Get the best data-driven crypto insights and analysis every week:

Crypto’s Constructive Start to 2026

Key Takeaways:

Digital assets kicked off 2026 with renewed momentum, with BTC rallying to $94K and total market cap approaching $3.3T amid a new layer of geopolitical uncertainty.

Spot Bitcoin ETFs reversed year-end outflows with ~$400M in net inflows on January 5th; whale distribution is cooling while retail accumulates.

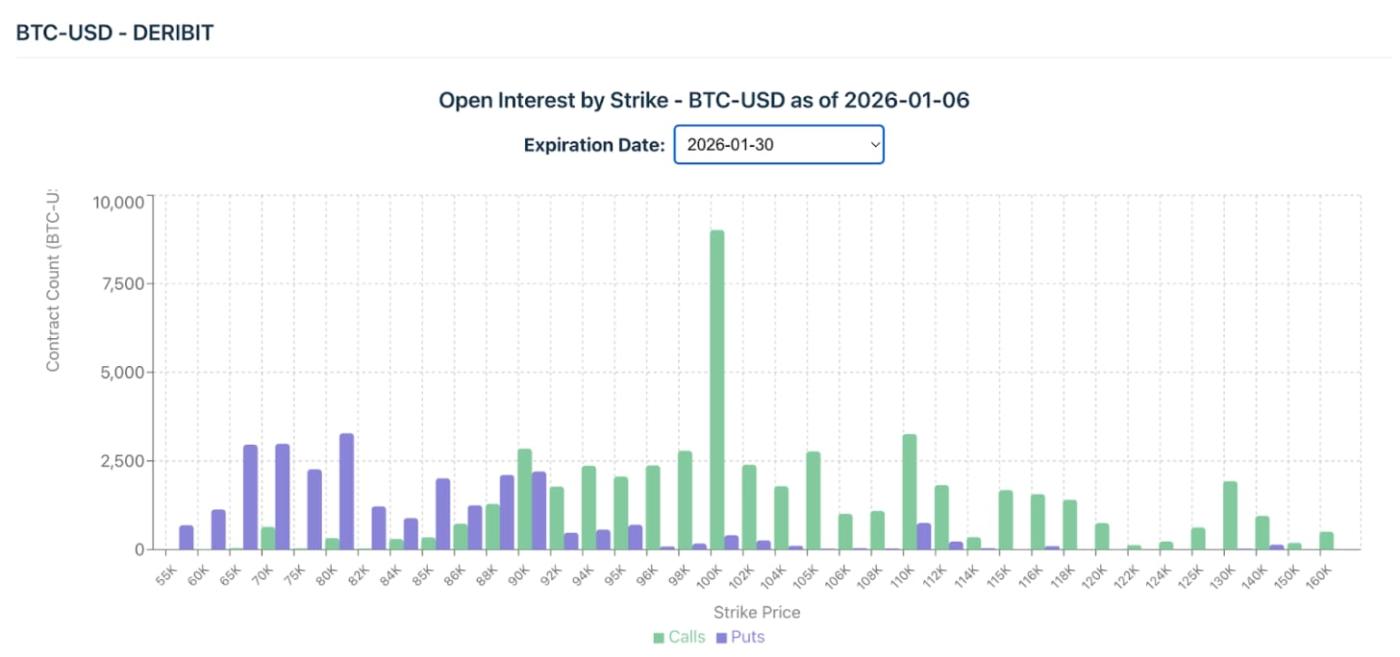

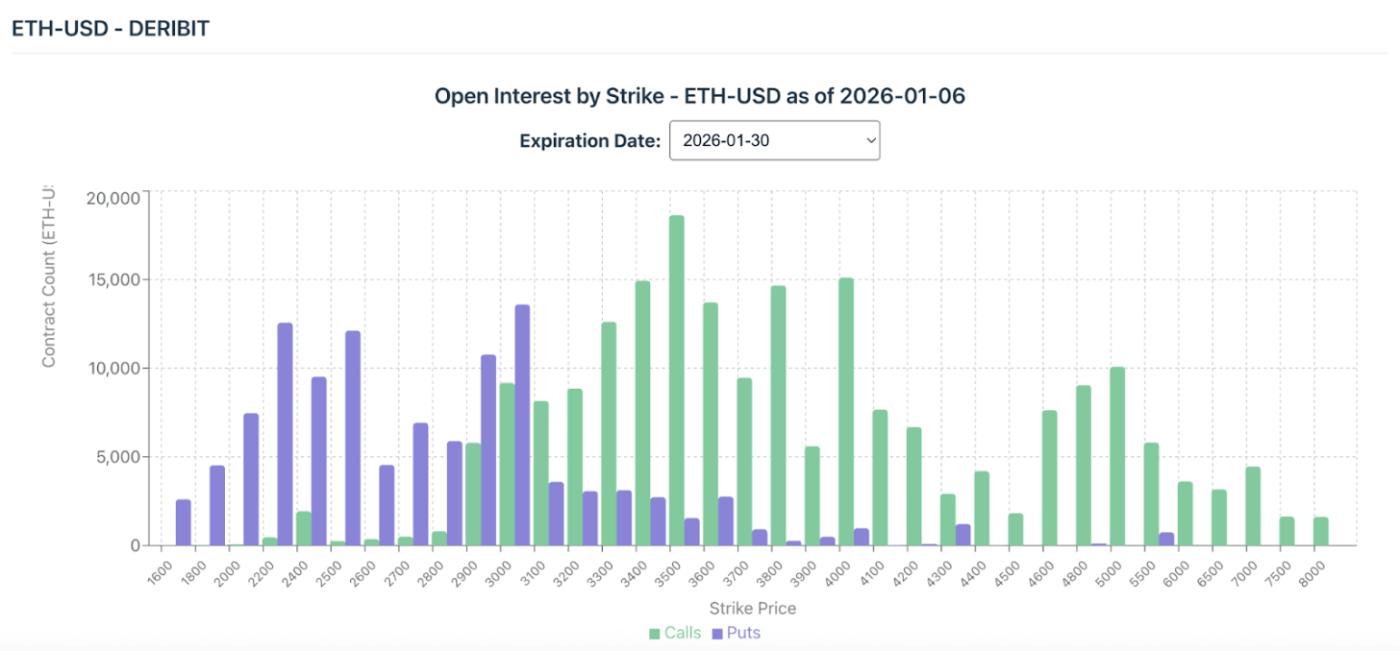

Derivatives positioning points to cautious bullishness, with options call OI clustered at $100K BTC / $3,500 ETH into late January expiries.

A Green Opening to 2026

After weeks of range bound trading around the holidays, digital asset markets kicked off the year with Bitcoin rallying to $94K and the total market cap approaching $3.3T.

Crypto remained resilient despite geopolitical escalations following US military operations in Venezuela, a move that would typically weigh on risk assets. Digital assets appear to be making up lost ground, with precious metals like Gold and Silver surging into year end. Additionally, strength in pockets of altcoins suggests increased risk appetite, with potential for near-term volatility across global markets as geopolitical developments unfold.

Source: Coin Metrics Network Data Pro & Reference Rates

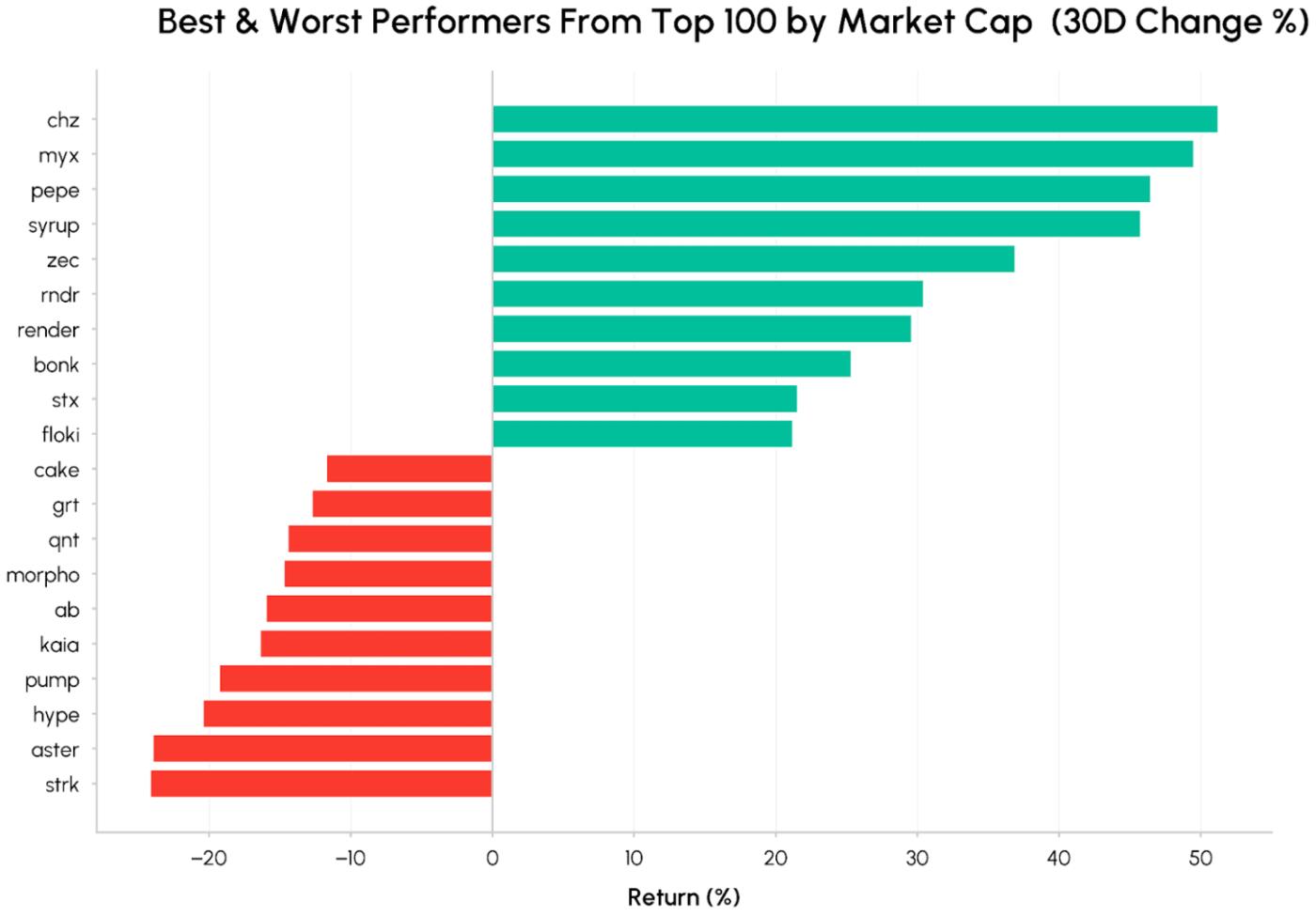

Notable gainers over the past month include memecoins like PEPE and BONK, privacy-focused networks Zcash (ZEC), and institutional credit platform Maple Finance (SYRUP), highlighting renewed interest across memecoins, privacy, and DeFi tokens with explicit revenue‑sharing and visible cash‑flow growth.

On the flipside, Hyperliquid (HYPE) and Aster (ASTER) underperformed as attention oscillates across the perpetual DEX landscape, particularly with Lighter’s (LIT) token airdrop—a ZK-rollup based decentralized perpetual exchange. DeFi lending protocol Aave (AAVE) also ended the period in negative territory amid ongoing debates and governance votes over tokenholder rights, revenue capture, and the role of Aave Labs within the DAO. These discussions reflect a broader trend across the DeFi sector, with protocols like Uniswap and Aave re-examining how value flows back to tokenholders.

Institutional Inflows Resume, Whale Distribution Cools

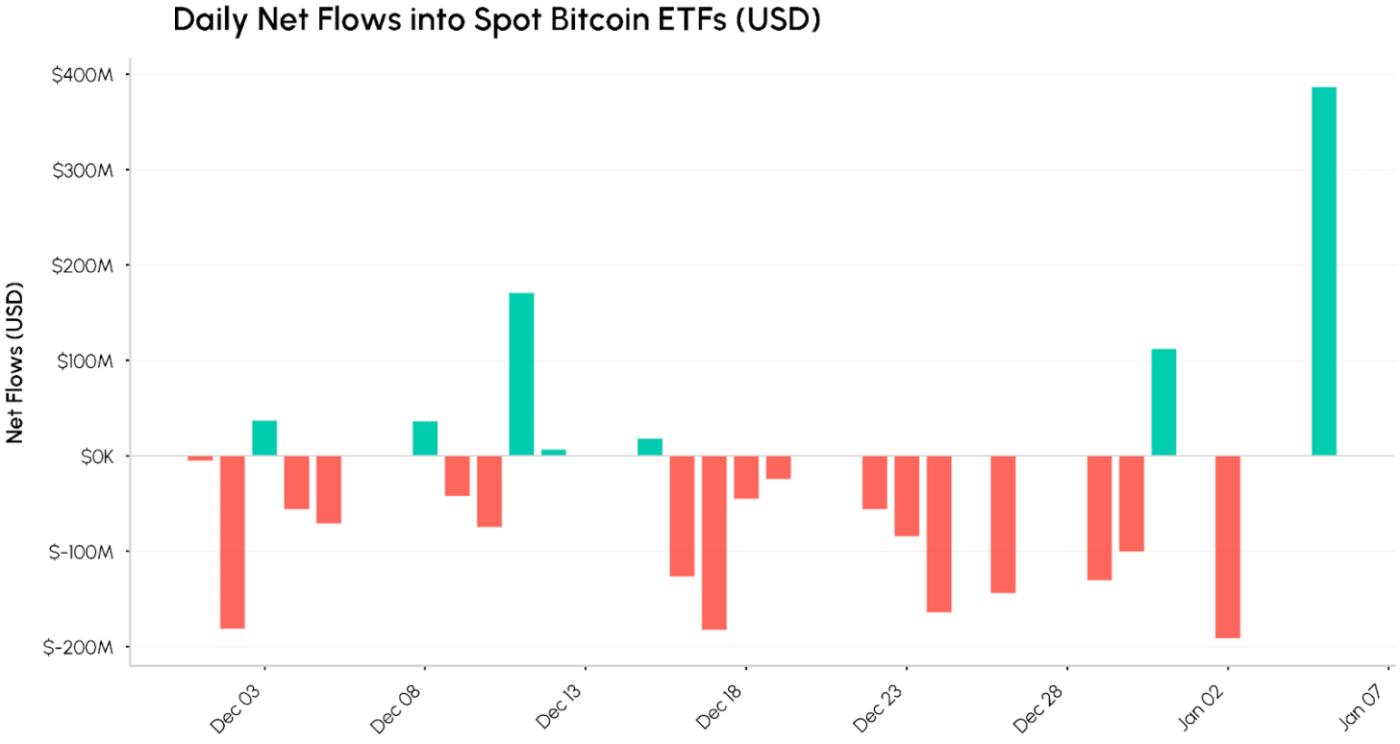

Institutional demand made a comeback as spot Bitcoin ETFs snapped a streak of year-end outflows, pulling in over $400M in net inflows on January 5th. The reversal follows over $320M in net outflows in the days surrounding New Year’s, signaling renewed appetite from institutional allocators as Q1 gets underway.

Digital asset treasury accumulation also continued, with Strategy adding 1287 BTC to bring total holdings to 673,783 BTC, while Bitmine Immersion Technologies increased its ETH reserves to 4.14 million ETH (~3.4% of total supply).

Source: Coin Metrics Network Data Pro

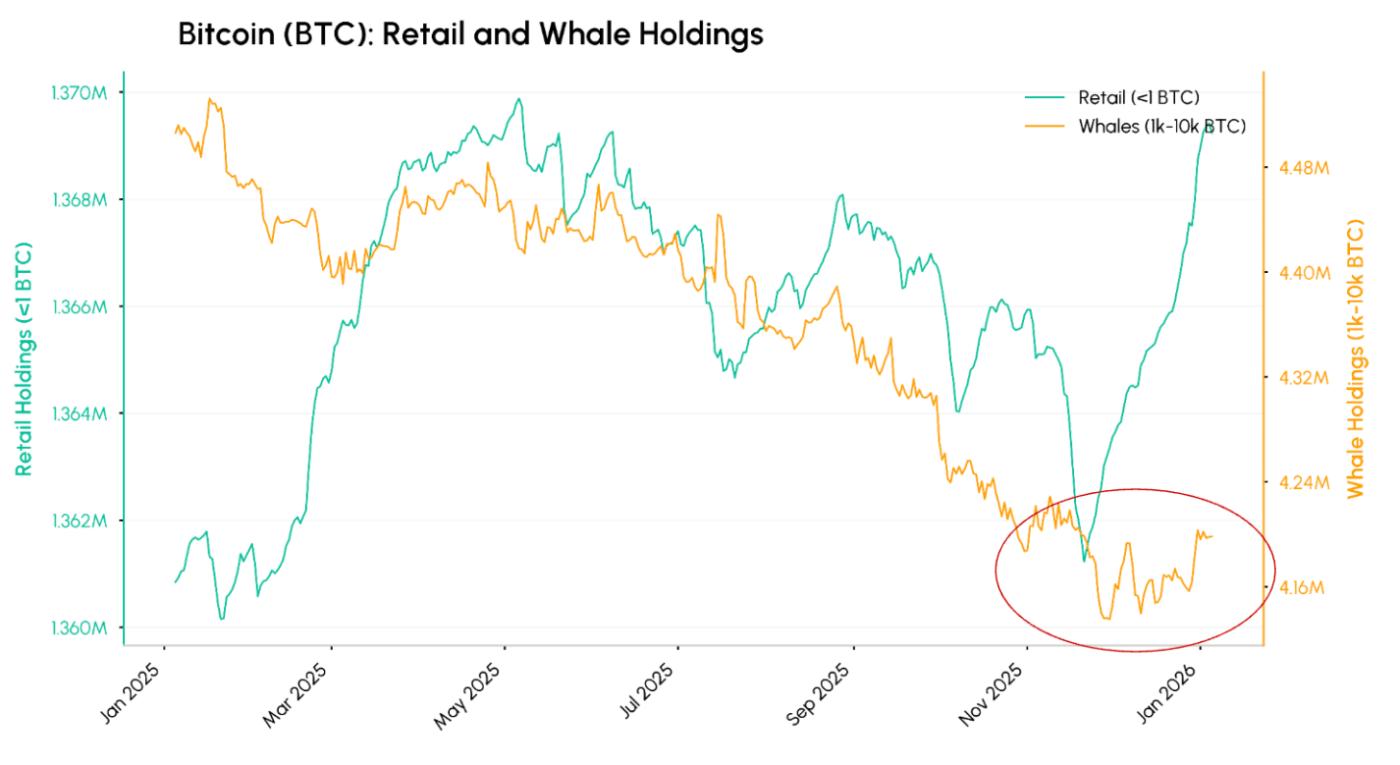

Onchain, distribution from whale wallets (1k-10k BTC) appears to be abating as we enter January, suggesting reduced sell pressure from this cohort. Meanwhile, retail accumulation (<1 BTC) has accelerated since mid November, with smaller investors growing holdings as prices pulled back and consolidated from highs. Together, these trends point to a constructive setup, diminishing large-holder selling alongside persistent demand from smaller participants.

Source: Coin Metrics Network Data Pro

Derivatives Point to Cautious Bullishness

Derivatives positioning points to cautious bullishness heading into Q1. The charts below show BTC and ETH open interest by strike price for contracts expiring on January 30th 2026 on Deribit. This offers a snapshot into how participants are positioning for near-term outcomes in options markets.

Source: Coin Metrics Market Data Feed

Options markets show significant call open interest clustered around $100K for BTC and $3,500 for ETH ahead of the January 30th expiry, with traders positioning for near-term upside without excessive exuberance. Downside protection remains in place with puts around the $70K to 90K level, with open interest skewed towards the upside.

Source: Coin Metrics Market Data Feed

Futures markets tell a similar story. Bitcoin and ether futures open interest saw a mild year‑end reset before rebuilding into January, with notional OI now back near December highs on major venues. Perpetual futures funding rates on both assets dipped into negative territory around late December amid broad deleveraging, but have since recovered, with ETH funding notably stronger than BTC. The market is leaning cautiously bullish without being overcrowded.

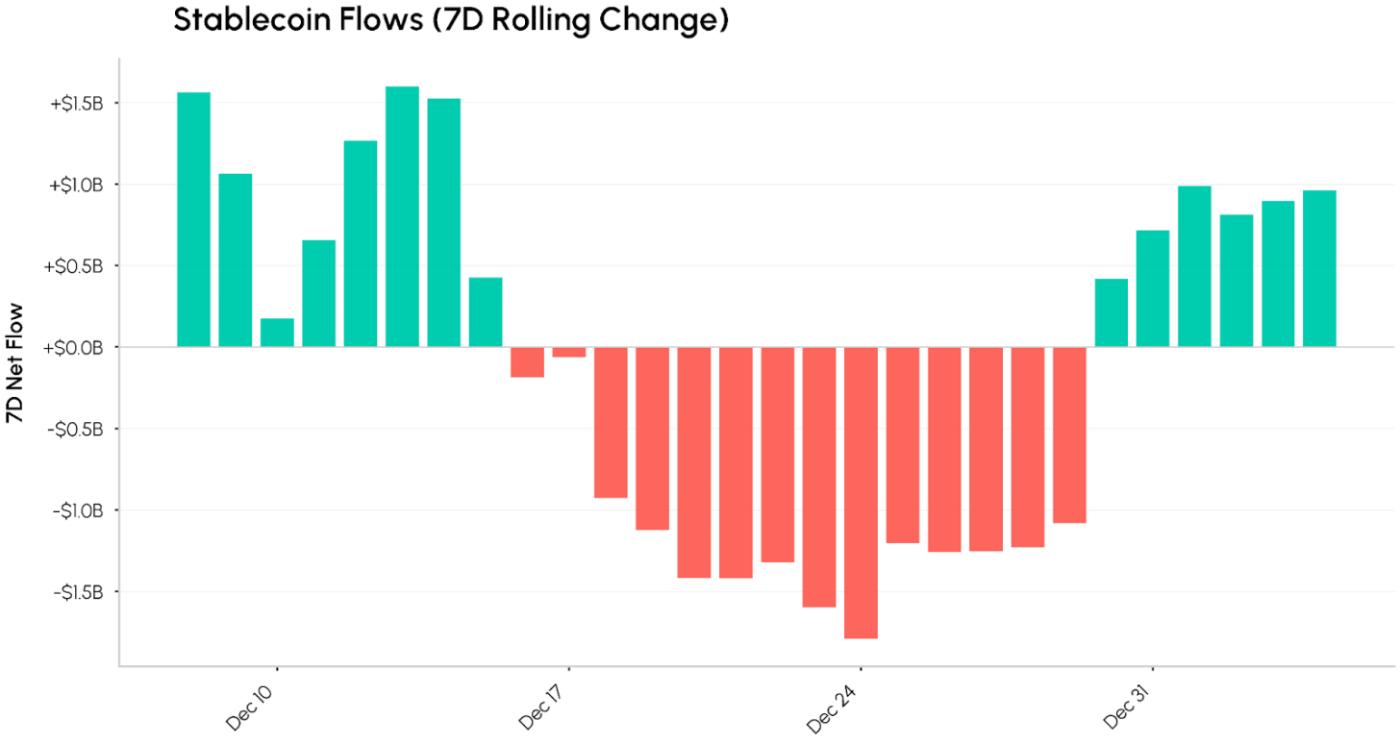

Stablecoin Flows & Onchain Activity

Stablecoin flows offer a proxy for capital entering or exiting the crypto ecosystem. After steady inflows through early December, flows turned negative into year-end, with weekly net outflows exceeding $1B. Heading into January, flows have begun to stabilize and turn positive, a constructive sign for sustained momentum if the trend holds.

Source: Coin Metrics Network Data Pro

On chain activity reinforces this picture. Ethereum mainnet reached an all-time high of 2.23M daily transactions following December’s Fusaka upgrade, with active addresses approaching record highs. This coincides with record stablecoin transfer volumes in December, suggesting capital is not just entering but actively moving through the ecosystem.

Conclusion

The first week of 2026 points to a cautiously constructive setup with the market finding its footing. Institutional flows have resumed, whale distribution is cooling, and derivatives positioning suggests cautious optimism without excessive leverage. Onchain activity remains robust, with stablecoin flows turning positive. That said, geopolitical developments around the United States and Venezuela bear watching as a potential source of near-term volatility for safe haven assets and global markets.

Subscribe and Past Issues

Coin Metrics State of the Network is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.