While Bitcoin is still trading around the $90K level, on-chain data shows that momentum may be slowing.

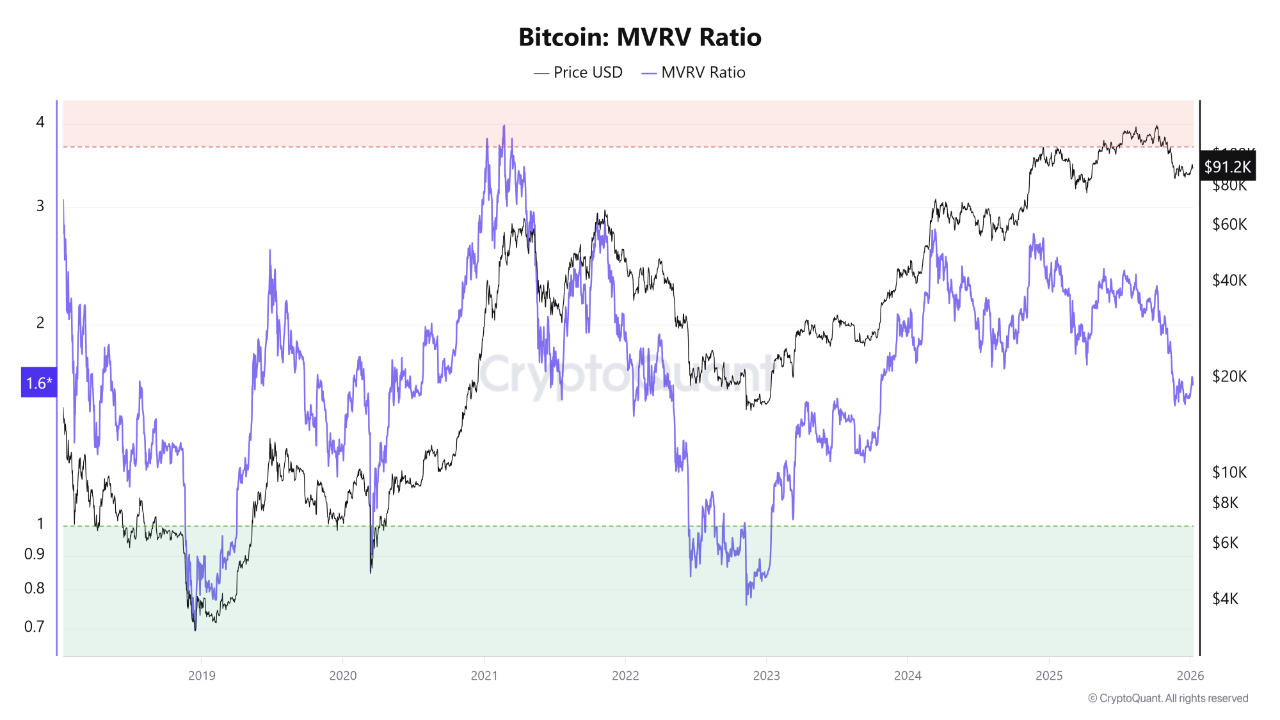

CryptoZeno, an analyst at CryptoQuant, points to the Market Value to Realized Value (MVRV) ratio as an early warning sign. The metric has started to trend lower after failing to stay near levels that typically signal overvaluation.

This suggests that even though prices remain high, fewer holders are seeing their profits grow. In other words, gains across the network are no longer expanding as quickly. This points to a cooling risk appetite in the market, despite Bitcoin’s price still holding up.

Notably, this analysis comes as Bitcoin attempted to reach the $95K price level this week but was unsuccessful. Bitcoin, which opened the year at $87,600, saw its value rise to $94,789 on January 5 before facing resistance. The move briefly stirred optimism that the Bitcoin bull run was back.

However, the price has since dipped back below the $90K level. At press time, Bitcoin is trading at $89,000. CryptoZeno’s analysis attempts to explain why momentum is slowing so quickly after just beginning.

Long-Term Bitcoin Holders More Willing to Sell

The analyst noted that divergence between Bitcoin’s price action and its on-chain valuation hints at a change in market structure. Long-term holders are more willing to sell at high prices, while most new buyers are short-term traders.

In past cycles, this pattern usually marked a transition. Instead of prices continuing strongly upward, the market often entered a phase of distribution and consolidation, where further gains were harder to sustain without new, confident buyers.

Notably, even though the MVRV shows some cooling, it is still well above historical levels. This means Bitcoin is far from a major sell-off or being deeply undervalued. However, it also places the market in an uncomfortable middle ground.

Prices aren’t low enough to attract strong bargain hunters, yet momentum isn’t strong enough to support a lasting premium. In this situation, Bitcoin can be more sensitive to bad news, with pullbacks happening faster and sentiment shifting quickly.

Consolidation or Deeper Correction More Likely

CryptoZeno says that unless the MVRV stabilizes and starts rising again, the outlook favors slowing momentum rather than renewed strength. The market isn’t fully risk-off, but it’s more likely to move sideways or correct than continue its previous uptrend.

Essentially, Bitcoin is holding steady, but on-chain data suggests that pushing higher could be more difficult without stronger conviction from buyers.

BTC to Remain in Boring Sideways, Capital Shift to Metals

Separately, CryptoQuant CEO Ki Young Ju predicts that Bitcoin will see a “boring sideways” grind in the first quarter of 2026. He argues that capital inflows have “dried up,” with investors shifting back to stocks and precious metals.

Ju expects BTC to avoid a major crash, but flat movement would go against historical trends, as January typically sees modest gains followed by stronger returns in February and March.

While Ju is cautious, other experts are bullish. Tim Draper expects 2026 to be “big” for Bitcoin, and Bitwise’s Ryan Rasmussen predicts new all-time highs.