Instead of a mass exodus from crypto, the flow of money only paused briefly before returning. This forces us to ask the opposite question: what is it about this event that prevented crypto from being sold off, and even led to it being bought?

America's swift action "killed the uncertainty."

The biggest difference in this event lies in the speed and decisiveness. The US acted quickly, decisively, and with clear objectives, preventing prolonged uncertainty. This is extremely important for financial markets.

In protracted conflicts like the Russia-Ukraine conflict, fear doesn't stem from a specific event, but from the uncertainty of what will happen next: how far the fighting will spread, how long energy supplies will be disrupted, and whether global supply chain will be crippled. It is this uncertainty that drives money toward gold, silver, and other safe-haven assets.

In contrast to Venezuela, the market quickly viewed this as a "scenario-resolved" situation. There was no prolonged panic, no signs of global trade disruption, and most importantly: no wave of fleeing risky assets. The fact that Bitcoin and the broader market did not collapse is the clearest signal that investors did not XEM this as a systemic shock.

Oil, gold, and the hidden message of the macroeconomic market.

Immediately after the US intervention in Venezuela, a popular argument emerged: if Washington could “unlock” Venezuela’s oil—a country possessing the world’s largest proven oil reserves, around 300 billion barrels—oil prices would plummet, triggering major changes in the global macroeconomic landscape.

But upon closer examination of the data, the market quickly realized this scenario was unlikely in the short term, and therefore lacked the power to create a supply shock or reactivate lingering inflation fears. In fact, the oil market's reaction showed the opposite.

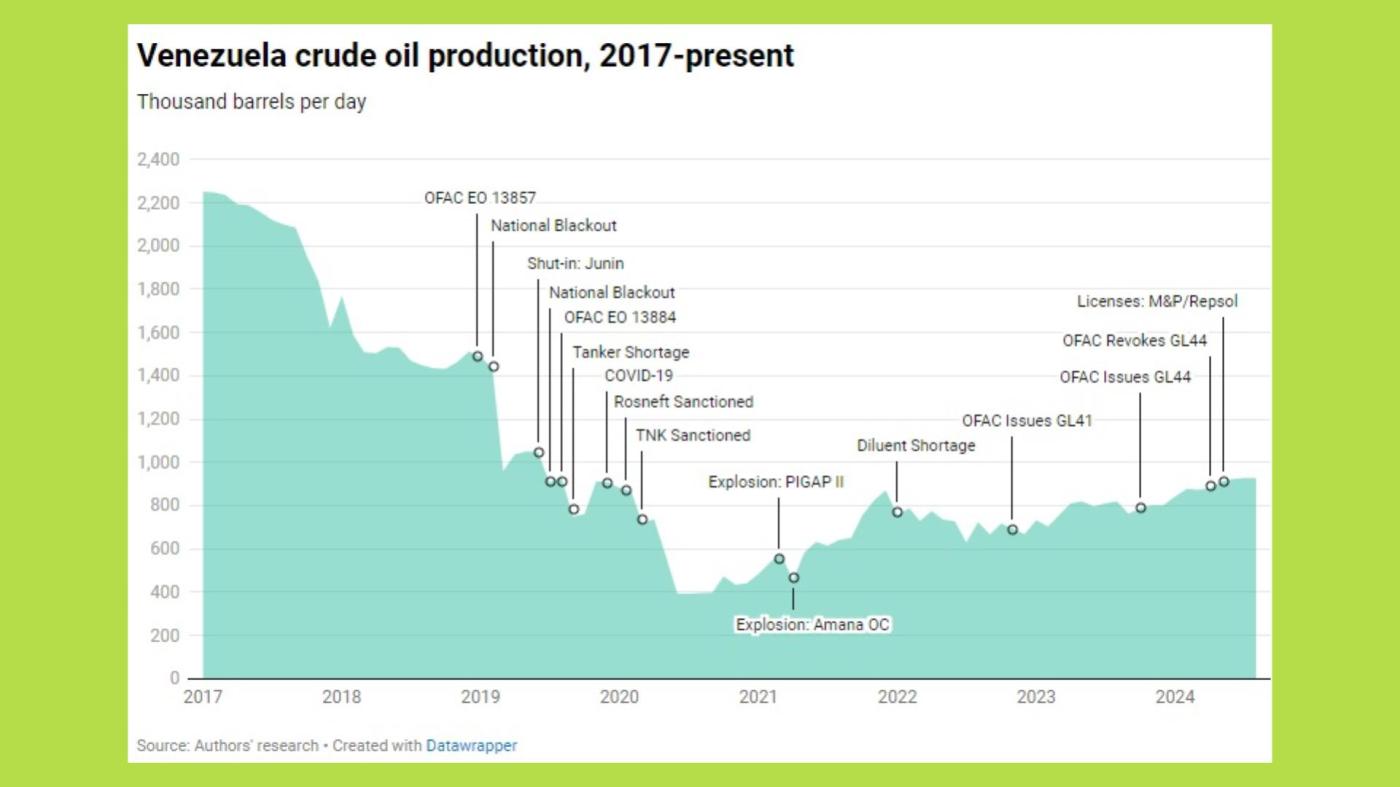

Currently, Venezuela's oil production hovers around just under 1 million barrels per day, equivalent to less than 1% of global production, a far cry from its peak of over 3 million barrels per day. The country's oil and gas infrastructure has deteriorated significantly after decades of neglect and sanctions.

According to estimates from PDVSA, EIA, and energy analysts, Venezuela needs at least $30-50 billion in investment for basic restoration, and potentially over $100 billion to bring production back to above 2 million barrels per day. Even in the most favorable scenario, this process will take years, not just a few quarters.

Therefore, after the initial fluctuations due to risk factors, Brent and WTI oil prices are again under downward pressure. This is not because supply has increased, but because the geopolitical risk premium is quickly being eliminated, while the market still faces the prospect of oversupply from OPEC+ and record-high US oil production. In other words, Venezuela currently plays only a minor Vai in the global oil supply-demand balance, not enough to change the game.

Conversely, gold acted as a defensive instrument in the initial phase. The price of gold surged from around $4,330 to nearly $4,400 per ounce on January 3, 2026. However, like oil, this reaction wasn't sustainable enough to become a leading medium-term story, as inflation fears weren't re-triggered.

Crypto market sentiment at the beginning of 2026: more risk-taking, but not yet complacent.

Entering the beginning of 2026, the sentiment in the crypto market showed a clear shift. After the year-end profit-taking and portfolio restructuring period, money tended to flow back with renewed expectations. The swift handling of geopolitical events in early January, avoiding prolonged instability, made investors more willing to accept risk in search of growth opportunities.

Looking deeper into geopolitics, the view that "the US intervened in Venezuela because of oil" is essentially a 20th-century interpretation of warfare. In the current context, the US doesn't lack oil, nor does it need to seize it through bombs and bullets. What Washington cannot accept is not Venezuela's resource reserves, but the way the country is trying to circumvent the US-controlled financial and monetary system.

For years under sanctions, Venezuela was forced to rely on oil, gold, and payment channels outside the traditional banking system to maintain its cash flow. When a country can trade outside the USD and outside of U.S. financial controls, the effectiveness of sanctions is weakened. That is the real threat to the current global monetary order. Modern wars are not fought to seize resources, but to maintain the rules of the game.

When the market recognizes the monetary nature of the conflict, money flow behavior becomes highly logical. Crypto is XEM as a non-sovereign asset, difficult to freeze and not directly dependent on the central banking system. In the context of geopolitical instability associated with sanctions and asset freezes, crypto is gradually being seen as a structural risk hedging tool, rather than just a speculative asset.

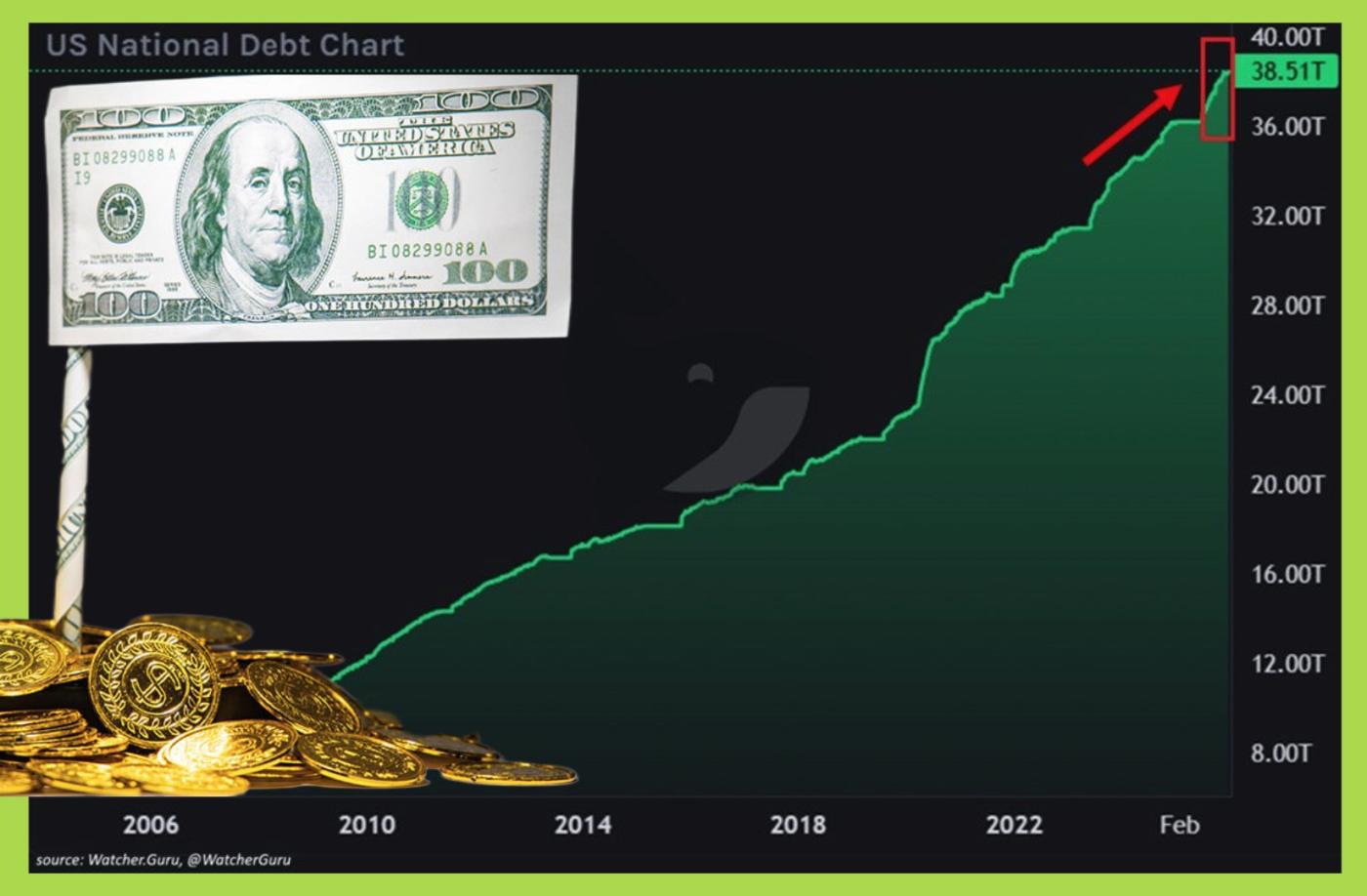

In addition, fiscal factors also play a significant Vai . The US federal debt reached a record high of approximately $38.5 trillion in 2025, increasing by more than $2.3 trillion in just one year, equivalent to more than $6 billion per day.

Since 2020, the total US debt has increased by more than $15 trillion. Against this backdrop, any geopolitical tensions increase expectations that fiscal pressure will continue to be addressed by softer monetary policies in the long term.

With gold failing to provide long-term leadership, oil not creating a supply shock, and confidence in the traditional monetary system continuing to be questioned, crypto has become the first platform to absorb expectations.

However, from an investment perspective, it's necessary to distinguish between trends and safe positions. In the short term, Bitcoin maintains a positive structure as the price holds firm above key support levels. This indicates that buying pressure hasn't been broken. But looking at longer timeframes, divergence signals are appearing – a familiar pattern in previous cycles, often accompanied by technical rallies before deeper market corrections.

In other words, the crypto market is embracing risk again, but has not yet entered a period of "easy" growth. The rise in crypto in this context reflects a redefining of risk and long-term expectations, rather than a signal to be complacent. For investors, the crucial question is how prepared their portfolios are for a worse-case scenario.

According to Coin98