Hedera price has surged in recent trading sessions, pushing HBAR close to a key resistance zone. This rally had previously offered hope for a recovery among retail investors.

However, this altcoin continues to be stalled near a resistance zone that it has failed to break through for weeks, putting buyers at risk as selling pressure gradually increases.

HBAR traders face losses.

HBAR traders consistently lean towards buying, opening numerous Longing positions in anticipation of a price breakout. Data from Derivative products also indicates that optimism remains strong. However, this confidence may be premature as technical barriers have yet to be broken.

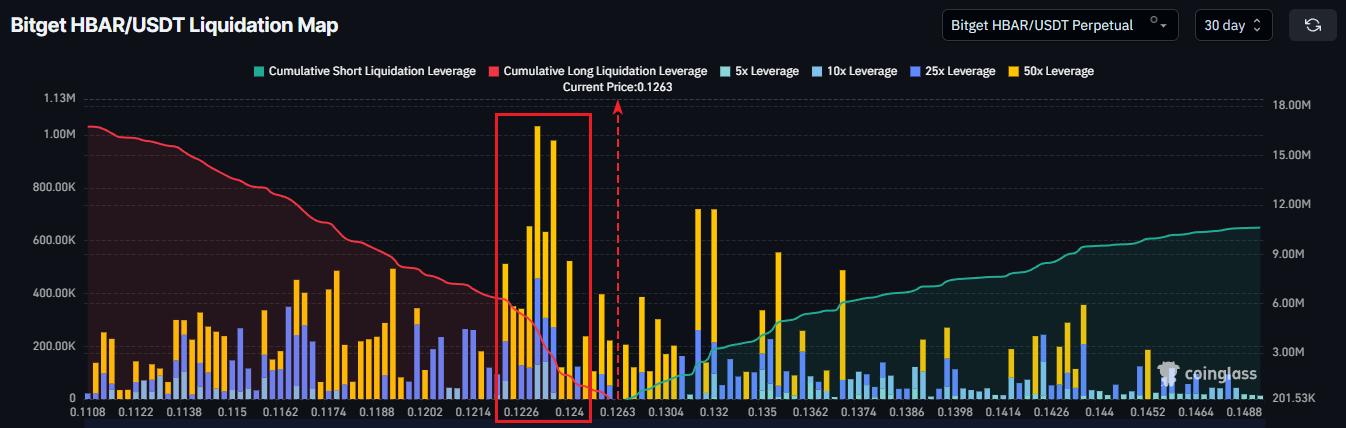

The liquidation heatmap data shows a concentrated risk zone between $0.124 and $0.122. If the HBAR price falls close to this level, approximately $6.23 million in Longing positions could be liquidated. This would significantly increase selling pressure and shake the confidence of buyers.

Want to receive more information about Token like this article? Sign up for the daily Crypto newsletter from editor Harsh Notariya here .

Heat map of HBAR liquidation levels. Source: Coinglass

Heat map of HBAR liquidation levels. Source: CoinglassForced liquidation often causes the market to decline more rapidly. When leverage is "Dump," prices fall even more sharply, creating a ripple effect that triggers further selling. If buying pressure is not strong enough at the current price level, HBAR faces the risk of a deeper sell-off.

HBAR is overbought.

Momentum indicators are warning of caution. The Money Flow Index has now entered overbought territory, even just surpassing the 80.0 level. This level typically signifies overheating rather than sustained strength.

The MFI combines both price and volume data to measure buying and selling pressure. When this index is at its current high level, the market is often prone to corrections because buyers have weakened. For HBAR, this suggests that the recent rally is likely to be a short-term rebound and may not last.

HBAR's MFI indicator. Source: TradingView

HBAR's MFI indicator. Source: TradingViewA market being in an overbought zone doesn't necessarily mean an immediate reversal. However, the risk of a price correction increases when it coincides with a strong resistance zone and a large volume of leveraged Longing positions.

Can HBAR prices break out of their downtrend?

Currently, HBAR is trading around $0.126, below the $0.130 resistance level. The price has also failed to break above the six-week-old downtrend line, causing every upward move to reverse. This severely limits the potential for further price increases.

Based on current investor sentiment and leverage, a rejection scenario at this resistance level seems quite likely. If the price falls, HBAR could easily lose the $0.125 mark. In that case, the price risks dropping to the $0.120 support zone, triggering a wave of Longing positions to be liquidated and intensifying the decline.

HBAR price analysis. Source: TradingView

HBAR price analysis. Source: TradingViewHowever, there is still a chance for recovery if the situation changes. If strong buying pressure emerges in the spot market or the overall market trend becomes more positive, HBAR could be pushed above the $0.130 mark. Breaking out of this downtrend, the price is likely to head towards the $0.141 region, invalidating the bearish scenario and rekindling hopes of a recovery for retail investors.