Editor's Note: On January 13th, Wintermute released its 2025 analysis report on the cryptocurrency OTC market. As the industry's leading market maker, Wintermute is undoubtedly extremely sensitive to market liquidity trends. In this 28-page report, the organization reviews changes in cryptocurrency market liquidity in 2025 and concludes that the market is shifting from clear, narrative-driven cyclical fluctuations to a more structurally constrained, execution-driven mechanism. Based on this conclusion, Wintermute also presupposes three key scenarios for the market to achieve a recovery in 2026.

The following is the original report from Wintermute, compiled and edited by Odaily(with some content omitted).

Report Summary

2025 marked a fundamental shift in the cryptocurrency market's liquidity mechanism. Capital was no longer widely dispersed across the market; liquidity became more concentrated and unevenly distributed, leading to a greater divergence between returns and market activity. Consequently, a large amount of trading volume was confined to a few tokens. Price rallies were shorter in duration, and price performance became more dependent on the channels and methods by which liquidity entered the market compared to previous years.

The following report summarizes the key changes in liquidity and trading dynamics observed by Windemute in 2025:

Trading activity is concentrated on a few major tokens. BTC, ETH, and a select group of Altcoin account for the majority of trading activity. This reflects the gradual expansion of ETFs and Digital Asset Treasury (DAT) products into a wider range of Altcoin, and the waning of the Meme coin cycle in early 2025.

The fading of narrative convictions is accelerating, and the rate of decline in Altcoin rallies is doubling. Investors are no longer following narratives with sustained conviction, but instead engaging in opportunistic trading on themes such as Meme coin launch platforms, perpetual contract trading platforms, and emerging payment and API infrastructure (such as x402), with limited follow-up momentum.

As the influence of professional counterparties increases, trade execution is becoming more prudent. This is manifested in more cautious cyclical trade execution (breaking away from the previous fixed four-year cycle), wider use of leveraged over-the-counter trading products, and diversified application of options as a core asset allocation tool.

The way capital enters the crypto market is just as important as the overall liquidity environment. Capital is increasingly flowing in through structured channels such as ETFs and DAT, influencing the flow and final concentration of liquidity in the market.

This report primarily uses proprietary OTC trading data from Wintermute to interpret the aforementioned market developments. As one of the industry's largest OTC trading platforms, Wintermute provides liquidity services across regions, products, and diverse counterparties, thus offering a unique and comprehensive perspective on off-chain crypto OTC trading. Price movements reflect market outcomes, while OTC activity reveals how risks are deployed, how participant behavior evolves, and which parts of the market remain consistently active. From this perspective, the market structure and liquidity dynamics in 2025 have undergone significant changes compared to earlier cycles.

Part 1: Spot Goods

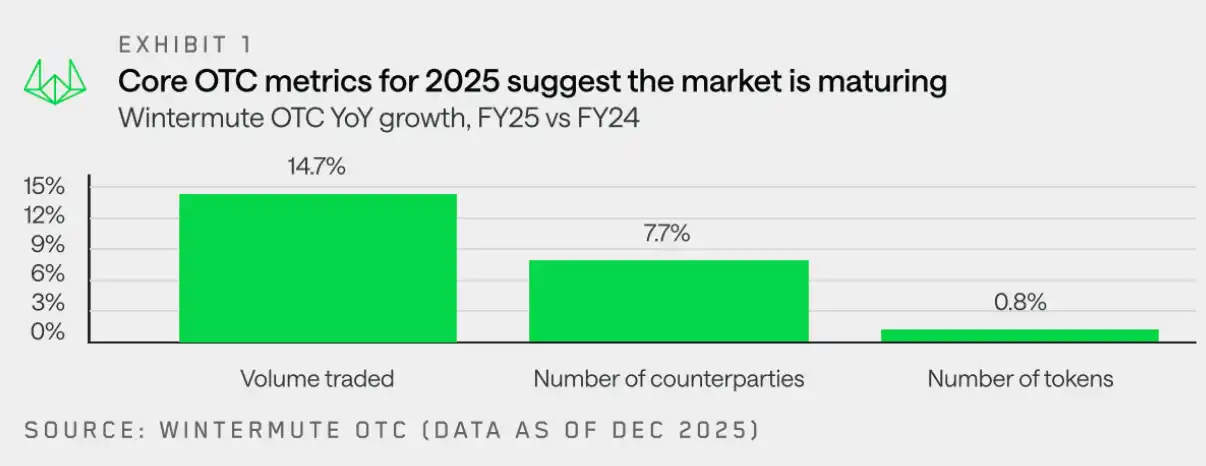

Wintermute's OTC trading data shows that **trading activity in 2025 shifted from being purely volume-driven to a more mature and strategic trading environment.** While trading volume continued to grow, trade execution became more planned, and OTC trading gained increasing popularity due to its ability to facilitate large-scale transactions, privacy, and controllability.

Market positioning has also shifted from simple directional trading to more customized execution strategies and wider use of derivatives and structured products. This indicates that market participants are becoming more experienced and disciplined.

In Wintermute's spot over-the-counter trading activities, the aforementioned structural changes are mainly reflected in the following three aspects:

**Transaction Volume Growth:** The continued growth in OTC transaction volume highlights the market's persistent need for off-chain liquidity and efficient execution of large transactions (while limiting market impact).

**• Increase in counterparties:** The scope of participants has further expanded, driven by factors including venture capital funds shifting from pure private placements to liquid markets; corporations and institutions executing large transactions through over-the-counter channels; and individual investors seeking alternatives to traditional venues beyond centralized and decentralized trading platforms.

**Token Landscape:** Overall token activity has surpassed that of BTC and ETH, with funds flowing into a wider range of Altcoin via DAT and ETFs. Nevertheless, year-to-date positioning data shows that following the major liquidation on October 11, 2025, both institutional and retail investors have shifted back to major tokens. The shorter duration and greater selectivity of Altcoin rallies reflect the waning of the meme cycle and an overall contraction in market breadth as liquidity and risk capital become more selective.

Next, Wintermute will provide a more detailed analysis of these three aspects.

Trading volume growth: cyclical patterns are being replaced by short-term fluctuations.

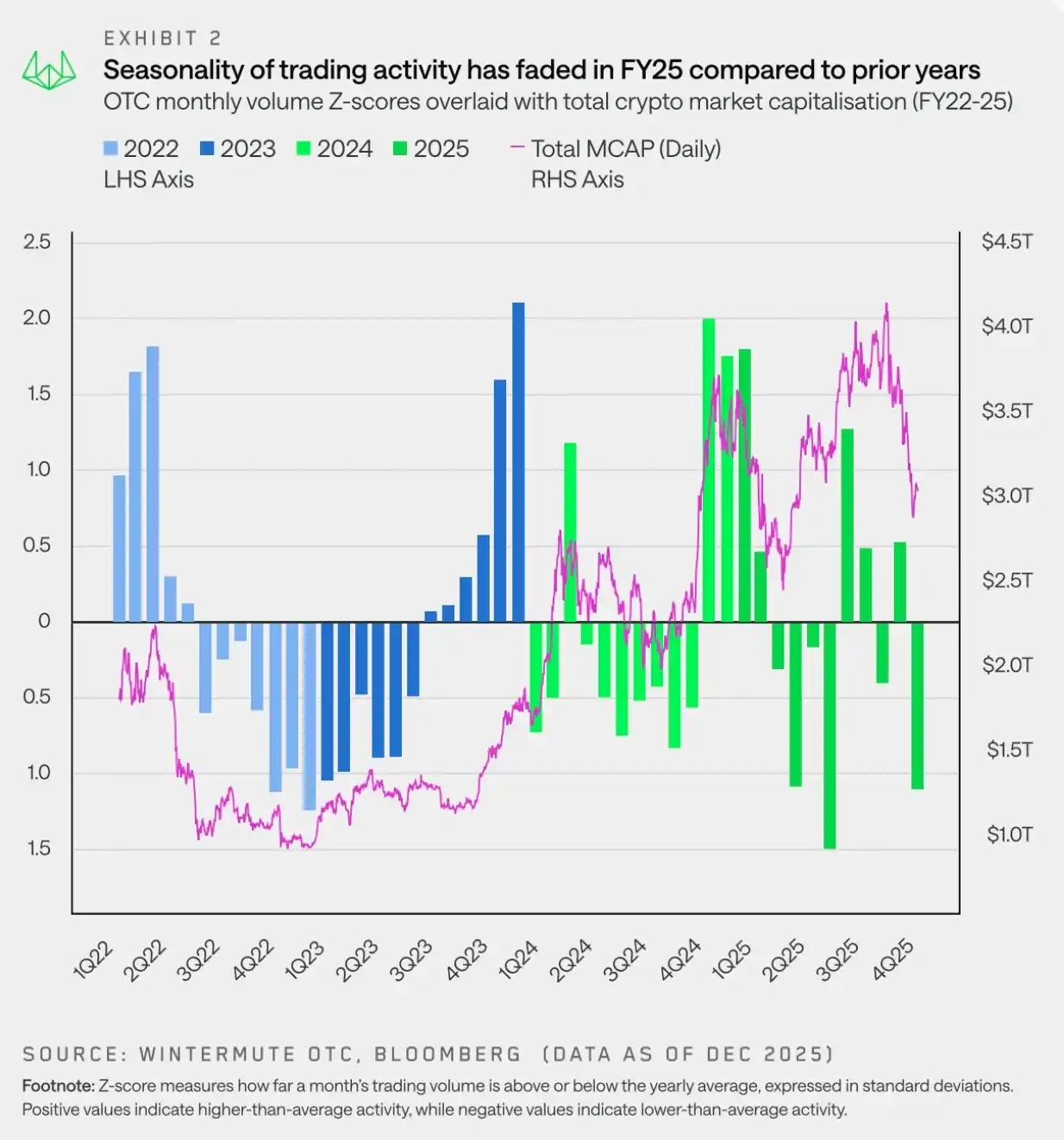

**"The market in 2025 will be characterized by volatile price movements, with price fluctuations primarily driven by short-term trends rather than longer-term seasonal variations."**

Wintermute OTC trading data shows that trading activity in 2025 exhibited a significantly different seasonal pattern, a marked departure from previous years. Market optimism regarding the new pro-cryptocurrency US government quickly faded, and risk sentiment deteriorated sharply at the end of the first quarter as the Meme coin and AI Agent narratives cooled. Top-down negative news, such as Trump's announcement of tariffs on April 2, 2025, further pressured the market.

Therefore, market activity in 2025 was concentrated in the first half of the year, with a strong start followed by a broad weakening in the spring and early summer. The year-end rallies seen in 2023 and 2024 did not repeat themselves, breaking what seemed to be a regular seasonal pattern—a pattern often reinforced by narratives like the "October rally." In reality, this was never a true seasonal pattern, but rather a year-end rally driven by specific catalysts, such as the ETF approvals in 2023 and the inauguration of the new US administration in 2024.

Entering the first quarter of 2025, the upward momentum of the fourth quarter of 2024 failed to fully recover. Market volatility intensified, and with macroeconomic factors dominating market direction, price movements became more of short-term fluctuations than sustained trends.

In short, fund flows became passive and intermittent, fluctuating in bursts around macro headlines but showing no sustained momentum. In this volatile environment, **over-the-counter trading remains the preferred execution method as market liquidity thins and execution certainty becomes increasingly important.**

Counterparties: Institutional Foundation Deepening

**"Despite a lackluster price performance in 2025, institutional counterparties have already established a foothold here."**

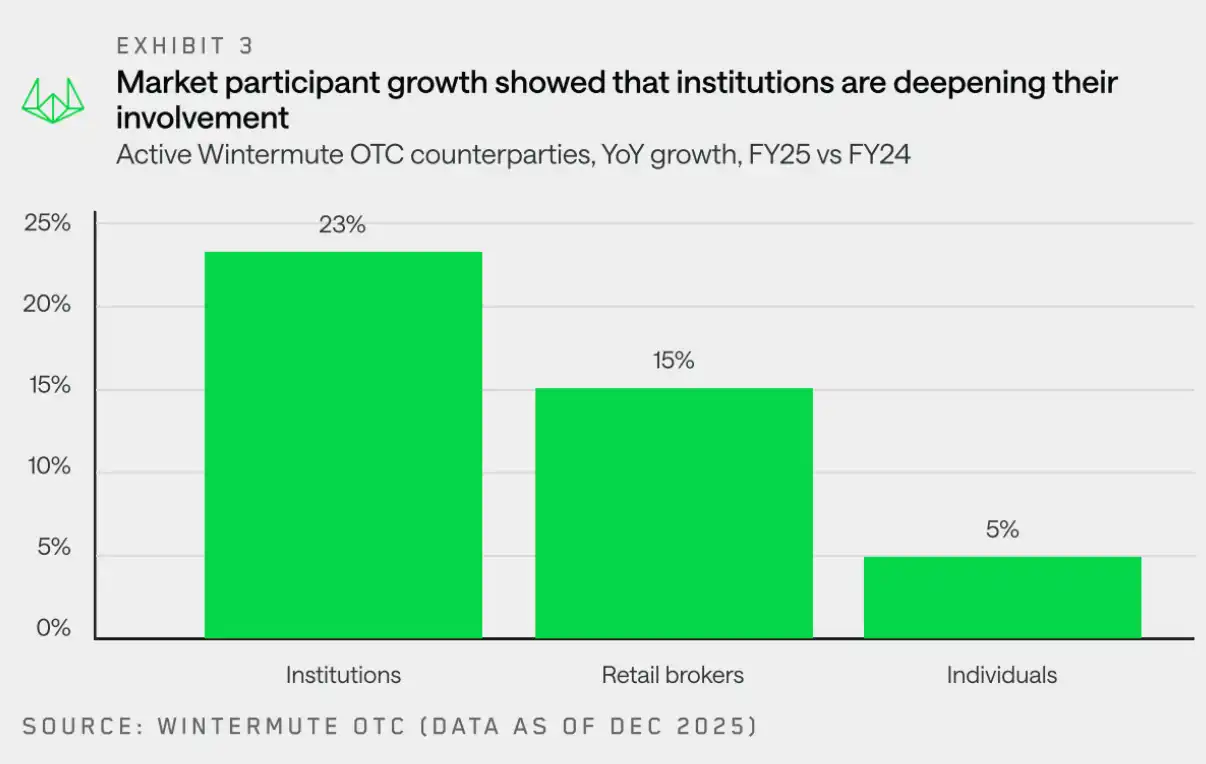

Wintermute observed strong growth across most counterparty types, with institutional and retail brokers showing the largest increases. Within the institutional category, while growth for traditional financial institutions and corporations remained modest, their participation deepened significantly—activity became more consistent and increasingly focused on prudent execution strategies.

Despite a lackluster market performance in 2025, institutions have clearly established a foothold. Compared to the more tentative and fragmented participation of last year, **2025 was characterized by deeper consolidation, larger trading volumes, and more frequent activity.** These all provide constructive and positive signals for the industry's long-term future.

Token Landscape: The Leading Market is Becoming Increasingly Diversified

**"Trading volume is increasingly flowing to large tokens outside of BTC and ETH, a trend driven by DAT and ETFs."**

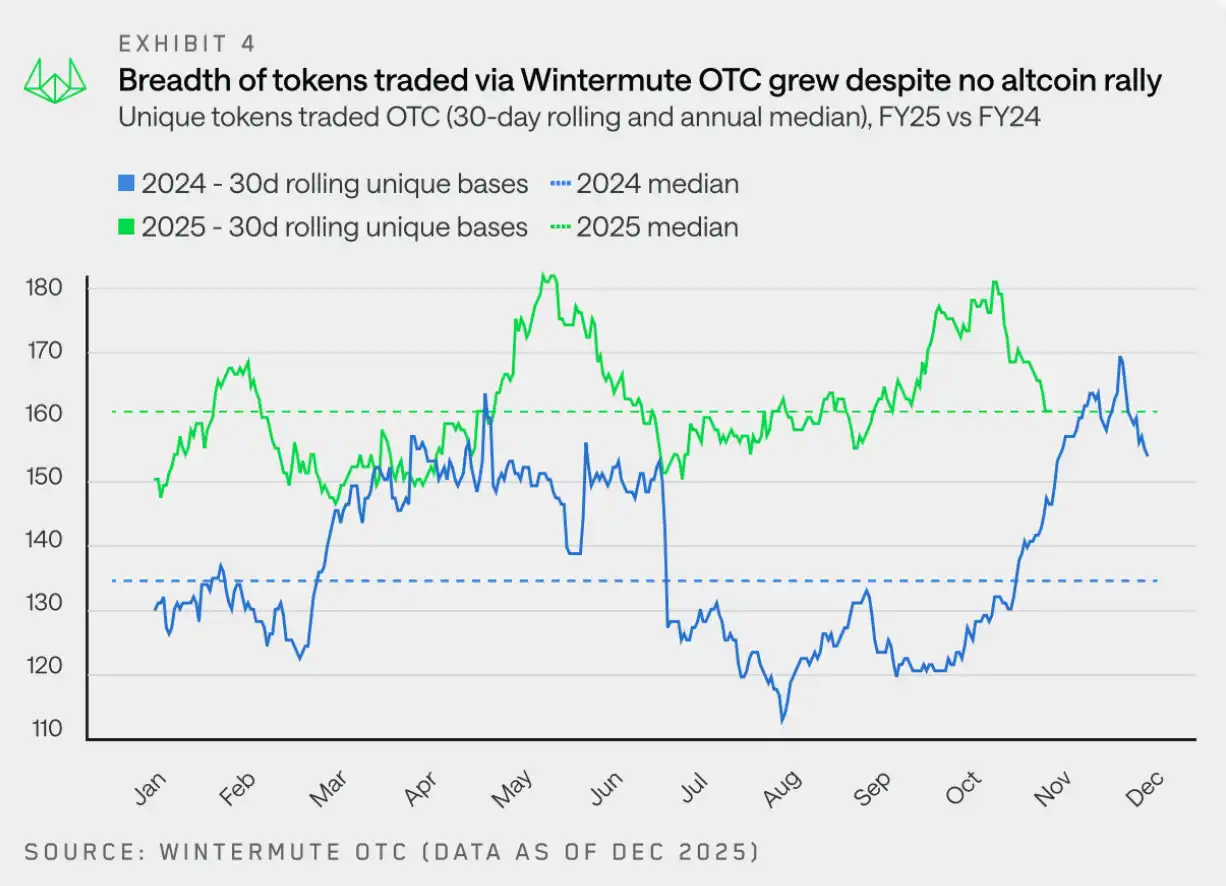

In 2025, the total number of tokens traded remained relatively stable overall. However, looking at 30-day rolling data, Wintermute traded an average of 160 different tokens, up from 133 in 2024. This indicates that OTC trading activity has expanded to a wider and more stable range of tokens.

The key difference from 2024 is that the hype cycle driving token activity weakened in 2025—the range of tokens traded remained relatively stable throughout the year, rather than experiencing a sharp leap in token breadth around a specific theme or narrative.

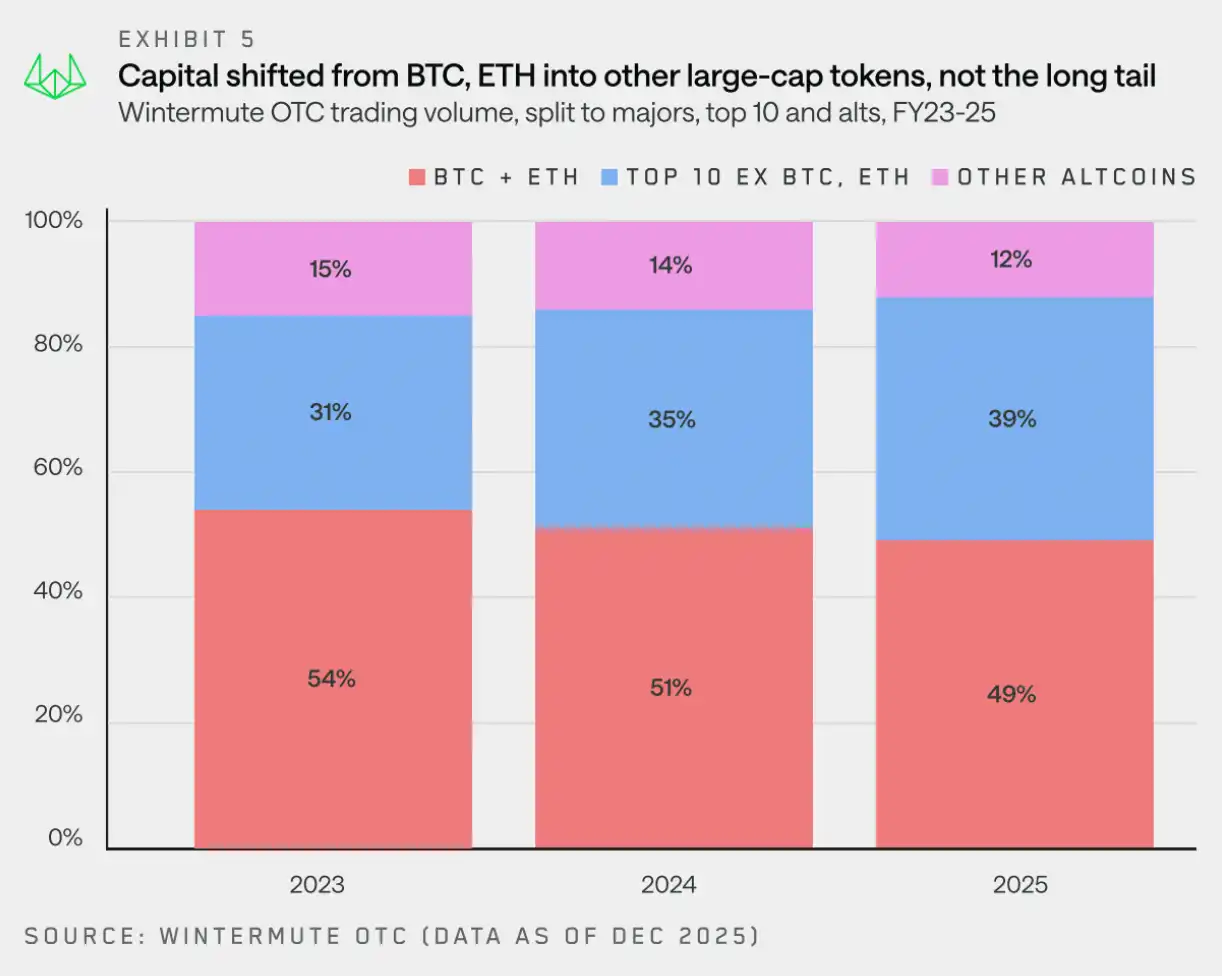

Since 2023, Windemute's total nominal trading volume has become increasingly diversified, with other segments now accounting for more trading volume than the combined volume of BTC and ETH. While BTC and ETH remain significant components of the trading flow, their share of total trading volume has decreased from 54% in 2023 to 49% in 2025.

It's worth noting where these funds went—**While the share of long-tail tokens in trading volume has continued to decline, blue-chip assets (the top 10 assets by market capitalization, excluding BTC, ETH, wrapped assets, and stablecoins) have increased their share of total nominal trading volume by 8 percentage points over the past two years.**

While some funds and individuals have concentrated their investments in large-cap tokens this year, the increase in trading volume has also benefited from ETFs and DATs expanding their investment scope beyond mainstream assets. DATs have been authorized to invest in these assets, while ETFs are also expanding their investment scope, including launching staked ETFs (such as SOL) and index funds.

These investment instruments continue to favor over-the-counter (OTC) trading rather than trading on trading platforms, especially when the required liquidity is not available on trading platforms.

Analysis of spot fund flows for various types of tokens

Major cryptocurrencies: Funds gradually flow back at the end of the year.

"By the end of 2025, both institutional and retail investors were reallocating back to mainstream cryptocurrencies, indicating their expectation that mainstream cryptocurrencies would rebound before Altcoin recovered."

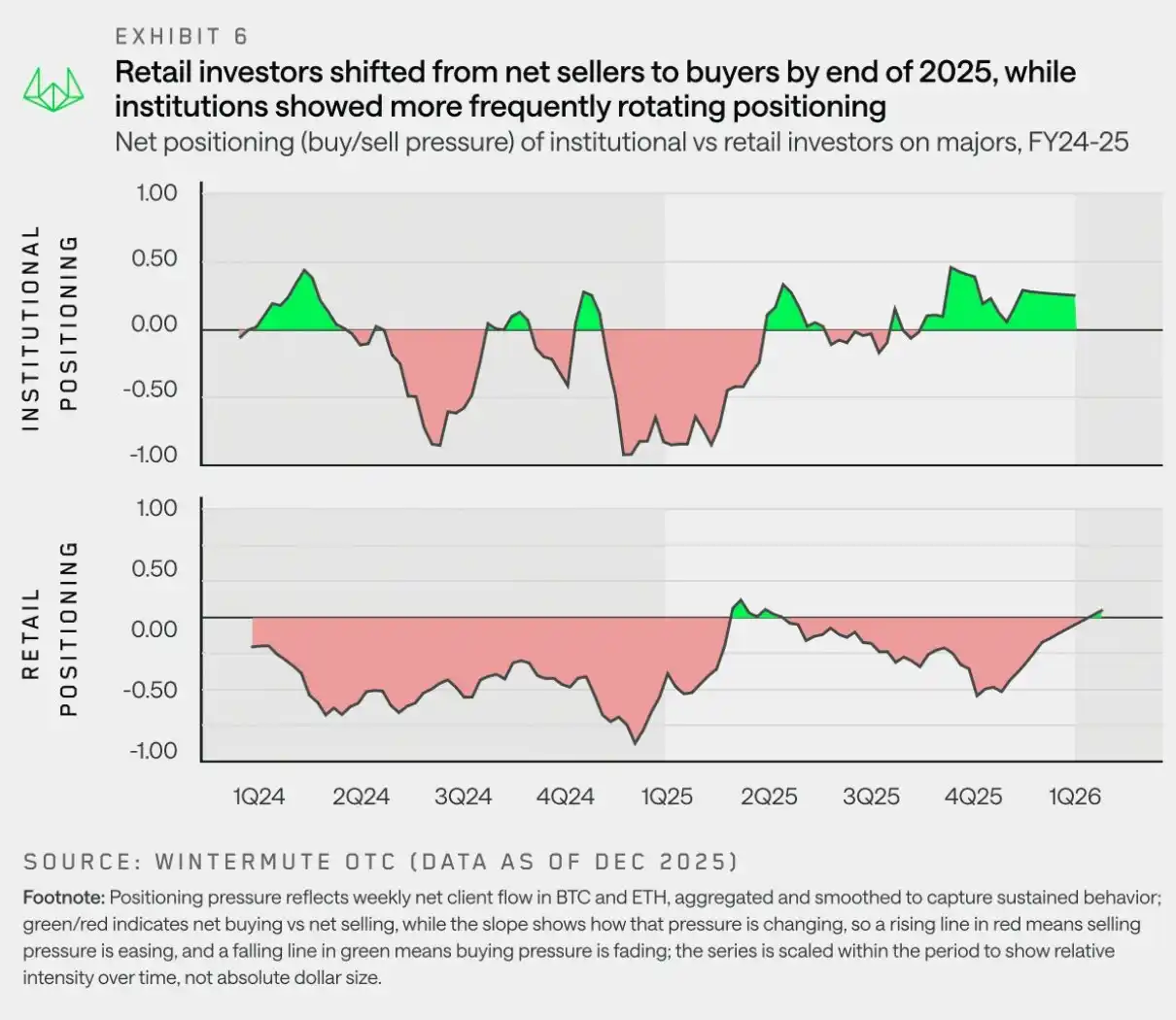

**As the Altcoin narrative fades and macroeconomic uncertainties re-emerge in early 2025, asset allocation is returning to BTC and ETH.** Windemute's OTC liquidity data shows that institutional investors have consistently overweighted mainstream cryptocurrencies since Q2 2025; however, retail investors shifted to Altcoin in Q2 and Q3 2025, hoping for a market rebound, but quickly returned to Altcoin cryptocurrencies after the deleveraging event on October 11th.

The trend of funds shifting to mainstream cryptocurrencies was driven by market fatigue, as the "altcoin season" failed to truly take off, leading to a gradual decline in market confidence. This trend was initially led by institutions (who have long been net buyers of mainstream cryptocurrencies), but by the end of the year, retail investors had also become net buyers.

This portfolio allocation aligns with the prevailing market view: **BTC (and ETH) need to lead the market before risk appetite returns to Altcoin.** Retail investors seem to increasingly agree with this stance.

Altcoin: Price surges tend to be shorter-lived.

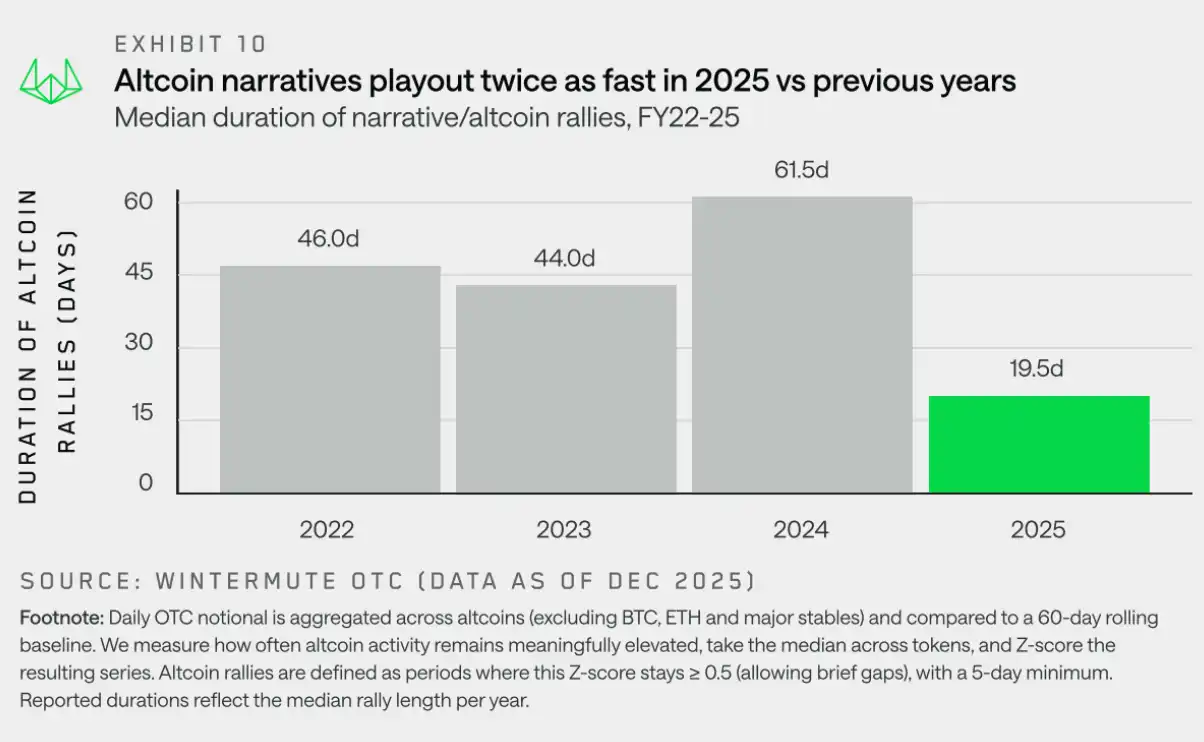

**"In 2025, the average duration of Altcoin-driven rallies was approximately 19 days, a significant decrease from the previous year's 61 days, indicating that the market had shown signs of fatigue after last year's excessive gains."**

In 2025, Altcoin generally underperformed, with a significant decline in overall annual returns, failing to achieve any meaningful and sustained recovery except for brief rebounds. While individual themes attracted attention periodically, these themes consistently failed to accumulate momentum or translate into broader market participation. **From a fund flow perspective, this was not due to a lack of narrative, but rather because the market showed clear signs of exhaustion—uptrends were repeatedly tested but quickly faded due to a lack of sustained conviction.**

To understand this dynamic, we move beyond price appearances and focus on persistence analysis. Here, "persistence" is defined as the duration for which Altcoin participation in over-the-counter (OTC) trading remains above recent normal levels. In practice, persistence metrics are used to measure whether an upward trend attracts sustained participation or whether market activity quickly dissipates after initial volatility. This perspective allows us to distinguish between persistent Altcoin movements and intermittent, cyclical bursts that fail to develop into a broad trend.

The chart above illustrates a clear shift in Altcoin rallies. Between 2022 and 2024, Altcoin rallies typically lasted approximately 45 to 60 days. 2024 was a strong year for Bitcoin, driving a wealth effect that rotated to Altcoin and maintaining the popularity of narratives such as Memecoin and AI. In 2025, despite the emergence of new narratives including the Memecoin launch platform, Perp DEX, and the x402 concept, the median duration plummeted to approximately 20 days.

While these narratives may trigger brief market activity, they have failed to develop into a sustained, market-wide rally. This reflects the volatility of the macro environment, market fatigue following last year's excessive gains, and insufficient liquidity in Altcoin to support a breakthrough in the initial stages of the narrative. Consequently, Altcoin price movements resemble more of tactical trading than a high-confidence trend.

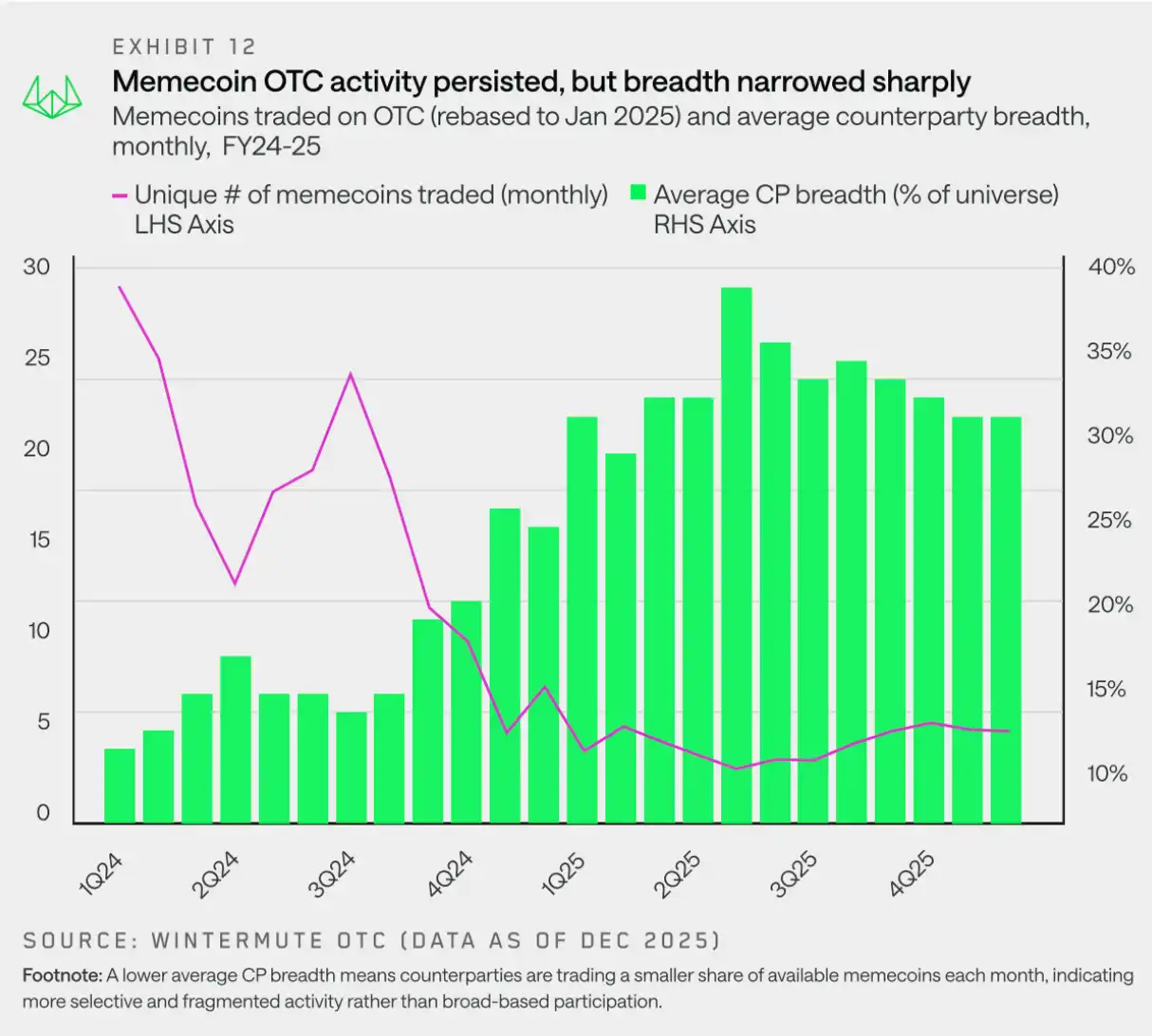

Meme Coin: Narrowing Scope of Activity

"Meme failed to recover after peaking in the first quarter of 2025, as trading became more decentralized and narrower, making it unable to regain support."

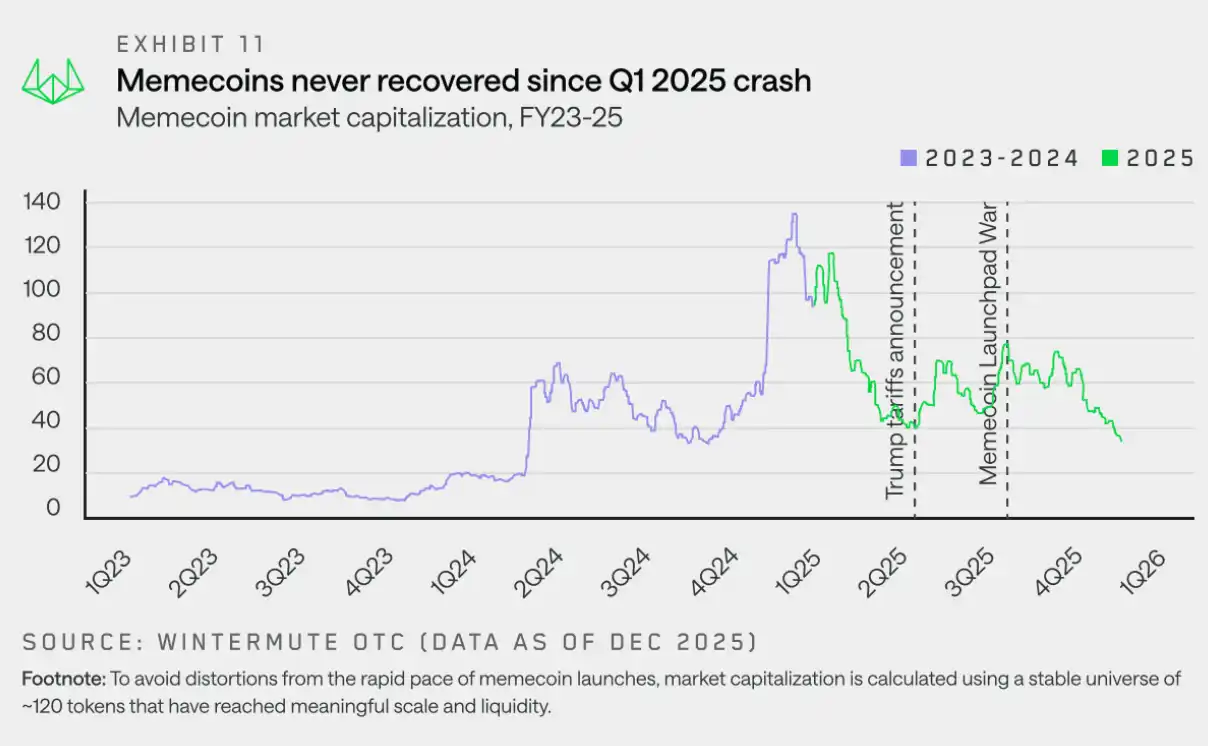

Memecoin entered 2025 with the most crowded market presence, characterized by a rapid issuance schedule, persistently bullish market sentiment, and price movements that reinforced the narrative. However, this momentum abruptly ended. Unlike other sectors with higher beta coefficients, Memecoin turned downwards earlier and more decisively, and has consistently failed to rebuild its upward momentum.

Despite significant price pullbacks, the absolute number of Meme coins traded over-the-counter remained healthy at all points in time. Even by the end of 2025, the number of monthly traded tokens remained above 20, indicating that trading interest had not disappeared. The change lay in the way activity manifested. In practice, this meant a significant reduction in the number of tokens involved by counterparties each month, with activity concentrated on specific tokens rather than being broadly traded across the entire Meme coin space.

Part 2: Derivatives

Wintermute's OTC derivatives data shows strong growth, with OTC becoming the preferred venue for executing complex, capital-efficient products due to increased market volatility and larger transactions, as it offers price certainty and operational privacy.

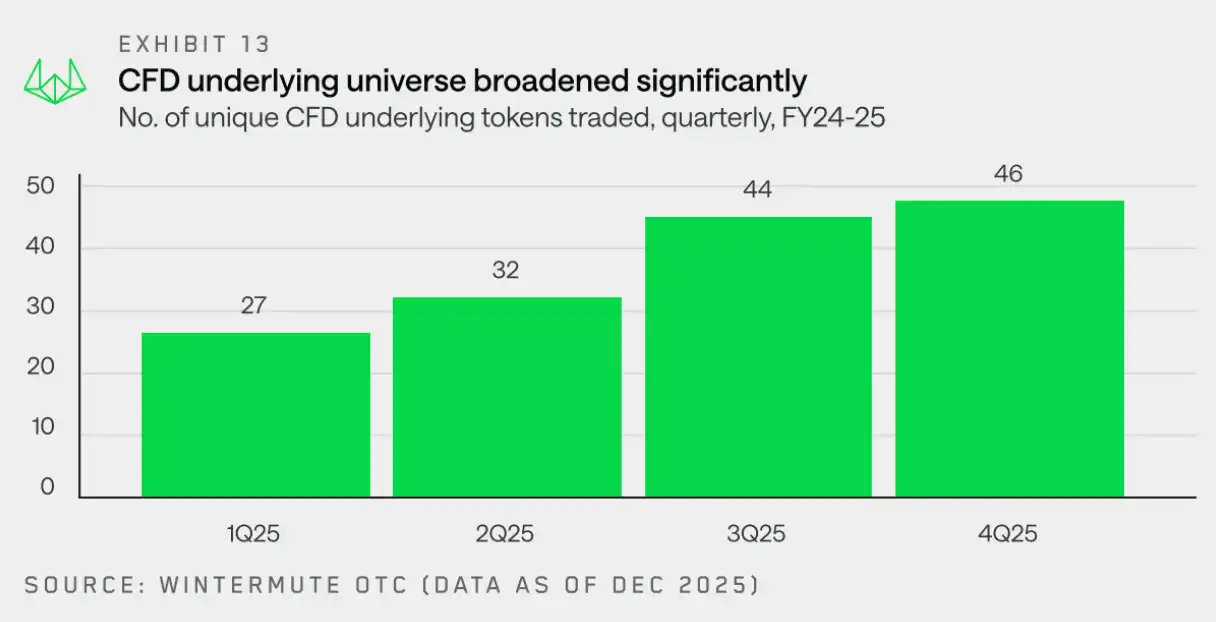

Contracts for Difference (CFDs): Expanded Range of Underlying Assets

"In 2025, the underlying assets of contracts for difference (CFDs) will be further expanded, and futures will be increasingly favored as a capital-efficient way to gain market exposure."

The number of tokens used as underlying assets for CFDs on the Wintermute OTC trading desk has more than tripled year-over-year, from 15 in Q4 2024 to 46 in Q4 2025. This continued growth reflects the market's increasing acceptance of CFDs as a capital-efficient way to access a wider range of assets, including long-tail tokens.

The growing demand for CFDs reflects a market-wide shift toward capital-efficient exposure through futures. Perpetual contract open interest rose from $120 billion at the beginning of the year to $245 billion in October, followed by a significant decline in market risk appetite during the October 11 liquidation event.

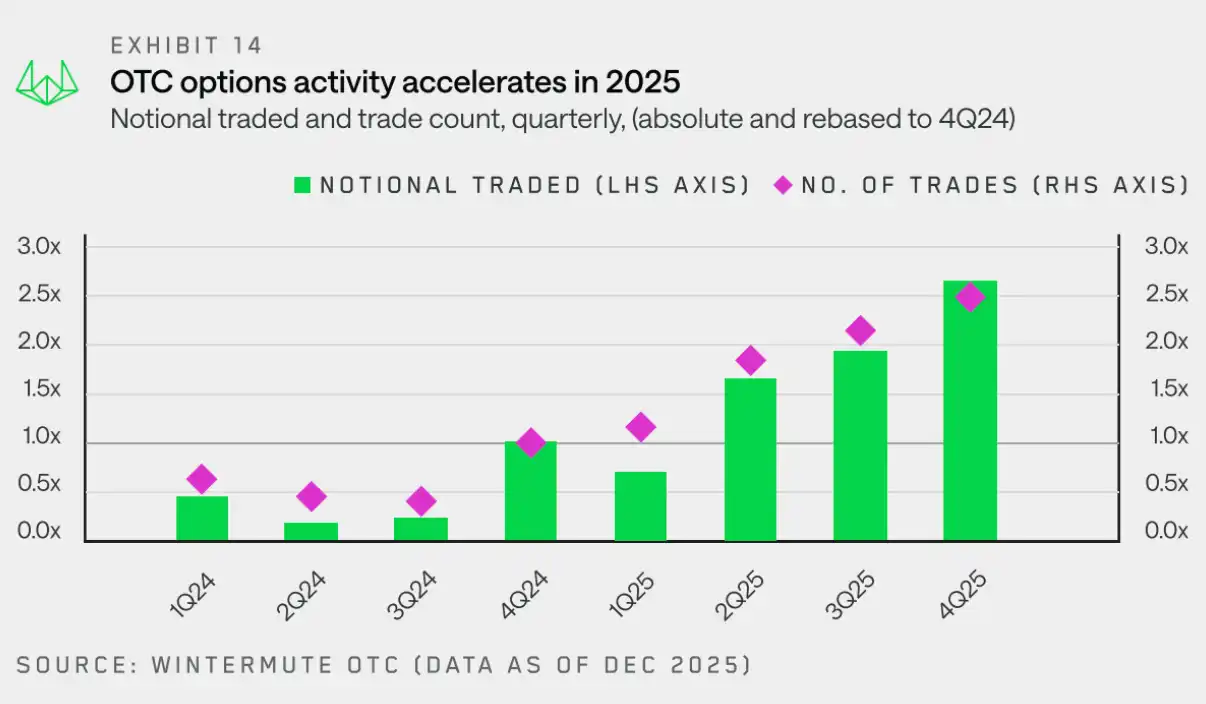

Options: Strategy complexity continues to increase

"As systematic strategies and profit generation become the main drivers of trading volume growth, the options market is rapidly maturing."

Building on previous activity in CFDs and futures, Windemute OTC data shows that **counterparties are increasingly turning to options to build more customized and sophisticated crypto asset exposures.**

This shift has fueled a dramatic increase in options market activity: from Q4 2024 to Q4 2025, both notional trading volume and the number of trades increased by approximately 2.5 times year-over-year. This was primarily driven by more counterparties—especially crypto funds and digital asset treasuries—adopting options strategies to generate passive returns.

The chart below tracks the changes in quarterly OTC options activity relative to the first quarter of 2025, clearly showing the growth trend throughout 2025. By the fourth quarter, notional trading volume had reached 3.8 times that of the first quarter, and the number of trades had increased 2.1 times, highlighting the continued growth in both the size and frequency of individual trades.

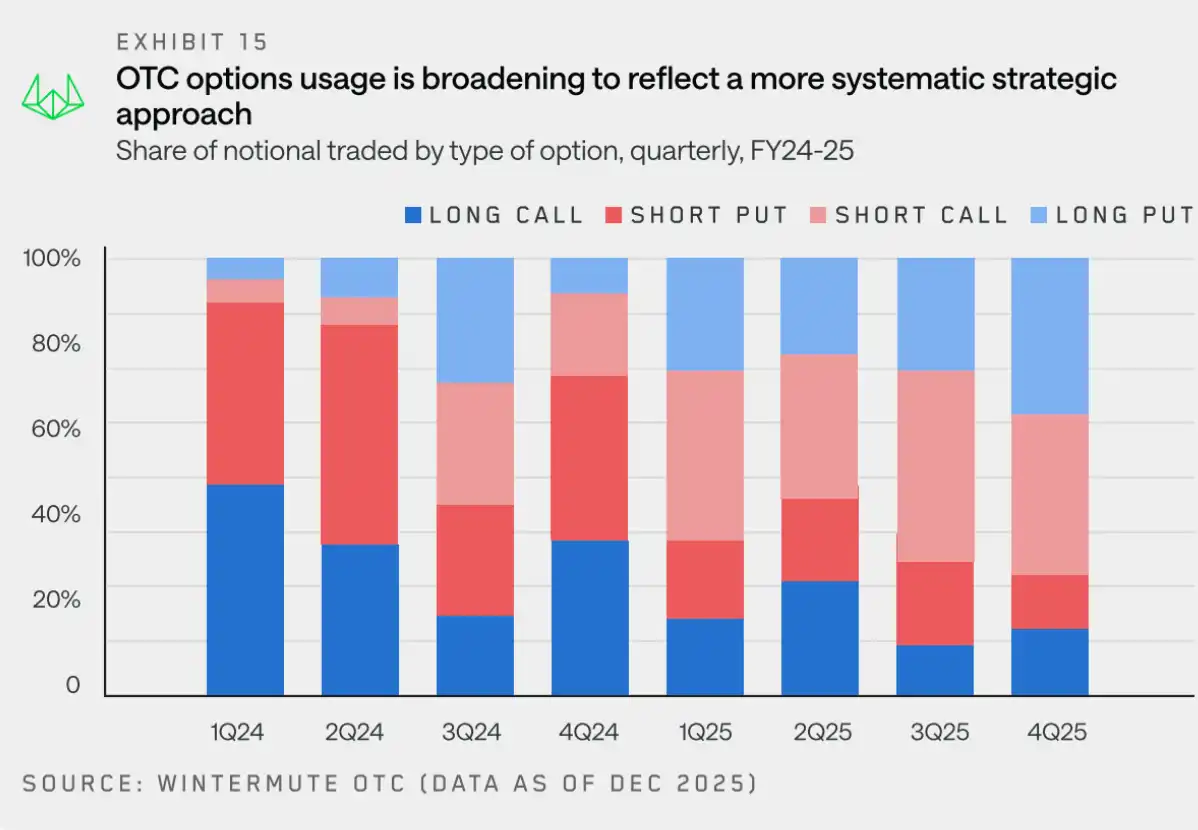

**Part of the notional trading volume growth stems from the rise of systematic options strategies, which involve holding exposure and rolling over positions over time.** This marks a significant shift compared to previous years—where options were more often used to express purely directional views.

To understand the evolution of options funding flows, we further examined BTC (which still accounted for a large share of nominal trading volume in 2025). The chart below shows the quarterly distribution of long and short positions in call/put options.

The composition of BTC options fund flows in 2025 reflects a clear shift: from focusing on buying call options for upward movement to a more balanced use of both call and put options, with activity increasingly gravitating towards profit generation and structured, repeatable strategies. Profit-generating strategies have become increasingly prevalent, with investors earning profits by selling put options and covered call options, increasing the stable supply of options and suppressing volatility. Meanwhile, as BTC failed to break through previous highs, demand for downside protection remained strong, and long put options continued to be used. Overall, the market is more focused on earning profits and managing risk than betting on further gains.

The decrease in naked call option buying further confirms that options are being used less for directional upward exposure and more for systematic strategy execution. These developments collectively indicate that, compared to previous years, the options market in 2025 is becoming increasingly mature and has a more professional user base.

Part 3: Liquidity

Cryptocurrencies have historically served as a conduit for excess risk appetite. Due to their weak valuation anchors, embedded leverage, and high dependence on marginal cash flows, cryptocurrency prices are extremely sensitive to changes in the global financial environment. When liquidity is ample, risk tolerance increases, naturally attracting capital into the crypto space; conversely, when the environment tightens, the lack of structural buying pressure quickly becomes apparent. Therefore, cryptocurrencies have been, and will continue to be, fundamentally dependent on global liquidity.

In 2025, the macroeconomic environment will be a key driver of crypto prices. **Despite the current backdrop featuring slower interest rates, improved liquidity, and a stronger economy—factors that typically support risk asset prices—the crypto market remains weak. We believe there are two key reasons behind this disconnect: retail investor attention and new liquidity channels.**

Retail investor attention: Cryptocurrencies are no longer the "preferred" risk asset.

"By 2025, cryptocurrencies will have lost their status as the preferred risk asset for retail investors."

Despite increased institutional participation, retail investors remain the cornerstone of the crypto market. A key reason for the poor market performance in 2025 was the diversification of retail investor attention and the weakening rotation effect of crypto assets as the preferred risk asset.

Despite numerous influencing factors, the following two stand out most: **Technological advancements have lowered market entry barriers, making other investment opportunities (especially in areas like AI) more accessible. These assets offer similar risk profiles, narratives, and return potential, thus diverting attention from the crypto space.** At the same time, we are experiencing a return to normalcy following 2024—a year of extremely high retail participation, initially flooding into Meme Coin and later shifting towards AI agent-related stocks. A return to normal market activity is an inevitable trend.

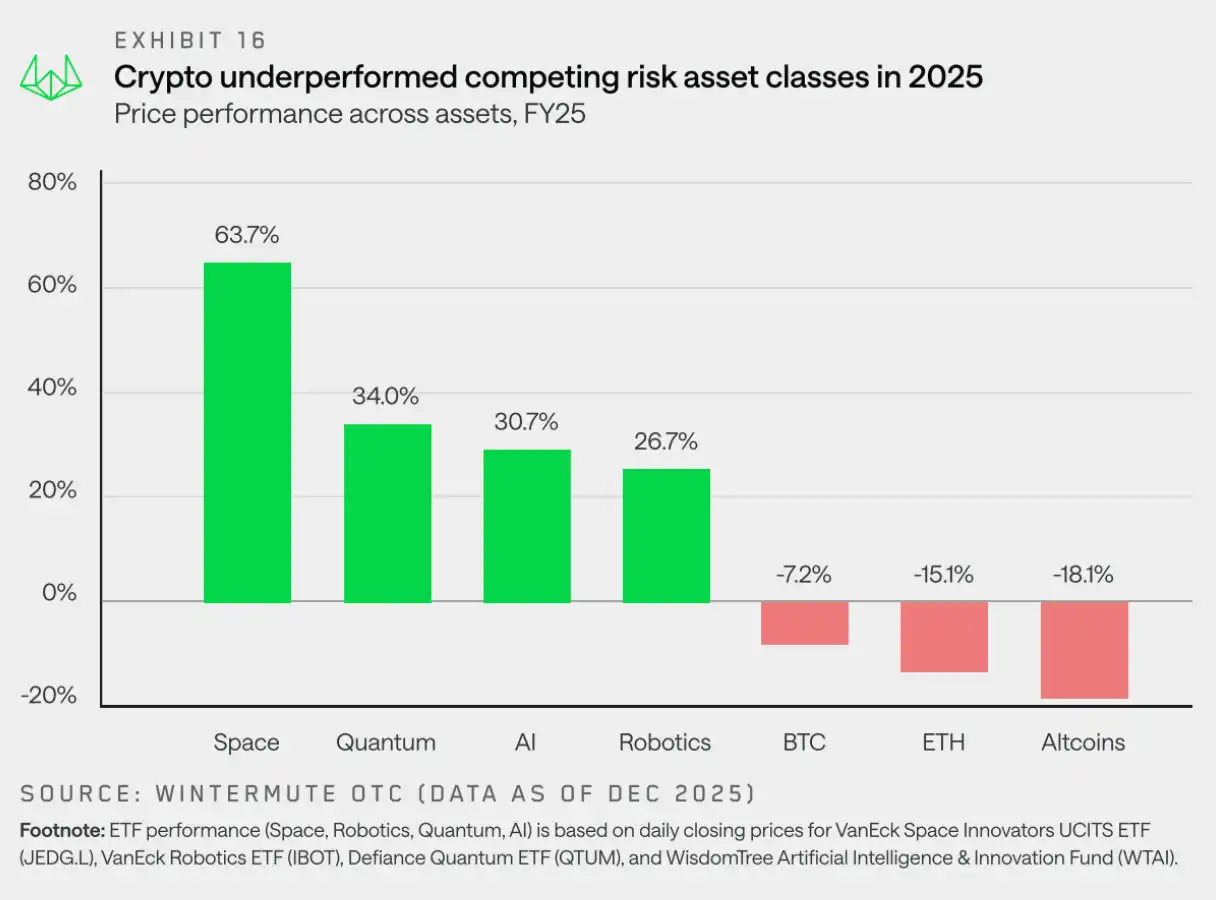

Therefore, retail investors favor stock market themes such as AI, robotics, and quantum technology, while BTC, ETH, and most Altcoin lag behind major risk assets. Cryptocurrencies are no longer a pre-set outlet for excessive risk-taking.

Liquidity channels: ETFs and DAT become new pathways

"Today, ETFs and DAT, along with stablecoins, are becoming significant channels driving capital inflows into the crypto market."

BTC and ETH prices declined slightly, but the biggest relative weakness appeared in the Altcoin sector. Besides weak retail participation, a key factor was the shift in liquidity and how capital enters the market.

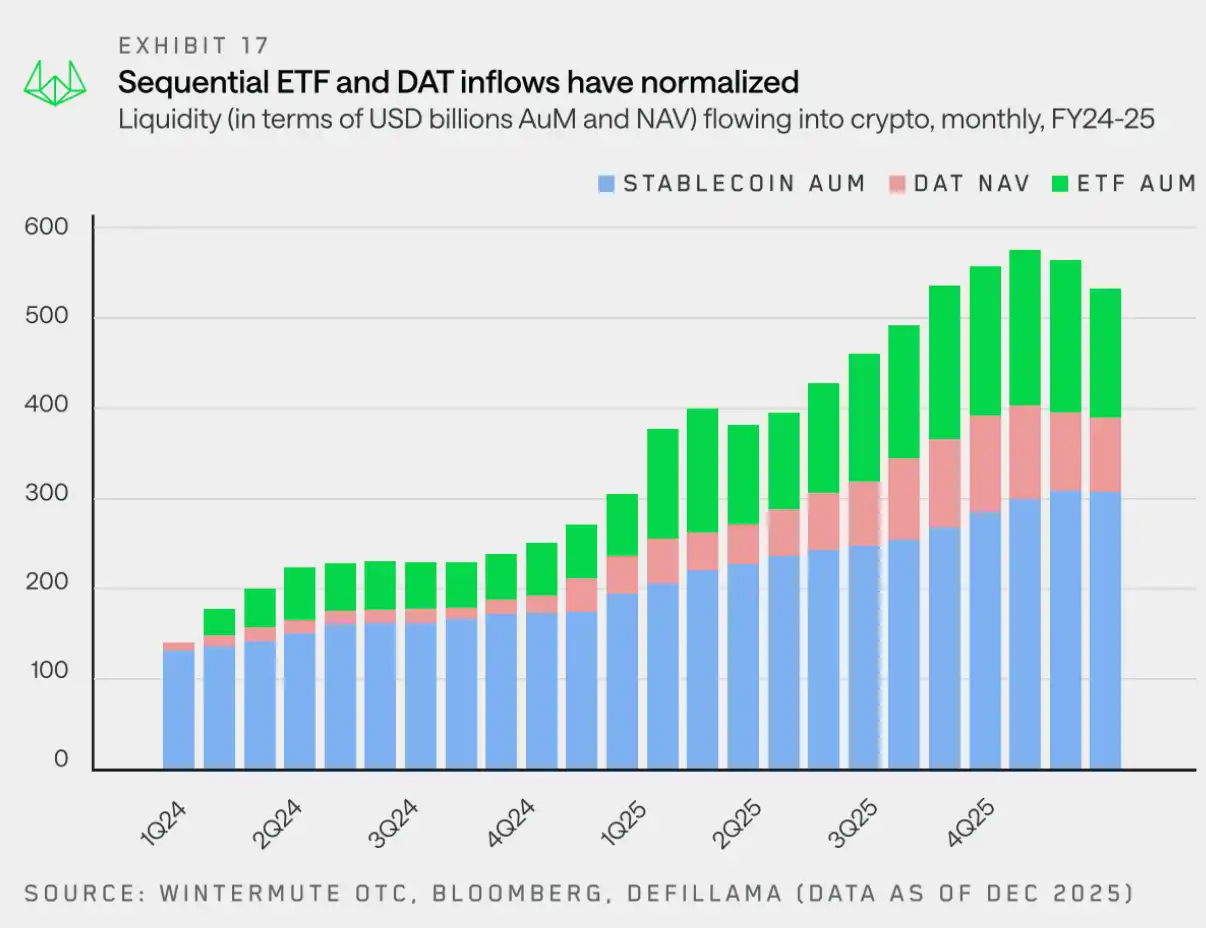

Until two years ago, stablecoins and direct investment were the primary channels for capital to enter the crypto market. However, ETFs and DAT have structurally altered the pathways through which liquidity is injected into the ecosystem.

Earlier this year, we summarized crypto liquidity into three core pillars: stablecoins, ETFs, and DAT. Together, they constitute the main channels through which capital flows into the crypto market.

Stablecoins have become one of many entry points: they remain crucial for settlement and collateralization, but today they share the role of capital entry points rather than dominating them.

ETFs direct liquidity toward the top two assets: inflows of funds constrained by investment scope enhance the depth and resilience of major assets, but have limited spillover effects beyond BTC and ETH.

• DAT introduced stable and non-circular demand: Treasury fund allocation further strengthened the concentration on major assets, failing to naturally expand risk appetite while absorbing liquidity.

Liquidity isn't solely flowing in through ETFs and DAT, but the chart above illustrates how important these channels have become. As mentioned earlier, their investment scope is expanding, and they're beginning to allow exposure beyond BTC and ETH, primarily involving other blue-chip tokens. However, this process is gradual, so the benefits to the Altcoin market will take time to materialize.

In 2025, cryptocurrencies were no longer driven by broad market cycles. Instead, rallies were limited to a few assets with concentrated liquidity, while the majority of the market underperformed. **Looking ahead to 2026, market performance will depend on whether liquidity spreads to more tokens or continues to concentrate on a few large tokens.**

2026 Market Outlook: Saying Goodbye to Pure Cyclical Patterns

"The market failed to deliver the expected rally in 2025, but this may mark the beginning of a shift for cryptocurrencies from a speculative asset to a more mature asset class."

**Market performance in 2025 demonstrates that the traditional four-year cycle model is gradually becoming ineffective.** Our observations suggest that market performance is no longer driven by a self-fulfilling four-year narrative, but rather depends on liquidity flows and investor focus.

Historically, cryptocurrency native wealth has functioned as a single, fungible pool of funds, with Bitcoin's returns naturally spilling over to mainstream coins and then to Altcoin. Wintermute OTC trading data shows this spillover effect has significantly weakened. New capital instruments—especially ETFs and DATs—have evolved into "closed ecosystems." While they provide sustained demand for a few blue-chip assets, funds don't naturally rotate to the broader market. 2025 became an extremely concentrated year as retail investor interest shifted dramatically to stocks and prediction markets—a few mainstream assets absorbed the vast majority of new funds, while the rest of the market struggled to sustain growth.

Three possible paths to 2026

2025 was a year of significantly narrowed market breadth. As mentioned earlier, the average duration of Altcoin rallies shortened from approximately 60 days last year to about 20 days. Only a select few tokens performed exceptionally well, while the broader market continued its downward trend due to selling pressure from token unlocks.

To reverse this trend, at least one of the following three conditions must occur:

**Expanding Investment Scope for ETFs and DATs:** Currently, most of the new liquidity is still limited to institutional channels such as ETFs and DATs. A broader market recovery requires these institutions to expand their investment scope, and there are already initial signs of this, with more ETF applications for SOL and XRP being submitted.

**Major Cryptocurrencies Leading the Market:** Similar to 2024, a strong surge in Bitcoin (and/or ETH) could generate a wealth effect that spills over into a wider market. However, how much of this capital will ultimately flow back into the digital asset sector remains to be seen.

**Market Attention Returns:** Another less likely scenario is that retail investors' attention will significantly shift from the stock market (including themes such as AI and rare earths) back to the crypto space, leading to new capital inflows and stablecoin issuance.

The market trajectory in 2026 will depend on whether at least one of the aforementioned catalysts can effectively drive liquidity beyond a few mainstream assets; otherwise, market concentration will persist.