Written by: Jademont, Evan Lu, Waterdrip Capital

Reviewing the volatile year of 2025, and looking ahead to the long-term AI cycle.

A new industrial revolution: computing power becomes the engine of economic operation.

"In this world, only a very few people can, like Edwin Drake, inadvertently usher in an era that changes human history... His drill rod, which went deep into the ground, not only touched the black liquid, but also the artery of modern industrial civilization."

In 1859, in the mud of Pennsylvania, people surrounded Colonel Edwin Drake, jeers and laughter. At that time, the world's lighting relied on increasingly scarce whale oil, yet Drake firmly believed that naphtha could be extracted on a large scale. This was considered a madman's delusion at the time. Until the first gushing of black liquid, no one could have imagined that the emergence of oil would not only replace whale oil as a lighting energy source, but would also become the cornerstone behind the struggle for power in human society for the next two centuries, reshaping global power and geopolitics for the next hundred years. Human history also reached a turning point: old wealth depended on trade and shipping, while new wealth was rising with the advent of railroads and energy (oil).

In 2025, we find ourselves in a remarkably similar game. However, this time, the surging power is the computing power flowing through silicon wafers, and the "gold" is the code etched onto the blockchain; the new era's "gold" and "oil" are reshaping our entire consensus on productivity and store-of-value assets. Looking back at 2025, the market experienced unexpected and severe volatility. Trump's aggressive tariff policies forced global supply chains to relocate, triggering a massive inflationary rebound; gold historically broke through $4,500 amidst geopolitical uncertainty; the crypto market began the year with the epic boost of the GENIUS Act, only to suffer the painful liquidation caused by leveraged liquidation in early October.

Beyond the noise of macroeconomic fluctuations, an industry consensus on AI computing power is rapidly taking shape: Nvidia, dubbed the "AI water seller," reached a milestone market capitalization of $5 trillion in October. Furthermore, the three giants—Google, Microsoft, and Amazon—have already invested nearly $300 billion in AI infrastructure this year. For example, xAI's upcoming completion of a million-GPU cluster by the end of the year foreshadows this significant increase in computing power. Musk's xAI built the world's largest AI data center in Memphis in less than six months and plans to expand to an astonishing 1 million GPUs by the end of the year.

The Digital Age: The Main Theme of the Next Industrial Revolution

As Bridgewater Associates founder Ray Dalio once said, "The market is like a machine; you can understand how it works, but you can never accurately predict its behavior." Even with a random and unpredictable macroeconomic environment, it's undeniable that AI remains the primary long-term growth driver for the US stock market. In the next decade, AI technology has become a crucial core gear in the market machine, continuously impacting all aspects of government, business, and individual life.

Despite the ongoing debate about an "AI bubble," many institutions have warned that the AI investment boom is showing signs of becoming a bubble. Morgan Stanley research points out that by 2025, investment growth in the AI sector will lead to soaring valuations of tech stocks while productivity gains are not yet significant. This divergence has been likened to signs of a bubble during the dot-com boom of the 1990s.

However, an undeniable fact is that the AI-driven productivity revolution has gradually entered a period of substantial monetization. From an investment perspective, AI is no longer just a narrative for tech giants; the efficiency dividends and cost optimization it brings are the main drivers of profitability and productivity improvements for non-tech companies. But the price behind this comes with a brutal replacement of jobs. AI's replacement of the workforce, especially white-collar workers, is undeniable, most directly manifested in the exponential reduction of entry-level positions. Basic coding, accounting, auditing, and even junior management consulting and legal practice jobs are likely to be among the first to be replaced by AI.

As AI applications deepen, the risk of unemployment is accumulating in sectors such as healthcare, education, and even retail. Recently, a harsh joke has circulated in the US investment community: software engineers will be like civil engineers today; and as Elon Musk emphasized in an interview, AI may replace everyone's jobs. However, this also heralds the arrival of a new industrial era belonging to AI, an era known as the "digital intelligence era."

Looking ahead to 2026, the demand for AI will continue to expand.

Four Stages of AI Industry Investment

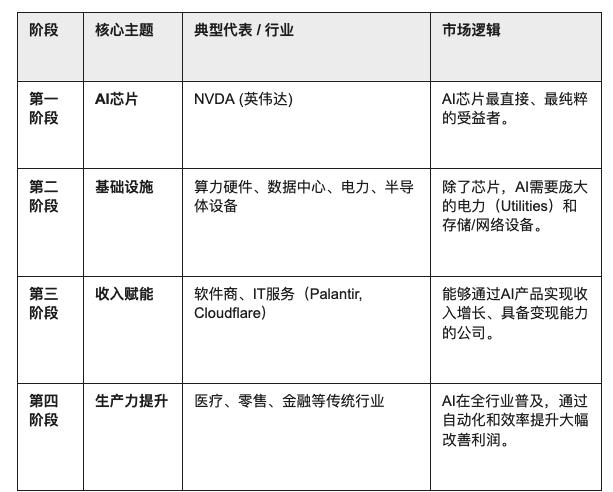

As the AI craze spreads from concept to the entire industry, and given that the market has already fully priced in its MAG7 (the seven major US stock exchanges), where will the next wave of growth in the AI theme come from? Goldman Sachs equity strategist Ryan Hammond's "four-stage model for AI investment" points to the subsequent path: AI investment will successively go through four stages : chips, infrastructure, revenue empowerment, and productivity improvement .

The AI investment four-stage model, referenced at: https://www.goldmansachs.com/insights/articles/ai-infrastructure-stocks-poised-to-be-next-phase

Currently, the AI industry has just reached the intersection of "infrastructure expansion" and "application implementation," that is, the period of transition from stage 2 to stage 3. Demand for AI infrastructure is about to explode.

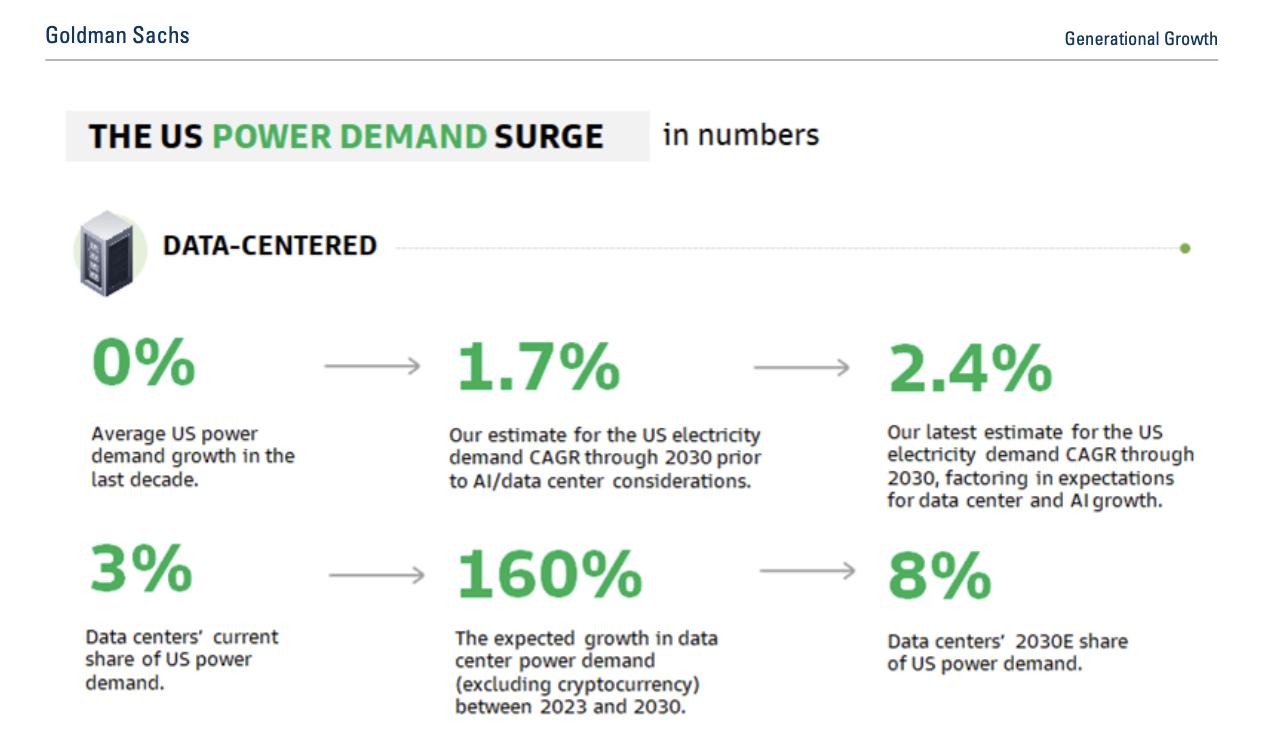

It is predicted that global data center electricity demand will increase by 165% by 2030.

From 2023 to 2030, the compound annual growth rate of electricity demand from U.S. data centers is projected to be 15% , increasing their share of total U.S. electricity demand from the current 3% to 8% by 2030.

Global spending on data centers and hardware is projected to reach $3 trillion by 2028.

Goldman Sachs' forecast for U.S. data center electricity demand. Image source: https://www.goldmansachs.com/pdfs/insights/pages/generational-growth-ai-data-centers-and-the-coming-us-power-surge/report.pdf

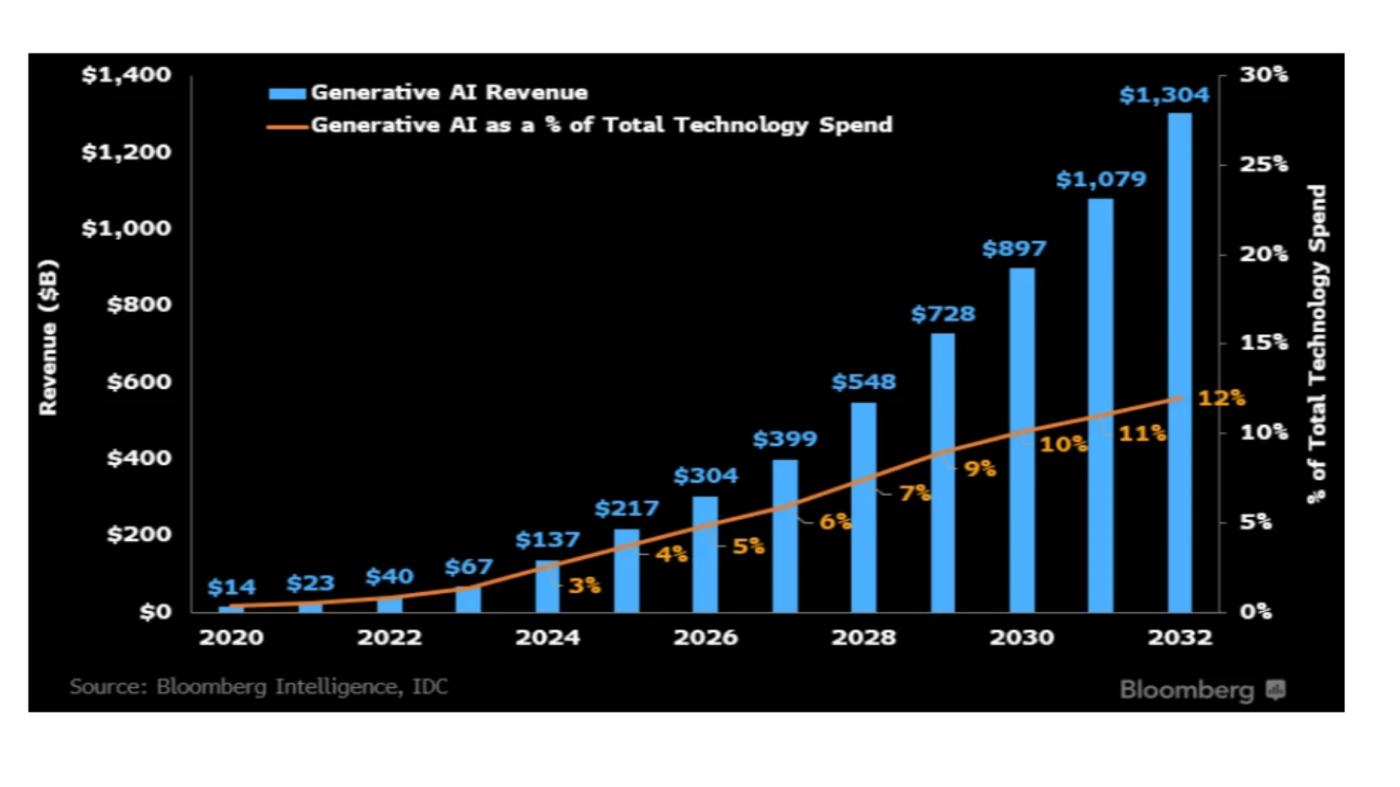

Meanwhile, the market for generative AI applications is experiencing explosive growth, projected to reach $1.3 trillion by 2032. In the short term, the development of training infrastructure will drive the market at a CAGR of 42%; while in the medium to long term, growth will gradually shift towards inference devices for large language models (LLMs), digital advertising, professional software, and services.

Bloomberg: Forecasts of Generative AI Growth Over the Next 10 Years. Data Source: https://www.bloomberg.com/company/press/generative-ai-to-become-a-1-3-trillion-market-by-2032-research-finds

This prediction will be validated in 2026. Goldman Sachs, in its latest macroeconomic outlook for 2026, points out that 2026 will be the "year of realization" for AI's return on investment (ROI), with AI expected to have a substantial cost-reduction effect on 80% of non-technology companies in the S&P 500. This means verifying whether AI can truly achieve a qualitative shift from "potential" to "performance" on corporate balance sheets.

Therefore, in the next 2-3 years, the market's focus will no longer be limited to a single technology giant, but will further expand: digging deeper into AI infrastructure (such as power, computing hardware, and data centers) and looking upwards for generalized industry companies that have successfully transformed AI into profit growth.

AI computing power is the "new oil," and Bitcoin is the "new gold."

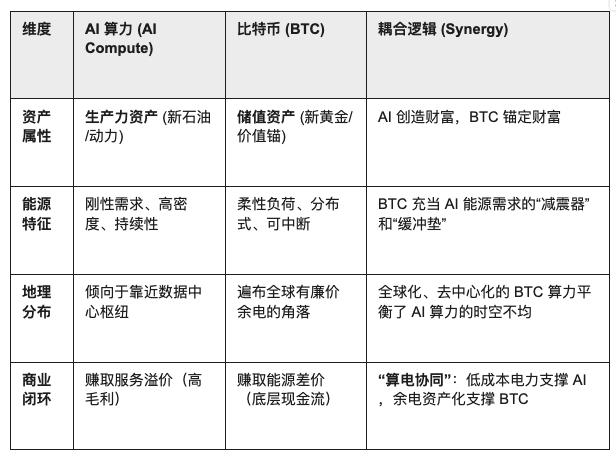

If AI computing power is the "new oil" of the digital age, driving an exponential leap in productivity, then BTC (Bitcoin) will be the "new gold" of this era, serving as the ultimate foundation for value anchoring and credit settlement.

As an independent economic entity, AI does not require a human banking system; its only need is energy . Bitcoin ( BTC) is a pure "digital energy storage device." In the future, AI will be the "fuel" of the economy, while BTC will be the "anchor" behind economic value. The issuance of BTC depends entirely on Proof-of-Work (PoW) based on electricity consumption, which perfectly aligns with the essence of AI (electricity transformed into intelligence).

Secondly, AI computing power, as a consumable productivity asset, derives its core cost from electricity, while its value output depends on algorithm efficiency. BTC, as a decentralized store of value, is essentially a monetization of energy and naturally possesses the function of a "reservoir" to balance the spatiotemporal unevenness of global computing power. AI requires a continuous and stable power supply, and BTC mining can absorb the waste electricity generated by the grid due to spatiotemporal unevenness. In other words, BTC mining stabilizes the grid through "demand response": when there is a power surplus (such as peak wind and solar power), computing power can absorb the excess power as a load; when there is a power shortage (peak AI computing time), mining computing power can be shut down instantly, releasing electricity to higher-value AI clusters.

GENIUS Act: The starting point for the convergence of stablecoins, RWA, and on-chain computing power.

With the passage of the GENIUS Act in the United States in 2025, the US dollar is also preparing to gradually complete its digital transformation, and stablecoins will be included in the federal regulatory framework and become an "on-chain extension" of the dollar system. This act not only injects trillions of dollars of new on-chain liquidity pools into US Treasury bonds, but also provides a paradigm that can be learned from for designing stablecoin regulatory systems in important jurisdictions around the world (such as the European Union, the United Kingdom, Singapore and Hong Kong).

The establishment of this compliance framework first and foremost injects strong institutional impetus into the RWA (Real World Assets) market: with the help of regulated stablecoins to improve global liquidity and support efficient cross-border settlement and transactions, the issuance and circulation of RWA will be more convenient. Stablecoins have become the main payment means for on-chain investment in RWA such as real estate, bonds, and art, supporting fast global cross-border clearing.

AI computing power assets, due to their high investment costs, stable returns, and heavy asset attributes, and their inherent suitability for on-chain digital management, are gradually being regarded as a standardized RWA (Resource-Based Asset Management). Whether it's GPU cloud computing, AI inference resources, or the operational capabilities of edge computing nodes, parameters such as pricing methods, leasing periods, load rates, and energy efficiency ratios can all be quantified and mapped through on-chain smart contracts. This means that future computing power leasing, revenue splitting, transfer, and staking will be fully migrated to on-chain financial infrastructure for transactions, settlements, and refinancing. Furthermore, computing power can achieve real-time insights into equipment operation and revenue through on-chain data, ensuring transparent and verifiable returns. Simultaneously, computing power supply can be flexibly allocated on demand, reducing the risks of capital occupation and resource idleness under the traditional heavy asset model, and guaranteeing the stability and transparency of returns.

What's even more intriguing is that, much like the oil exchanges that emerged on Wall Street two hundred years ago after the discovery of oil, AI computing power, through RWA, can become a financial asset that can be standardized, traded, mortgaged, and leveraged. This could enable innovative financial operations such as on-chain financing, trading, leasing, and dynamic pricing. The next-generation "computing power capital market" based on RWA will have more efficient value transfer channels and unlimited potential application space.

New Opportunities under the "Dual Consensus"

In the new era where AI is fully integrated into our lives, computing power will become the consensus of high-efficiency productivity, and the ultimate liquidity accompanying high-efficiency productivity—BTC—will become the new definition of the consensus of value storage.

Therefore, companies that can control either "productivity" or "assets" will become the most valuable entities in the future cycle, and cloud service providers are at the intersection of "BTC value storage consensus" and "AI production consensus." If computing power is the high-energy fuel driving the rapid operation of the digital economy, then cloud services are the intelligent conduits that carry and distribute this power.

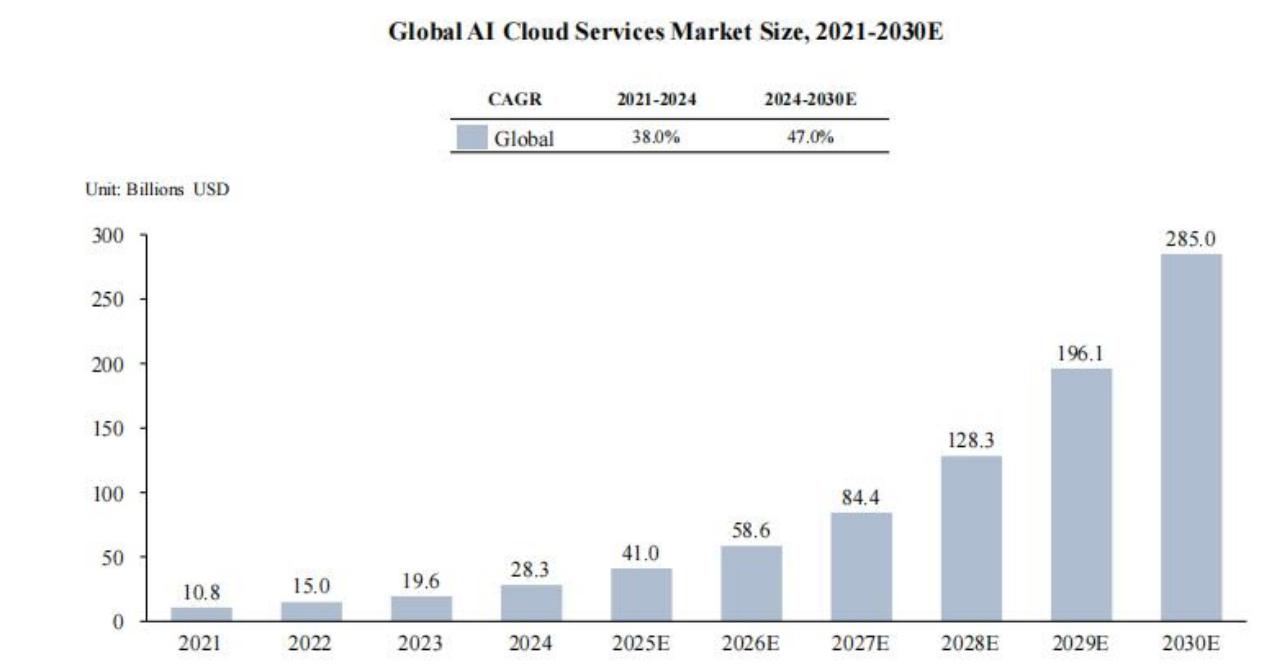

Global AI cloud services market size forecast, data source: Frost & Sullivan

This includes several giants: Microsoft, Amazon, Google, XAI, and Meta. They are also known as "Hyperscalers" (hyperscale cloud service providers). Their main business is IaaS (Infrastructure as a Service) catering to general needs. Although they have large computing resource pools, their resource scheduling can be inefficient when needed. Hyperscalers are at the very top of the AI computing power service chain, controlling the vast majority of computing resources in the market, and they continue to expand their computing infrastructure.

Microsoft: Launches the $100 billion Stargate project, which aims to build a cluster of millions of GPUs to provide extreme computing power support for the evolution of OpenAI models.

Amazon (AWS) has pledged to invest $150 billion over the next 15 years to accelerate the deployment of its self-developed Trainium 3 chip, aiming to decouple computing power costs from external supply through hardware self-sufficiency.

Google: Annualized capital expenditures remain at a high level of $80-90 billion. Leveraging the high energy efficiency of its self-developed TPU v6, Google is rapidly expanding its AI Regions globally.

Meta: Zuckerberg clearly stated in the earnings call that Meta's capital expenditure (Capex) will continue to grow, with the 2025 guidance revised upward to $37-40 billion . Through liquid cooling technology upgrades and a reserve of 600,000 H100 equivalent computing power, Meta aims to build the world's largest open-source AI computing power pool.

xAI: With its "Memphis speed," it has completed Colossus, the world's largest single supercomputing cluster, aiming to reach a scale of 1 million GPUs, demonstrating an extremely aggressive and efficient infrastructure delivery capability.

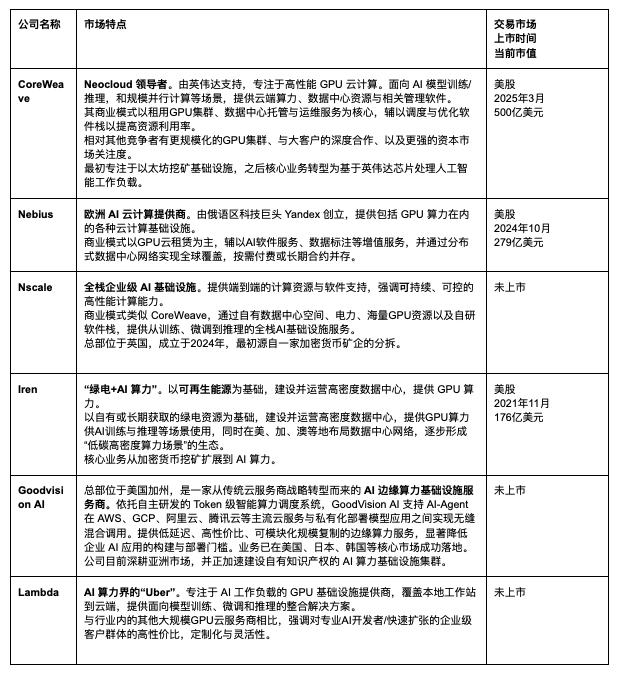

Other emerging cloud service providers such as CoreWeave and Nebius are called NeoCloud, whose main business has expanded to IaaS + PaaS (Platform as a Service). Compared with the general cloud platform services provided by giants, NeoCloud focuses on creating a high-performance computing platform for AI training and inference. It not only provides more flexible computing power leasing solutions, but also provides computing power scheduling solutions specifically for AI training and inference needs, with faster response and lower latency.

At the same time, we stockpile top-of-the-line GPUs (H100, B100, H200, Blackwell, etc.) and build our own high-performance AIDC, pre-installing the entire unit, liquid cooling, RDMA network, and scheduling software, and quickly deliver them to customers on flexible lease agreements based on the entire unit or the entire campus plus daily charges.

Coreweave is undoubtedly the leading player in Neo Cloud. As one of the most anticipated tech stocks of 2025, Coreweave's core business currently focuses on cloud computing and GPU-accelerated infrastructure services for AI training and inference scenarios. Of course, Coreweave isn't the only company eyeing this new type of computing power leasing opportunity; Nebius, Nscale, and Crusoe are all strong competitors.

Unlike Neo Cloud platforms like CoreWeave, which focus on large-scale, asset-heavy computing clusters in Europe and the US, GoodVision AI represents another possibility for global computing power. Through intelligent scheduling and management of multiple computing users, it builds rapidly deployable, low-latency, and cost-effective AI infrastructure in emerging markets with relatively weak power and infrastructure, achieving the equalization of computing power. Furthermore, while tech giants are building million-level GPU clusters in places like Memphis for training models with larger parameters, GoodVision AI addresses the "last mile" latency problem in AI application deployment by distributing modular inference computing nodes across emerging markets like Asia.

It's worth noting that most top AI computing power service providers share a clear characteristic: their founding teams or core architecture are deeply rooted in the cryptocurrency mining industry. The shift from mining to AI computing power isn't a career change, but rather a strategic reuse of core capabilities. BTC mining and AI high-performance computing are highly isomorphic in their underlying logic, both heavily reliant on large-scale power acquisition, high-power central deployment, and 24/7 extreme operation and maintenance. The cheap electricity channels and hardware management experience these companies accumulated in their early years have become their most scarce and valuable assets in the AI wave.

As the demand for AI computing power grows exponentially, it is natural for them to switch their existing infrastructure from "mining store-of-value assets (BTC)" to "outputting productivity computing power (AI)." And as the technology for this "two-way switching" matures, BTC can effectively balance the problem of uneven energy distribution in time and space. Therefore, in the digital age, the "fuel" driving productivity leaps will change from oil to computing power, and the "underlying asset" anchoring its value will evolve from gold to BTC.

By combining computing power with blockchain technology and putting it on-chain as RWA assets, not only can the source, efficiency, and operational revenue of computing power be verifiablely recorded, but a smart contract settlement mechanism can also be built across regions and time periods. This reduces credit risk and intermediary costs, expanding its application scenarios in DeFi and cross-border computing power leasing. For example, edge computing nodes, whose load rate, energy efficiency ratio, and other parameters can be provided through intelligent scheduling to achieve Proof-of-Work (PoW) and quantified through smart contracts, can make edge inference computing power a standardized financial product that is transferable and collateralizable, realizing an "on-chain computing power market." The combination of computing power and RWA will further enrich the types of on-chain assets and open up new liquidity space for global capital markets.

Connecting Productivity and Stored Value: Towards the Future of Computing Power Monetization

This is a real-world confirmation of the "dual consensus" logic we previously proposed: BTC is the top-level value anchor for energy, while AI is the productive application of energy. From this perspective, the era of "computing power as currency" is arriving much faster and more disruptively than imagined. As humanity enters the digital age, the "fuel" driving productivity leaps is shifting from oil to computing power, and the "underlying asset" supporting its value consensus is evolving from gold to BTC.

At this moment, we are like the onlookers standing on the muddy land of Pennsylvania in 1859, finding it hard to imagine how that drill pipe, deep into the ground, would usher in a new era of industrial civilization. Today, fiber optic cables extending to data centers around the world are quietly building the arteries of this new era. And those pioneers who bet on computing power and Bitcoin will play the role of new "oil tycoons" in this transformation, redefining the distribution of wealth and power in this new cycle.

References:

John S. Gordon, *The Great Game: The Rise of the Wall Street Financial Empire*

Daniel Yergin [USA]: The Oil Game

Goldmansachs: AI infrastructure stocks are poised to be the next phase of investment

Goldmansachs: AI, data centers and the coming US power demand surge

Bloomberg: Generative AI to Become a $1.3 Trillion Market by 2032, Research Finds

KPMG: Bitcoin's role in the ESG imperative

Square: Bitcoin is Key to an Abundant, Clean Energy Future

Arthur Hayes: Bitcoin will be the currency of artificial intelligence

36Kr: CoreWeave: In the era of computing power, wielding the "golden shovel"