For investors who feel lost amidst the noise of the cryptocurrency market, " TokenPost Academy ," with its eight years of field expertise, presents a true investment benchmark. We invite you to embark on a seven-step masterclass journey that will help you achieve your goal of joining the top 1%, relying on data instead of intuition and skill instead of luck. [Editor's Note]

"Options trading? Isn't that something only institutions do? It's so difficult."

Yes, options are difficult. But once you understand the principles, there's no weapon safer and more powerful. While futures trading is simply a game of guessing direction (up or down), options are a three-dimensional strategy that trades not only direction but also "time" and "volatility."

◆ Call Option: Apartment Pre-sale Rights

A 'call option' that bets on a rising market is the same as an apartment subscription right.

Situation: I paid a premium of 10 million won to purchase the right (pre-sale right) to buy an apartment currently worth 500 million won for 500 million won a year from now.

When prices skyrocket: A year later, the apartment's value has risen to 1 billion won. You exercise your right to buy it for 500 million won. You've made a profit of 500 million won with 10 million won. (Wow!)

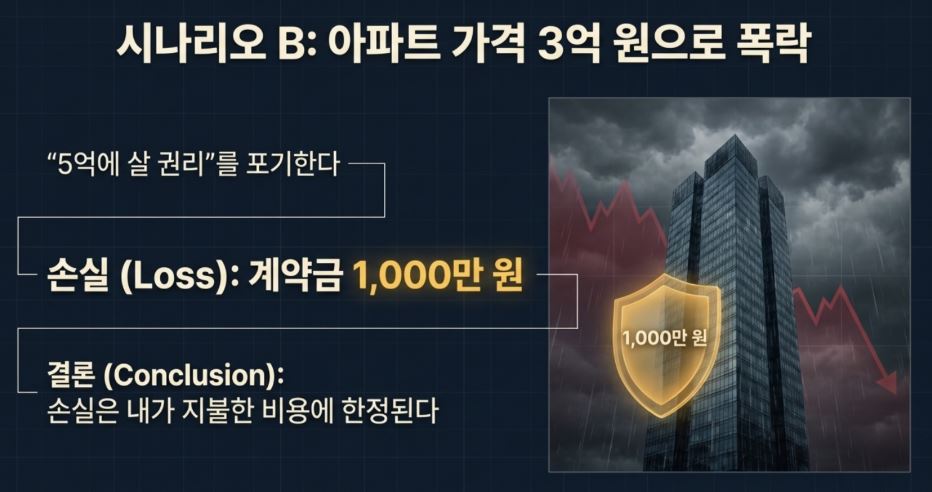

When prices plummet: The apartment's value has dropped to 300 million won. You're giving up your right to buy it for 500 million won. You're only losing 10 million won (the premium).

This is the appeal of buying options. Profits are unlimited, while losses are limited to the premium . Unlike futures trading, there's no risk of liquidation and incurring debt.

◆ Put Option: Car Insurance

Put options, which bet on a bear market or protect assets, are like car insurance.

Situation: I bought a put option (insurance) because I was worried that the value of my Bitcoin would fall.

If the price holds/rises: Nothing happens. I lost the premium, but my Bitcoin price has gone up, so it's okay.

When the price crashes: Bitcoin is halved. However, the value of put options skyrockets dozens of times, covering all Bitcoin losses (hedging).

Buyer vs. Seller

There are two types of people in the options market.

Option Buyer: A person who buys a lottery ticket. The odds of winning are low, but if it happens, it could be a life-changing experience.

Option sellers: These are people who sell lottery tickets (like casinos). They don't hit the jackpot, but they regularly collect the premiums paid by people, generating income similar to "monthly rent."

If you're a beginner, start with "buying." If you're afraid of a bear market, consider buying "put options" instead of selling your Bitcoin. It's the only way to sleep soundly at night.

👉 [Options Practice] From calculating the P&L of call/puts to profit-making covered call strategies even in sideways markets, discover the secret weapons of professional traders in TokenPost Academy's "Step 6: The Professional."

(Click here to register for classes: https://academy.tokenpost.kr )

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.