Zcash prices have been trading sideways for months, leaving both buyers and sellers dissatisfied. Despite occasional slight upward movements and continued accumulation by whales, ZEC remains tightly bound within a narrow price range.

The issue isn't that Zcash lacks interest. It depends on the timing and dynamics of Bitcoin. Furthermore, tight technical conditions, conflicting on-chain signals, and weak market sentiment are preventing ZEC price from breaking out. Below are the reasons why Zcash hasn't yet escaped this prolonged consolidation zone.

The isosceles triangle pattern illustrates the tug-of-war between technical analysis and on-chain data.

Zcash has been trading within an isosceles triangle pattern since mid-October 2023. This pattern appears when the price continuously creates progressively lower highs and higher Dip , indicating indecision between buyers and sellers. Buyers and sellers are constantly competing, but neither side is strong enough to break through this price range.

Every time ZEC touches the upper trendline, selling pressure reappears. When the price approaches the lower trendline, buyers jump in. This back-and-forth dynamic repeats itself for weeks, causing the price of ZEC to become increasingly compressed.

The Bull-Bear Power (BBP) indicator helps explain this. BBP measures XEM buyers or sellers are in control of price momentum. When Zcash attempted to break above the triangle area, buyers were at times in control. However, recent BBP candles show that sellers are regaining the upper hand, shifting momentum towards selling.

This is quite similar to what happened in early December 2023, when a sharp drop was avoided thanks to unexpected buying pressure from buyers.

Zcash triangle formation: TradingView

Zcash triangle formation: TradingViewWant to read more Token analyses like this? Sign up for Editor Harsh Notariya's Daily Crypto Newsletter here .

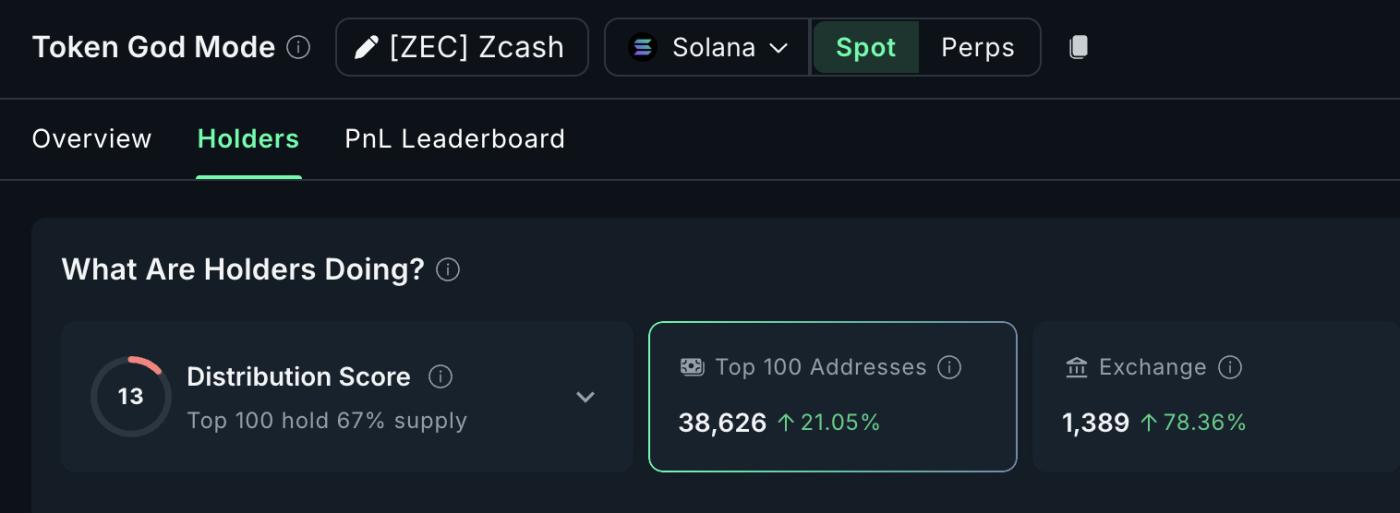

on-chain data also reflects this tug-of-war. Large whale wallets have increased their Zcash holdings by approximately 21% over the past seven days. The total ZEC held by this whale group is now nearly 38,626 ZEC. At current prices, this is equivalent to a net accumulation of approximately $3.3 million.

Whales and retail investors: Nansen

Whales and retail investors: NansenHowever, that buying pressure was offset by the actions of retail investors. The amount of ZEC deposited into exchanges increased by approximately 78%, indicating that many retail investors took advantage of the price increase (up 25% compared to the previous month) to take profits. In short, whales are accumulating while retail investors are selling, causing the price to remain stagnant. This also explains why the triangle pattern continues to persist.

The psychological collapse explains why whale buying was still not enough.

The mere accumulation of Zcash by whales isn't enough to cause a sharp price increase. Market sentiment is always a crucial factor in ZEC price surges , but right now, that factor is lacking.

The positive sentiment index has dropped sharply over the past month, falling from around 151 to nearly 2. This is significant because Zcash has historically been very sensitive to positive sentiment trends.

In early December 2023, when the sentiment index broke above 150, the price of ZEC surged from around $345 to $464 in less than a week, an increase of nearly 34%. Then, around December 27, 2023, sentiment rose again to nearly 32, and the price immediately jumped from around $512 to $549, equivalent to a 7% increase.

ZEC sentiment plummets: Santiment

ZEC sentiment plummets: SantimentBut currently, that "emotional" factor has disappeared. Although whales are still actively accumulating, the broader market is largely unconcerned. Without a wave of positive sentiment, the whales' buying activity isn't receiving widespread support. Prices are likely to move sideways, making it difficult to form a clear trend.

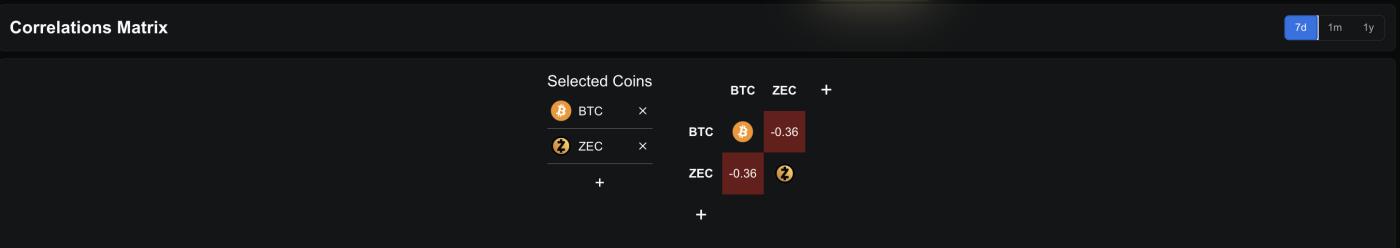

The declining sentiment is also consistent with the overall market context. Bitcoin is reclaiming many key price levels, while Zcash has a negative short-term correlation coefficient with Bitcoin near -0.36.

Inverse correlation with BTC: defillama

Inverse correlation with BTC: defillamaAs Bitcoin attracts more Capital, demand for ZEC slows, making it difficult for the price to break out in the short term. Notably, BTC has risen nearly 4% in the past week, while the price of ZEC has fallen by about 7%. A prime example of an inverse correlation!

Smart money and key price points for Zcash determine the delay.

Smart investor trading activity also reflects a cautious sentiment. The Smart Money Index, which tracks the flow of large orders during quiet hours, has now fallen below the signal line. This signals a lack of confidence in the prospect of short-term price increases, rather than a strong wave of selling.

"Smart Capital " typically anticipates price breakouts when the probability is high. However, that hasn't happened with ZEC yet.

From a price perspective, the current resistance level is quite clear. Zcash needs to close the day above $561 decisively to truly break the upper trendline of the isosceles triangle pattern and overcome the nearest resistance zone. This price level is approximately 14% higher than the current price and is XEM a point of release from the prolonged accumulation pressure.

Zcash price analysis: TradingView

Zcash price analysis: TradingViewIf Zcash successfully breaks out, the price could surge sharply in the short term. However, if positive sentiment doesn't return and participation doesn't increase, this scenario remains quite unlikely. If the price stays above $400, the current pattern hasn't been broken. But if it falls below this level, the technical structure will collapse, and expectations of an uptrend need to be XEM .

Currently, Zcash shows no signs of a sharp decline. The market is still in a wait-and-see phase.

Big players are buying, while small investors are taking advantage of the situation to sell. Overall sentiment has calmed down, and smart money hasn't yet entered the market strongly. Until one side truly gains the upper hand in this tug-of-war, the price of Zcash is likely to remain sideways, prompting many traders to patiently wait for a clearer breakout signal.