Zcash (ZEC) rebounded on January 8, 2024, after an initial sharp sell-off driven by concerns about the project's core development team.

The recovery occurred after the leadership of Electric Coin Company (ECC) issued a statement clarifying the information, helping to allay concerns that this privacy-focused blockchain had been abandoned.

Clarifying the term ECC changes the perspective on leaving.

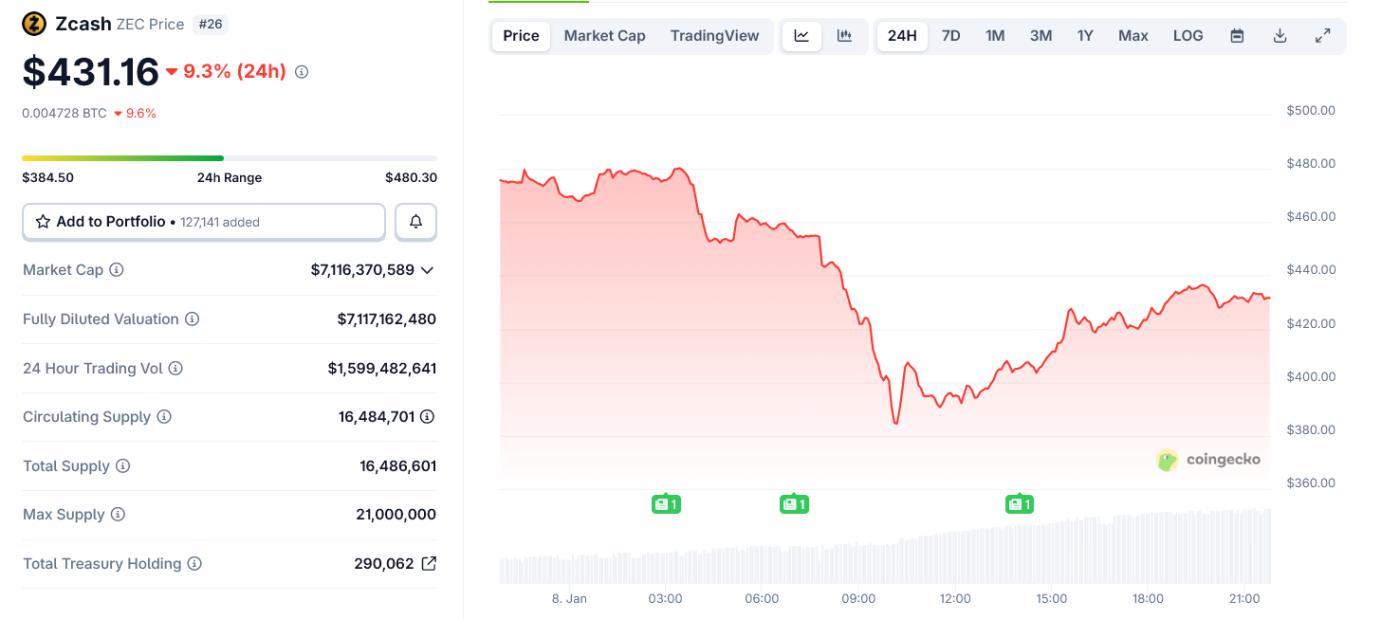

The price of ZEC at one point dropped by more than 20% , even falling below $390, before quickly recovering to above $430.

Volume surged while prices plummeted, suggesting the sell-off pressure stemmed from negative news, rather than changes in the protocol's fundamentals .

Zcash price recovers strongly after sharp drop. Source: CoinGecko

Zcash price recovers strongly after sharp drop. Source: CoinGeckoThe sell-off occurred following an announcement from ECC CEO Josh Swihart . The entire ECC team left the project due to "forced resignations" stemming from governance disagreements with the Bootstrap board (a non-profit organization).

This initial message led many to worry that Zcash had lost its core development team.

However, clarifying statements later that day revealed the issue was not as serious as initially thought. Swihart affirmed that the entire team remained committed to Zcash and had reorganized into a new startup model.

He also emphasized that this change was due to structural governance barriers within the nonprofit organization. This was not an abandonment of the project.

Importantly, the parties have clarified that the Zcash protocol remains fully operational and unaffected.

There are no changes to the consensus rules, encryption system, or network infrastructure of the project.

Zcash governance dispute, not a protocol crisis.

The main conflict stemmed from issues of governance and organizational control, rather than from the technical development process. The entire ECC team left the non-profit organization that managed Zcash, but retained the same personnel, goals, and roadmap in the form of a new business entity.

This distinction was not recognized by the market at the beginning. Many mistakenly thought it was a mass exodus or a project with serious problems, leading to a stronger wave of sell-offs.

As information became clearer, market sentiment began to stabilize.

Many industry figures have spoken out against the initial assessments, arguing that the market's reaction was "overreacted" and that the event was actually a corporate restructuring rather than a mass exodus of the development team.

These opinions help investors alleviate concerns and focus on the continuity of the project development process.

Although governance issues remain unresolved, the risk of serious project failure has been XEM exaggerated. Currently, the market is waiting to XEM how the new development model will operate and whether transparency in communication will help avoid similar shocks in the future.