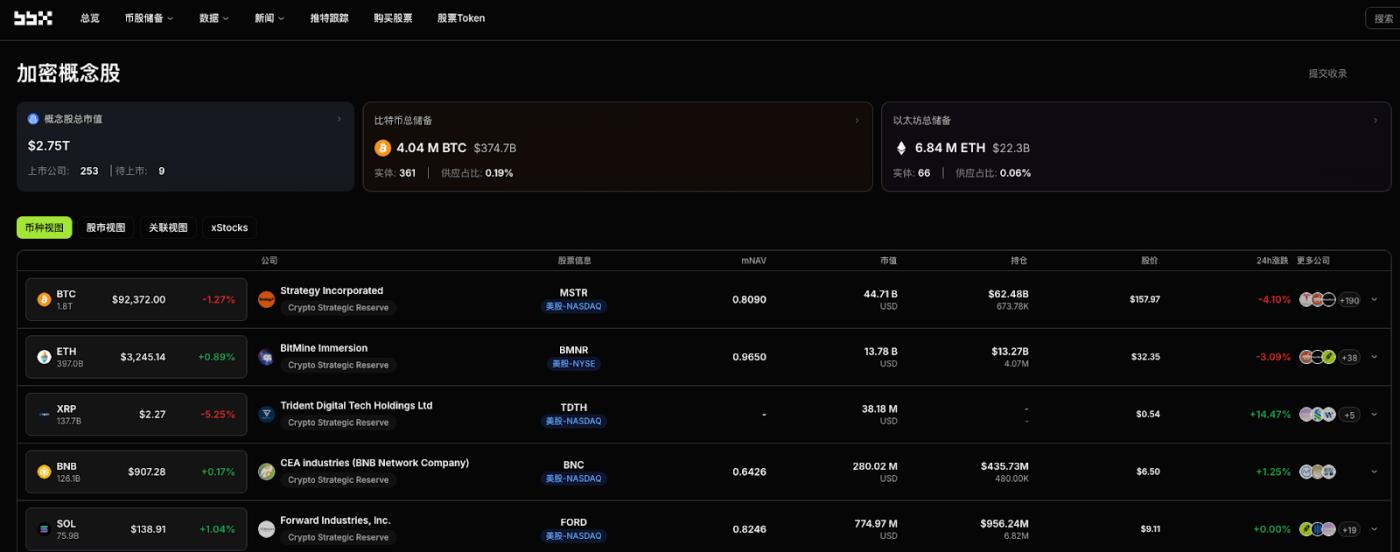

According to ME News, on January 7 (UTC+8), BBX Crypto Concept Stock Information disclosed that listed companies updated their digital asset purchases, treasury expansion, or potential strategic deployments yesterday, covering mainstream crypto assets such as Bitcoin and Ethereum, reflecting the continuity of companies' long-term allocation to crypto assets.

Bitcoin Treasury Expansion and Purchases

Sentinum, Inc., a wholly owned subsidiary of Hyperscale Data, Inc. (NYSE: GPUS), has accumulated approximately 524.6978 BTC in its Bitcoin treasury as of now (approximately 84.4637 BTC were mined and 440.2341 BTC were purchased on the open market), and continues to execute its long-term Bitcoin accumulation strategy.

Ethereum Treasury related updates

Bitmine Immersion Technologies (NYSE: BMNR) recently announced that it holds approximately 4,143,502 ETH as of today. The company has continued to expand its ETH treasury through accumulation and staking strategies over the past period.

Market perspective

Yesterday's global publicly traded companies' cryptocurrency asset allocation signals showed that BTC and ETH-related holdings remain at the core of most institutional treasury strategies. Overall, Bitcoin remains the preferred asset for corporate treasury allocation, while Ethereum's "utility asset + treasury" approach is also growing. (Source: ME)